Advanced Materials and Chemicals

Additive Manufacturing Market

Additive Manufacturing Market Size, Share, Growth & Industry Analysis, By Application (Dental, Medical, Footwear & Consumer Goods & Others), By Technique (Polyjet Printing, Binder Jetting Printing, Laser Sintering & Others), By Component (Material, Systems/Hardware, Services, Software), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR965

Additive Manufacturing Market Size

The global Additive Manufacturing Market size was valued at USD 24.38 billion in 2023 and is projected to grow from USD 27.60 billion in 2024 to USD 74.21 billion by 2031, exhibiting a CAGR of 15.17% during the forecast period. The market is expanding rapidly as industries actively explore new possibilities for enhancing production efficiency and design innovation.

This growth is further fueled by the increasing demand for rapid prototyping and low-volume production capabilities. Enhanced software solutions and improved printing techniques are boosting advancements, while the expansion of AM into new sectors, such as consumer goods and defense, is broadening its market potential and applications.

In the scope of work, the report includes solutions offered by companies such as 3D Systems, Inc., 3DCeram, Autodesk, Inc., Canon, Inc., Dassault Systemes, ENVISIONTEC US LLC, ExOne, General Electric Company, HP Development Company, Materialise NV, and others.

The additive manufacturing market is experiencing robust growth, driven by ongoing technological advancements and expanding applications across various industries. Innovations in 3D printing technology and material science are significantly enhancing the production of complex, customized parts by improving both efficiency and precision.

- In February 2022, UK-based Bentley Motors adopted 3D printing with an investment of 3 million USD. With powder-based technology, the automotive company was able to manufacture a batch of parts in a day and a half, significantly increasing its productivity compared to its counterparts.

The market benefits from increased adoption across diverse sectors such as aerospace, automotive, and healthcare, where there is a strong demand for personalized and high-performance components. Additionally, the broadening range of compatible materials, including metals, ceramics, and biological substances, is creating new opportunities and applications.

These trends are fostering market expansion, positioning additive manufacturing as a critical component of innovation and efficiency in modern manufacturing.

Additive manufacturing (AM) refers to a set of manufacturing processes that build objects layer by layer from digital designs, as opposed to traditional subtractive methods that involve removing material to achieve the final product. This technology encompasses various 3D printing techniques, such as fused deposition modeling (FDM), selective laser sintering (SLS), and stereolithography (SLA).

Additive manufacturing allows for the creation of complex and customized parts with high precision and minimal waste. It is utilized across diverse industries, including aerospace, automotive, healthcare, and consumer goods, enabling rapid prototyping, on-demand production, and the fabrication of intricate geometries that are challenging or unattainable through conventional manufacturing methods.

Analyst’s Review

The additive manufacturing and materials market is highly competitive, with major players intensifying their focus on generative design capabilities for 3D printing. These companies are integrating advanced software solutions optimized for additive manufacturing to expand their global customer bases and increased market share. Strategic collaborations and acquisitions are emerging as key strategies for fostering growth.

- For instance, in August 2022, Carbon acquired ParaMatters, a software provider specializing in additive manufacturing. This acquisition allows Carbon to expedite the development of high-performance part designs by using advanced automation techniques,. This advancement leads to improved geometries and performance characteristics, thus strengthening their market position and innovation capabilities.

Key players are expected to drive market growth by leveraging strategic acquisitions and integrating advanced software solutions, thereby enhancing innovation, improving performance, and expanding their global customer base.

Additive Manufacturing Market Growth Factors

The additive manufacturing market is experiencing robust growth, largely attributed to its broad adoption across key industries such as aerospace, automotive, and healthcare. This technology facilitates the production of complex, customized parts with remarkable precision, resulting in reduced waste and significantly shorter lead times compared to traditional manufacturing methods.

Industries focusing on innovation and operational efficiency are increasingly adopting additive manufacturing due to its ability to produce high-quality components and prototypes quickly and cost-effectively.

- In July 2022, Toyota commenced the production of stock parts using HP Multi Jet Fusion 3D printing technology. The company offered these 3D-printed parts alongside conventionally manufactured spares, thereby enhancing the design efficiency and lead times for newly developed parts.

By enabling more flexible and efficient production processes, additive manufacturing is meeting the evolving demands of modern industries, thereby propelling its widespread integration.

The additive manufacturing market is facing challenges related to high equipment and material costs. The initial investment in advanced 3D printers and specialized materials is proving substantial, thereby limiting access for smaller companies and startups. Additionally, the ongoing expenses for maintenance and materials are impacting long-term affordability.

Key players are actively addressing these issues by investing in research and development to reduce costs and improve material affordability. Companies are further focusing on optimizing equipment and forming strategic partnerships to share resources and technologies, with the aim of making AM solutions more accessible and promoting broader adoption across various industries.

Additive Manufacturing Market Trends

Additive manufacturing's capability to produce highly customized parts and products on demand is significantly propelling market growth. In the healthcare sector, this technology facilitates the development of personalized implants and prosthetics that are tailored to individual patient needs, thereby improving outcomes and expanding market opportunities.

In the consumer goods industry, the demand for customized products, such as bespoke accessories and tailored consumer electronics, is leading to the widespread adoption of additive manufacturing. The ability to quickly and cost-effectively produce unique items in small batches aligns with the growing consumer preference for personalization, thereby stimulating market expansion and fostering innovation across various sectors.

The rapid expansion of materials compatible with additive manufacturing (AM) is significantly propelling market growth. Advancements in material science are expanding the range of options available to include advanced metal alloys, high-performance ceramics, and even living cells.

This diverse range of materials enables the production of parts with specialized properties tailored to specific applications. For instance, metal alloys are enhancing the durability of aerospace and automotive components, while biocompatible materials are revolutionizing healthcare through advancements in custom implants and tissue engineering.

- In August 2022, Strastays, a leading company in polymer 3D printing, acquired Covestro AG, aimed at enhancing its additive manufacturing materials business. This acquisition allowed Stratasys to offer innovative materials capable of producing end-use parts such as dental aligners and automotive components. By integrating Covestro AG’s expertise, Stratasys advanced its strategy to provide a comprehensive polymer 3D printing portfolio and increased investments in cutting-edge developments in 3D printing materials.

The ability to cater to a wide range of industries and applications by leveraging these materials is fostering innovation, increasing adoption, and fueling market expansion.

Segmentation Analysis

The global market is segmented based on application, technique, component, and geography.

By Application

Based on application, the market is categorized into dental, medical, footwear & consumer goods, aerospace, energy, automotive, and others. The automotive segment garnered the highest revenue of USD 6.99 billion in 2023. The automotive sector is increasingly leveraging additive manufacturing to revolutionize its production processes.

Companies such as Volkswagen, BMW, and Ford are incorporating 3D printing technology to produce final car parts, benefiting from its toolless production capabilities and extensive design flexibility. Recent advancements, such as Fused Filament Fabrication (FFF), have enabled the use of materials with properties similar to plastics, thereby enhancing the versatility of 3D printing in automotive manufacturing.

- For instance, Ford Automotive has integrated AI with 3D printing technology to boost production efficiency. In March 2022, Ford developed a robotic system that allows 3D printers from different suppliers to communicate and operate autonomously, thereby streamlining production and reducing dependency on external suppliers.

This trend underscores the industry's commitment to improving productivity and flexibility in automotive manufacturing through advanced additive technologies.

By Technique

Based on technique, the market is categorized into polyjet printing, binder jetting printing, laser sintering, electron beam melting, fused disposition modelling, and others. The fused disposition modelling segment captured the largest additive manufacturing market share of 29.78% in 2023. FDM's ability to produce durable, functional prototypes and end-use parts with minimal waste contributes significantly to its expansion.

Its versatility in handling a range of materials, including ABS, PLA, and composite filaments, makes it appealing to various industries, including aerospace and healthcare. The segment is witnessing increased adoption due to its accessibility and scalability, making advanced 3D printing technology more attainable for businesses of all sizes. Furthermore, innovations in FDM technology, such as enhanced material formulations and improved printer capabilities, are expanding its applications and bolstering growth.

By Component

Based on component, the additive manufacturing market is categorized into material, systems/hardware, services, and software. The services segment is expected to garner the highest revenue of USD 39.07 billion by 2031, as these services provide essential support such as 3D printing consulting, design optimization, material sourcing, and post-processing.

These services are crucial for businesses integrating additive technologies, as they assist in navigating complex processes and optimizing efficiency. The increasing demand for customized and rapid prototyping solutions is further propelling growth, as companies seek expert guidance to streamline their production and reduce time-to-market. The availability of on-demand manufacturing services and tailored solutions is making advanced 3D printing technologies more accessible, thereby augmenting the expansion of the segment.

Additive Manufacturing Market Regional Analysis

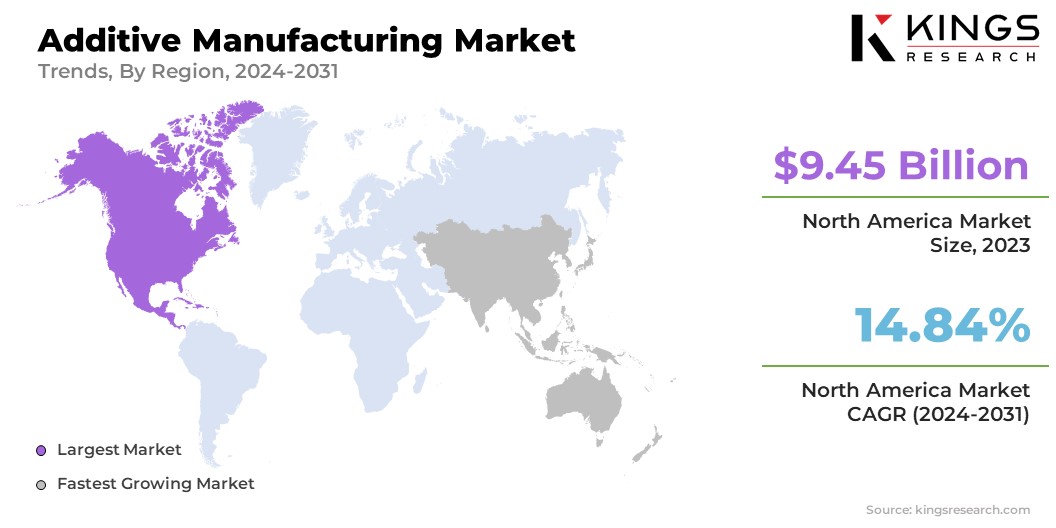

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America additive manufacturing market share stood around 38.77% in 2023 in the global market, with a valuation of USD 9.45 billion. The regional market benefits from a high concentration of key players, including tech giants and innovative startups, which fosters R&D efforts and bolsters growth. Industries in the U.S. and Canadian industries, particularly aerospace, automotive, and healthcare, are at the forefront of the adoption of 3D printing for rapid prototyping and customized manufacturing.

- For instance, in October 2022, GE Additive, a US-based company, launched its new Series 3 binder jet platform. This machine facilitated the creation of metal parts, such as castings, on an industrial scale. GE Additive produced over 140,000 components, which achieve a 15% improvement in fuel efficiency compared to standard parts.

Government initiatives and funding contribute significantly to technological development, while a well-established network of research institutions and industry partnerships fosters innovation. This combination of factors positions North America as a leading market for additive manufacturing, bolstering both technological progress and regional market expansion.

Asia-Pacific is anticipated to witness substantial growth at a robust CAGR of 16.19% over the forecast period. This rapid growth is largely attributable to advancements in 3D printing technologies and increasing industrial adoption. China's aviation sector is leveraging cutting-edge 3D printing to build next-generation warplanes, showcasing the technology’s potential in high-precision applications.

In South Korea, Pohang University of Science and Technology (POSTECH) is at the forefront of advancing 3D bio-printing technologies for creating realistic organ substitutes, with future integration of AI and robotics expected to enhance these capabilities.

Additionally, Japan’s JGC Holdings Corporation is implementing COBOD 3D printing technology in its construction projects, resulting in a significant reduction in formwork construction times. These developments highlight the region's commitment to innovation and its growing prominence in the global market.

Competitive Landscape

The global additive manufacturing market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Additive Manufacturing Market

- 3D Systems, Inc.

- 3DCeram

- Autodesk, Inc.

- Canon, Inc.

- Dassault Systemes

- ENVISIONTEC US LLC

- ExOne

- General Electric Company

- HP Development Company

- Materialise NV

Key Industry Development

- March 2023 (Partnership): Merz Dental, a leader in digital dentistry, partnered with Nexa 3D, a pioneer in polymer 3D printing. This collaboration aims to support Nexa 3D’s customers across Germany. Renowned for its speed and precision, Nexa 3D’s printing platform enhances a range of professional and dental desktop 3D printing applications, including orthodontic models, splints, and surgical guides.

The global additive manufacturing market is segmented as:

By Application

- Dental

- Medical

- Footwear & Consumer Goods

- Aerospace

- Energy

- Automotive

- Others

By Technique

- Polyjet Printing

- Binder Jetting Printing

- Laser Sintering

- Electron Beam Melting

- Fused Disposition Modelling

- Others

By Component

- Material

- Systems/Hardware

- Services

- Software

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership