Automotive and Transportation

Air Taxi Market

Air Taxi Market Size, Share, Growth & Industry Analysis, By Technology (Autonomous, Piloted), By Range (Intercity, Intracity), By Propulsion (Parallel Hybrid, Electric, Turboshaft, Turboelectric), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2024

Report ID: KR473

Market Definition

An air taxi is a type of aircraft, typically small and electric or hybrid, designed to provide on-demand, short-distance air transportation within urban areas. It offers a faster and more efficient alternative to traditional ground transportation.

Air Taxi Market Overview

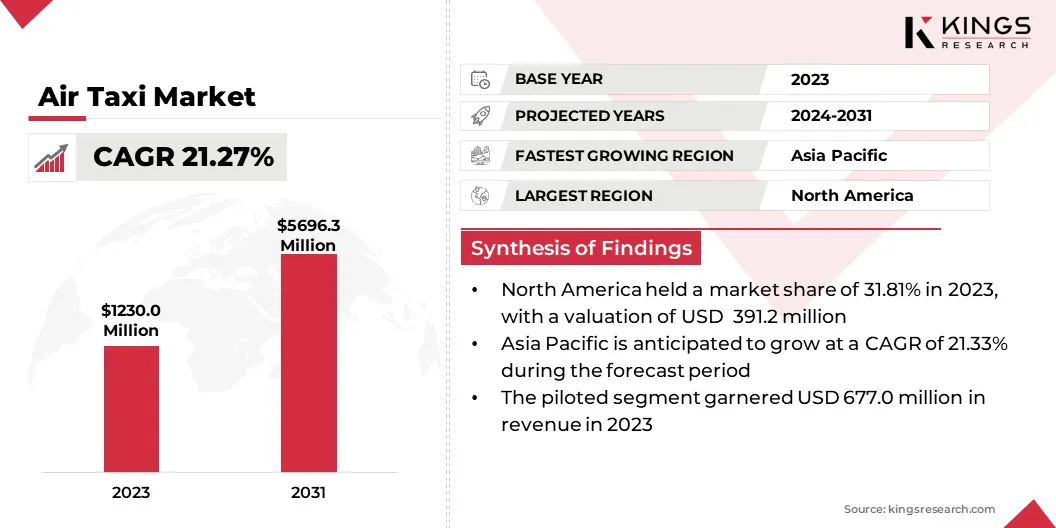

The global air taxi market size was valued at USD 1230.0 million in 2023 and is projected to grow from USD 1477.1 million in 2024 to USD 5696.3 million by 2031, exhibiting a CAGR of 21.27% during the forecast period. This market is a part of the broader Urban Air Mobility (UAM) industry, driven by advancements in electric vertical take-off and landing (eVTOL) technologies, which promise to revolutionize urban transportation.

Major companies operating in the air taxi industry are Joby Aero, Inc., Volocopter GmbH., Lilium GmbH, Archer Aviation Inc., Vertical Aerospace, Boeing (Wisk Aero), Airbus, EHANG, BETA Technologies, Uber Technologies Inc., Embraer S.A, Jaunt Air Mobility LLC., Overair, Inc., Hyundai Motor Company (Supernal), and SkyDrive Inc.

Additionally, air taxis provide a faster alternative to traditional ground transportation. Air taxis can bypass traffic, which is expected to significantly reduce travel time and improve overall efficiency in densely populated areas. This market is characterized by the growing demand for efficient, quick, and eco-friendly transportation solutions to address urban congestion and reduce travel times.

- In July 2024, Groupe ADP and Lilium announced a partnership to develop vertiport infrastructure for the Lilium Jet in Europe, the Middle East, and Asia. Groupe ADP will integrate Lilium’s aircraft into its global airport network, including key locations in Paris, Saudi Arabia, Turkey, and India, supporting the launch of regional electric aviation by 2026.

Key Highlights:

Key Highlights:

- The air taxi industry size was valued at USD 1230.0 million in 2023.

- The market is projected to grow at a CAGR of 21.27% from 2024 to 2031.

- North America held a market share of 31.81% in 2023, with a valuation of USD 391.2 million.

- The piloted segment garnered USD 677.0 million in revenue in 2023.

- The intracity segment is expected to reach USD 3121.0 million by 2031.

- The parallel hybrid segment is expected to reach USD 1705.5 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 21.33% during the forecast period.

Market Driver

“Expansion of Urban Air Mobility is Propelling the Market”

The air taxi market is being propelled by the increasing demand for sustainable urban mobility and rapid advancements in eVTOL technology and infrastructure. Cities are seeking cleaner and more efficient transportation alternatives with the growing urbanization and traffic congestion.

Electric air taxis provide a zero-emission solution, aligning with global sustainability goals and reducing reliance on fossil fuel-powered vehicles. Simultaneously, the expansion of UAM ecosystems and increasing investments from key market players are shaping the future of the market.

Cities are actively developing vertiports, charging infrastructure, and air traffic management systems to seamlessly integrate air taxis into existing transportation networks. Governments and private companies are collaborating on pilot programs and regulatory frameworks to enable large-scale adoption.

- For instance, in June 2023, NEOM and Volocopter successfully conducted the first electric vertical takeoff and landing aircraft test flights in Saudi Arabia. The flights, carried out in collaboration with Saudi Arabia’s General Authority of Civil Aviation (GACA), marked a significant milestone in the adoption of UAM in Saudi Arabia.

Market Challenge

“Regulatory Concerns and High Infrastructure Costs”

Regulatory hurdles and airspace integration pose significant challenges for the air taxi market. Ensuring safe operations within existing air traffic control systems requires extensive coordination with aviation authorities. Regulations for eVTOL certification, pilot training, and urban airspace management are still evolving, leading to delays in commercial deployment.

A solution lies in close collaboration between air taxi manufacturers, regulatory bodies, and infrastructure developers to establish clear operational frameworks and testing programs that ensure safe and efficient integration.

Additionally, high infrastructure costs and scalability also present obstacles to widespread adoption.Developing vertiports, charging stations and maintenance facilities demands substantial investment, particularly in densely populated urban areas.

Public-private partnerships and strategic collaborations between governments, real estate developers, and transportation authorities can help fund and accelerate infrastructure deployment. Additionally, modular and scalable vertiport designs can be introduced to reduce costs and facilitate gradual expansion in key urban hubs.

Market Trend

“Advancements in Air Taxi Management Software and Increased Investments & Partnerships”

Advancements in air taxi management software are playing a crucial role in shaping the future of UAM. These intelligent systems integrate real-time ride-matching, pilot assistance tools, and operational management, enabling seamless on-demand services and efficient fleet coordination. Enhanced automation and AI-driven optimization are making air taxi operations more reliable, scalable, and cost-effective.

- For instance, in June 2024, Joby Aviation, Inc. announced FAA approval for ‘ElevateOS,’ its proprietary software for managing air taxi operations. The system includes pilot tools, operations management software, a rider app, and an intelligent matching engine. The system enables on-demand flights, pilot training, and safety system implementation.

At the same time, the air taxi industry is registering increased investments and strategic partnerships, with aviation giants, technology firms, and mobility providers collaborating to accelerate commercialization.

Funding from airlines, automakers, and venture capital firms is driving the development of eVTOL infrastructure, pilot training programs, and regulatory compliance efforts, positioning air taxis as a viable future transportation mode.

Air Taxi Market Report Snapshot

|

Segmentation |

Details |

|

By Technology |

Autonomous, Piloted |

|

By Range |

Intercity, Intracity |

|

By Propulsion |

Parallel Hybrid, Electric, Turboshaft, Turboelectric |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Technology (Autonomous, Piloted): The piloted segment earned USD 677.0 million in 2023, due to the reliance on human pilots for ensuring the safety, operational control, and air taxi services as autonomous technology continues to evolve and undergo rigorous testing.

- By Range (Intercity, Intracity): The intracity segment held 54.86% share of the market in 2023, due to the growing demand for efficient, quick transportation solutions within urban areas to alleviate traffic congestion and reduce travel times for short-distance commutes.

- By Propulsion (Parallel Hybrid, Electric, Turboshaft, and Turboelectric): The parallel hybrid segment is projected to reach USD 1705.5 million by 2031, owing to its ability to combine the benefits of electric propulsion with traditional fuel-powered engines, offering increased range, reliability, and energy efficiency.

Air Taxi Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

.webp) North America accounted for a substantial air taxi market share of 31.81% in 2023, with a valuation of USD 391.2 million. This dominance can be attributed to the region's strong technological advancements, well-established aerospace industry, and significant investments in UAM infrastructure.

North America accounted for a substantial air taxi market share of 31.81% in 2023, with a valuation of USD 391.2 million. This dominance can be attributed to the region's strong technological advancements, well-established aerospace industry, and significant investments in UAM infrastructure.

Leading companies and innovative startups in North America are driving the development of eVTOL technologies, with major players at the forefront. Additionally, government support in the U.S. through regulatory frameworks has provided a favourable environment for the market growth.

The air taxi industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 21.33% over the forecast period. This growth is driven by rapid urbanization, and rising middle class in major cities across countries like China, Japan, and India.

