Advanced Materials and Chemicals

Activated Alumina Market

Activated Alumina Market Size, Share, Growth & Industry Analysis, By Form (Beads, Powder, Extruded), By Application (Water Treatment, Oil & Gas, Petrochemical, Pharmaceutical), and Regional Analysis, 2024-2031

Pages : 160

Base Year : 2023

Release : January 2025

Report ID: KR1245

Market Definition

Activated alumina is a highly porous and adsorbent form of aluminum oxide (Al₂O₃), typically produced by heating alumina at high temperatures to enhance its surface area and porosity.

This material is widely used in various industrial applications, including water purification, gas drying, and as a catalyst support in chemical processes. Its high surface area and ability to adsorb water, gases, and impurities make it an effective desiccant and adsorbent.

Activated Alumina Market Overview

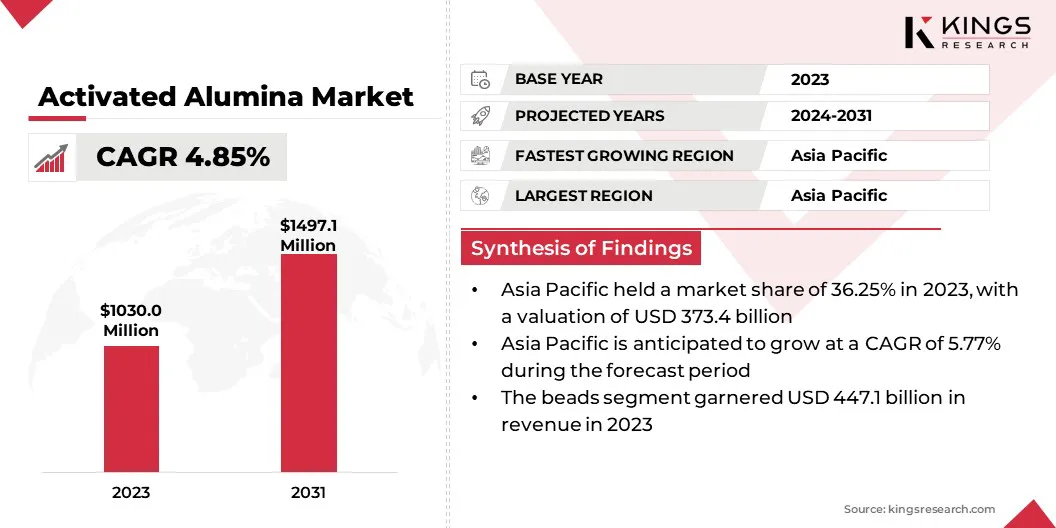

Global activated alumina market size was valued at USD 1,030.0 million in 2023, which is estimated to be valued at USD 1,074.8 million in 2024 and reach USD 1,497.1 million by 2031, growing at a CAGR of 4.85% from 2024 to 2031.

The market is experiencing significant growth due to its widespread use in water treatment for removing fluoride and arsenic, driven by increasing environmental concerns and stringent regulations. Expanding industrial applications, particularly in oil refining, petrochemicals, and hydrogen production, are further boosting demand.

Major companies operating in the global activated alumina market are BASF, CHALCO Shandong Co.,Ltd, J.M. Huber Corporation, Axens, Sumitomo Chemical Co., Ltd., Delta Adsorbents, Interra Global, HengYe Inc., Doyle Dryers LLC, DAWN SCIENTIFIC INC, Evonik Industries AG, Devson Catalyst, Honeywell International Inc., JALON, Camfil, and others.

The demand for activated alumina in water treatment has surged due to its efficiency in removing contaminants such as fluoride, arsenic, and selenium. Increasing concerns over water safety have led to stricter water quality regulations globally.

Municipalities and industrial facilities are increasingly adopting advanced filtration systems with activated alumina to meet these standards. Additionally, government initiatives promoting clean drinking water access in developing economies has further fueled the growth of the market.

- The UN World Water Development Report 2023 emphasizes Sustainable Development Goal 6 (SDG 6), focused on ensuring the availability and sustainable management of water and sanitation for all by 2030. It provides recommendations to policymakers on accelerating progress, including capacity building, enhanced data systems, innovation, financing, and governance enhnacements.

Key Highlights:

- The global activated alumina market size was recorded at USD 1,030.0 million in 2023.

- The market is projected to grow at a CAGR of 4.85% from 2024 to 2031.

- Asia Pacific held a share of 36.25% in 2023, valued USD 373.4 million, and is anticipated to grow at a CAGR of 5.77% throughg the forecast period.

- The beads segment garnered a valuation of USD 447.1 million in 2023.

- The water treatment segment is expected to reach USD 607.1 million by 2031.

Market Driver

"Expansion of the Oil and Gas Industry"

The activated alumina market benefits greatly from the growing global energy demand and the expansion of oil and gas production. Essemtial for drying gases, liquids, and refining processes, activated alumina effectively removes moisture and contaminants from fuels and feedstocks.

Increasing investments in oil refining and natural gas processing facilities, particularly in the Middle East, North America, and Asia-Pacific, have further boosted its adoption.

- The IEA Oil Market Report (OMR) highlights a seasonal rise in global oil demand in Q4 2024, with annual growth reaching 1.5 mb/d—the highest since Q4 2023 and 260 kb/d above prior forecasts. Annual growth for 2024 is revised to 940 kb/d, with an expected acceleration to 1.05 mb/d in 2025, supported by a modestly improved economic outlook.

Market Challenge

"High Production Costs and Limited Raw Material Availability"

The high production costs and the limited availability of high-quality raw materials pose significant challenges to the growth of the activated alumina market. Fluctuating prices of aluminum hydroxide, a key input, further impact cost structures, deterring adoption in price-sensitive regions.

To address these challenges, companies are investing in research and development to optimize production processes, reduce energy consumption, and develop cost-efficient alternatives. Collaborations with raw material suppliers to ensure a stable supply chain and strategic sourcing initiatives are also being implemented.

Additionally, firms are exploring recycling and reuse methods to mitigate dependency on virgin raw materials.

Market Trend

"Rising Use in Hydrogen Production"

The growing adoption of activated alumina in hydrogen production processes, such as steam methane reforming and hydrogen purification, is driving market expansion.

The global transition to cleaner energy sources has led to increased investments in hydrogen as a sustainable energy carrier, supporting the growth of the activated alumina market.

- The U.S. Department of Energy's (DOE) Hydrogen and Fuel Cell Technologies Office is advancing technologies to produce hydrogen at USD 2/kg by 2026 and USD 1/kg by 2031 through net-zero carbon pathways. This aligns with the Hydrogen Energy Earthshot initiative, which aims to reduce the cost of clean hydrogen by 80% to USD 1 per kilogram within a decade.

Activated alumina is utilized for removing moisture and impurities during hydrogen production and storage, ensuring the efficiency and safety of operations. The rising adoption of hydrogen in fuel cells, coupled with government initiatives supporting the hydrogen economy, is contributing to the growth of the market.

Activated Alumina Market Report Snapshot

| Segmentation | Details |

| By Form | Beads, Powder, Extruded |

| By Application | Water Treatment, Oil & Gas, Petrochemical, Pharmaceutical, Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Form (Beads, Powder, and Extruded): The beads segment secured a revenue of USD 447.1 million in 2023 due to its superior surface area and uniform particle size, which enhance adsorption efficiency, making it ideal for water treatment and gas drying applications.

- By Application (Water Treatment, Oil & Gas, Petrochemical, Pharmaceutical, and Others): The water treatment segment held a share of 38.55% in 2023, fueled by its exceptional efficiency in removing contaminants such as fluoride and arsenic, coupled with stringent regulatory standards and the rising need for clean and safe water globally.

Activated Alumina Market Regional Analysis

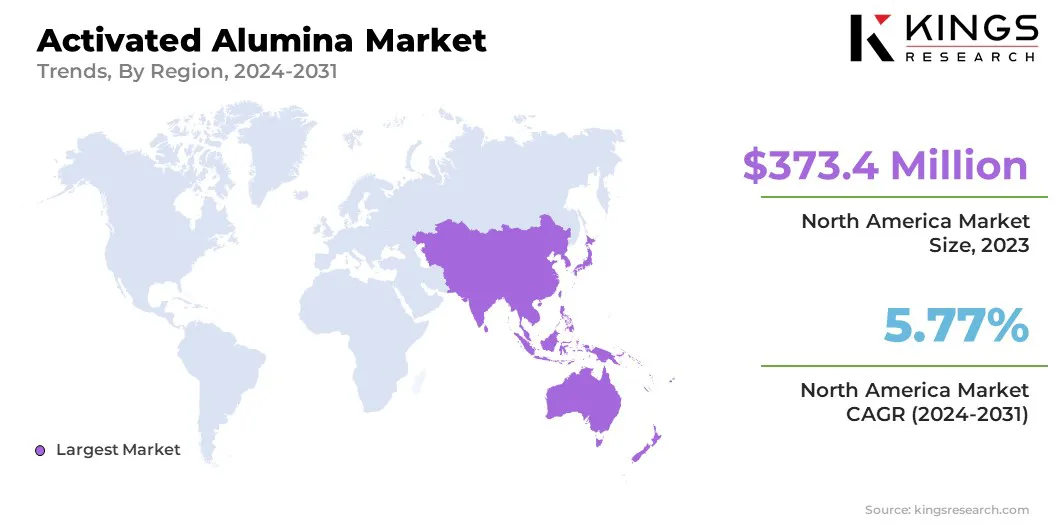

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific activated alumina market captured a notable share of around 36.25%in 2023, valued at USD 373.4 million. The growing petrochemical production in the region, particularly in China, India, and the Middle East, is creating a strong demand for activated alumina in refining processes.

The material's ability to remove impurities and moisture from petrochemical products enhances operational efficiency, contributing to regional market expansion.

Additionally, governments across the region are implementing stricter environmental regulations, leading to increased adoption of activated alumina for air and water purification. These measures, aimed at reducing pollution, are boosting demand for advanced filtration and purification technologies.

- According to Infrastructure Asia, Singapore utilizes advanced filtration and disinfection technologies to produce "NEWater," recycling up to 800,000 cubic meters of water daily. By 2060, NEWater is projected to meet 55% of the nation's water demand.

The Europe activated alumina market is set to witness significant growth over the forecast period, recording a robust CAGR of 4.71%. This growth is largely attributed to rigorous environmental policies, including the European Green Deal and water quality standards.

These regulations prompt industries to adopt advanced water treatment and air purification technologies, significantly boosting the demand for activated alumina for contaminant removal.

With growing concerns over water scarcity and contamination, there is a heightened focus on sustainable water treatment solutions across Europe. Activated alumina plays a vital role in removing contaminants such as fluoride and arsenic from drinking water, driving demand in municipal and industrial water treatment sectors.

- In October 2024, Water Europe introduced a USD 272.85 billion research initiative aimed at water investments over the next six years to safeguard Europe's economy and promote environmental sustainability. The "Value of EU Investing in Water" study highlights the need for improved water management to tackle the increasing risk of water scarcity, which effects 38% of the EU population.

This expansion is expected to increase water demand by 2.6 times, underscoring the critical need for sustainable water management to meet future requirements.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the United States, the regulatory framework for activated alumina involves oversight by multiple agencies. The Environmental Protection Agency (EPA) regulates its use in water treatment under the Safe Drinking Water Act and requires compliance with NSF/ANSI Standard 61 for materials in contact with drinking water. The Food and Drug Administration (FDA) oversees its use in food processing and pharmaceuticals, ensuring compliance with relevant purity and safety standards.

- In the European Union, the regulatory framework for activated alumina is governed primarily by the European Chemicals Agency (ECHA) under the REACH Regulation, which mandates registration, evaluation, and authorization for chemical substances. Its use in water purification must comply with the European Drinking Water Directive to ensure safety for human consumption.

- In China, the activated alumina market is regulated under GB Standards, with oversight by the Ministry of Ecology and Environment (MEE) and the State Administration for Market Regulation (SAMR). For water treatment, it must comply with GB 5749 for drinking water safety.

- In India, the regulatory framework is governed by the Bureau of Indian Standards (BIS) and Central Pollution Control Board (CPCB), adhering to IS 10500 standards for drinking water and environmental regulations.

- In Japan, activated alumina is managed by the Chemical Substances Control Law and the Industrial Safety and Health Act, with water treatment applications meeting JIS K 3450 standards.

Competitive Landscape

The global activated alumina market is characterized by a large number of participants, including both established corporations and rising organizations.

Companies are investing heavily in R&D to enhance the performance of activated alumina, focusing on improving its adsorption efficiency, increasing sustainability, and exploring new applications in water treatment, air purification, and hydrogen production. These innovations expand market potential and provide a competitive edge in meeting evolving regulatory requirements.

List of Key Companies in Activated Alumina Market:

- BASF

- CHALCO Shandong Co.,Ltd

- M. Huber Corporation

- Axens

- Sumitomo Chemical Co., Ltd.

- Delta Adsorbents

- Interra Global

- HengYe Inc.

- Doyle Dryers LLC

- DAWN SCIENTIFIC INC

- Evonik Industries AG

- Devson Catalyst

- Honeywell International Inc.

- JALON

- Camfil

Recent Developments (Expansion)

- In February 2024, BASF inaugurated a global aluminum competence center in Giussano, Italy, to strengthen its research and development capabilities in aluminum surface treatment. This facility will centralize R&D efforts, accelerating the introduction of innovative solutions, including activated alumina, for key industries such as architecture, aerospace, and automotive construction.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership