Machinery Equipment-Construction

Agriculture Equipment Market

Agriculture Equipment Market Size, Share, Growth & Industry Analysis, By Product Type (Tractors, Harvesting Equipment, Soil Preparation and Cultivation Equipment, Planting and Seeding Equipment, Irrigation and Crop Processing Equipment, Others), By Application, By Automation, and Regional Analysis, 2021-2031 2024-2031

Pages : 150

Base Year : 2023

Release : January 2025

Report ID: KR1236

Market Definition

The agriculture equipment market encompasses the production, distribution, and sale of machinery used in agricultural activities. This market includes a wide variety of equipment designed to assist with tasks such as planting, irrigation, cultivating, harvesting, and processing crops. These tools and machines are essential for increasing efficiency, improving productivity, and supporting modern farming practices across different agricultural sectors.

Agriculture Equipment Market Overview

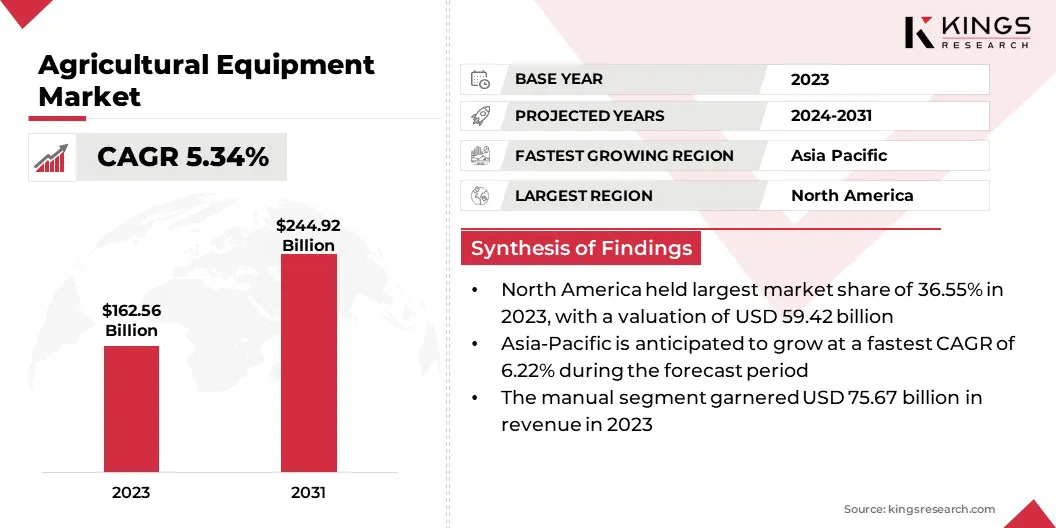

The global agriculture equipment market size was valued at USD 162.56 billion in 2023, which is estimated to be valued at USD 170.14 billion in 2024 and reach USD 244.92 billion by 2031, growing at a CAGR of 5.34% from 2024 to 2031.

The increasing global population and growing demand for higher agricultural yields are driving the market. Farmers require advanced machinery that enhances productivity, improves efficiency, and supports larger-scale, more sustainable farming operations.

Major companies operating in the global agricultural equipment market are AGCO Corporation, APV GmbH, CLAAS KGaA mbH, CNH Industrial N.V., Deere & Company, Escorts Kubota Limited, HORSCH Maschinen GmbH, ISEKI & CO.,LTD, J C Bamford Excavators Ltd., Quivogne CEE, Rostselmash, KUBOTA Corporation., Mahindra&Mahindra Ltd, Mascar SpA, and Morris Equipment Ltd.

The market is dynamic and evolving, characterized by constant innovation and the adoption of advanced technologies. It plays a pivotal role in modernizing agricultural practices, enabling farmers to improve operational efficiency and productivity.

Additionally, the demand for sustainable farming practices is rising. The market continues to witness changes driven by technological advancements, regulatory pressures, and evolving consumer expectations. As global agricultural demands grow, this market adapts to meet the diverse needs of farmers, facilitating the transition to more mechanized, efficient, and sustainable agriculture.

- In September 2023, the Food and Agriculture Organization (FAO) of the United Nations (UN) held its first Global Conference on Sustainable Agricultural Mechanization, focusing on promoting innovation, efficiency, and resilience through the adoption of digital, geospatial, and motorized equipment.

Key Highlights:

- The global agriculture equipment market size was recorded at USD 162.56 billion in 2023.

- The market is projected to grow at a CAGR of 5.34% from 2024 to 2031.

- North America held a market share of 36.55% in 2023, with a valuation of USD 59.42 billion.

- The tractors segment garnered USD 49.68 billion in revenue in 2023.

- The land development & seed bed preparation segment is expected to reach USD 83.39 billion by 2031.

