Air Compressor Market Size

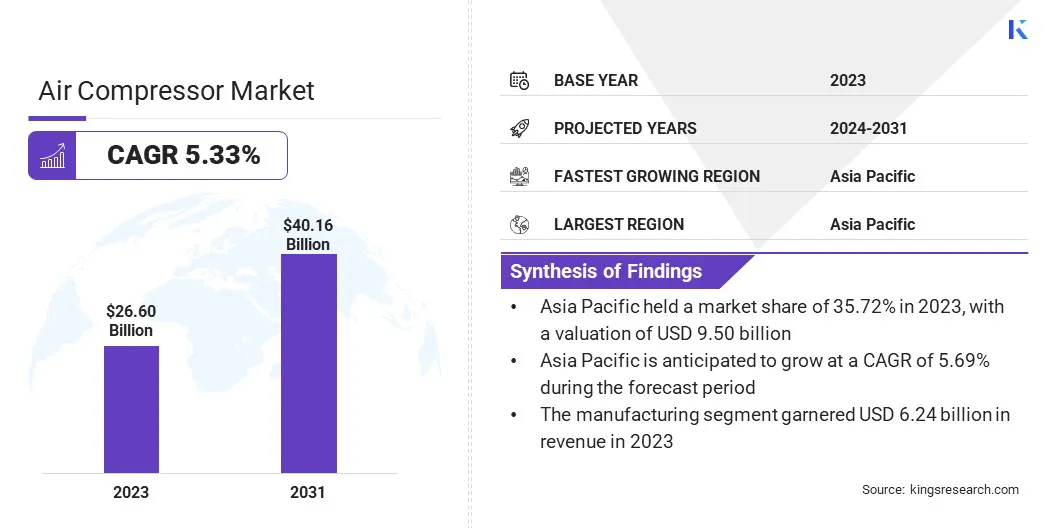

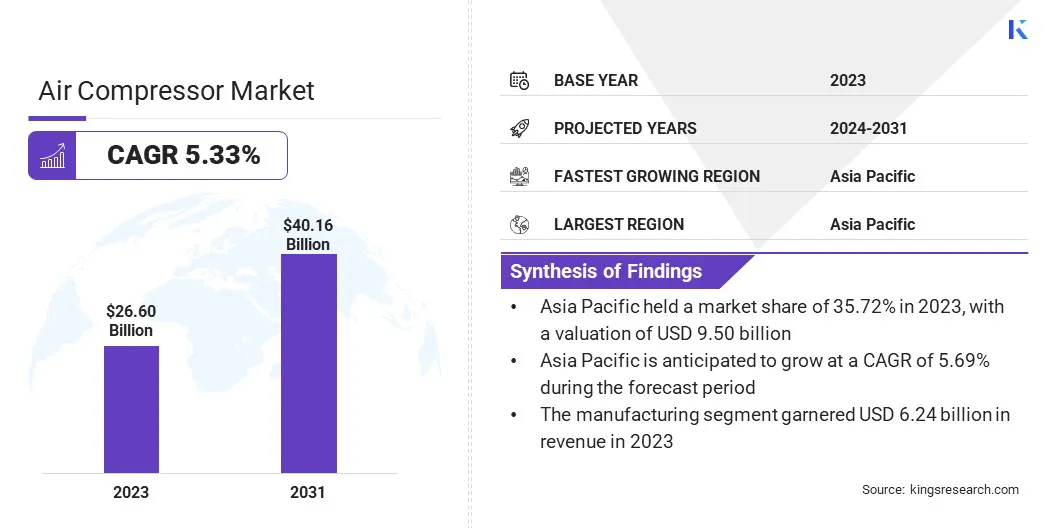

The global air compressor market size was valued at USD 26.60 billion in 2023 and is projected to grow from USD 27.92 billion in 2024 to USD 40.16 billion by 2031, exhibiting a CAGR of 5.33% during the forecast period.

The expansion of the manufacturing, construction, and energy industries has significantly increased the demand for air compressors. These devices are essential for powering tools, equipment, and processes in industrial operations, making them indispensable in production facilities. Additionally, industries such as oil & gas and mining rely heavily on compressed air systems for various operational tasks.

The growing industrial activities aid in the expansion of the air compressor market. In the scope of work, the report includes products offered by companies such as Atlas Copco AB, Sulzer Ltd., Hitachi Industrial Products, Ltd., Ingersoll Rand, Mitsubishi Heavy Industries Ltd., Doosan Bobcat., MAT Industries, LLC (Campbell Hausfeld), Siemens AG, EBARA CORPORATION, KAESER KOMPRESSOREN, and others.

The healthcare industry’s growing reliance on clean and oil-free air systems has bolstered the demand for advanced air compressors. Medical equipment, ventilators, and laboratory processes require high-precision compressed air to maintain hygiene and safety standards. The increasing focus on modernizing healthcare infrastructure, particularly in emerging economies, has further strengthened this trend.

Air compressor is a mechanical device that converts power, typically from an electric motor, diesel engine, or gasoline engine, into potential energy stored in pressurized air. It operates by compressing air to increase its pressure and storing it in a tank or chamber for various applications.

Air compressors are widely used across industries for tasks such as powering pneumatic tools, inflating tires, spray painting, operating machinery, and more. Depending on their design and operating mechanism, air compressors can be classified into different types, including reciprocating, rotary screw, and centrifugal compressors.

Analyst’s Review

Analyst’s Review

Companies across the globe are adopting several strategic initiatives to boost the adoption of air compressors, driven by the growing demand for energy-efficient and sustainable solutions. A key strategy is the development and integration of advanced, energy-efficient air compressors, which help businesses reduce operational costs and comply with stringent environmental regulations.

- In October 2023, Kaishan USA launched the KROF series, a new range of industrial, oil-free rotary screw air compressors. The KROF is a two-stage oil-free rotary screw compressor designed to deliver high-quality compressed air that meets ISO 8573-1 Class 0 standards for oil-free air. The KROF series ensures the production of high-quality air for sensitive applications by incorporating two sequential compression stages, along with intercooling and aftercooling.

Companies are meeting the increasing need for eco-friendly systems without compromising performance by prioritizing the creation of energy-efficient models and oil-free compressors. Additionally, the introduction of innovative air compressor models such as variable speed drive (VSD) compressors, has played a significant role in this shift.

Moreover, businesses are increasingly focusing on sustainability, recognizing the long-term benefits of investing in cost-effective and environmentally responsible systems.

- In January 2024, Atlas Copco unveiled its latest innovation, the battery-powered portable screw air compressor, 'B-Air.' This new model signifies a pivotal step in the global industrial sector's shift toward a low-carbon future. Equipped with advanced Variable Speed Drive (VSD) and a permanent magnet motor, the 'B-Air' reduces total ownership costs by automatically adjusting the motor speed to align with real-time air demand, boosting energy efficiency by up to 70%.

These strategies meet regulatory requirements and position companies as leaders in energy conservation, further accelerating the global adoption of air compressors. Companies are contributing to the ongoing expansion of the market through these initiatives, driven by technological advancements and the growing need for sustainable industrial solutions.

Air Compressor Market Growth Factors

Rapid urbanization and extensive infrastructure development projects in emerging economies have significantly increased the demand for air compressors. These devices are crucial for applications in construction, such as drilling, paving, and heavy equipment operations. Governments and private investors are allocating substantial budgets for infrastructure growth, including roads, bridges, and smart cities, further driving market demand.

The construction of industrial facilities and warehouses also necessitates reliable compressed air systems. These ongoing developments continue to create lucrative opportunities, accelerating the usage of air compressors in the infrastructure sector.

The expanding oil & gas industry remains a major contributor to the growth of the air compressor market, with air compressors playing a crucial role in extraction, refining, and transportation processes.

- The International Energy Agency's (IEA) report from December 2024 indicates that global oil demand growth is expected to increase from 840 kb/d in 2024 to 1.1 mb/d in 2025, driving consumption to 103.9 mb/d. Meanwhile, global oil supply grew by 130 kb/d month-over-month to reach 103.4 mb/d in November, marking a year-on-year increase of 230 kb/d.

These devices are used in offshore drilling operations, pipeline maintenance, and oil platform operations. The industry's continuous expansion, particularly in emerging regions, has driven the demand for reliable and durable air compressor systems. As the oil & gas industry invests in new exploration and production technologies, the requirement for high-capacity and efficient compressors continues to grow, fueling the global air compressor market.

However, high initial investment and maintenance costs associated with advanced air compressor systems are restraining the growth of the market. These costs can be a barrier for small and medium-sized enterprises (SMEs) looking to adopt modern, energy-efficient technologies.

To address this challenge, companies are offering flexible financing options, such as leasing and rental programs, which allow businesses to access high-performance equipment without the large upfront expenditure. Additionally, manufacturers are focusing on developing cost-effective, energy-efficient solutions that lower the overall total cost of ownership, making advanced air compressors more accessible to a wider range of industries.

Air Compressor Industry Trends

Renewable energy initiatives, such as wind and solar power projects, have contributed to the rising demand for air compressors. These devices are used in applications like wind turbine maintenance and cooling systems, ensuring the efficiency and longevity of renewable energy infrastructure. Governments globally are actively promoting clean energy solutions, increasing the deployment of air compressors in this domain.

Moreover, innovations in compressor technology tailored to renewable energy requirements are further enhancing their adoption. The growing focus on sustainable energy development is supporting the expansion of the market.

The growing demand for heating, ventilation, and air conditioning (HVAC) systems, driven by urbanization and rising living standards, is contributing to the expansion of the air compressor market. Air compressors are integral to the operation of HVAC systems, powering refrigeration and air-conditioning units in residential, commercial, and industrial settings.

With an increase in construction and renovation projects globally, the need for efficient and reliable HVAC systems has surged, thereby boosting the demand for high-performance air compressors.

- In December 2024, Kaeser Kompressoren introduced the Mobilair M44, a Stage V compliant compressor designed to fill a market gap by providing portable compressed air systems that deliver high performance with a compact and eco-friendly design. Key features include an operating mode indicator, system monitoring and diagnostics, and anti-frost control, making it an ideal solution for powering pneumatic hammers and impact moles.

The trend toward energy-efficient and environmentally friendly HVAC systems is fostering the development of advanced, sustainable air compressors, further driving the market.

Segmentation Analysis

The global market has been segmented based on type, operation, propulsion, end use, and geography.

By Type

Based on type, the market has been segmented into stationary and portable. The stationary segment led the air compressor market in 2023, reaching the valuation of USD 16.05 billion, due to its versatility and ability to cater to both low and high-pressure applications across diverse industries. These compressors offer the flexibility to handle a wide range of operations, from powering pneumatic tools in manufacturing to ensuring efficient operations in oil & gas applications.

Businesses prioritize stationary systems to optimize investment by using a single machine for multiple functions, reducing the need for separate equipment. The growing demand for cost-effective and energy-efficient solutions further amplifies the appeal of stationary compressors, driving their adoption and establishing their leadership within the market.

By Operation

Based on operation, the market has been classified into rotary, centrifugal, and reciprocating. The rotary segment secured the largest revenue share of 41.43% in 2023. Rotary air compressors, particularly screw models, are preferred in the manufacturing, automotive, and construction industries, where uninterrupted operations are essential.

Their compact design, quieter operation, and lower maintenance requirements make them a cost-effective choice for businesses aiming to optimize productivity. Additionally, advancements in technology, such as Variable Speed Drive (VSD) integration, further enhance energy efficiency, making rotary compressors the ideal solution for industries focusing on sustainable and efficient operations.

By End Use

Based on end use, the market has been divided into oil & gas, healthcare, energy & power, manufacturing, electronics and semiconductor, food and beverages, and others. The energy & power segment is poised for significant growth at a robust CAGR of 6.03% through the forecast period. Air compressors are integral to a range of applications, including powering pneumatic controls, maintaining system pressure, and operating essential equipment within power plants.

The growing demand for energy to support industrial, commercial, and residential needs has spurred the expansion of power generation infrastructure globally, further boosting the adoption of air compressors. Additionally, advancements in energy-efficient compressor technologies align with the energy sector’s focus on reducing operational costs and complying with stringent environmental regulations.

Air Compressor Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 35.72% share of the global air compressor market in 2023, with a valuation of USD 9.50 billion. The growing manufacturing and automotive industries in Asia Pacific are driving the demand for air compressors. The region is home to some of the largest automotive production facilities globally, where air compressors are used in assembly lines, painting, and tire inflation processes.

Asia Pacific accounted for around 35.72% share of the global air compressor market in 2023, with a valuation of USD 9.50 billion. The growing manufacturing and automotive industries in Asia Pacific are driving the demand for air compressors. The region is home to some of the largest automotive production facilities globally, where air compressors are used in assembly lines, painting, and tire inflation processes.

Additionally, the growth of the textiles, electronics, and consumer goods industries in countries like China, India, and Vietnam is further boosting the market, as these industries require air compressors for various production and maintenance tasks.

Governments across Asia Pacific are heavily investing in infrastructure development and construction projects, particularly in emerging economies. These investments are driving the demand for air compressors in the construction, energy, and transportation sectors. Air compressors are crucial for powering tools and machinery used in large-scale construction projects, such as roads, bridges, and residential complexes.

- India's National Highway (NH) network has experienced substantial growth, as reported by the Press Information Bureau (PIB), increasing by 60% from 91,287 km in 2014 to 146,145 km in 2023. Additionally, the pace of NH construction has surged by 143%, rising from 12.1 km per day in 2014 to 28.3 km per day, reflecting the country's commitment to improving its transportation infrastructure.

The demand for air compressors is expected to rise significantly, due to the expansion of urban infrastructure and industrialization. This factor makes government-led projects a major contributor to the market's growth in the region.

The air compressor market in Europe is poised for significant growth at a robust CAGR of 5.33% over the forecast period. The expansion of the renewable energy sector in Europe is also contributing to the growth of the market.

- The revised Renewable Energy Directive of 2023 has raised the EU's binding renewable energy target for 2030 to a minimum of 42.5%, a significant increase from the previous target of 32%, with an ambitious goal of reaching 45%. This marks a nearly twofold increase in the current share of renewable energy across the EU. The directive was officially implemented in all EU member states on November 20, 2023.

Wind and solar power industries rely on air compressors for various applications, including powering tools and equipment during the construction and maintenance of renewable energy infrastructure.

The push for cleaner energy sources and the transition to sustainable power generation has increased the demand for air compressors in the renewable energy sector. As European countries continue to invest in renewable energy projects, the market is expected to benefit from the growing need for efficient and reliable equipment in this field.

Competitive Landscape

The global air compressor market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create opportunities for the market growth.

List of Key Companies in Air Compressor Market

- Atlas Copco AB

- Sulzer Ltd.

- Hitachi Industrial Products, Ltd.

- Ingersoll Rand

- Mitsubishi Heavy Industries Ltd.

- Doosan Bobcat.

- MAT Industries, LLC (Campbell Hausfeld)

- Siemens AG

- EBARA CORPORATION

- KAESER KOMPRESSOREN

Key Industry Developments

- December 2024 (Partnership): EBARA CORPORATION partnered with Hyundai Construction Company of Korea and Maire Tecnimont of Italy to supply compressors, turbines, and custom pumps for the AMIRAL project, a SATORP petrochemical complex currently under construction in Jubail, Saudi Arabia.

- January 2024 (Partnership): Hitachi Industrial Equipment Systems Co., Ltd. introduced the Predictive Diagnosis Service for air compressors, commonly utilized as power sources for factory equipment. This innovative service leverages machine learning (ML) to analyze data collected through remote monitoring, integrating it with the expertise of Hitachi’s maintenance professionals. The service aims to proactively detect and address potential issues or abnormalities, helping to prevent equipment stoppages before they occur.

The global air compressor market has been segmented as:

By Type

By Operation

- Rotary

- Centrifugal

- Reciprocating

By Propulsion

By End Use

- Oil & Gas

- Healthcare

- Energy & Power

- Manufacturing

- Electronics and Semiconductor

- Food and Beverages

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America