Machinery Equipment-Construction

Aerial Work Platform Market

Aerial Work Platform Market Size, Share, Growth & Industry Analysis, By Product (Scissor Lift, Boom Lift, Telescopic Lift, Others), By Propulsion (ICE, Electric, Hybrid), By Height (Less than 20 Ft, 21-50 Ft, More than 51 Ft), By Application and Regional Analysis, 2024-2031

Pages : 200

Base Year : 2023

Release : February 2025

Report ID: KR1365

Market Definition

The aerial work platform (AWP) industry involves the production and sale of equipment designed for safe and efficient elevated work, including scissor lifts, boom lifts, and vertical mast lifts.

These platforms are used across industries such as construction, maintenance, and warehousing for tasks requiring access to elevated areas safely and efficiently.

Aerial Work Platform Market Overview

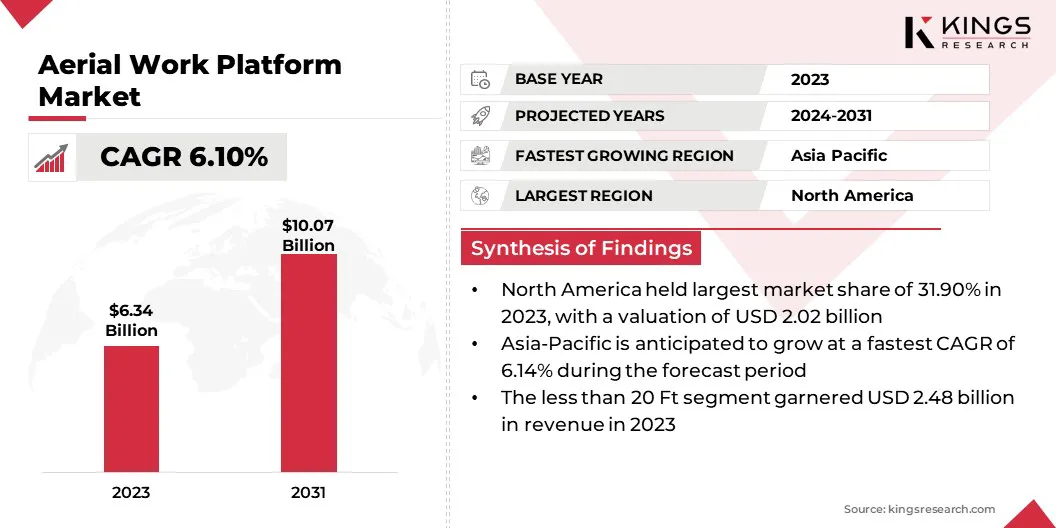

Global aerial work platform market size was valued at USD 6.34 billion in 2023 and is projected to grow from USD 6.65 billion in 2024 to USD 10.07 billion by 2031, exhibiting a CAGR of 6.10% during the forecast period.

Market growth is driven by increasing infrastructure development, rapid urbanization, and rising safety regulations across industries. The shift toward electric and hybrid-powered AWPs, coupled with advancements in automation and remote monitoring, is further fueling demand.

Major companies operating in the aerial work platform industry are AICHI CORPORATION, Advance Lifts, Inc., Altec Industries, Bronto Skylift, DINOLIFT OY, EdmoLift AB, Haulotte group, Oshkosh Corporation Company, Linamar Corporation, MEC, RUNSHARE Heavy Industry Company, Ltd, Tadano Ltd., Terex Corporation, Zhejiang Dingli Machinery Co., Ltd., and The Manitowoc Company, Inc.

The market is evolving rapidly due to the rising demand for electric and hybrid aerial work platforms, fueled by rising environmental concerns and stringent regulations. IoT and telematics integration is optimizing fleet management through real-time data and predictive maintenance.

The growing preference for rental services offers cost-effective access to diverse equipment, particularly for smaller businesses. These trends including electrification, digitalization, and rentals are reshaping the AWP landscape, driving growth and innovation.

Key Highlights:

- The aerial work platform industry size was recorded at USD 6.34 billion in 2023.

- The market is projected to grow at a CAGR of 6.10% from 2024 to 2031.

- North America held a share of 31.90% in 2023, valued at USD 2.02 billion.

- The scissor lift segment garnered USD 2.05 billion in revenue in 2023.

- The ICE segment is expected to reach USD 3.89 billion by 2031.

- The less than 20 Ft segment is projected to generate a revenue of USD 3.94 billion by 2031.

- The construction segment is expected to reach USD 3.46 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.14% over the forecast period.

Market Driver

"Expanding Construction Sector and E-commerce Growth"

The aerial work platform market is primarily driven by the flourishing construction and infrastructure development sectors globally. Rapid urbanization, coupled with increasing investments in infrastructure projects such as bridges, roads, and high-rise buildings, significantly boosts the demand for AWPs.

These platforms are essential for ensuring safety, productivity, and efficiency during elevated tasks. Furthermore, the ongoing expansion of e-commerce and logistics industries highlights the need for AWPs in warehouses, distribution centers, and retail spaces for material handling, storage, and inventory management.

- For instance, in 2023, according to the India Brand Equity Foundation (IBEF), Social commerce significantly impacted India's retail and e-commerce sectors, fueling an expected compound annual growth rate (CAGR) of 31%, with the market forecasted to reach USD 37 billion by 2025. The shift to digital-first strategies and seamless online experiences is influencing industries, including the AWP market, as businesses adopt technology-driven solutions such as AWPs to enhance efficiency and meet evolving demands.

Market Challenge

"High Initial Cost"

The substantial capital investment required in the aerial work platform market poses a significant hurdle, particularly for smaller businesses and budget-conscious projects . This high initial cost can restrict market penetration and limit access to crucial equipment.

To address this challenge, companies are offering flexible financing options such as leasing, installments, and pay-per-use models, which can alleviate the upfront financial strain. Expanding rental services and promoting equipment sharing platforms provide cost-effective alternatives to purchasing.

Market Trend

"Demand for Electric and Hybrid AWPs"

A key trend in the aerial work platform market is the increasing adoption of electric and hybrid-powered AWPs. These eco-friendly alternatives offer reduced emissions and noise pollution, aligning with sustainability goals and regulations.

Furthermore, technological advancements are leading to the development of more versatile and efficient AWPs with features such as enhanced maneuverability, increased lifting capacity, and improved safety systems. The growing demand for rental services is influencing the market by providing cost-effective access to AWPs for various applications.

- In October 2024, Dingli announced its latest generation of mild hybrid scissor aerial work platforms, including the JCPT1823MRTt. Featuring a distinctive cyan body design, it is powered by a low-power engine and a lithium battery for enhanced efficiency and performance.

Aerial Work Platform Market Report Snapshot

|

Segmentation |

Details |

|

By Product |

Scissor Lift, Boom Lift, Telescopic Lift, Others, Sub1_Seg5 |

|

By Propulsion |

ICE, Electric, Hybrid |

|

By Height |

Less than 20 Ft, 21-50 Ft, More than 51 Ft |

|

By Application |

Construction, Utilities, Transportation, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Product (Scissor Lift, Boom Lift, Telescopic Lift, and Others): The scissor lift segment earned USD 2.05 billion in 2023 due to its versatility and suitability for various indoor and outdoor applications, including maintenance, installation, and warehousing.

- By Propulsion (ICE, Electric, and Hybrid): The ICE segment held a share of 38.62% in 2023, attributed to the established infrastructure supporting ICE-powered equipment and their ability to handle demanding tasks in rugged environments.

- By Height (Less than 20 Ft, 21-50 Ft, and More than 51 Ft): The less than 20 Ft segment is projected to reach USD 3.94 billion by 2031, fueled by the increasing demand for low-height access solutions in indoor environments such as warehouses, retail spaces, and manufacturing facilities.

- By Application (Construction, Utilities, Transportation, and Others): The construction segment is likely to reach USD 3.46 billion by 2031, propelled by ongoing infrastructure development, rapid urbanization, and increasing investments in commercial and residential building projects.

Aerial Work Platform Market Regional Analysis

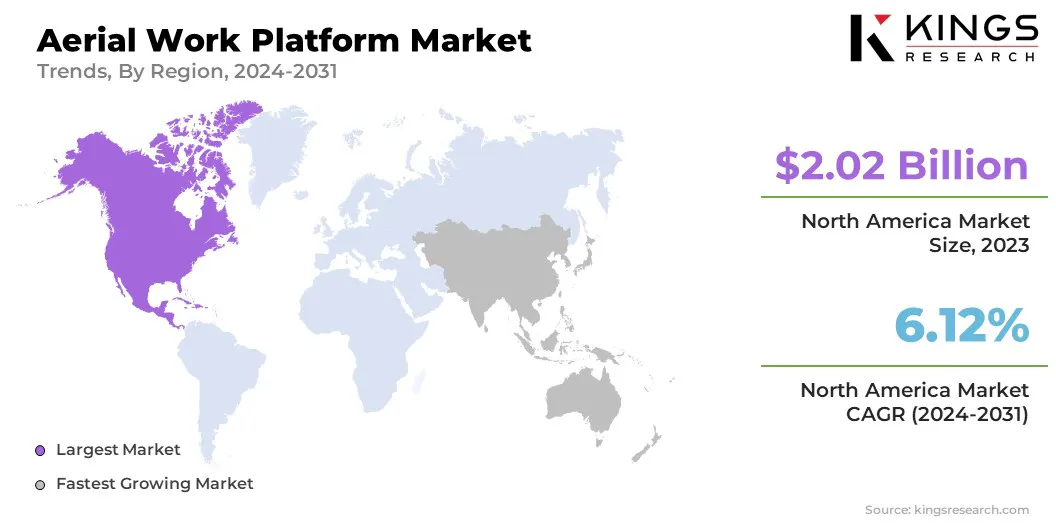

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America aerial work platform market captured a share of around 31.90% in 2023, valued at USD 2.02 billion. This dominance is reinforced by a robust and expanding construction sector, a mature and well-established rental equipment industry that provides easy access to AWPs for various projects, and stringent safety regulations that mandate the use of AWPs for elevated work, ensuring worker safety and compliance.

- In February 2024, Manitou Group, a global leader in handling, aerial work platforms, and earthmoving, introduced a new scissor lift range. This strategic expansion targets the market’s key segment, reinforcing its commitment to innovation and offering a comprehensive portfolio of self-propelled aerial work platforms to meet diverse industry needs.

Asia-Pacific aerial work platform industry is poised to grow at a CAGR of 6.14% over the forecast period. This growth is fostered by rapid urbanization, increasing infrastructure investments, and a growing emphasis on workplace safety, leading to a surge in demand for AWPs.

Furthermore, the rising awareness of the benefits of AWPs in terms of safety, productivity, and cost-effectiveness is boosting their adoption in various industries.

- In September 2023, Manitou Group, a global leader in handling, aerial work platforms, and earthmoving solutions, inaugurated a new spare parts logistics center in Greater Noida, India. This facility aligns with the Group’s strategic expansion plans to enhance production and distribution capabilities in the region, reinforcing its long-term growth objectives in the Indian market.

Regulatory Frameworks

- In the U.S., the Occupational Safety and Health Administration (OSHA) regulates aerial work platforms and sets safety standards for their use. Additionally, the American National Standards Institute (ANSI) further defines specific safety guidelines for manufacturers and operators.

- In Europe, The European Committee for Standardization (CEN) is responsible for developing these safety standards, ensuring AWPs meet stringent regulatory requirements. Additionally, the European Agency for Safety and Health at Work (EU-OSHA) oversees workplace safety compliance, reinforcing the safe operation and use of AWPs

- Globally, the International Organization for Standardization (ISO) regulates aerial work platforms, which establishes global safety and performance requirements for mobile elevating work platforms (MEWPs).

Competitive Landscape

The global aerial work platform market is characterized by a large number of participants, including both established corporations and emerging players. Key market participants are actively driving innovation and advancing technology to strengthen their market position in a rapidly growing industry.

With applications spanning construction, infrastructure maintenance, warehousing, logistics, and utilities, companies are continuously enhancing their product offerings to meet sector-specific demands.

As the market experiences significant expansion, businesses are prioritizing regional penetration, adapting their solutions to address localized requirements while simultaneously scaling operations to capture opportunities in broader international markets.

List of Key Companies in Aerial Work Platform Market:

- AICHI CORPORATION

- Advance Lifts, Inc.

- Altec Industries

- Bronto Skylift

- DINOLIFT OY

- EdmoLift AB

- Haulotte group

- Oshkosh Corporation Company

- Linamar Corporation

- MEC

- RUNSHARE Heavy Industry Company, Ltd

- Tadano Ltd.

- Terex Corporation

- Zhejiang Dingli Machinery Co., Ltd.

- The Manitowoc Company, Inc.

Recent Developments (M&A/ New Product Launch)

- In January 2023, JLG Industries, Inc., a subsidiary of Oshkosh Corporation, acquired Hinowa S.p.A., expanding its product portfolio in the Access segment. This acquisition strengthens JLG's offerings in specialty applications, including landscaping, agriculture, and vegetation management.

- In February 2023, Paul Becker GmbH, a company specializing in rental service for operations at heights, expanded its fleet with the addition of two new aerial platforms by Bronto Skylift. The acquisition includes a 70-meter Bronto S70XR and a 56-meter Bronto S56XR, enhancing the company's capabilities for high-altitude operations.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)