- The automatic segment is projected to witness highest CAGR of 6.17% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.22% during the forecast period.

Market Driver

Increasing Demand for Food

The increasing global population and rising demand for food are driving the agriculture equipment market.

- As per United Nations projections, the global population is expected to reach 8.5 billion by 2030, 9.7 billion by 2050, and 10.4 billion by 2100. These projections carry some uncertainty but highlight the growing demand for food and agricultural productivity.

The need for higher agricultural yields is increasing. Hence, farmers are adopting advanced machinery to boost productivity, efficiency, and crop output. Modern equipment, from precision tools to automated systems, aids in optimizing land use, improving resource management, and reducing labor requirements.

This demand for more effective agricultural solutions is pushing the development and adoption of innovative equipment designed to address the growing food production needs.

- In July 2024, Zoomlion showcased its agricultural machinery at the "Field Exhibition Agricultural Machinery into 10,000" event in Changde City, Hunan. The RK904 tractor and G60C high-speed transplanter demonstrated innovative technology enhancing land preparation, rice transplanting, and yield, reinforcing Zoomlion's role in modernizing farming practices in the "Dongting Granary."

Market Challenge

Limited Financing Options

Limited financing options pose a significant challenge for farmers, particularly in developing regions, as they often lack the capital to invest in modern agricultural equipment. This hinders the adoption of advanced machinery, impacting productivity and growth.

Financial institutions, governments, and equipment manufacturers can collaborate to provide tailored financing solutions, such as low-interest loans, leasing programs, or subsidies, to address this challenge.

- In November 2023, Mahindra Finance announced a strategic co-lending partnership with State Bank of India (SBI) to offer affordable financing solutions for the agriculture equipment market. Leveraging Mahindra Finance’s expertise in vehicle and tractor financing, the collaboration provides competitive interest rates, supporting farmers and SMEs in acquiring essential machinery with accessible credit options.

These initiatives would help make agricultural equipment more accessible, enabling farmers to improve efficiency, increase yields, and adopt sustainable practices.

Market Trend

Sustainability Trends

A key trend in the agriculture equipment market is the increasing focus on sustainability. Amid rising environmental concerns, the demand for eco-friendly, fuel-efficient machinery that minimizes the carbon footprint and conserves resources is growing.

Farmers are adopting technologies that reduce emissions, optimize fuel consumption, and promote sustainable farming practices. This shift not only aligns with global sustainability goals but also helps improve operational efficiency and reduce long-term costs, pushing manufacturers to innovate with more environmentally conscious equipment.

- In September 2024, Mahindra Tractors unveiled its first Compressed Bio-Gas (CBG)-powered Yuvo Tech+ tractor, showcasing eco-friendly, fuel-efficient technology. This sustainable innovation reduces emissions, supports renewable energy use, and strengthens Mahindra’s commitment to environmental responsibility in agriculture.

Agriculture Equipment Market Report Snapshot

| Segmentation | Details |

| By Product Type | Tractors, Harvesting Equipment, Soil Preparation and Cultivation Equipment, Planting and Seeding Equipment, Irrigation and Crop Processing Equipment,Others |

| By Application | Land Development & Seed Bed Preparation, Sowing & Planting, Weed Cultivation, Plant Protection, Harvesting & Threshing, Post-harvest & Agro-processing |

| By Automation | Manual, Semi automatic, Automatic |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (tractors, harvesting equipment, soil preparation and cultivation equipment, planting and seeding equipment, irrigation and crop processing equipment, and others): The tractors segment earned USD 49.68 billion in 2023, due to the rising demand for efficient, sustainable, and high-performance agricultural machinery.

- By Application (land development & seed bed preparation, sowing & planting, weed cultivation, plant protection, harvesting & threshing, and post-harvest & agro-processing): The land development & seed bed preparation held 31.22% share of the market in 2023, due to the increasing adoption of mechanized farming for improved soil preparation and higher crop yields.

- By Automation (manual, semi automatic, and automatic): The manual segment is projected to reach USD 108.25 billion by 2031, owing to the growing demand in emerging markets and cost-effectiveness of small-scale farming.

Agriculture Equipment Market Regional Analysis

North America accounted for around 36.55% share of the global agriculture equipment market in 2023, with a valuation of USD 59.42 billion. North America is a dominant region in the market, driven by advanced farming practices, high adoption of technology, and large-scale mechanized agriculture.

The region sees widespread use of cutting-edge equipment, including precision farming tools and automated machinery, to optimize crop production. Additionally, strong financial support and government incentives for equipment purchase and modernization contribute to market growth. North America remains a key player in shaping global agricultural trends, due to focus on innovation, sustainability, and high crop yields in the region.

- In August 2024, AGCO Corporation introduced its AE50 award-winning Fendt 600 Vario Series tractor to North America at the Farm Progress show. This versatile, fuel-efficient tractor, equipped with advanced technology like the VarioDrive CVT and FendtONE system, is ideal for small to medium-sized farms, offering exceptional performance and maneuverability across various farming tasks.

The agriculture equipment market in Asia Pacific is poised for significant growth over the forecast period at a CAGR of 6.22%. Asia Pacific is emerging as the fastest-growing region in the market, driven by rapid industrialization, increased mechanization in farming, and government initiatives promoting modern farming practices.

Countries in these regions are investing heavily in advanced agricultural machinery to meet the rising demand for food production and improve efficiency. The region's large agricultural sector and rising adoption of eco-friendly equipment further contribute to its growth in the market.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- OSHA is part of the United States Department of Labor. OSHA aims to ensure that American workers have safe and healthful working conditions free from unlawful retaliation. OSHA carries out its mission by setting and enforcing standards; enforcing anti-retaliation provisions of the OSH Act and other federal whistleblower laws; providing and supporting training, outreach, education, and assistance; and working collaboratively with other state OSHA programs as well.

- In the EU, the Outdoor Noise Directive 2000/14/EC (OND) regulates the noise emissions into the environment by outdoor equipment.

- The Bureau of Indian Standards was established in 1947 for harmonious development of activities of standardization, marking and quality certification of goods, and for matters connected therewith or incidental thereto. This Act also covers agriculture equipment.

Competitive Landscape:

The global agriculture equipment market is characterized by a large number of participants, including established corporations and rising organizations. Key market participants include AGCO Corporation, APV GmbH, CLAAS KGaA mbH, CNH Industrial N.V., Deere & Company, Escorts Kubota Limited, HORSCH Maschinen GmbH, ISEKI & CO.,LTD, J C Bamford Excavators Ltd., Quivogne CEE, Rostselmash, KUBOTA Corporation., Mahindra&Mahindra Ltd, Mascar SpA, and Morris Equipment Ltd.

Companies in the market are actively introducing innovations and products to enhance farming productivity and efficiency. These launches focus on incorporating advanced technologies such as automation, fuel-efficient engines, and precision farming tools to meet the growing demand for sustainable, high-performance machinery in modern agriculture.

- In August 2024, H&S Manufacturing launched its new brand at Wisconsin Farm Tech Days, showcasing advanced equipment for the forage, dairy, and beef industries. The launch featured new products like the TF6128 Twin-Flex Merger, with special financing offers available.

List of Key Companies:

- AGCO Corporation

- APV GmbH

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Deere & Company

- Escorts Kubota Limited

- HORSCH Maschinen GmbH

- ISEKI & CO.,LTD

- J C Bamford Excavators Ltd.

- Quivogne CEE

- Rostselmash

- KUBOTA Corporation.

- Mahindra&Mahindra Ltd

- Mascar SpA

- Morris Equipment Ltd. and

- Others

Recent Developments (M&A/ New Product Launch)

- In July 2023, Deere & Company acquired Smart Apply, a precision spraying equipment company, to enhance its portfolio of high-value crop solutions. Smart Apply’s Intelligent Spray Control System reduces chemical use, airborne drift, and runoff, helping growers optimize yields while meeting sustainability goals and regulatory requirements.

- In April 2024, Swaraj Tractors unveiled a limited-edition tractor to mark its Golden Jubilee, featuring golden accents and MS Dhoni’s signature. Available in five variants, the celebratory launch was part of a nationwide campaign, "Josh Ka Swaran Utsav," highlighting Swaraj's legacy, with the introduction of the ‘Skilling 5000’ CSR program.

- In November 2023, Mahindra Tractors unveiled its first CNG mono fuel tractor at Agrovision, Nagpur. Developed with advanced technology, this eco-friendly tractor offers a 70% reduction in emissions and lower noise levels, promising significant savings and operational efficiency, with a focus on sustainability and performance.

- In September 2023, Swaraj Tractors, part of the Mahindra Group, launched a new range of 40-50 HP tractors. Designed to enhance India’s agricultural mechanization, these tractors offer advanced features, blending power, reliability, and style, boosting productivity and meeting the evolving needs of Indian farmers in modern agriculture.

- In June 2023, JCB launched the 403E electric wheeled loader, featuring a 20kWh battery pack, offering best-in-class performance with zero emissions. Equipped with multiple driving modes, hydraulic systems, and precision controls, it provides enhanced productivity, low noise, and improved operator comfort, making it ideal for various applications.

- In December 2023, Linamar Corporation announced its acquisition of Bourgault Industries Ltd., enhancing its industrial segment and solidifying its position as a leading agriculture equipment manufacturer. Bourgault's expertise in broad-acre seeding complements Linamar’s existing agricultural brands, expanding its portfolio across the crop production cycle.

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years