Semiconductor and Electronics

Advanced Packaging Market

Advanced Packaging Market Size, Share, Growth & Industry Analysis, By End-Use Industry (Consumer Electronics, Automotive, Healthcare, Telecommunications, Others), By Packaging Platform (Flip-chip, Fan-out, Fan-in WLP, 3D Stacking, Embedded Die), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR998

Advanced Packaging Market Size

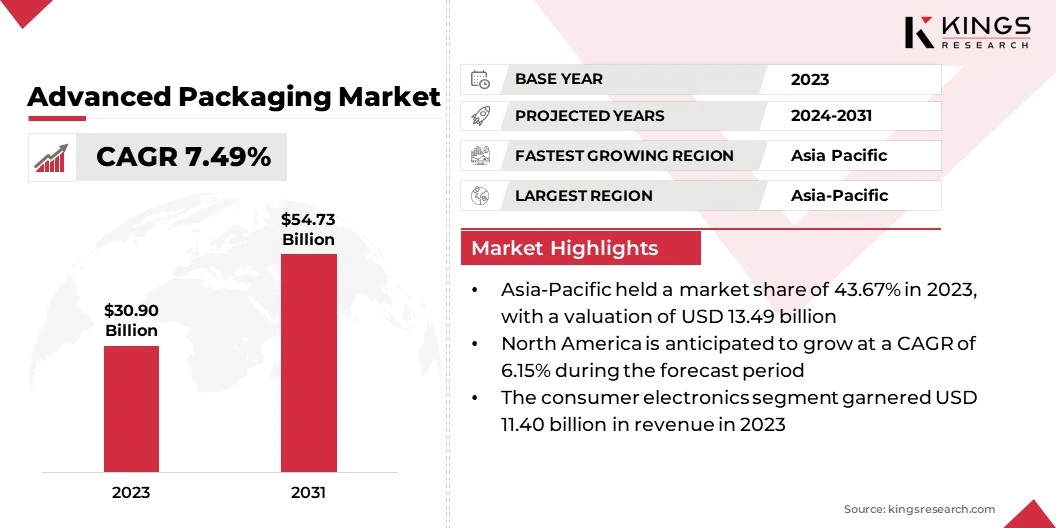

The global Advanced Packaging Market size was valued at USD 30.90 billion in 2023 and is projected to grow from USD 33.00 billion in 2024 to USD 54.73 billion by 2031, exhibiting a CAGR of 7.49% during the forecast period. The market is witnessing significant growth, driven by the increasing complexity of semiconductor devices and the need for higher performance and efficiency.

Innovations such as through-silicon vias (TSVs) and advanced substrates are enhancing packaging capabilities. The market is also benefiting from the rising demand in healthcare and aerospace, where reliable and compact packaging solutions are critical for advanced medical devices and sophisticated aerospace electronics.

In the scope of work, the report includes solutions offered by companies such as Amkor Technology, Taiwan Semiconductor Manufacturing Company Limited, ASE TECHNOLOGY HOLDING, Intel Corporation, JCET Group Co. Ltd, Chipbond Technology Corporation, Samsung, Universal Instruments Corporation, ChipMOS Technologies Inc., Brewer Science, Inc., and others.

The advanced packaging market is experiencing robust growth, driven by the increasing demand for miniaturized, high-performance electronic devices across consumer electronics, automotive, and telecommunication applications. The adoption of 5G networks and the integration of IoT and AI technologies are further propelling market expansion.

Advanced packaging solutions, such as Wafer Level Chip Scale Package (WLCSP), fan-out packaging, and 3D packaging with embedded die solutions, are becoming essential for achieving compact form factors, reduced power consumption, and enhanced thermal management. Meanwhile, investments from private players are further driving market growth.

- For instance, in August 2023, the National Natural Science Foundation of China (NSFC) invested USD 6.4 million in 30 Chiplet projects the next big advanced packaging technology.

As industries seek to innovate and improve efficiency, investments in advanced packaging technologies are expected to continue rising, fostering sustained market growth.

Advanced packaging refers to a set of innovative techniques used to enhance the performance, functionality, and integration of semiconductor devices beyond traditional packaging methods. These techniques, including 3D integration, system-in-package (SiP), fan-out wafer-level packaging (FOWLP), and through-silicon vias (TSVs), allow for higher density, improved thermal management, reduced power consumption, and greater miniaturization of electronic components.

Advanced packaging is crucial for meeting the demands of modern electronics, including high-performance computing, telecommunications, and consumer electronics, by enabling the integration of multiple functions and components into a single, compact package.

Analyst’s Review

The increasing demand for advanced technology solutions drives significant investments in advanced packaging facilities. Companies are expanding their capabilities to meet the evolving needs of high-performance electronics and semiconductor devices.

- For instance, in August 2023, Taiwan Semiconductor Manufacturing Company (TSMC) announced an investment of USD 2.87 billion to establish an advanced chip packaging facility in Taiwan, driven by booming global demand.

- Similarly, in June 2023, Micron declared it would invest millions in a new factory in China, despite recent security concerns. Micron plans to upgrade its chip packaging facility in Xi'an with an investment of USD 603 million in the coming years.

Key players can leverage these significant investments in advanced packaging facilities to drive market growth by capitalizing on the increasing demand for high-performance and miniaturized electronic devices. These investments enable them to offer innovative packaging solutions that meet the evolving needs of various industries, thereby fueling further growth and advancing technology development.

Advanced Packaging Market Growth Factors

The increasing push toward smaller, more powerful electronic devices is significantly driving the demand for advanced packaging solutions. This trend is crucial in sectors like consumer electronics, automotive, and telecommunications, where compact, high-performance components are consistently in demand.

Advanced packaging technologies, such as 3D integrated circuits (ICs) and system-in-package (SiP), facilitate the integration of multiple functionalities within a reduced footprint. These technologies meet the industry's miniaturization goals, enhancing device performance and efficiency, thereby driving market growth.

The advanced packaging market is facing significant challenges due to the high costs of technology development and the intricate integration of diverse semiconductor components. These issues contribute to increased production expenses and extended development timelines, potentially slowing market expansion and impeding the entry of smaller players.

To address these obstacles, leading companies are making substantial investments in research and development to streamline and economize advanced packaging technologies. They are also focusing on strategic partnerships and collaborations to leverage combined expertise and resources, which foster innovation and enhance operational efficiency. By optimizing processes and implementing cost-effective strategies, key players are boosting scalability and driving market growth.

Advanced Packaging Market Trends

The trend of heterogeneous integration, where diverse components, such as logic, memory, and sensors, are combined into a single package, is revolutionizing electronic system design. This approach is enhancing system performance and functionality while simultaneously reducing power consumption and improving thermal management.

Heterogeneous integration is becoming increasingly crucial for high-performance computing, automotive electronics, and advanced communication systems, where the demand for compact, efficient, and powerful solutions is imperative. This integration is propelling market growth by enabling the development of more sophisticated and efficient devices, prompting increased investment in advanced packaging technologies to meet the evolving needs of these high-demand applications. These factors are expected to fuel market expansion over the forecast period.

The increasing adoption of 5G networks is also boosting the development of the advanced packaging market significantly. The rollout of 5G technology necessitates compact and efficient devices to manage complex communication systems. Advanced packaging solutions, such as Wafer Level Chip Scale Package (WLCSP) and fan-out packaging, are enabling smaller form factors, reduced power consumption, and improved thermal management, ideal for 5G devices.

Additionally, 3D packaging with embedded die solutions is gaining traction as a key integration tool for next-generation devices. This trend is expected to drive substantial market growth over the forecast period.

Segmentation Analysis

The global market is segmented based on end-use industry, packaging platform, and geography.

By End-Use Industry

Based on end-use industry, the market is categorized into consumer electronics, automotive, healthcare, telecommunications, industrial, and others. The consumer electronics led the advanced packaging market in 2023, reaching a valuation of USD 11.40 billion, mainly fueled by the demand for compact, high-performance devices such as smartphones, tablets, wearables, and smart home products.

Technological advancements in these devices require sophisticated packaging solutions like fan-out wafer-level packaging (FOWLP) and 3D integration to meet performance, size, and energy efficiency requirements. The rising consumer demand for smaller, more powerful devices with enhanced features accelerates the adoption of advanced packaging technologies.

As manufacturers strive to integrate multiple functions into compact forms, the market for advanced packaging solutions continues to expand, propelling overall market growth.

By Packaging Platform

Based on packaging platform, the market is categorized into flip-chip, fan-out, fan-in WLP, 3D stacking, and embedded die. The flip-chip segment captured a staggering advanced packaging market share of 80.12% in 2023, as industries increasingly adopt this technology to enhance performance and thermal management. In high-performance computing (HPC), the demand for faster processing and efficient heat dissipation is elevating the use of flip-chip packaging.

- For instance, in July 2023, Amkor Technology highlighted its progress and accomplishments in advancing wire bond and flip-chip packaging for devices using TSMC's advanced low-k process technologies. The company worked with various clients to qualify low-k products and targeted a significant increase in the production volume of low-k packages in the second half of the year.

In addition, consumer electronics are benefiting from flip-chip solutions, which enable compact, high-density designs for smartphones and tablets. The automotive sector is also integrating flip-chip technology to meet the advanced requirements of driver-assistance systems and infotainment. As these sectors continue to expand, the flip-chip segment is anticipated to experience significant growth due to its performance and miniaturization benefits over the forecast period.

Advanced Packaging Market Regional Analysis

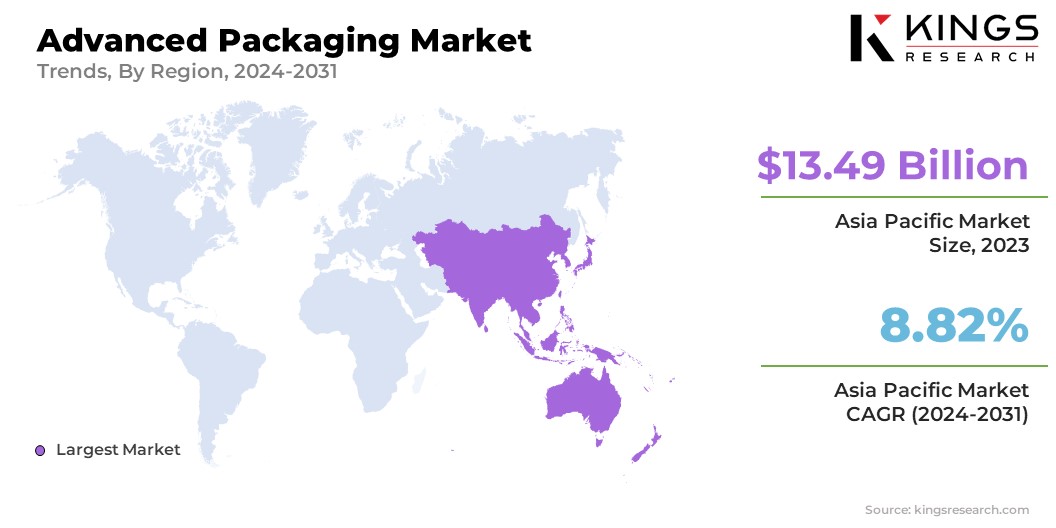

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific advanced packaging market share stood around 43.67% in 2023 in the global market, with a valuation of USD 13.49 billion, driven by its prominence in semiconductor manufacturing, rapid industrialization, and growing consumer electronics market. The region is renowned for high-volume semiconductor production and the integration of advanced packaging technologies across diverse sectors, including consumer electronics, automotive, and telecommunications. Recent strategic moves underscore this growth trajectory.

- For instance, in September 2023, China announced its plans to launch a new state-backed investment fund targeting approximately USD 40 billion to bolster its semiconductor sector.

- This followed a December 2022 commitment of over YUAN 1 trillion (USD 143 billion) to support semiconductor industry advancements. These initiatives would be critical for achieving chip production self-sufficiency and drive increased demand for advanced packaging services in the region.

North America is anticipated to witness significant growth at a CAGR of 6.15% over the forecast period. The region’s growth is driven by its advanced infrastructure along with leading semiconductor companies and prominent research institutions focused on cutting-edge packaging solutions. The demand for advanced packaging is supported by various high-growth sectors, such as high-performance computing, automotive electronics, and telecommunications, all of which require sophisticated packaging technologies to enhance data processing capabilities and connectivity.

- For instance, in July 2024, Amkor Technology, Inc. signed a non-binding preliminary memorandum of terms with the US Department of Commerce to receive proposed funding under the CHIPS and Science Act.

- Earlier, in November 2023, Amkor had revealed plans to build its first domestic OSAT facility in Peoria, Arizona, with an investment of approximately USD 2 billion and the creation of about 2,000 jobs.

This development is expected to bolster the region’s position in advanced packaging and drive market growth.

Competitive Landscape

The global advanced packaging market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategies, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Advanced Packaging Market

- Amkor Technology

- Taiwan Semiconductor Manufacturing Company Limited

- ASE TECHNOLOGY HOLDING

- Intel Corporation

- JCET Group Co. Ltd

- Chipbond Technology Corporation

- Samsung

- Universal Instruments Corporation

- ChipMOS Technologies Inc.

- Brewer Science, Inc.

Key Industry Development

- October 2023 (Product Launch): Advanced Semiconductor Engineering Inc. (ASE) launched its Integrated Design Ecosystem (IDE), a collaborative toolset designed to enhance advanced package architecture across its VIPack platform. This innovation facilitated a seamless transition from single-die SoCs to multi-die disaggregated IP blocks, including chiplets and memory, for integration using 2.5D or advanced fan-out structures.

The global advanced packaging market is segmented:

By End-Use Industry

- Consumer Electronics

- Automotive

- Healthcare

- Telecommunications

- Industrial

- Others

By Packaging Platform

- Flip-chip

- Fan-out

- Fan-in WLP

- 3D Stacking

- Embedded Die

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership