BFSI

Buy Now Pay Later Market

Buy Now Pay Later Market Size, Share, Growth & Industry Analysis, By Channel (Online, POS), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End User (Healthcare, Retail, Leisure & Entertainment, Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR411

Buy Now Pay Later Market Size

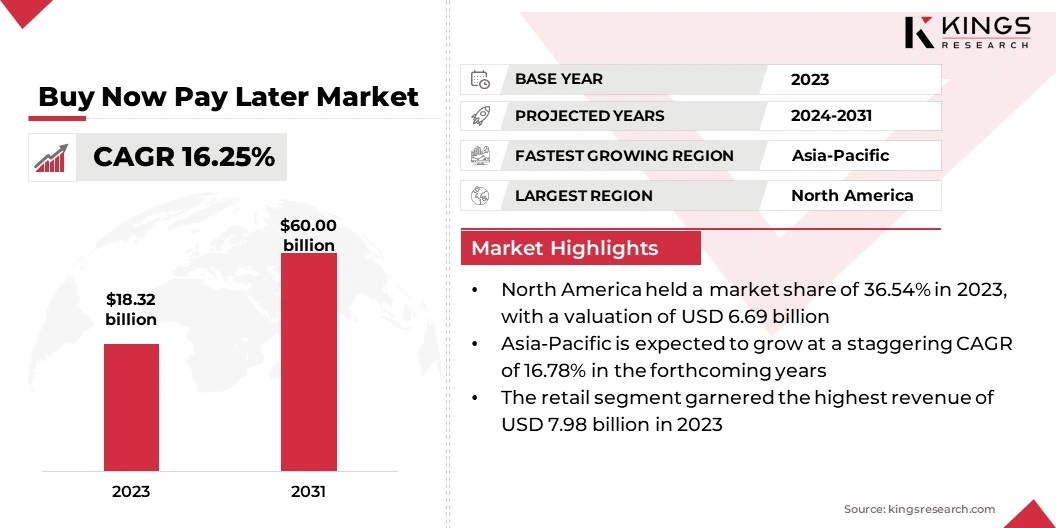

The global Buy Now Pay Later Market size was valued at USD 18.32 billion in 2023 and is projected to grow from USD 20.91 billion in 2024 to USD 60.00 billion by 2031, exhibiting a CAGR of 16.25% during the forecast period. Rising inclination toward cashless transactions and increased e-commerce penetration are fueling the demand for BNPL services.

In the scope of work, the report includes services offered by companies such as Affirm, Inc., Klarna, Splitit, Sezzle, Payl8r, Zip Co Ltd., PayPal Holdings, Inc., AfterPay Limited, Lazypay, Pine Labs, and others.

The incorporation of cryptocurrency payment options in buy now pay later (BNPL) platforms presents a significant opportunity for innovation in the global payments landscape. With the rise of cryptocurrencies such as Bitcoin, Ethereum, and stablecoins, BNPL providers can expand their offerings to appeal to tech-savvy consumers and crypto enthusiasts.

This integration can streamline cross-border transactions, reduce payment processing fees, and provide access to new demographics, particularly in regions with limited traditional banking services. Furthermore, by enabling cryptocurrency payments, BNPL platforms seek to meet the growing demand for decentralized finance (DeFi) solutions that emphasize security, transparency, and low transaction costs.

Additionally, crypto integration offers consumers greater flexibility and control over their finances, allowing them to make purchases using digital assets without the need for conversion to fiat currencies. This strategic move may attract users with existing investments in cryptocurrency and enable BNPL providers to differentiate themselves from traditional payment systems. As cryptocurrency adoption rises, this trend is expected to reshape the landscape of the buy now pay later market.

Buy now pay later (BNPL) is a financial service that allows consumers to purchase products or services and pay for them in installments over time, typically without accruing interest if payments are made on time. BNPL services are widely available through e-commerce platforms, mobile apps, and in-store purchases, providing consumers with an accessible, flexible alternative to traditional credit.

BNPL channels include both online and in-store, with digital platforms significantly propelling growth as more people shop online. Enterprises of all sizes, including small retailers and large multinational corporations, are adopting BNPL to enhance consumer spending and improve conversion rates.

End-users of BNPL services span various demographics, with Millennials and Gen Z notable favoring debt-free, short-term financing options. Moreover, the retail, fashion, electronics, and travel sectors prominently utilize BNPL, leading to increased average order values and customer retention for merchants.

Analyst’s Review

The buy now pay later market is witnessing robust growth, driven by increasing consumer demand for flexible payment options and rising e-commerce penetration. Key industry players are employing a variety of strategies to enhance their market presence and gain a competitive edge. Many companies are focusing on strategic partnerships with e-commerce giants, retailers, and financial institutions to expand their reach and customer base.

- For instance, in February 2024, Adyen partnered with Billie to offer buy now pay later (BNPL) solutions for B2B payments. This collaboration helps merchants manage cash flow, reduce payment defaults, and minimize fraud risks. Billie's BNPL solution offers a cost-effective alternative to corporate credit cards, simplifying dunning and collection processes for business transactions.

Additionally, diversification into new geographic markets, particularly in emerging economies, is becoming a critical growth strategy as these regions offer untapped potential. Companies are further enhancing their technological capabilities by integrating advanced analytics and artificial intelligence to assess consumer creditworthiness and optimize risk management.

Moreover, an emphasis on regulatory compliance and consumer protection is becoming an imperative as regulators worldwide are increasingly scrutinizing the BNPL sector. Current market dynamics indicate that BNPL providers are well positioned for growth. However, they must innovate and adapt to evolving consumer expectations and regulatory frameworks to maintain their competitive standing.

Buy Now Pay Later Market Growth Factors

The shift toward cashless payments is fueling the growth of the buy now pay later market. With the increasing adoption of digital payment methods, consumers are shifting from traditional cash transactions and adopting mobile payments, digital wallets, and other contactless solutions. This global trend is supported by the rise of e-commerce, where cashless transactions are more efficient, secure, and convenient.

BNPL services align perfectly with this shift, offering users the ability to make purchases with flexible, interest-free payment options that integrate seamlessly with digital payment platforms.

- In March 2024, Visa's Consumer Payment Attitudes (CPA) report indicates that 56% of Vietnamese respondents carry less physical cash, reflecting a shift toward modern financial technologies. This transition is primarily driven by younger consumers, particularly Gen Z and Gen Y, with 89% adopting cashless payment methods.

Furthermore, cashless payments reduce the friction associated with carrying and handling physical money, allowing more consumers to use online and in-store BNPL services.

As more businesses, particularly in retail and e-commerce, adopt cashless payment systems, the demand for BNPL options is expected to rise. This trend is further reinforced by the growing use of mobile apps and digital wallets, which integrate cashless transactions into consumers' daily lives and fuel the expansion of BNPL across various sectors.

Rising concerns over consumer debt are emerging as significant challenges for the development of the buy now pay later market. As BNPL services become more widely available, concerns are rising about younger consumers accumulating unsustainable debt due to lack of understanding of the financial implications of deferred payments.

The ease of accessing BNPL services, combined with minimal credit checks, increases the risk of consumers overextending themselves, leading to missed payments, late fees, and debt spirals. This issue is further compounded by some BNPL providers’ lack of transparency regarding the true cost of missed payments, which leaves consumers vulnerable to financial stress.

Mitigating this challenge involves increased regulatory oversight to ensure BNPL providers implement responsible lending practices. Educating consumers on the potential risks associated with overuse of BNPL, along with clearer communication of terms and conditions, is critical. BNPL providers should further invest in tools that allow customers to manage their spending and avoid debt accumulation.

Buy Now Pay Later Market Trends

The rising integration of artificial intelligence technology in buy now pay later apps is significantly augmenting industry growth. AI is being leveraged to improve consumer experiences by providing personalized payment options, offering real-time credit assessments, and automating fraud detection. By utilizing machine learning algorithms, BNPL providers may assess consumer risk profiles more accurately, enabling faster credit approvals and minimizing the chances of defaults.

- For instance, in April 2024, Klarna leveraged generative artificial intelligence to enhance its profit margins. OpenAI estimates that the payments network's use of AI may result in a USD 40 million profit boost in 2024, as BNPL firms adopt digital innovations to address profitability challenges.

Moreover, AI enables BNPL platforms to offer tailored payment plans based on individual user behavior, creating a more flexible and personalized experience. This trend is further contributing to improved customer retention by providing seamless support through chatbots and virtual assistants, effectively addressing queries and enhancing user engagement.

As BNPL providers integrate AI into their operations, they are likely to create more efficient and secure payment ecosystems, fostering trust and enabling rapid scalability. The adoption of AI is anticipated to foster innovation and operational efficiency within the market.

Segmentation Analysis

The global market has been segmented on the basis of channel, enterprise size, end user, and geography.

By Channel

Based on channel, the market has been bifurcated into online and POS. The online segment captured the largest buy now pay later market share of 56.73% in 2023, primarily due to the widespread adoption of e-commerce and the growing preference for digital transactions. Consumers are increasingly turning to online shopping, with buy now pay later services seamlessly integrated into online platforms, making it easy for users to access these flexible payment options.

The convenience of shopping online, coupled with the ability to split payments over time without interest, has fueled the popularity of BNPL among e-commerce customers. Additionally, the rise of mobile shopping and digital wallets has supported the growth of the online segment, as consumers increasingly prefer purchasing through apps that offer BNPL services.

Furthermore, retailers are actively promoting BNPL options on their online platforms to increase conversion rates and average order values. As digital shopping experiences evolve, the online segment is projected to maintain its dominant position, reflecting shifts in consumer behaviors and ongoing technological advancements.

By Enterprise Size

Based on enterprise size, the market has been classified into large enterprises and small & medium enterprises. The small and medium enterprises (SMEs) segment is poised to record a remarkable CAGR of 16.99% through the forecast period. SMEs are increasingly adopting buy now pay later services to boost sales, enhance customer acquisition, and provide flexible payment options to their customers.

For smaller businesses, BNPL represents an effective tool to compete with larger companies by offering financing alternatives that make their products and services more accessible. Additionally, the lower cost and ease of integrating BNPL solutions into e-commerce platforms appeal to SMEs that may lack the resources for traditional financing systems.

The global transition to digitization and online commerce has boosted the adoption of BNPL by SMEs, enabling them to reach broader audiences and meet consumer demand for flexible payments. This growing acceptance of BNPL services within the SME sector, combined with the increasing penetration of e-commerce, is estimated to stimulate the growth of the segment through the forecast period.

By End User

Based on end user, the buy now pay later market has been divided into healthcare, retail, leisure & entertainment, and others. The retail segment garnered the highest revenue of USD 7.98 billion in 2023, mainly propelled by the increasing integration of buy now pay later services across both online and in-store retail environments.

Retailers are leveraging BNPL to increase sales volumes by enabling consumers to make larger purchases without immediate financial burden. The widespread adoption of BNPL in sectors such as fashion, electronics, and home goods has contributed significantly to this revenue growth by increasing the likelihood of purchase completion through flexible payment options.

Additionally, BNPL platforms are partnering with major retail chains to provide customized payment plans that enhance the overall customer experience. This is leading to increased average order values and improved customer retention, thereby boosting segmental expansion. The seamless integration of BNPL services into digital shopping platforms and physical stores has aided the growth of the retail segment.

Buy Now Pay Later Market Regional Analysis

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America buy now pay later market accounted for a substantial share of 36.54% and was valued at USD 6.69 billion in 2023. This dominance is reinforced by the widespread adoption of digital payment solutions, particularly in the United States and Canada, where consumers are increasingly shifting toward flexible, interest-free payment methods.

The high penetration of e-commerce in North America is contributing significantly to regional market growth, as leading retailers and online platforms offer these services to attract more customers and increase sales.

- For instance, in June 2024, Afterpay introduced a new collection of brands for U.S. consumers to shop in installments, including Curology, Helzberg Diamonds, Journeys, Rawlings Sporting Goods, and Zenni Optical. Shoppers can choose Afterpay at checkout for flexible payment options during summer 2024.

In addition, strong partnerships between BNPL providers and established financial institutions have fueled the regional market by increasing credit access for a wide range of consumers.

The growing preference for cashless transactions and the rise of mobile payment platforms are further supporting regional market growth. North American consumers are actively seeking alternatives to traditional credit cards. North America market is expected to maintain its leading position due to continued technological advancements and increasing consumer demand.

Asia-Pacific market is projected to grow at a robust CAGR of 16.78% in the forthcoming years. The region is experiencing rapid digitalization and a surge in e-commerce activities, particularly in countries such as China, India, and Southeast Asian nations.

With the growing prevalence of online shopping, the demand for flexible payment options, such as BNPL, is rising. Furthermore, the relatively low penetration of traditional credit cards in many parts of Asia-Pacific presents a significant opportunity for BNPL services to provide credit access to underserved populations.

The growing number of fintech companies and mobile payment platforms in the region is further fostering BNPL adoption, as these providers partner with retailers to offer seamless payment solutions. Additionally, the younger population in Asia-Pacific, particularly Gen Z and Millennials, are boosting the demand for BNPL due to their preference for interest-free, short-term financing options.

Competitive Landscape

The global buy now pay later market report provides valuable insights, highlighting the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Buy Now Pay Later Market

- Affirm, Inc.

- Klarna

- Splitit

- Sezzle

- Payl8r

- Zip Co Ltd.

- PayPal Holdings, Inc.

- AfterPay Limited

- Lazypay

- Pine Labs

Key Industry Developments

- July 2024 (Partnership): Klarna, the AI-powered global payments network, announced a partnership with Adobe Commerce to integrate its Buy Now Pay Later (BNPL) services. This collaboration allows merchants to easily implement flexible payment options, expanding Klarna's reach and enhancing payment flexibility for consumers on Adobe Commerce platforms.

- March 2024 (Launch): Galileo Financial Technologies, owned by SoFi Technologies, expanded its Buy Now Pay Later (BNPL) offerings, allowing banks and fintechs to offer cardholders new post-purchase installment payment options. This service integrates with existing debit and credit card accounts to enhance consumer payment flexibility.

The global buy now pay later market has been segmented:

By Channel

- Online

- POS

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End User

- Healthcare

- Retail

- Leisure & Entertainment

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)