Semiconductor and Electronics

Active Optical Cable Market

Active Optical Cable Market Size, Share, Growth & Industry Analysis, By Connector Type (QSFP, CXP, CDFP, Others), By Technology (InfiniBand, Ethernet, HDMI, Others), By Application (Data Center, High-Performance Computing (HPC) & Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1028

Active Optical Cable Market Size

The global Active Optical Cable Market size was valued at USD 3,350.0 million in 2023 and is projected to grow from USD 3,711.5 million in 2024 to USD 8,333.9 million by 2031, exhibiting a CAGR of 12.25% during the forecast period.

The growth of the market is driven by the increasing demand for high-speed data transmission, the expansion of data centers, the rise of cloud computing, and advancements in technologies such as 5G and AI.

In the scope of work, the report includes products offered by companies such as Alysium-Tech GmbH, Amphenol Communications Solutions, Broadcom, Dell Inc., Eaton, EverPro Technology Co., Ltd., Molex, LLC, Sumitomo Electric Industries, Ltd., TE Connectivity, MOBIX LABS, INC., and others.

The expansion of the active optical cable (AOC) market is primarily fueled by the rising demand for high-performance data centers and the growing need for faster data transmission across various industries.

As companies increasingly adopt cloud computing, big data analytics, and AI, the need for high-speed, low-latency connectivity solutions has become increasingly critical. Additionally, the expansion of 5G networks is boosting the demand for AOCs, which offer higher bandwidth and extended reach compared to traditional copper cables.

- For instance, telecom service providers (TSPs) in India started offering 5G services in October 2022. By January, 2023, 5G had been launched in 238 cities across all licensed service areas. The government's phased rollout plan, which spans five years, has led to a growing demand for active optical cables (AOCs) as the infrastructure expands to meet both technical and commercial needs.

The rising trend toward miniaturization in consumer electronics and the growing use of AOCs in high-definition multimedia applications are further propelling market growth. This trend is supported by the demand for energy-efficient solutions in data communication.

The active optical cable market is witnessing steady growth, fueled by technological advancements and increasing applications across various sectors, including telecommunications, data centers, and consumer electronics. AOCs are increasingly preferred for their superior performance, providing high-speed data transfer, reduced electromagnetic interference, and longer transmission distances compared to copper cables.

Moreover, the market is characterized by ongoing innovations, such as the development of higher bandwidth AOCs and the integration of advanced materials to enhance durability and efficiency. Despite the challenges posed by the high initial cost, the market is expected to grow, supported by the growing emphasis on digital transformation and the rising adoption of high-speed internet services globally.

Active optical cables (AOCs) are fiber optic cables equipped with transceivers integrated within their connectors. Unlike traditional copper cables, AOCs use optical fibers to transmit data, offering several advantages such as higher bandwidth, longer transmission distances, and reduced electromagnetic interference.

AOCs are typically used in data centers, telecommunications, and high-performance computing environments where high-speed and reliable data transfer is crucial. They are engineered as plug-and-play solutions, ensuring ease of use and energy efficiency.

The cables are offered in various configurations, including different lengths and connector types, to meet the diverse needs of end-users in industries that require robust, high-speed connectivity solutions.

Analyst’s Review

Manufacturers in the active optical cable market are increasingly focusing on innovation to meet the rising demand for high-speed, efficient connectivity solutions. Companies are investing in the development of new products that provide enhanced bandwidth, lower power consumption, and improved durability.

- For instance, in March 2024, Broadex Technologies introduced a series of 800G Active Electrical Cables (AEC) products. These products support 800G/400G transmission rates utilizing Marvell’s technology. Additionally, the seriers offers extensive form-factor compatibility, including QSFP-DD, OSFP, and QSFP112, and is designed for various configurations such as Breakout and Straight. Additionally, the series facilitates interconnection across different serdes I/O speeds and supports half-active (AEC to DAC) applications.

These efforts are aligning with the growing needs of data centers, telecommunications, and high-performance computing sectors. As the market evolves, it is recommended that manufacturers continue to prioritize research and development to maintain competitiveness.

Additionally, expanding partnerships with cloud service providers and investing in regional market expansions, particularly in Asia-Pacific, could further stimulate growth.

Active Optical Cable Market Growth Factors

A key factor augmenting the expansion of the active optical cable market is the increasing adoption of cloud computing and data-intensive applications. As businesses shift toward cloud-based infrastructure, the need for faster and more reliable data transmission is growing.

Active optical cables are meeting this demand by providing high-speed connectivity with minimal latency, which is essential for handling large volumes of data in real-time. This trend is particularly evident in data centers, where efficient data management and transfer are critical.

Additionally, as more companies adopt technologies such as artificial intelligence and big data analytics, the demand for AOCs is steadily rising, supporting the market's ongoing growth.

A significant challenge hampering the development of the market is the high initial cost of AOCs compared to traditional copper cables. This increased cost may deter some businesses, especially smaller enterprises, from adopting AOC solutions. However, this challenge is being addressed by the long-term cost benefits provided by AOCs.

AOCs are reducing operational costs by offering greater energy efficiency, lower maintenance needs, and longer lifespans. Additionally, as production volumes increase and manufacturing processes improve, the cost of AOCs is gradually decreasing.

Active Optical Cable Industry Trends

The market is experiencing a significant trend toward miniaturization, supported by the rising demand for more compact and efficient devices. As consumer electronics and data communication equipment are becoming smaller and more powerful, there is a growing need for AOCs that can deliver high performance within limited space.

Manufacturers are developing thinner, lighter cables with enhanced durability to meet these requirements. This trend is evident in industries such as telecommunications and automotive, where space constraints are critical. The transition to miniaturization is improving the versatility of AOCs and expanding their application across various sectors that require high-speed, space-saving connectivity solutions.

Another notable trend influencing the active optical cable market is the increasing integration of advanced materials to enhance performance and durability. Companies are increasingly focusing on developing AOCs with improved thermal management, higher bandwidth, and greater resistance to environmental factors.

This trend is particularly important in data centers and high-performance computing environments, where reliable and efficient data transmission is essential. The use of innovative materials is enabling the production of more energy-efficient AOCs, which aligns with the global shift toward sustainable technology.

As the demand for robust and high-speed connectivity continues to grow, the integration of these advanced materials is emerging as a key factor in the evolution of the AOC market.

Segmentation Analysis

The global market is segmented based on connector type, technology, application, and geography.

By Connector Type

Based on connector type, the market is categorized into QSFP, CXP, CDFP, and others. The QSFP segment led the active optical cable market in 2023, reaching a valuation of USD 1,328.3 million. This expansion is largely attributed to its widespread adoption in data centers and telecommunications.

QSFP connectors are favored for their ability to support high data transmission rates and their compatibility with various network applications The QSFP connectors are enabling efficient data management in complex IT environments, which is critical for industries that rely on high-performance networking. Their versatility and scalability are contributing to the dominance of the segment.

By Technology

Based on technology, the market is classified into InfiniBand, Ethernet, HDMI, and others. The Ethernet segment is poised to witness significant growth at a robust CAGR of 13.72% through the forecast period (2024-2031). Ethernet technology is becoming increasingly popular in data centers and enterprise networks due to its ability to provide reliable, high-bandwidth connections.

The growing adoption of cloud computing, video conferencing, and IoT devices is further fueling this trend, as these applications require fast and stable data transfer. Additionally, advancements in Ethernet technology, such as the development of higher-speed variants, are enhancing its performance and increasing its appeal, thereby supporting the expansion of the segment.

By Application

Based on application, the market is segmented into data center, high-performance computing (HPC), personal computer, and others. The data center segment secured the largest active optical cable market share of 45.62% in 2023. Data centers play a crucial role in managing and processing large volumes of data, making high-speed and reliable connectivity critical.

Active optical cables are increasingly used in data centers to facilitate efficient data transfer and reduce latency, thereby ensuring maintaining performance in demanding IT environments.

The expansion of global data centers, supported by the proliferation of digital services, e-commerce, and streaming, is fueling the growth of the segment. The rising focus on energy efficiency and sustainability in data centers is urther contributing significantly to increased demand for AOCs.

Active Optical Cable Market Regional Analysis

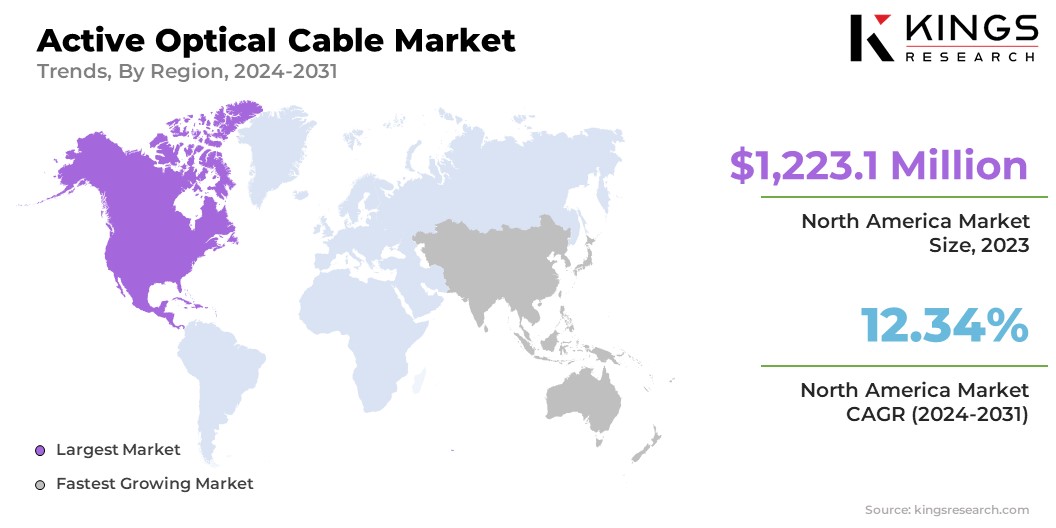

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America active optical cable market captured a considerable share of around 36.51% in 2023, with a valuation of USD 1,223.1 million. This dominance is primarily attributed to the region's advanced technological infrastructure and the high concentration of data centers.

North America serves as a central hub for leading tech companies, leading to a rise in demand for high-speed, reliable connectivity solutions. Additionally, the rapid adoption of cloud computing, big data analytics, and IoT technologies is boosting the need for active optical cables.

Government initiatives supporting digital transformation and the presence of major AOC manufacturers in the region are solidifying North America's leading position in the market.

Asia-Pacific is poised to experience notable growth, recording a staggering CAGR of 12.87% over the forecast peiod. This rapid growth is propelled by the region's increasing investment in digital infrastructure and the expansion of data centers. Countries such as China, Japan, and South Korea are witnessing a surge in demand for high-speed internet and cloud-based services.

This growing demand is fueling the adoption of active optical cables in the region. Additionally, the development of smart cities and the proliferation of 5G networks are bolstering regional market growth.

The strong economic growth and government support for technological advancements in the region are supporting the robust expansion of the Asia-Pacific market.

Competitive Landscape

The global active optical cable market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Active Optical Cable Market

- Alysium-Tech GmbH

- Amphenol Communications Solutions

- Broadcom

- Dell Inc.

- Eaton

- EverPro Technology Co., Ltd.

- Molex, LLC

- Sumitomo Electric Industries, Ltd.

- TE Connectivity

- MOBIX LABS, INC.

Key Industry Developments

- November 2023 (Launch): Bridgee launched its Hybrid Active Optical 2.1 HDMI cables (Mark Series), which are certified by the Imaging Science Foundation (ISF). These cables support data transmission rates of up to 48Gbps over distances up to 30m without the need for external power, and are capable of handling ultra-high-definition signals up to 10K. Featuring Bridgee’s OE-Optiz design and built with premium materials, the Mark Series offers enhanced audio and video performance. Additionally, Bridgee introduced the durable Kai 2.1 cable, which is designed to meet the demands of rigorous installation environments.

- September 2023 (Launch): Pure Fi unveiled the Pure Fi Pro HDMI 2.1 Active Optical Cable (AOC) at the CEDIA Expo, specifically designed for A/V professionals. This cable features a modular design for easy installation, a CL3 rating for safe in-wall use, and the capability to transmit 8K content over long distances with minimal interference. It is compatible with earlier HDMI versions and is characterized by its enhanced durability and flexibility, making it ideal for various professional and high-end applications.

The global active optical cable market is segmented as:

By Connector Type

- QSFP

- CXP

- CDFP

- Others

By Technology

- InfiniBand

- Ethernet

- HDMI

- Others

By Application

- Data Center

- High-Performance Computing (HPC)

- Personal Computer

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership