Advanced Materials and Chemicals

Abrasive Market

Abrasive Market Size, Share, Growth & Industry Analysis, By Product Type (Bonded, Coated, Others), By Application (Metalworking, Construction, Automotive, Aerospace, Others), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : January 2025

Report ID: KR1243

Market Definition

Abrasives are hard materials or substances used to wear down, smooth, polish, or shape surfaces through friction. They are commonly employed in industrial, construction, and manufacturing processes for grinding, cutting, polishing, and finishing. Abrasives can be natural, such as garnet and emery, or synthetic, such as aluminum oxide and silicon carbide.

These materials are vital in applications ranging from metal fabrication and woodworking to electronics and automotive industries, where precision and surface finishing are crucial.

Abrasive Market Overview

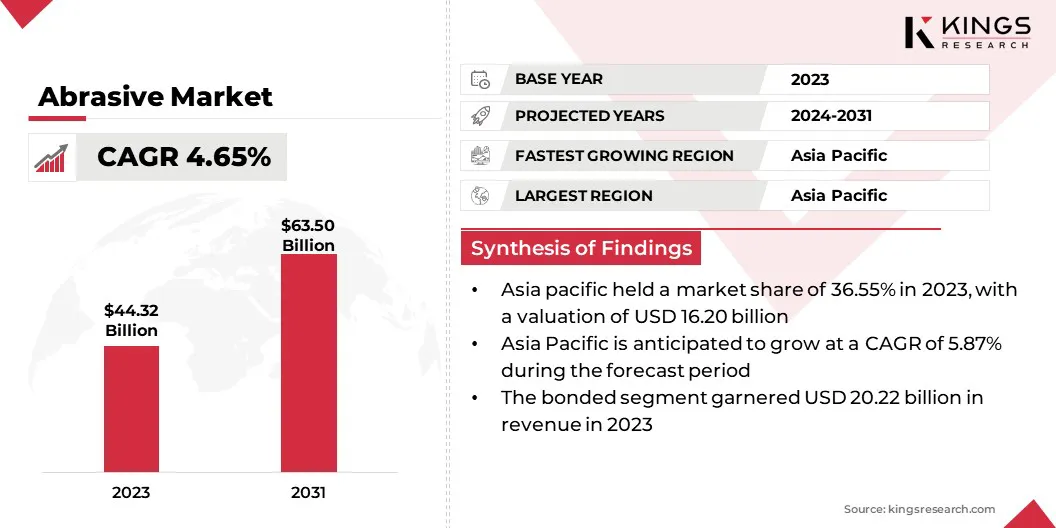

The global abrasive market size was valued at USD 44.32 billion in 2023, which is estimated to be valued at USD 46.18 billion in 2024 and reach USD 63.50 billion by 2031, growing at a CAGR of 4.65% from 2024 to 2031.

The growing demand for high-performance materials across industrial sectors is significantly driving the market. Industries such as automotive, aerospace, and electronics require advanced abrasives for grinding, polishing, and surface finishing to meet precise quality standards. The increasing adoption of lightweight and durable materials in automotive and aerospace applications has further fueled the need for precision abrasives.

Major companies operating in the global abrasive market are Saint-Gobain Limited, 3M, TYROLIT, Henkel AG & Co. KGaA, Fujimi Incorporated, Bosch, Mirka Ltd., Asahi Diamond Industrial, deerfos, KREBS & RIEDEL Schleifscheibenfabrik GmbH & Co. KG, DuPont, sia Abrasives Industries AG, NORITAKE CO., LIMITED, NIPPON RESIBON CORPORATION, WEILER ABRASIVES, and others.

Rapid industrialization and the growing focus on manufacturing efficiency are fueling the market. Key industries such as automotive, construction, and electronics rely heavily on abrasives for shaping, finishing, and cutting materials. The demand for precision tools and efficient production processes in manufacturing facilities has further strengthened the market.

The shift to advanced manufacturing technologies is creating opportunities for abrasives, emphasizing their importance in ensuring high-quality and durable end products across a wide range of industrial applications.

- In December 2023, the Government of India and the Asian Development Bank (ADB) signed a USD 250 million policy-based loan aimed at advancing industrial corridor development. This initiative seeks to enhance the competitiveness of manufacturing, bolster national supply chains, and strengthen connections with regional and global value chains.

Key Highlights:

- The global abrasive market size was recorded at USD 44.32 billion in 2023.

- The market is projected to grow at a CAGR of 4.65% from 2024 to 2031.

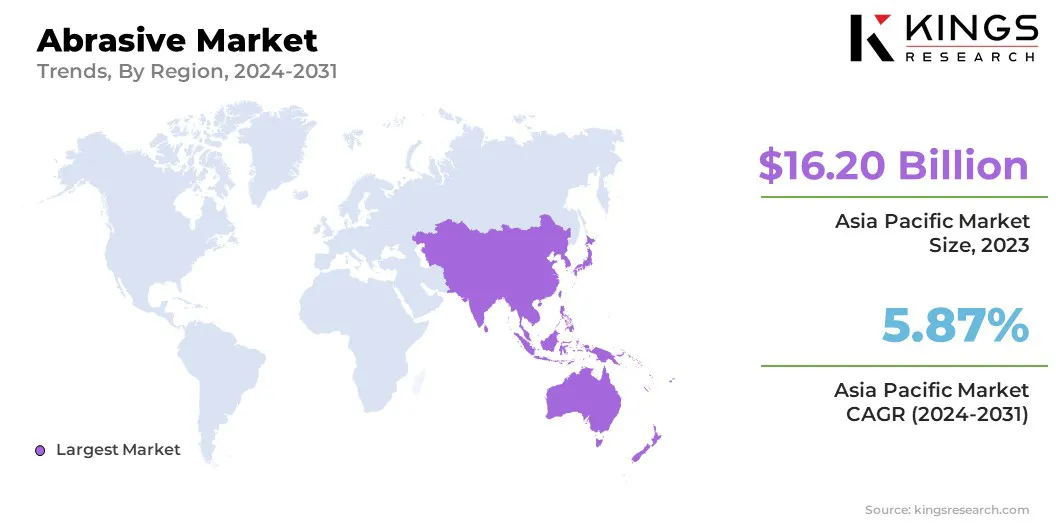

- Asia Pacific held a market share of 36.55% in 2023, with a valuation of USD 16.20 billion, and is anticipated to grow at a CAGR of 5.87% during the forecast period.

- The bonded segment garnered USD 20.22 billion in revenue in 2023.

- The metalworking segment is expected to reach USD 24.06 billion by 2031.

Market Driver

"Growth in Automotive and Aerospace Industries"

The automotive and aerospace sectors play a pivotal role in driving the abrasive market. These sectors require advanced abrasive solutions for critical applications, including grinding, polishing, and cutting high-performance materials. The increasing production of lightweight vehicles and aircraft has intensified the need for abrasives to meet stringent quality and precision standards.

- Boeing's 2023 Commercial Market Outlook (CMO) forecasts a global demand for 42,595 new commercial jets by 2042, with an estimated market value of USD 8 trillion.

Additionally, the shift to electric and hybrid vehicles demands abrasives for specialized components such as batteries and lightweight materials. The ongoing expansion in global transportation infrastructure further amplifies the adoption of abrasive technologies in these high-growth industries.

- According to the International Energy Agency (IEA), the market for electric light commercial vehicles (LCVs) registered continued growth in 2023. Global sales of electric LCVs increased by over 50%, with their market share rising to nearly 5%.

Market Challenge

"Concerns Regarding Environmental Impact"

A significant challenge for the growth of the market is the environmental impact associated with the production and disposal of abrasive materials. The manufacturing process often generates harmful emissions and waste, while improper disposal can lead to pollution.

Companies are adopting sustainable practices such as developing eco-friendly abrasives made from biodegradable or recyclable materials. Additionally, manufacturers are investing in advanced technologies to reduce energy consumption and minimize emissions during production.

Circular economy models, including recycling spent abrasives and reusing them in manufacturing, are also being implemented, enabling businesses to align with stricter environmental regulations and sustainability goals.

Market Trend

"Integration of Automation and Robotics"

The adoption of automation and robotics in manufacturing processes is contributing to the growth of the abrasive market. Automated systems rely on abrasives for grinding, deburring, and polishing tasks to achieve uniform quality at scale. Advanced robotic technologies equipped with precision abrasives enable faster operations and reduced downtime, enhancing overall productivity.

- On April 9, 2024, Flexxbotics, a provider of workcell digitalization solutions for robot-driven manufacturing, announced that Darmann Abrasive Products (Darmann), a global leader in fine grit abrasive products for superfinishing and precision grinding, chose Flexxbotics for advanced robotic machine tending. This collaboration enables Darmann to significantly enhance production capacity while maintaining a steady and consistent operational rhythm.

This trend is particularly evident in automotive and electronics industries, where high-volume production requires abrasives designed for efficiency and consistency. The increasing integration of these technologies continues to strengthen the market's outlook, aligning with industrial modernization efforts.

Abrasive Market Report Snapshot

| Segmentation | Details |

| By Product Type | Bonded, Coated, and Others |

| By Application | Metalworking, Construction, Automotive, Aerospace, and Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Bonded, Coated, and Others): The bonded segment earned USD 20.22 billion in 2023, due to its superior durability, precision in shaping and grinding applications, and widespread use across industries such as automotive, aerospace, and metal fabrication.

- By Application (Metalworking, Construction, Automotive, Aerospace, and Others): The metalworking segment is projected to reach USD 24.06 billion by 2031, owing to its extensive use in grinding, cutting, and polishing applications across industries such as automotive, aerospace, and heavy machinery.

Abrasive Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounts for a notable market share of around 36.55% in 2023, with a valuation of USD 16.20 billion. The growing investments in construction and infrastructure projects across countries significantly drive the market in the region.

In countries like China, India, and Southeast Asia, these investments are creating a surge in demand for abrasives used in construction activities, road building, and structural finishing. The expanding construction sector, driven by urbanization and economic growth, continues to be a critical factor pushing the demand for abrasives in Asia Pacific.

- As per the International Trade Administration (ITA), China’s 14th Five-Year Plan focuses on new infrastructure projects in sectors such as transportation, energy, water systems, and urbanization. Estimates suggest that total investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) will amount to approximately USD 4.2 trillion. The plan highlights nine key areas for enhancing energy efficiency and promoting green building development, including retrofitting over 350 million square meters of buildings and constructing more than 50 million square meters of buildings designed to achieve net zero energy consumption.

The abrasive market in North America is set to register significant growth over the forecast period, recording a robust CAGR of 4.10%. The expansion of North America’s aerospace and defense industries is a significant driver for the market.

These sectors require highly specialized abrasive products for the manufacturing of complex components used in aircraft, military equipment, and defense technologies.

- The Aerospace Industries Association highlights that the U.S. aerospace and defense industry achieved a remarkable milestone, generating more than USD 955 billion in sales in 2023, marking a 7.1% growth compared to the previous year. The industry contributed $425 billion to the economy, accounting for 1.6% of the U.S. nominal GDP in 2023.

The increasing demand for aircraft parts, both for commercial aviation and military defense systems, continues to support the usage of abrasives in the region. Additionally, ongoing technological advancements in the production of fighter jets, drones, and defense systems further intensify the demand for high-precision abrasive products.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The U.S. Customs and Border Protection mandates that imported abrasive products, such as abrasive belts, must be marked with their country of origin. This requirement ensures transparency and assures consumers about the manufacturing source of the products.

- The European Committee for Standardization (CEN) develops and maintains standards for abrasives to ensure product safety and quality. These standards are adopted by member countries to regulate the manufacturing and application of abrasive products.

- Germany implements the Deutsches Institut für Normung (DIN) standards for abrasives, which align with European (EN) and international (ISO) standards. These standards cover various aspects, including product specifications, safety requirements, and testing methods, ensuring high-quality and safe abrasive products in the market.

- In India, the Ministry of Environment, Forest and Climate Change (MoEFCC) mandates compliance with environmental norms for various industries, including the abrasive industry, focusing on emission controls and sustainable resource utilization.

- The Japanese Industrial Standards Committee (JISC) develops and maintains the Japanese Industrial Standards (JIS) applicable to abrasive products, ensuring consistency and safety in their use.

Competitive Landscape:

The global abrasive market is characterized by a large number of participants, including established corporations and rising organizations. Key participants in the market are increasingly adopting the latest technological innovations to drive growth and meet evolving industry demands.

Key advancements include the development of high-performance abrasives that offer greater efficiency, longer lifespan, and better results in precision applications. These technological innovations are enabling companies to maintain a competitive edge, improve product offerings, and address the diverse needs of their customers, significantly contributing to the growth of the market.

- In August 2024, Weiler Abrasives introduced two enhancements to its high-performance Tiger 2.0 cutting, grinding, and combination wheels. These upgrades are specifically designed to tackle the challenges faced by demanding metal fabrication industries, including shipbuilding, pressure vessel manufacturing, and heavy equipment fabrication.

List of Key Companies in Abrasive Market:

- Saint-Gobain Limited

- 3M

- TYROLIT

- Henkel AG & Co. KGaA

- Fujimi Incorporated

- Bosch

- Mirka Ltd.

- Asahi Diamond Industrial

- deerfos

- KREBS & RIEDEL Schleifscheibenfabrik GmbH & Co. KG

- DuPont

- sia Abrasives Industries AG

- NORITAKE CO., LIMITED

- NIPPON RESIBON CORPORATION

- WEILER ABRASIVES

Recent Developments:

- In August 2024, Weiler Abrasives introduced its new Precision Express program, which reduces lead times for gear grinding wheels from months to just days. This program aims to assist gear manufacturers in industries like automotive, energy, and aerospace by enhancing quality, boosting consistency, and ensuring timely delivery to customers.

- In October 2023, Saint-Gobain revealed a partnership with Dedeco Abrasive Products, a manufacturer of specialty abrasives, under which Saint-Gobain will market Dedeco's Sunburst abrasive line. This collaboration supports the company's broader objective of providing comprehensive abrasive solutions.

- In October 2023, Tyrolit Group announced the acquisition of Acme Holding Company, a Michigan-based abrasives manufacturer. This acquisition is part of Tyrolit's strategy to expand its portfolio by integrating grinding with specialty abrasives solutions. The Michigan facility becomes the company's seventh location in the U.S. and is expected to play a significant role in key industries such as foundry, steel, and rail.

- In March 2024, Norton Saint-Gobain Abrasives unveiled a new three-pointed curved grain technology as part of its RazorStar coated abrasive line. This innovative approach provides significant benefits, including cooler cuts and extended durability in demanding grinding applications, transforming productivity in abrading substance grinding.

- In May 2023, Sak Abrasives Limited acquired Jowitt & Rodgers Co. in Philadelphia, U.S., expanding its product portfolio to include resin-bonded grinding wheels, discs, and segments. This strategic acquisition enhances Sak Abrasives' capabilities, offering a broader range of products and reinforcing its position in the abrasive market through focused portfolio growth.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership