Semiconductor and Electronics

Power Management IC Market

Power Management IC Market Size, Share, Growth & Industry Analysis, By Product Type (Voltage Regulators, Battery Management ICs, Energy Management ICs, LED Driver ICs, Power Supply ICs, Others), By Applications (Battery Powered Devices, Energy Harvesting Systems, Power Supply Control, Display and Lighting, Others), By Industry Vertical, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1104

Power Management IC Market Size

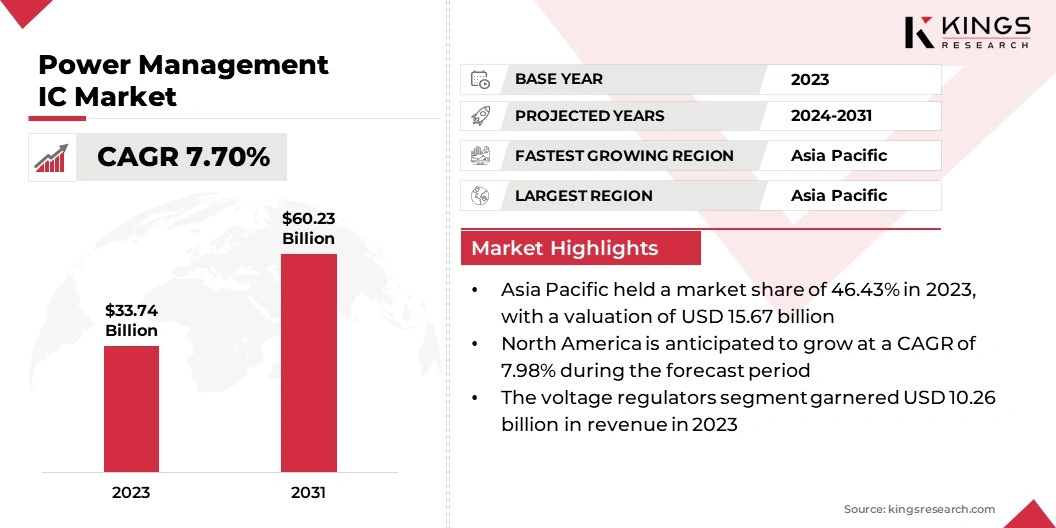

The Power Management IC Market size was valued at USD 33.74 billion in 2023 and is projected to grow from USD 35.84 billion in 2024 to USD 60.23 billion by 2031, exhibiting a CAGR of 7.70% during the forecast period. The growing popularity of portable consumer electronics, such as smartphones, tablets, laptops, and wearables, is boosting the growth of market.

These devices require advanced power management to optimize battery life, ensure efficient charging, and regulate power consumption. To meet consumers demands for smaller, more powerful, and energy-efficient devices, manufacturers are increasingly relying on power management ICs, which enhance performance and reliability while reducing overall power consumption.

In the scope of work, the report includes products offered by companies such as Renesas Electronics Corporation., Texas Instruments Incorporated, Infineon Technologies AG, STMicroelectronics, NXP Semiconductors, Analog Devices, Inc., TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Mitsubishi Electric Corporation, Qualcomm Technologies, Inc., MediaTek Inc., and others.

Moreover, the global rollout of 5G networks is leading to increased demand for PMICs. 5G infrastructure, including base stations, network equipment, and user devices, requires efficient power management to support higher data rates, low latency, and increased bandwidth. PMICs help regulate the complex power requirements of 5G systems, enabling efficient energy distribution and reducing power losses.

- According to the March 2024 report by 5G Americas, global 5G connections experienced a significant expansion in 2023, reaching 1.76 billion, marking a 66% increase due to the addition of 700 million new connections.

A power management IC (PMIC) is an integrated circuit that manages the power requirements of a system by controlling voltage regulation, power sequencing, battery management, and energy conversion. It plays a critical role in optimizing energy efficiency, prolonging battery life, and ensuring stable power delivery in electronic devices.

PMICs are widely used in portable electronics, automotive systems, industrial equipment, and renewable energy solutions. They integrate various functions such as voltage regulators, battery chargers, and power switches, offering compact and efficient power management solutions for complex systems, reducing the need for multiple discrete components.

Analyst’s Review

The global transition to renewable energy is accelerating, characterized by increased investment in solar and wind power systems. This shift is creating a significant demand for advanced power management ICs (PMICs), which are critical for optimizing energy conversion, storage, and distribution in renewable energy infrastructures.

Governments and industries are prioritizing sustainability, which is fostering the adoption of renewable energy technologies and stimulating the growth of the power management IC market.

- In July 2024, the Indian government approved a Viability Gap Funding (VGF) scheme of USD 890 million to boost offshore wind energy development. The initiative aims to facilitate the installation and commissioning of 1 GW of offshore wind projects, with 500 MW allocated for the coasts of Gujarat and Tamil Nadu.

Power management IC enhance the efficiency of solar panels, wind turbines, and battery storage systems by ensuring precise power control, minimizing energy loss, and optimizing energy utilization. Their ability to manage complex power requirements in these systems positions them as indispensable components in the renewable energy ecosystem.

The growing global focus on green energy and the pressing need for highly efficient power management solutions fuels the demand for PMICs, making them a major factor in the advancement of the renewable energy sector.

Power Management IC Market Growth Factors

The rapid expansion of the Internet of Things (IoT) ecosystem is fueling the growth of the power management IC market. IoT devices, including smart home systems and industrial sensors, typically operate on low power and require efficient power management solutions to extend battery life and maintain reliable performance.

PMICs are essential for these devices, providing voltage regulation, energy harvesting, and power distribution. The expanding IoT market , particularly in smart cities, industrial automation, and healthcare, create a strong demand for compact and energy-efficient PMICs.

- According to a March 2024 report by 5G Americas, global IoT subscriptions reached 3.1 billion, while smartphone subscriptions totaled 6.6 billion.

Moreover, ongoing advancements in semiconductor manufacturing are making PMICs more efficient, compact, and cost-effective.

The miniaturization of components allows manufacturers to integrate multiple power management functions into a single chip, reducing the need for multiple discrete components. This increases design flexibility and reduces both the size and cost of electronic devices. These innovations help manufacturers develop PMICs that deliver higher performance and greater efficiency, fueling the adoption of PMICs in various industries.

However, the production of advanced power management ICs requires sophisticated semiconductor manufacturing processes, which are highly capital-intensive. These elevated manufacturing costs present a significant barrier, particularly for manufacturers operating in cost-sensitive industries, hindering power management IC market expansion.

To mitigate this challenge, companies are improving manufacturing efficiency, and utilizing outsourced semiconductor fabrication (foundries) to reduce overheads. Additionally, investment in research and development is focused on cost-optimization techniques, enabling manufacturers to balance high performance with reduced production costs, thereby aiding market growth.

Power Management IC Industry Trends

The increasing adoption of electric vehicles and advanced driver-assistance systems (ADAS) has notable increased the demand for PMICs in the automotive industry. EVs require highly efficient power management to optimize battery usage, manage charging systems, and ensure reliable power distribution across various vehicle subsystems.

The automotive industry's shift toward electric and hybrid vehicles is highlighting the need for robust, reliable, and high-performance PMICs.

Additionally, the medical devices and healthcare sectors are experiencing rapid growth, necessitating reliable, energy-efficient power management solutions. Wearable health monitors, portable diagnostic equipment, and other medical devices require extended battery life and consistent power management to function effectively.

PMICs are critical in these devices, providing precise power control, reducing energy consumption, and ensuring long-term reliability, thereby fueling the growth of the power management IC market.

Segmentation Analysis

The global market has been segmented based on product type, applications, industry vertical, and geography.

By Product Type

Based on product type, the market has been segmented into voltage regulators, battery management ICs, energy management ICs, LED Driver ICs, power supply ICs, and others. The voltage regulators segment led the power management IC market in 2023, reaching a valuation of USD 10.26 billion due to their essential role in ensuring stable power supply across a wide range of electronic devices.

Their demand is particularly high in applications such as smartphones, tablets, automotive systems, and industrial electronics, where precise power control is necessary for efficient operation. Additionally, the growing trend of miniaturization and the pressing need for energy-efficient solutions in portable devices are prompting manufacturers to integrate more advanced, compact voltage regulators.

By Applications

Based on applications, the market has been classified into battery powered devices, energy harvesting systems, power supply control, display and lighting, and others. The battery powered devices segment secured the largest revenue share of 45.43% in 2023. This expansion is attributed to the surging adoption of portable electronic devices and electric vehicles (EVs).

Increasing consumer demand for smartphones, wearables, and tablets requires highly efficient PMICs to optimize battery life and power consumption. PMICs play a crucial role in ensuring energy efficiency, managing battery charging, and regulating power distribution, making them essential for battery-dependent devices. The global transition to energy efficiency and sustainability further increases the demand for PMICs in battery-powered applications.

By Industry Vertical

Based on industry vertical, the market has been divided into consumer electronics, automotive, industrial, telecommunications, healthcare, and others. The automotive segment is poised tow witness significant growth at a robust CAGR of 9.11% through the forecast period. This is due to the rising adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS).

EVs demand highly efficient power management for battery optimization, charging systems, and overall vehicle energy distribution. PMICs ensure stable power supply to critical automotive functions, including infotainment, lighting, and sensor systems, making them essential for modern vehicle performance. Increasing integration of electronics in vehicles underscores the need for reliable, efficient power management solutions, augmenting the growth of the automotive segment.

Power Management IC Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

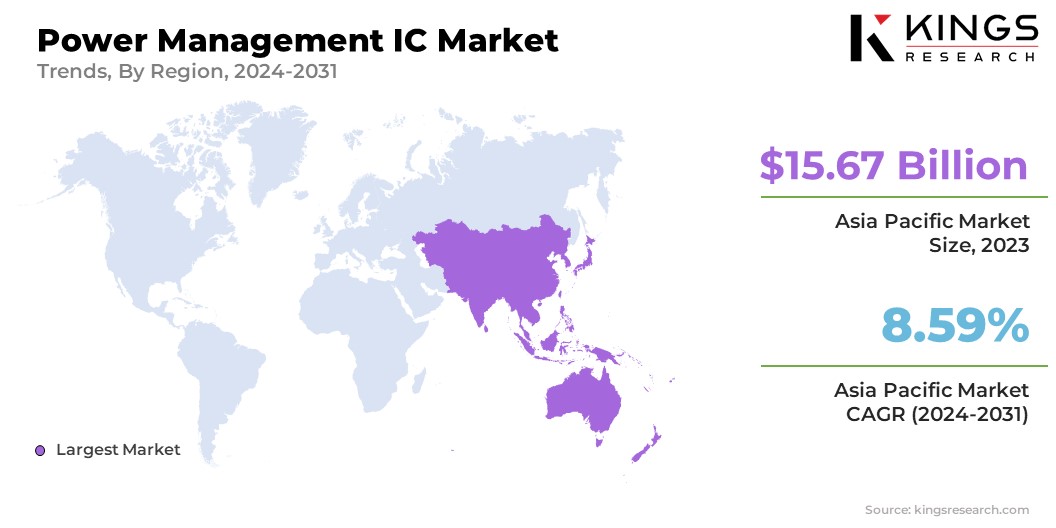

Asia-Pacific power management IC market accounted for a notable share of around 46.43% in 2023, with a valuation of USD 15.67 billion. This growth is bolstered by the region's rapidly expanding consumer electronics market, supported by rapid urbanization, rising disposable incomes, and a tech-savvy population.

As manufacturers introduce more advanced and feature-rich devices, including smartphones, tablets, and wearable technology, the demand for power management ICs (PMICs) is rising.

- A 2024 report from the China Chamber of Commerce for Import and Export of Machinery and Electronic Products highlights China's emergence as a global hub for consumer electronics and household appliances. In 2023, China led the Asia-Pacific market, securing around 48% of total sales. Furthermore, the report notes that China's exports constituted 42% of global export shares in 2022, reflecting its significant presence in international markets.

Moreover, countries such as Taiwan, South Korea, and Japan are at the forefront of semiconductor manufacturing, enhancing the region’s ability to innovate and produce advanced PMICs. This strong manufacturing base facilitates efficient fulfillment of local and global demand, further thereby propelling the expansion of the Asia-Pacific market.

North America is poised to experience significant growth, registering a robust CAGR of 7.98% over the forecast period. The surging popularity of home automation devices is boosting the demand for PMICs in North America. These devices need compact and efficient power management solutions to enhance battery life while ensuring uninterrupted operation.

With consumers seeking more advanced, power-efficient home automation devices, manufacturers are increasingly integrating PMICs into their designs to enhance performance and energy efficiency.

- According to the 2024 IoT M2M Council reports, nearly 20% of U.S. households have six or more smart home devices. Moreover, tThe Smart Home Dashboard survey reveals that 45% of U.S. internet households own at least one smart home device, with 18% having six or more.

Furthermore, the aerospace and defense sectors in North America are increasingly adopting advanced electronic systems, which require sophisticated power management solutions. The growing focus on technology-driven advancements in aerospace is leading to increased demand for PMICs to support the power needs of complex electronic systems, thereby propelling regional market development.

Competitive Landscape

The global power management IC market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Power Management IC Market

- Renesas Electronics Corporation.

- Texas Instruments Incorporated

- Infineon Technologies AG

- STMicroelectronics

- NXP Semiconductors

- Analog Devices, Inc.

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- Mitsubishi Electric Corporation

- Qualcomm Technologies, Inc.

- MediaTek Inc.

Key Industry Developments

- July 2024 (Product Launch): Renesas Electronics Corporation, introduced a comprehensive space-ready reference design for the AMD Versal AI Edge XQRVE2302 Adaptive SoC. This design is tailored for cost-efficient AI edge applications, offering radiation-hardened and radiation-tolerant plastic solutions. It is specifically engineered to support diverse power rails, meeting the stringent voltage tolerances, high current demands, and efficient power conversion required by next-generation space avionics systems.

- September 2024 (Partnership): STMicroelectronics introduced a highly integrated power-management IC designed for its latest microprocessors. The IC features seven DC/DC buck converters and eight low-dropout (LDO) regulators, along with an additional LDO to supply the reference voltage (Vref) for system DDR3 and DDR4 DRAMs.

The global power management IC market has been segmented below as:

By Product Type

- Voltage Regulators

- Battery Management ICs

- Energy Management ICs

- LED Driver ICs

- Power Supply ICs

- Others

By Applications

- Battery Powered Devices

- Energy Harvesting Systems

- Power Supply Control

- Display and Lighting

- Others

By Industry Vertical

- Consumer Electronics

- Automotive

- Industrial

- Telecommunications

- Healthcare

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership