Advanced Materials and Chemicals

Agrochemicals Market

Agrochemicals Market Size, Share, Growth & Industry Analysis, By Product Type (Fertilizers, Pesticides, Plant Growth Regulators, Others), By Application (Crop-based, Non-crop-based) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2024

Report ID: KR477

Agrochemicals Market Size

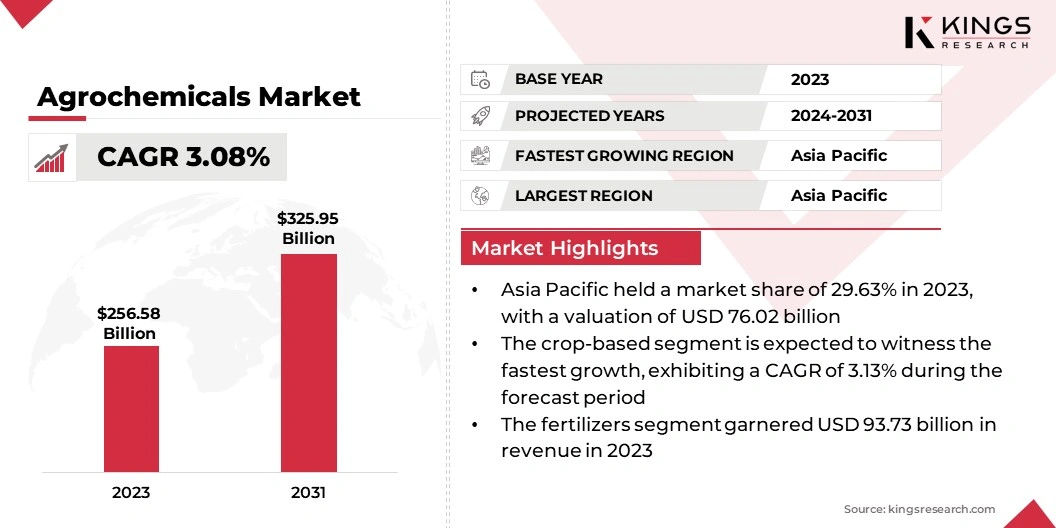

The global Agrochemicals Market size was valued at USD 256.58 billion in 2023 and is projected to reach USD 325.95 billion by 2031, growing at a CAGR of 3.08% from 2024 to 2031. The agrochemicals market is experiencing steady growth driven by several factors. Currently, the market is characterized by an increasing global population, which is driving higher demand for food production. In the scope of work, the report includes products offered by companies such as Bayer AG, Corteva, Yara International ASA, Nufarm Canada, Nutrien Ltd., Solvay, UPL, ADAMA, BASF SE, CLARIANT, ADM and others.

Agrochemicals play a pivotal role in modern agriculture by enhancing crop yields, controlling pests and diseases, and improving overall agricultural productivity. The market outlook for the forecast years remains positive, with continued advancements in agricultural biotechnology and precision farming techniques. Additionally, the growing emphasis on sustainable agriculture and environmentally friendly farming practices is expected to fuel the demand for eco-friendly agrochemicals. Despite challenges such as regulatory constraints and environmental concerns, the agrochemicals market is projected to expand as key players invest in research and development to address evolving market needs.

Analyst’s Review

Numerous significant trends are impacting the expansion of the agrochemicals market. Notably, there is rising adoption of precision agriculture technologies such as GPS-guided tractors and drones, empowering farmers to optimize agrochemical usage and enhance crop yields. Moreover, the emergence of biotechnology and genetically modified crops is fostering a demand surge for specialized agrochemicals tailored to these crops. Additionally, increasing awareness regarding sustainable agriculture is propelling the development of eco-friendly agrochemicals and organic farming methods. Looking ahead, the market's growth trajectory remains optimistic driven by ongoing technological innovations and evolving consumer preferences.

Market Definition

Agrochemicals, also known as agricultural chemicals, encompass a broad range of chemical products used in agriculture to enhance crop production and protect crops from pests, diseases, and weeds. These products include fertilizers, pesticides, herbicides, insecticides, and fungicides. Fertilizers provide essential nutrients to plants, while pesticides, herbicides, insecticides, and fungicides are used to control pests, weeds, insects, and fungal diseases that can adversely affect crop yields. Agrochemicals play a crucial role in modern agriculture as they improve crop productivity and ensure food security.

Market Dynamics

The rising consumer demand for sustainably produced food is a significant driver shaping the agrochemicals market. Consumers are increasingly concerned about the environmental and social impact of food production and are seeking products that are produced using sustainable agricultural practices. This trend is driving the adoption of eco-friendly agrochemicals and organic farming methods, which minimize the use of synthetic chemicals and promote soil health and biodiversity. Moreover, food retailers and manufacturers are responding to consumer preferences by sourcing ingredients from farms that adhere to sustainable agricultural practices, thereby driving the demand for agrochemicals that support sustainable food production.

Longer product development cycles and escalating costs pose significant restraints on the development of the agrochemicals market. Developing new agrochemical products involves extensive research and development efforts, including testing for efficacy, safety, and environmental impact. These processes can be time-consuming and costly, particularly as regulatory requirements become more stringent. Additionally, escalating costs of raw materials and manufacturing further add to the challenges faced by agrochemical companies. These factors can hinder innovation and slow down the introduction of new agrochemical products to the market, impacting market growth and competitiveness.

Segmentation Analysis

The global agrochemicals market is segmented based on product type, application, and geography.

By Product Type

Based on product type, the market is divided into fertilizers, pesticides, plant growth regulators, and others. The fertilizers segment garnered the highest revenue of USD 93.73 billion in 2023 owing to its crucial role in enhancing crop productivity. Fertilizers provide essential nutrients such as nitrogen, phosphorus, and potassium to plants, promoting healthy growth and higher yields. With the increasing global population and growing food demand, the use of fertilizers has become essential to meet agricultural production targets. Moreover, technological advancements in fertilizer formulations and application methods have further boosted the demand for fertilizers in modern agriculture, driving the dominance of the fertilizers segment in the agrochemicals market.

By Application

Based on application, the market is bifurcated into crop-based and non-crop-based. The crop-based segment is expected to witness the fastest growth, exhibiting a CAGR of 3.13% over the assessment period owing to the increasing adoption of specialized agrochemicals tailored to specific crops. Different crops have unique pest, weed, and disease management requirements, necessitating the development of crop-specific agrochemical solutions. Furthermore, the rising demand for high-value crops such as fruits, vegetables, and cash crops is driving the need for specialized agrochemicals to optimize crop yields and quality. Additionally, advancements in biotechnology and genetically modified crops are driving the development of specialized agrochemicals designed to complement these crops, further fueling the growth of the crop-based segment in the agrochemicals market.

Agrochemicals Market Regional Analysis

Based on region, the global agrochemicals market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia-Pacific Agrochemicals Market share stood around 29.63% in 2023 in the global market, with a valuation of USD 76.02 billion attributed to the region's large agricultural sector and increasing adoption of agrochemicals in countries like China, India, and Southeast Asian nations. Rapid population growth and urbanization are driving higher demand for food, leading to increased agricultural activities and the use of agrochemicals to improve crop yields and ensure food security.

Moreover, government initiatives to support agricultural development and modernization in emerging economies are further driving the growth of the agrochemicals market in the Asia Pacific region. Additionally, favorable climatic conditions in many parts of Asia Pacific support year-round agricultural production, creating a conducive environment for the growth of the agrochemicals market in the region.

Competitive Landscape

The global agrochemicals market study will provide valuable insight with an emphasis on the fragmented nature of the sector. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing heavily in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Agrochemicals Market

- Bayer AG

- Corteva

- Yara International ASA

- Nufarm Canada

- Nutrien Ltd.

- Solvay

- UPL

- ADAMA

- BASF SE

- CLARIANT

- ADM

Key Industry Developments

- January 2024 (Launch): ADAMA Ltd unveiled the introduction of five new cereal fungicide products throughout Europe. These products are specifically formulated to combat the most critical diseases affecting farmer yields at every stage of the crop's reproductive cycle.

- September 2023 (Launch): Corteva introduced Reklemel active, a novel nematicide designed to safeguard an extensive range of food and row crops from the harmful effects of plant-parasitic nematodes while preserving the beneficial soil microorganism ecosystem.

- August 2023 (Investment): Bayer reinforced its dedication to innovative solutions in regenerative agriculture through a substantial EUR 220 million investment in research and development (R&D) at its Monheim facility. This marks the company's most substantial singular investment within its Crop Protection business sector in Germany.

The Global Agrochemicals Market is Segmented as:

By Product Type

- Fertilizers

- Pesticides

- Plant Growth Regulators

- Others

By Application

- Crop-based

- Non-crop-based

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)