Healthcare Medical Devices Biotechnology

Advanced Wound Care Market

Advanced Wound Care Market Size, Share, Growth & Industry Analysis, By Product Type (Dressings, Therapies and Active Wound Care Products), By Wound Type (Acute wounds and chronic wounds), By End User, and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : January 2025

Report ID: KR1244

Market Definition

Advanced wound care focuses on the specialized treatment and management of chronic, complex, or difficult-to-heal wounds using advanced technologies, products, and techniques. It is used on wounds that fail to healwithin the expected timeframe, or are complicated by factors such as infections, diabetes, vascular disease, or tissue damage.

Skin accounts for 16% of the total body weight and represents the largest organ of the human body. In addition to playing a pivotal role in maintaining homeostasis, skin also acts as a protective barrier against the external environment to prevent infections and fluid losses. Preserving skin integrity is essential for overall health.

Wounds caused by trauma, burns, chronic diseases, and surgery may lead to significant disability, distress, and a substantial burden on global healthcare systems.

Advanced Wound Care Market Overview

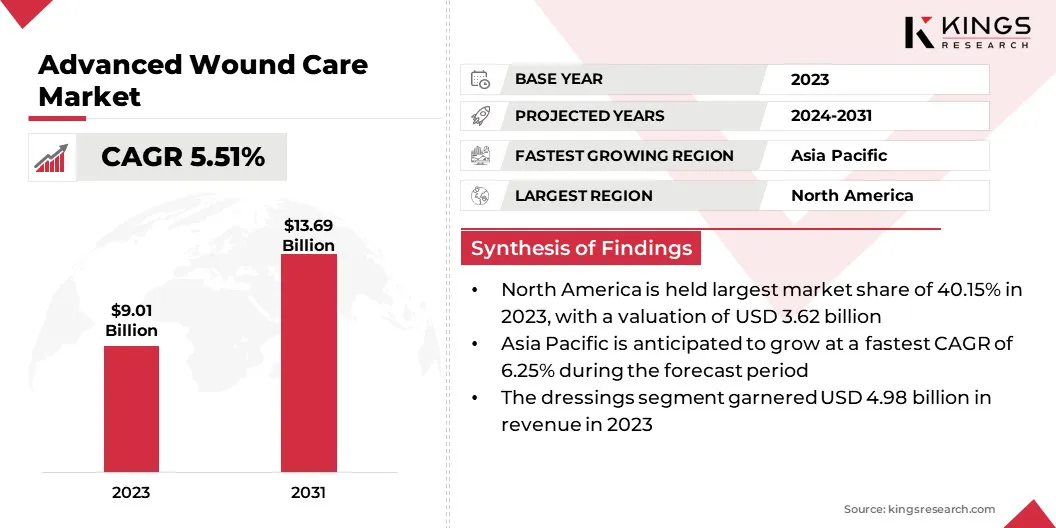

Global advanced wound care market size was valued at USD 9.01 billion in 2023 and is projected to grow from USD 9.40 billion in 2024 to USD 13.69 billion by 2031, exhibiting a CAGR of 5.51% from 2024 to 2031.

The market is rapidly expanding, mainly due to increasing prevalence of chronic and complex wounds. Several factors such as an aging population, rising incidence of chronic diseases, and obesity are contributing to the demand for advanced wound care solutions.

Additionally, innovations, including antimicrobial dressings, biologics, negative pressure wound therapy (NPWT), and skin substitutes, are enhancing treatment outcomes. These technologies enable faster healing while minimizing the risk of severe infections, ensuring comprehensive recovery and improved patient outcomes across diverse healthcare settings.

Major companies operating in the global advanced wound care market Smith+Nephew, 3M, Coloplast Corp., Convatec Inc., Mölnlycke Health Care AB., Johnson & Johnson Medical NV. (Ethicon), Essity AB, B. Braun SE, INTEGRA LIFESCIENCES, Organogenesis Inc., Cardinal Health, PAUL HARTMANN AG, Solventum, Lohmann & Rauscher GmbH & Co. KG, Hollister Incorporated, and others.

The market is experiencing robust growth, mainly driven by the adoption of digital health technologies such as telemedicine, which enhance the reach and effectiveness of monitoring and management. As healthcare providers prioritize improving patient outcomes, the demand for cost-effective, and efficient wound care treatments is increasing, further boosting market growth.

- In June 2024, researchers from USC and Caltech developed smart bandages that can sense changes in chronic wounds and deliver real-time treatments. Supported by the NIH, the Product Type showed potential in animal models, with a review published in Nature Materials addressing its commercialization and approval challenges.

The market focuses on the development of innovative treatments that accelerate healing, enhance tissue regeneration, and minimize complications in wound management.

By incorporating advanced technologies such as regenerative medicine, gene therapy, and biomaterials, the market addresses a wide range of wound types, including chronic, surgical, and traumatic wounds.

Key Highlights:

- The global advanced wound care market size was recorded at USD 9.01 billion in 2023.

- The market is projected to grow at a CAGR of 5.51% from 2024 to 2031.

- North America held a susbtantial share of 40.15% in 2023, valued at USD 3.62 billion.

- The dressings segment garnered USD 4.98 billion in revenue in 2023.

- The chronic wounds segment is expected to reach USD 8.99billion by 2031.

- The specialty clinics segment is set to record a staggering CAGR of 6.15% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.25% over the projection period.

Market Driver

"Rising Prevalence of Chronic Diseases and Continuous Innovation in Wound Care"

Ongoing advancements in dressings are fueling the growth of the advanced wound care market by continuously enhancing precision and expanding treatment options across various wound types, inlcuding personalized care. Additionally, rising prevalence of chronic conditions, including diabetes, vascular disorders, and obesity is contributing significantly to market growth.

- In January 2025, the FDA addressed the rising burden of chronic diseases (CCDs) in the U.S. on Chronic Disease Day. The FDA emphasized the importance of regulatory strategies to accelerate treatment development and highlighted the need for greater focus on underserved communities disproportionately affected by CCDs. Additionally, the FDA aims to address gaps in evidence generation and optimize therapy use, particularly for populations with higher comorbidities.

These conditions often result in complex, difficult-to-heal wounds such as diabetic foot ulcers, pressure ulcers, and venous ulcers, which require advanced treatment methods. As the prevalence of these diseases increases, the demand for advanced wound care solutions is growing.

The expanding use of therapies and dressings is fueling market growth by enabling innovative solutions for a wider range of wound types. This progress is creating new opportunities and attracting investments in advanced wound care technologies.

Market Challenge

"High Costs and Access Barriers"

The advanced wound care market encounters significant challenges, notably the high costs of products such as specialized dressings, biologics, and negative pressure wound therapy devices, which limit accessibility for low-income populations and those with inadequate insurance coverage.

Furthermore,the management of chronic wounds is complicated by the complex wound environment, limited understanding of the biological, biochemical, and immunological healing processes, and the increasing complexity of disease pathophysiology, particularly in aging populations.

- As noted in the January 2025 edition of the Indian Journal of Pharmacy Practice, the high costs of advanced wound care products and emerging technologies pose significant barriers to access for patients in low-resource settings. Additionally, regulatory hurdles related to the testing and approval of new technologies may delay their availability, with safety and efficacy remaining key concern.

To address these challenges, key players are investing in research and development to create more cost-effective solutions, improving access to advanced wound care treatments through innovative distribution models, and collaborating with healthcare providers to enhance education and training on the management of chronic wounds.

Market Trend

"Biocompatible Therapies and 3D Printing"

The advanced wound care market is witnessing significant evolution, driven by innovative therapies and technologies aimed at improving patient outcomes and reducing healthcare costs. A key trend is the increasing use of non-invasive, biocompatible therapies that promote natural healing.

Topical dressings and medicated formulations, such as hydrogel dressings, are gaining popularity due to their ability to maintain a moist wound environment,promoting faster healing and pain reduction. Their superior physicochemical and biological properties enhance autolytic debridement and improve patient comfort, making them an attractive alternative to traditional wound care solutions.

- In September 2024, an article published in Current Pharmaceutical Design discussed the potential of biocompatible electrospun hydrogel fibers for advanced wound healing. The review emphasized the advantages of these fibers, including their biomimetic structure, versatility in customization, and ability to integrate therapeutic and sensing capabilities, positioning them as a promising solution for next-generation wound care.

- In January 2025, ACS Omega published a review on the integration of silver nanoparticles (AgNPs) and 3D printing in wound healing. The article highlighted the antibacterial properties of AgNPs and their potential to enhance recovery, while also discussing the benefits and challenges of using AgNPs in 3D-printed structures for regenerative medicine.

The growing use of 3D-printed wound care products is revolutionizing the advanced wound care market. Customizable dressings created through 3D printing are tailored to individual patient needs, allowing for more personalized and effective treatment. This trend is expected to grow as 3D printing product technology becomes increasingly refined and cost-effective, offering enhanced precision in wound care.

Advanced Wound Care Market Report Snapshot

| Segmentation | Details |

| By Product Type | Dressings, Therapies, Active Wound Care Products |

| By Wound Type | Acute Wounds, Chronic Wounds |

| By End User | Hospitals, Specialty Clinics, Home Care Setting, Ambulatory Surgical Centers (ASCs) |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Dressings, Therapies, and Active Wound Care Products): The dressings segment earned USD 4.98 billion in 2023, fueled by its diverse wound applications and growing use in medical research and drug development.

- By Wound Type (Acute Wounds and Chronic Wounds): The chronic wounds segment held a share of 65.04% in 2023, due to the increasing incidences of chronic diseases.

- By End User (Hospitals, Specialty Clinics, Home Care Settings, and Ambulatory Surgical Centers (ASCs)): The hospitals segment is projected to reach USD 6.61 billion by 2031, fueled by the use of advanced wound care for treating chronic and acute wounds.

Advanced Wound Care Market Regional Analysis

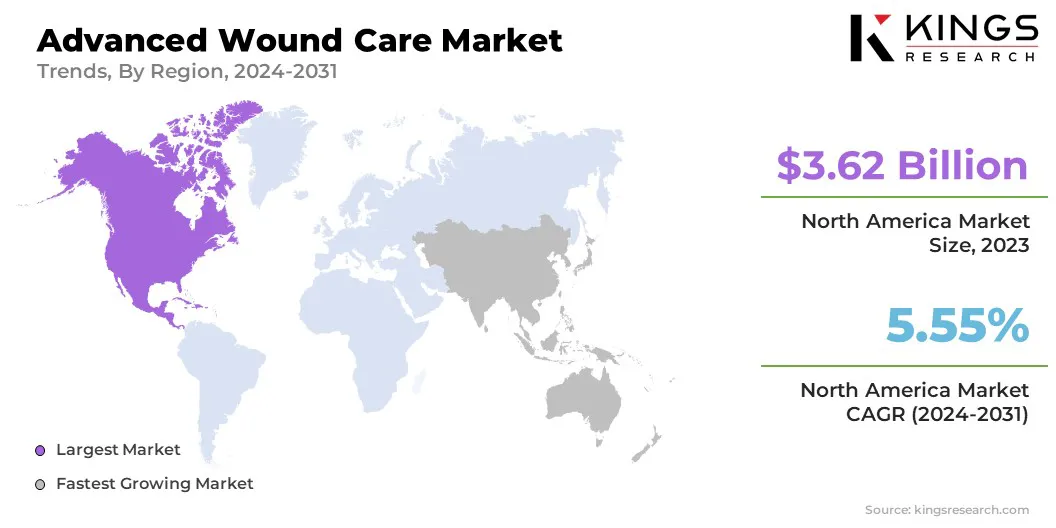

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America advanced wound care market accounted for a substantial share of 40.15% and was valued at USD 3.62 billion in 2023. This dominance is reinforced by its robust healthcare infrastructure, including world-leading academic institutions, cutting-edge healthcare systems, and strong collaboration between public and private sectors.

These factors foster innovation and the development of advanced wound care technologies. Moreover, this growth is supported by several factors, including a strong research environment, widespread adoption of advanced wound care technologies, and a rising prevalence of chronic wounds. The U.S. leads this market due to substantial government funding and regulatory approvals.

Asia-Pacific is expected to grow at the fastest CAGR of 6.25% over the estimated timeframe. Leading countries such as China, India, and Japan are heavily investing in biotechnology research and development. Government initiatives and partnerships between academic institutions and the biotech sector are transforming medical research and bolstering innovation in wound care.

This growth is further aided by government-backed initiatives, significant investments from emerging biotechnology companies, and a growing focus on personalized medicine and innovative wound care solutions.

These factors are driving advancements in wound care and are expected to influence the regional market through continuous research breakthroughs and supportive regulatory environments.

- For instance, in August 2024, Union Minister Jitendra Singh highlighted the significant growth of India's bio economy, which has surged from $10 billion in 2014 to over $130 billion in 2024, with projections to reach $300 billion by 2030.

Regulatory framework also plays a significant role in shaping the market

- The U.S. follows FDA guidelines, ensuring the safety, efficacy, and quality of wound care products through rigorous approval processes and clinical trials.

- In the EU, the regulatory framework for advanced wound care products upholds high safety and efficacy standards. Depending on the product type, it may fall under the Medical Device Regulation (MDR) or Advanced Therapy Medicinal Products (ATMP) regulations.

- In APAC, India has strengthened its regulatory framework for advanced wound care products, with the Central Drugs Standard Control Organization (CDSCO) introducing guidelines in 2020 to streamline approval processes while maintaining stringent patient safety standards.

- In South Korea, the Ministry of Food and Drug Safety (MFDS) has enhanced regulatory oversight , particularly for biologics and nanomaterials. The MFDS emphasizes post-market surveillance to ensure continued safety and efficacy.

- Global efforts are increasing to standardize regulatory frameworks, with organizations such as the International Medical Device Regulators Forum (IMDRF) working toward aligning approval processes and promoting transparency in clinical trials to boost global confidence in emerging technologies.

Competitive Landscape

The global advanced wound care market is characterized by a large number of participants, including both established corporations and rising organisations. To maintain a competitive edge in this evolving industry, these organizations are focusing on new product launches, collaborations and alliances, corporate expansions, and mergers and acquisitions.

Partnerships between medical device companies and healthcare providers are frequently reported to enhance the development and adoption of innovative wound care treatments, such as negative pressure wound therapy (NPWT) and bioactive dressings.

- In October 2024, Tides Medical launched APLICOR 3D, a personalized wound care solution that uses AI and 3D printing with the patient’s own tissue to create custom skin grafts. In partnership with ROKIT Healthcare, and Tides is the exclusive U.S. distributor.

List of Key Companies in Advanced Wound Care Market:

- Smith+Nephew

- 3M

- Coloplast Corp.

- Convatec Inc.

- Mölnlycke Health Care AB.

- Johnson & Johnson Medical NV. (Ethicon)

- Essity AB

- Braun SE

- INTEGRA LIFESCIENCES

- Organogenesis Inc.

- Cardinal Health

- PAUL HARTMANN AG

- Solventum

- Lohmann & Rauscher GmbH & Co. KG

- Hollister Incorporated

Recent Developments

- In October 2024, Royal Biologics launched two wound healing technologies: Peak Powder Collagen Matrix, which enhances healing and offers antimicrobial protection, and ElectroFiber 3D, an FDA-approved polymer matrix that accelerates healing by supporting cellular migration and reducing wound pH.

- In October 2024, researchers at TIBI and UNMC published a study on injectable granular filler for diabetic wound healing. The filler, made with electrospinning and electrospraying technologies, accelerates tissue regeneration and offers a minimally invasive treatment.

- In September 2024, HCAH partnered with Aroa Biosurgery to launch a Wound Care Initiative focused on improving patient recovery. The collaboration introduces new products for complex wounds and includes the "WOW Nurses" program, which trains nurses to prevent and treat bedsores, aiming to enhance healing and reduce complications.

- In September 2024, Solventum launched the V.A.C. Peel and Place Dressing, an all-in-one dressing for V.A.C. Therapy. It simplifies the dressing change process, reduces therapy time by 61%, and cuts costs by 41%. The dressing stays in place for up to seven days, improving patient outcomes and reducing the need for frequent dressing changes.

- In February 2024, research published in the International Journal of Biological Macromolecules by scientists at IASST, India, introduced an eco-friendly wound dressing made from banana fibers combined with biopolymers such as chitosan and guar gum. The patch, infused with a plant extract for antibacterial properties, offers a sustainable, low-cost solution for wound care, benefiting both the environment and farmers.

- In January 2024, Coloplast launched Biatain Silicone Fit in the U.S., a silicone foam dressing designed for pressure injury prevention and wound management. The dressing features 3DFit technology, ensuring a secure fit during patient movement and optimizing conditions for wound healing. It is available in 12 sizes and shapes to meet various clinical needs, aiming to simplify workflows and improve patient care.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)