Governments in the region are heavily investing in UAM initiatives and have shown a strong interest in integrating air taxis into their transportation systems to address issues like overcrowding and inefficient ground transport. Cities like Tokyo and Singapore are already testing prototypes and exploring regulatory frameworks to make air taxis a reality.

Furthermore, the region benefits from the presence of several key aerospace manufacturers and innovative startups, particularly in China, which has made substantial progress in eVTOL development.

- In November 2024, Toyota Motor Corporation and Joby Aviation, Inc. completed Joby’s first international exhibition flight at Toyota’s Higashi-Fuji Technical Center in Japan, showcasing the low acoustic footprint and zero-emission capabilities of Joby’s electric air taxi. The flight follows Toyota’s announcement of an additional USD 500 million investment in Joby to support certification, commercial production, and the establishment of a manufacturing alliance.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) is the regulatory authority that governs air taxis. The FAA has worked with industry stakeholders to develop regulatory frameworks for air taxi operations. The FAA determines the certification requirements for air taxis, including their design, production, airworthiness, and operation.

- In Europe, the regulatory authority governing air taxis is the European Union Aviation Safety Agency (EASA). It is responsible for setting the standards and rules for air taxi operations, including certification requirements for air taxi services within the EU.

- In China, the Civil Aviation Administration of China (CAAC) regulates air taxis, including the pilotless passenger-carrying eVTOL vehicles and ensuring airworthiness.

- In India, the Directorate General of Civil Aviation (DGCA) is the regulatory authority that governs air taxis. The DGCA is responsible for regulating air transport services, including air taxis, and ensuring air safety & airworthiness.

Competitive Landscape:

The global air taxi market is characterized by a large number of participants, including established corporations and rising organizations. Key market players with deep industry expertise and capital are leveraging their established market presence to dominate early-stage air taxi development and testing.

These players are focused on integrating air taxis into existing transportation systems and working closely with governments to ensure regulatory compliance and infrastructure development.

Market participants are focusing on reducing operational costs, increasing the efficiency of air taxis, and ensuring safety through rigorous testing and regulatory approvals. Many companies are also collaborating with government bodies, urban planners, and other stakeholders to build essential infrastructure, such as vertiports, which are key to the successful deployment of air taxis in urban environments.

- For instance, in November 2024, Joby Aviation, Inc. announced the start of construction on the first vertiport in its planned Dubai air taxi network at Dubai International Airport, developed in partnership with Dubai’s Road and Transport Authority and Skyports to support Joby’s exclusive air taxi service set to launch in late 2025.

List of Key Companies in Air Taxi Industry:

- Joby Aero, Inc.

- Volocopter GmbH.

- Lilium GmbH

- Archer Aviation Inc.

- Vertical Aerospace

- Boeing (Wisk Aero)

- Airbus

- EHANG

- BETA Technologies

- Uber Technologies Inc.

- Embraer S.A

- Jaunt Air Mobility LLC.

- Overair, Inc.

- Hyundai Motor Company (Supernal)

- SkyDrive Inc.

Recent Developments (Partnerships/Agreements)

- In December 2024, Joby Aviation, Inc. entered the final phase of certification for its electric air taxi by conducting its first FAA testing under Type Inspection Authorization (TIA). The company has also completed static load testing on an FAA-conforming tail structure and remains the first eVTOL manufacturer to complete three of five stages of the FAA type certification program.

- In December 2024, Joby Aviation, Inc. and Jetex announced a strategic partnership to integrate Joby’s electric air taxi service into Jetex’s network of private terminals across the Middle East, with plans to install Joby’s Global Electric Aviation Charging System (GEACS) at Jetex locations to support sustainable UAM.

- In December 2024, Anduril and Archer announced an exclusive partnership to develop a hybrid vertical-take-off-and landing (VTOL) aircraft for defence applications, targeting a potential program with the U.S. Department of Defence. The collaboration aims to accelerate the deployment of cost-effective hybrid VTOL capabilities using AI and scalable production.

- In December 2024, Archer Aviation Inc. partnered with key UAE and Abu Dhabi entities to launch electric air taxi operations. Signed under Smart and Autonomous Systems Council, the agreement positions Archer as the first eVTOL manufacturer and operator in the Middle East & North Africa, with support from the Abu Dhabi Investment Office and aviation stakeholders.

- In July 2024, Saudia Group and Lilium signed a binding sales agreement for 50 Lilium Jets, with options for 50 more. This agreement, following their 2022 Memorandum of Understanding (MoU), marks the largest eVTOL aircraft order in the Middle East & North Africa.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)