Advanced Materials and Chemicals

Active Insulation Market

Active Insulation Market Size, Share, Growth & Industry Analysis, By Product (Polyurethane (PU) Foam, Fiberglass, Aerogel, Expanded Polystyrene (EPS), Mineral Wool, Extruded Polystyrene (XPS), Ceramic-based Materials, Others), By End-User (Building & Construction, Textiles, Automotive, Aerospace), and Regional Analysis, 2024-2031

Pages : 150

Base Year : 2023

Release : January 2025

Report ID: KR1201

Active Insulation Market Size

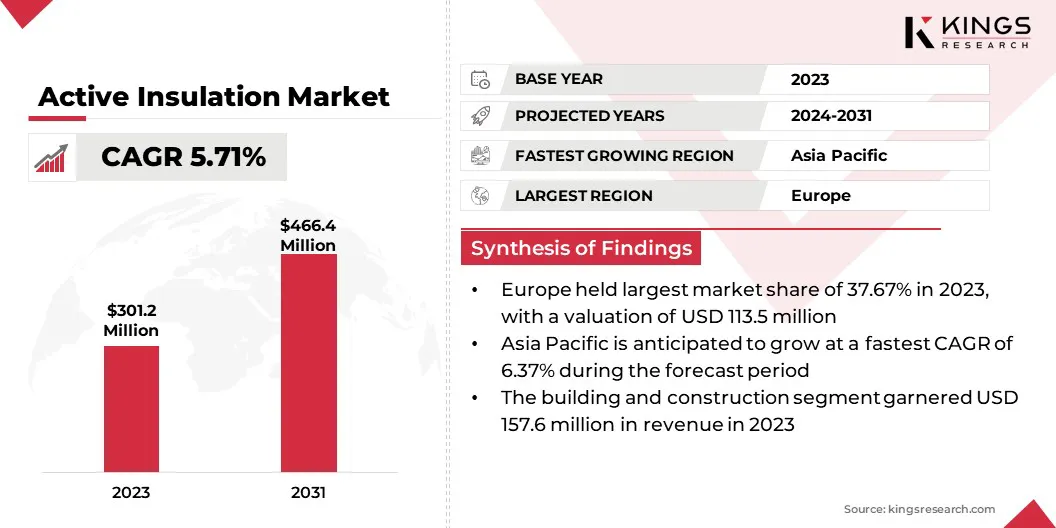

The global active insulation market size was valued at USD 301.2 million in 2023, and is projected to grow from USD 316.2 million in 2024 to USD 466.4 million by 2031, exhibiting a CAGR of 5.71% during the forecast period. The rising focus on thermal comfort in residential and commercial spaces is accelerating the market growth.

Consumers are seeking materials that can offer a consistent and comfortable indoor environment while reducing energy costs. Active insulation solutions enable buildings to adapt to external weather variations, ensuring optimal thermal performance.

In the scope of work, the report includes products offered by companies, such as Saint-Gobain, Cabot Corporation, BASF, Dow, Johns Manville, Rockwool A/S, Polartec, LLC, W.L. Gore & Associates, Remmers, PrimaLoft, Inc., and others.

The growing emphasis on outdoor activities and fitness is significantly driving the active insulation market. Consumers are prioritizing apparel with advanced thermal regulation and moisture management capabilities for outdoor and sports activities. This demand aligns with advancements in wearable textiles, pushing manufacturers to incorporate active insulation into their products.

- In February 2024, British outdoor brand, Rab, unveiled an updated version of its popular Xenair range. It features a 100% recycled polyamide liner, offering 10x increase in air permeability. The Xenair collection also includes a 20D Pertex Quantum Air outer layer with a fluorocarbon-free DWR treatment, enhancing moisture expulsion and ensuring extended comfort for mountain enthusiasts.

Active insulation is designed to dynamically regulate temperature by managing heat and moisture transfer in response to the changing environment or activity levels. Unlike traditional insulation, which provides passive thermal resistance, active insulation materials often incorporate advanced technologies such as breathable fabrics, phase-change materials, or electronic heating and cooling systems.

These features enable insulation to adapt to varying temperatures and humidity levels, ensuring comfort, thermal efficiency, and moisture control in diverse settings, such as outdoor gear, smart textiles, and energy-efficient buildings.

Analyst’s Review

Companies in the active insulation market are adopting innovative strategies to align with the growing demand for eco-friendly materials, contributing to market expansion. By incorporating recyclable and biodegradable components into insulation solutions, businesses are addressing the environmental concerns of consumers and industries.

- A Milan-based insulation manufacturer, Thermore, introduced its latest fiber product, Ecodown Fibers Ocean, in June 2023. This innovative thermal insulation is crafted entirely from ocean-bound raw materials, specifically PET bottles. Like other products in the Ecodown Fibers range, it offers exceptional softness and a high resistance to clumping.

Investments in research and development are producing advanced, eco-conscious insulation technologies, offering companies a competitive advantage. Additionally, aligning products with global sustainability goals and meeting stringent environmental regulations in Europe and North America are enhancing their market positioning. These strategic initiatives are propelling the active insulation industry forward, ensuring sustained growth in a competitive market.

Furthermore, companies are focusing on creating innovative products that offer improved functionality, such as enhanced moisture management and superior adaptability to extreme conditions.

- In March 2024, the Thermore Group unveiled Freedom, its most advanced stretch insulation. Crafted with 50% post-consumer recycled polyester, this cutting-edge insulation delivers exceptional stretch and reliable warmth, making it ideal for alpine sports, running, golf, commuting, fishing, hunting, cycling, and other active pursuits.

These advancements are enabling the development of active insulation materials suitable for a wide range of applications. R&D initiatives are also driving cost reductions, making active insulation more accessible to consumers and industries. The ongoing commitment to innovation is strengthening the competitive landscape and fueling market growth globally.

Active Insulation Market Growth Factors

The construction sector's focus on reducing energy consumption is boosting the growth of the active insulation market. Building materials that enhance thermal efficiency are essential in achieving sustainable infrastructure goals. The increasing prevalence of green building initiatives and strict energy regulations worldwide have prompted builders and developers to integrate advanced materials.

- In December 2023, the Governments of France and Morocco, in collaboration with the UN Environment Programme (UNEP), launched the Buildings Breakthrough at COP28. This initiative aims to accelerate the transformation of the buildings sector, which is responsible for 21% of global greenhouse gas emissions, with the goal of making near-zero emissions and climate-resilient buildings by 2030. To date, 27 countries have committed to supporting the Buildings Breakthrough.

This trend is particularly evident in regions like Europe, where sustainability mandates are prominent, positioning active insulation as a preferred choice in both residential and commercial constructions.

Government initiatives promoting energy-efficient practices are also bolstering the growth of the active insulation market. Policies encouraging the use of sustainable building materials have led to increased adoption of advanced insulation solutions in construction projects.

Incentives such as tax rebates, subsidies, and funding for green building certifications have made active insulation an attractive option for many developers. Regulatory frameworks in Europe and North America prioritize energy conservation, further boosting market demand.

However, the high cost of production associated with advanced insulation materials is restraining the market growth. The manufacturing process for active insulation involves specialized technologies and materials, which often lead to higher production costs compared to traditional insulation solutions. This can limit the affordability and accessibility of these products, particularly for smaller-scale projects or emerging markets.

To address this challenge, companies are investing in research and development to optimize their production and reduce material costs. Additionally, partnerships with sustainable raw material suppliers and innovations in manufacturing techniques are helping lower costs, making active insulation more economically viable.

Active Insulation Industry Trends

The automotive and aerospace sectors are increasingly incorporating active insulation technologies to enhance thermal efficiency and passenger comfort. These industries require lightweight materials that offer superior temperature control and durability, aligning with the characteristics of active insulation.

The growth of electric vehicles (EVs) and advancements in aerospace engineering have created a demand for materials that optimize energy consumption while maintaining performance standards. Manufacturers are adopting active insulation to meet these requirements, contributing to the overall growth of the active insulation market.

- In October 2024, the US Department of Energy approved a USD 670.6 million loan for Aspen Aerogels to support the construction of a new factory in Georgia focused on producing materials that enhance battery safety . Aspen’s PyroThin aerogel thermal barriers are designed to serve as a protective layer in EV batteries, helping EV manufacturers meet essential battery safety standards.

The rise of smart home technologies is contributing to the market's growth. Consumers are integrating advanced insulation solutions into smart building systems to optimize energy efficiency and indoor climate control. Active insulation materials, often paired with smart sensors and IoT devices, enable dynamic temperature regulation and real-time energy monitoring.

Segmentation Analysis

The global market has been segmented based on product, end-user, and geography.

By Product

Based on product, the market has been segmented into polyurethane (PU) foam, fiberglass, aerogel, expanded polystyrene (EPS), mineral wool, extruded polystyrene (XPS), ceramic-based materials, and others. The polyurethane (PU) foam segment led the active insulation market in 2023, reaching a valuation of USD 87.0 million.

PU foam is known for its high energy efficiency, light weight, and ability to provide consistent insulation performance, making it ideal for industries such as construction, automotive, and refrigeration.

Its adaptability allows for easy integration into both residential and commercial projects, where it helps achieve energy efficiency goals. Additionally, affordability and availability of PU foam and its high performance in extreme conditions, drive its widespread adoption.

By End-User

Based on end-user, the market has been classified into building & construction, textiles, automotive, and aerospace. The textiles segment is poised for significant growth at a robust CAGR of 7.51% over the forecast period. Active insulation materials are being used in textiles to enhance comfort, breathability, and temperature regulation for consumers engaged in outdoor activities.

The growing demand for high-performance, energy-efficient fabrics in sports and activewear has significantly contributed to this dominance. Additionally, the shift toward sustainable, eco-friendly textiles further strengthens the market for active insulation.

Active Insulation Market Regional Analysis

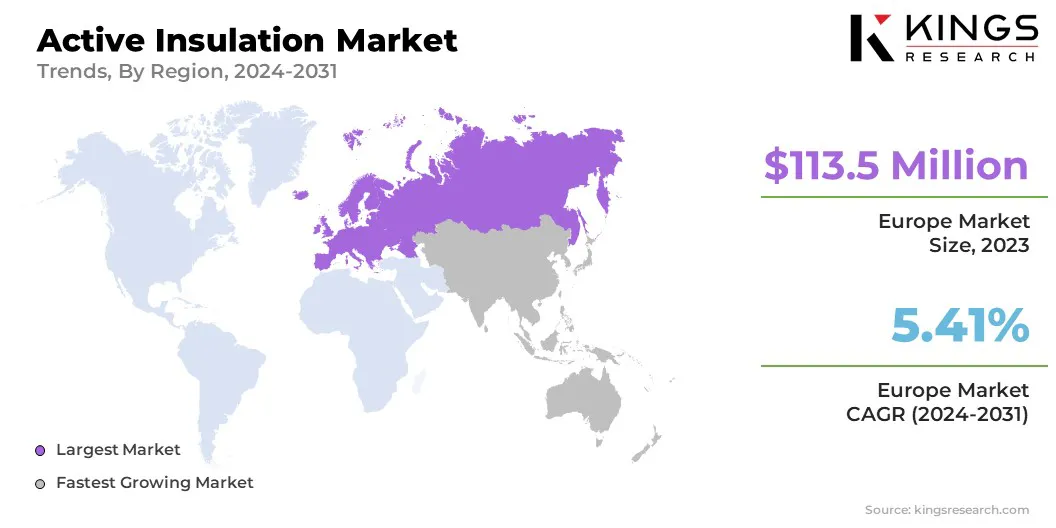

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Europe active insulation market share stood at around 37.67% in 2023 with a valuation of USD 113.5 million. Europe’s commitment to sustainability and stringent environmental regulations are significant factors driving the growth of the market. The European Union's Green Deal and various national policies encourage the use of eco-friendly materials, which has prompted industries to adopt active insulation solutions.

These solutions, often made from recyclable and biodegradable components, meet sustainability targets and align with both regulatory requirements and consumer expectations.

Additionally, governments in Europe are offering various investments and subsidies for adopting green technologies, including active insulation solutions. These financial incentives are designed to reduce carbon footprints, improve energy efficiency, and encourage sustainable material use in construction and manufacturing.

- The European Union’s 2024 Recovery and Resilience Fund (RRF) report reveals that more than half of the total energy-related funding of USD 116 billion is designated for energy efficiency initiatives to support European citizens, businesses, and industries. This includes USD 27.6 billion for energy efficiency measures across industries and approximately USD 87.5 billion for energy efficiency in buildings. Of this, USD 48.3 billion is allocated for private buildings, USD 24.2 billion for public buildings, and USD 14.8 billion for constructing new buildings.

Asia Pacific is poised for significant growth at a robust CAGR of 6.37% over the forecast period. The demand for energy-efficient solutions in the construction sector is rising across the Asia-Pacific, driven by increasing energy prices and environment awareness. Countries like Japan, South Korea, and India are actively seeking advanced insulation technologies to improve building energy performance.

Active insulation materials, known for their ability to regulate temperature and reduce energy loss, are becoming an essential component in green building designs, which is accelerating market growth.

Furthermore, the growing adoption of electric vehicles (EVs) across Asia-Pacific, particularly in China and Japan, is driving the demand for specialized insulation materials. As the EV market expands, the need for advanced insulation technologies to support energy efficiency and thermal management is propelling market growth in the region.

Competitive Landscape

The global active insulation market report provides valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Active Insulation Market

- Saint-Gobain

- Cabot Corporation

- BASF

- Dow

- Johns Manville

- Rockwool A/S

- Polartec, LLC

- L. Gore & Associates

- Remmers

- PrimaLoft, Inc.

Key Industry Developments

- October 2024 (Expansion): BASF revealed its plans to expand the production capacity of Neopor at its Ludwigshafen site by 50,000 metric tons annually. This expansion iwill address the rising demand for its grey insulation material. The new production facilities are set to begin operations by early 2027. Neopor serves as a key raw material in the manufacturing of energy-efficient insulation materials for building envelopes.

- December 2024 (Partnership): ROCKWOOL announced an investment of over USD 100 million in a new production line in Mississippi for industrial insulation products. This site has been strategically selected to serve the industrial hub of the southern U.S.

The global active insulation market has been segmented:

By Product

- Polyurethane (PU) Foam

- Fiberglass

- Aerogel

- Expanded Polystyrene (EPS)

- Mineral Wool

- Extruded Polystyrene (XPS)

- Ceramic-based Materials

- Others

By End-User

- Building & Construction

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

- Facade Insulation

- Roofing Insulation

- Floor Insulation

- Exterior Walls

- Energy-efficient Buildings

- Textiles

- Outdoor Apparel

- Sportswear

- Bedding and Upholstery

- Heated Garments

- Workwear

- Automotive

- Automotive Body Insulation

- Engine Compartments

- Electric Vehicles (EVs)

- Batteries and Powertrains

- Noise and Vibration Reduction

- Cabin and HVAC Insulation

- Aerospace

- Aircraft Interiors

- Aerospace Engines

- Spacecraft

- Aircraft Thermal Protection Systems

- Aerodynamic Components

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership