Consumer Goods

Organic Perfumes Market

Organic Perfumes Market Size, Share, Growth & Industry Analysis, By Fragrance (Floral, Fruity, and Others), By Form (Liquid Perfumes, Solid Perfumes, and Perfume Oils), By End User (Male, Female, and Unisex), By Sales Channel, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : July 2024

Report ID: KR436

Organic Perfumes Market Size

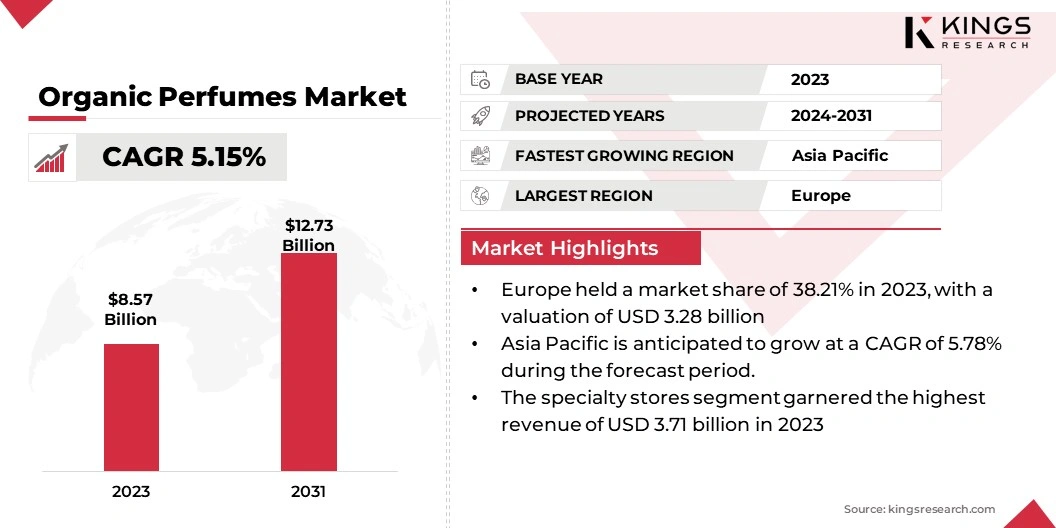

The global Organic Perfumes Market size was valued at USD 8.57 billion in 2023 and is projected to grow from USD 8.96 billion in 2024 to USD 12.73 billion by 2031, exhibiting a CAGR of 5.15% during the forecast period. In the scope of work, the report includes services offered by companies such Abel Fabriek, Symrise AG, Royal Aroma, Givaudan, Alpha Aromatics, Firmenich SA, ROBERTET SA, Agilex Fragrances, Fragrance Oils (International) Limited, Ogawa & Co., Ltd. and others.

Rise in e-commerce sales and increasing consumer preference for natural ingredients are augmenting market growth. The rise in e-commerce sales has significantly reshaped the landscape of the organic perfumes market. As consumers increasingly prioritize convenience and accessibility, online platforms have become pivotal in driving sales growth for organic perfumes.

E-commerce offers a vast reach, allowing consumers to browse and purchase products from anywhere at any time, which is particularly advantageous for niche products like organic perfumes. Moreover, e-commerce platforms provide a space for brands to directly engage with consumers through detailed product descriptions, reviews, and educational content about the benefits of organic ingredients.

This direct interaction fosters trust and transparency, which are crucial factors in the decision-making process for conscious consumers seeking natural and sustainable alternatives. Furthermore, the ease of comparative shopping and the availability of a wide range of organic perfume brands are contributing to the expansion of consumer choices and preferences.

Organic perfumes are defined by their use of natural and certified organic ingredients sourced from botanicals, essential oils, and plant extracts. Unlike conventional perfumes that may contain synthetic chemicals, organic perfumes prioritize natural fragrances that are free from parabens, phthalates, and other potentially harmful substances.

These perfumes are crafted to offer a sensory experience that is both luxurious and environmentally conscious, appealing to consumers who seek products aligned with their health and sustainability values.

Organic perfumes come in various forms including eau de parfum, eau de toilette, solid perfumes, and perfume oils, catering to different preferences for intensity and application methods. They are distributed through diverse sales channels, including specialty stores, organic retailers, and online platforms, and increasingly through direct-to-consumer models where brands can communicate their ethical sourcing and production practices directly to their customer base.

Analyst’s Review

In the competitive landscape of the organic perfumes market, key players are strategically focusing on innovation in formulations, sustainable sourcing practices, and expanding distribution channels to drive growth. Companies are increasingly leveraging consumer awareness about the benefits of organic ingredients to differentiate their offerings and capture a larger market share.

Some of their key strategies include partnerships with organic farms for direct sourcing, investment in research and development for new fragrance blends, and enhancing online presence through robust e-commerce platforms.

- For instance, in January 2024, Givaudan expanded its fragrance precursor collection with the introduction of Scentaurus Vanilla. This innovative, non-coloring precursor offers an elegant vanilla note. Activated naturally by oxygen, Scentaurus Vanilla delivers a burst of freshness, along with a long-lasting, powdery, and creamy vanilla effect.

Current market growth is bolstered by the rising consumer demand for natural and eco-friendly products, supported by regulatory frameworks promoting organic certifications and transparency in labeling.

Imperatives for key players include maintaining high product quality standards, navigating supply chain complexities related to sourcing natural ingredients and adapting to evolving consumer preferences toward clean beauty products. The market's growth trajectory emphasizes the importance of agility and sustainability in business strategies to capitalize on the growing global trend toward organic and natural perfumes.

Organic Perfumes Market Growth Factors

Growing awareness about the harmful effects of synthetic ingredients is reshaping consumer preferences in the organic perfumes market. Consumers are increasingly scrutinizing product labels and opting for natural alternatives due to concerns about potential health risks associated with synthetic chemicals commonly found in conventional perfumes.

Synthetic ingredients like phthalates and synthetic musks have been linked to allergies, hormone disruption, and environmental pollution, prompting a shift toward cleaner, safer alternatives. This awareness is driving the demand for organic perfumes that use natural fragrances derived from botanicals and essential oils, perceived as being gentler on the skin and less likely to cause adverse reactions.

Furthermore, as regulatory bodies impose stricter guidelines on ingredient transparency and safety standards, brands are under pressure to reformulate their products or risk losing consumer trust. This trend underscores a broader cultural shift toward sustainability and wellness, where consumers are seeking effective fragrance solutions that align with their values of health and environmental responsibility.

High production costs pose a significant challenge to organic perfumes market growth, impacting various stages from sourcing raw materials to manufacturing and packaging. Organic perfumes require ingredients that are sustainably sourced and often certified organic, which can be more expensive and subject to seasonal availability.

Additionally, the extraction and processing methods used for natural ingredients are typically more labor-intensive and require specialized equipment, further adding to production costs. Moreover, the commitment to sustainable practices, such as eco-friendly packaging and ethical sourcing, adds another layer of expenses. These higher production costs inevitably translate into higher retail prices for organic perfumes, potentially limiting affordability and accessibility for some consumers.

To mitigate these challenges, companies may explore economies of scale through bulk sourcing, invest in research and development for cost-effective formulations, or optimize supply chain efficiencies. Balancing cost considerations with maintaining product quality and sustainability standards remains crucial for brands navigating the competitive landscape of the organic perfumes market.

Organic Perfumes Market Trends

The increasing consumer preference for natural ingredients is a significant trend driving the growth of the organic perfumes market. Consumers are becoming more conscientious about the products they use on their skin, seeking perfumes that offer both fragrance and peace of mind.

Natural ingredients, such as botanical extracts and essential oils, are favored for their perceived purity and minimal impact on health and the environment. This preference aligns with broader trends in clean beauty and sustainable living, where transparency and ethical sourcing practices are paramount.

Brands are responding by formulating perfumes that highlight the natural essence of ingredients, often featuring organic certifications to assure consumers of their authenticity and safety. Furthermore, the shift toward natural ingredients extends beyond personal care routines. It reflects a cultural shift toward wellness and mindfulness, where consumers prioritize products that contribute positively to their overall well-being.

Segmentation Analysis

The global market is segmented based on fragrance, form, end user, sales channel, and geography.

By Fragrance

Based on fragrance, the market is categorized into floral, fruity, and others. The floral segment captured the largest organic perfumes market share of 45.84% in 2023. Floral fragrances have universal appeal and are widely favored for their elegant and timeless appeal across demographics. They evoke a sense of freshness, femininity, and sophistication, which makes them a popular choice among consumers seeking classic and pleasing scents.

Additionally, the growing consumer preference for natural and botanical ingredients has boosted the demand for floral perfumes, which often feature extracts from roses, jasmine, lilies, and other flowers known for their aromatic properties. Furthermore, advancements in fragrance technology and the art of perfumery have enabled brands to create complex and nuanced floral compositions that cater to diverse consumer preferences.

The floral segment's market leadership also reflects strategic product positioning by leading perfume houses and brands, who are continuously innovating with new floral blends and capitalize on the enduring popularity of floral notes in the fragrance industry. As a result, the floral segment is maintaining its market share and continuing to expand as consumers increasingly prioritize authenticity, quality, and sensory experiences in their fragrance choices

By Form

Based on form, the organic perfumes market is classified into liquid perfumes, solid perfumes, and perfume oils. The liquid perfumes segment is poised to record a staggering CAGR of 5.44% through the forecast period.

Liquid perfumes, including eau de parfum and eau de toilette formulations, offer convenience and versatility in application, appealing to a broad spectrum of consumers from casual users to aficionados. Their popularity is bolstered by innovations in packaging and formulation that enhance longevity and olfactive appeal.

Moreover, the increasing adoption of liquid perfumes in emerging markets, coupled with rising disposable incomes and urbanization, is fueling market expansion. Consumers in these regions are increasingly embracing personal care and grooming rituals, further propelling the demand for liquid perfumes.

Additionally, the shift toward natural and organic ingredients in perfumery is supporting the growth of this segment, as brands formulate liquid perfumes that emphasize botanical extracts and essential oils, catering to health-conscious consumers.

By End User

Based on end user, the market is divided into supermarkets/hypermarkets, specialty stores, online retailers, and others. The specialty stores segment garnered the highest revenue of USD 3.71 billion in 2023, primarily driven by their unique positioning and strategic advantages in catering to discerning consumers seeking niche and premium products. These stores specialize in offering a curated selection of organic perfumes, providing consumers with a personalized shopping experience and expert guidance on fragrance selection.

Furthermore, the growing consumer demand for natural and organic products has prompted specialty stores to expand their offerings and collaborate directly with perfume houses and artisanal brands known for their commitment to quality and sustainability. These strategic partnerships are strengthening the appeal of specialty stores as trusted destinations for authentic and ethically sourced organic perfumes.

Organic Perfumes Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

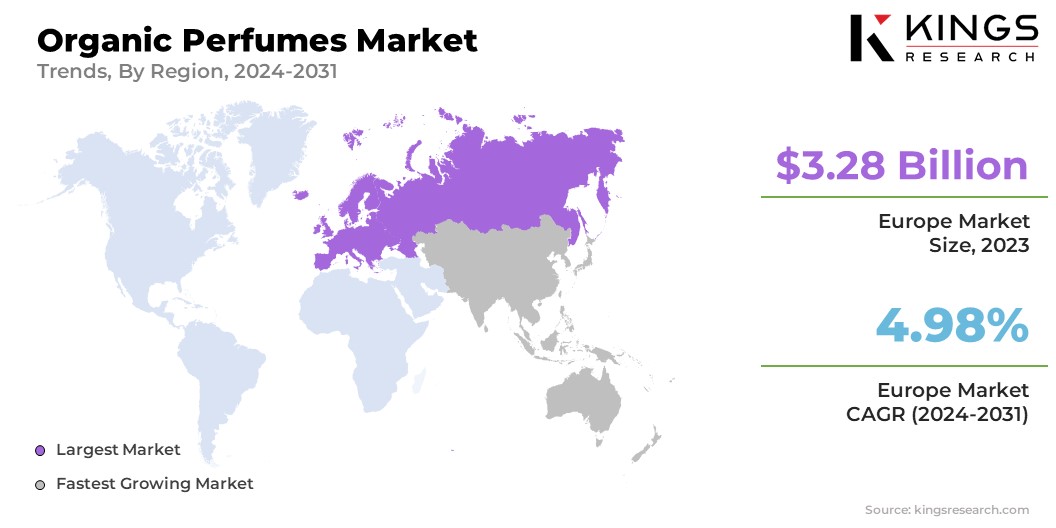

Europe maintained its leadership position in the organic perfumes market in 2023, capturing a significant market share of 38.21% and achieving a market value of USD 3.28 billion. This dominance can be attributed to several factors. Europe has a long-standing tradition of embracing natural and organic products, including fragrances, driven by consumer preferences for sustainable and eco-friendly choices.

- For instance, in June 2024, Symrise introduced SymDeo PMD green, a 100% biobased deodorizing ingredient for cosmetics. Produced using green chemistry, this versatile, odorless liquid was developed to meet the growing demand for natural, effective solutions. Suitable for all deodorant formats, it supports full-body applications and low-fragrance or aluminum-free concepts.

Moreover, stringent regulations and standards regarding cosmetic products in the region are encouraging the adoption of organic perfumes, which are perceived to be safer and less harmful to health and the environment. The presence of established luxury and premium fragrance markets in countries like France, Italy, and Germany is further boosting the demand for organic perfumes among affluent consumers who prioritize quality and authenticity.

As the market continues to evolve, Europe remains a key region for innovation in natural fragrance formulations and distribution strategies, reinforcing its pivotal role in shaping global trends in the organic perfumes industry.

The Asia-Pacific organic perfumes market is poised to experience robust growth, registering the highest CAGR of 5.78% over 2024-2031. Increasing disposable incomes and rapid urbanization in countries like China, India, and Japan are driving consumer spending on personal care products, including premium and natural fragrances.

Moreover, rising awareness about health and environmental issues is bolstering consumer interest in organic and natural ingredients in perfumes, aligning with global trends in clean beauty and sustainability.

The expanding middle-class population in the region seeks products that offer both quality and ethical sourcing, which is further boosting the demand for organic perfumes. Furthermore, strategic initiatives by international and local fragrance companies to expand their presence in Asia-Pacific, coupled with growing retail channels such as specialty stores and e-commerce platforms, are facilitating regional market growth.

Competitive Landscape

The global organic perfumes market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Organic Perfumes Market

- Abel Fabriek

- Symrise AG

- Royal Aroma

- Givaudan

- Alpha Aromatics

- Firmenich SA

- ROBERTET SA

- Agilex Fragrances

- Fragrance Oils (International) Limited

- Ogawa & Co., Ltd.

Key Industry Developments

- June 2024 (Partnership): Artefact partnered with Robertet to launch NaturIA, a generative AI project revolutionizing perfumery and flavoring. Their first creation, an AI-designed yogurt flavor for a major food group, highlighted NaturIA's potential for authentic, bespoke innovations.

- March 2024 (Launch): Givaudan introduced Nympheal, an exceptional molecule distinguished by its strong white floral profile. Nympheal claims to deliver superior olfactive performance and meet the most comprehensive regulatory standards. This launch underscores Givaudan’s dedication to innovation and our continuous efforts to develop groundbreaking products.

- March 2023 (Expansion): Firmenich unveiled Villa Harmony in China, expanding its global network of co-creation spaces. This collaboration with Xun Laboratory, a perfumery studio steeped in Chinese history, was purposed to blend ancient perfumery traditions with modern innovations, offering customers a unique connection to ancestral Chinese culture and techniques.

The global organic perfumes market is segmented as:

By Fragrance

- Floral

- Fruity

- Others

By Form

- Liquid Perfumes

- Solid Perfumes

- Perfume Oils

By End User

- Male

- Female

- Unisex

By Sales Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retailers

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership