Automotive and Transportation

Airlines Market

Airlines Market Size, Share, Growth & Industry Analysis, By Transport Type (Domestic, International), By Service Type (Passenger Airlines, Cargo Airlines), By Fleet Type (Narrow-Body Aircraft, Wide-Body Aircraft) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2024

Report ID: KR483

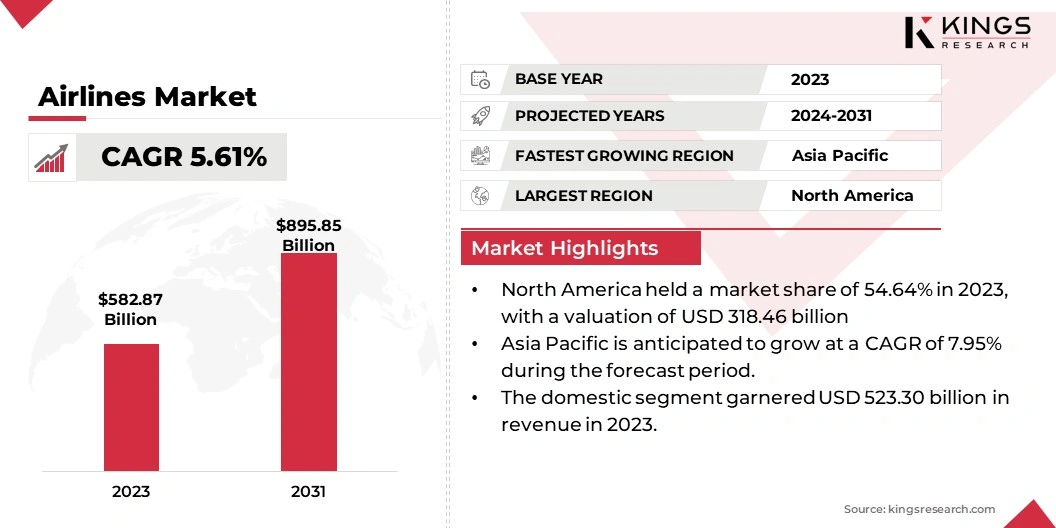

Airlines Market Size

The global Airlines Market size was valued at USD 582.87 billion in 2023 and is projected to reach USD 895.85 billion by 2031, growing at a CAGR of 5.61% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Delta Air Lines, Inc., American Airlines Group Inc., United Airlines Holdings, Inc., Lufthansa Group, Air France-KLM, International Airlines Group (IAG), Southwest Airlines Co., China Southern Airlines Company Limited, Emirates Group, Qantas Airways Limited and others.

The global airlines market presents a promising outlook, largely influenced by the increasing global travel demand. This growth is propelled by economic development and the rise in incomes among the middle-class population, leading to a surge in the number of passengers opting for air travel. As economies expand and disposable incomes increase, the demand for both domestic and international flights is expected to rise steadily.

This trend creates opportunities for airlines to expand their services, cater to a broader customer base, and explore new routes. The market perspective emphasizes the pivotal role of economic factors and changing demographics in driving the expansion of the global airline industry.

Analyst’s Review

Over the forecast period spanning from 2024 to 2031, several futuristic trends are poised to shape the growth trajectory of the global airlines market. Urban Air Mobility (UAM) introduces electric vertical takeoff and landing (eVTOL) aircraft, revolutionizing short-distance urban transportation. Simultaneously, the exploration of hydrogen-powered aircraft aligns with the industry's commitment to sustainable aviation, which is aimed at reducing carbon emissions.

Another noteworthy trend is the resurgence of supersonic travel, with technological advances potentially heralding the return of commercial supersonic flights. These trends underscore the industry's commitment to innovation, sustainability, and high-speed air travel, setting the stage for transformative developments in the forthcoming years.

Market Definition

Airlines, a vital component of the global transportation system, are companies that provide air transport services for passengers and cargo. Their applications encompass a wide range, from facilitating international and domestic travel to transporting goods in the case of cargo airlines.

The regulatory landscape governing airlines is complex and varies globally. Key regulations include safety standards set by the International Civil Aviation Organization (ICAO) and regional authorities.

Regulatory bodies such as the Federal Aviation Administration (FAA) in the United States and the European Union Aviation Safety Agency (EASA) play crucial roles in ensuring compliance. Laws such as the Air Carrier Access Act and the Montreal Convention further delineate passenger rights and liabilities, thereby contributing to the overall regulatory framework of the aviation industry.

Market Dynamics

Market liberalization and deregulation play a pivotal role in shaping the competitive landscape of the global airlines market. The removal of restrictions fosters healthy competition, leading to increased efficiency, reduced fares, and expanded airlines market access. Simultaneously, the significance of technological advancements in enhancing operational efficiency and cost-effectiveness for airlines plays a pivotal role.

From the adoption of fuel-efficient aircraft to the integration of digitalization and artificial intelligence, technology remains a major factor driving industry progress. The synergy between market liberalization and technological progress positions the global airlines market for sustained growth and innovation.

Despite the optimistic growth prospects, the global airlines market faces challenges that can impact its stability. Fuel price volatility highlights how fluctuations in fuel costs pose a significant challenge to airline profitability and operational costs.

The industry's vulnerability to oil price changes underscores the need for effective fuel hedging strategies. Additionally, the obstacles presented by regulatory compliance and environmental concerns impede the airlines market expansion. Stringent regulations and the industry's carbon footprint contribute to additional compliance costs and operational complexities.

Despite facing challenges, the global airlines market is presented with notable opportunities, such as expansion into emerging markets, particularly in untapped economies. This presents airlines with the chance to broaden their route networks, reach new customer bases, and capitalize on the growing demand for air travel.

Additionally, the increasing focus on sustainable aviation offers significant opportunities. The industry can seize this opportunity by investing in eco-friendly technologies and practices, catering to environmentally conscious passengers, and contributing to global efforts aimed at creating a more sustainable aviation sector.

Segmentation Analysis

The global airlines market is segmented based on transport type, service type, fleet type, and geography.

By Transport Type

Based on transport type, the market is segmented into domestic and international. In 2023, the domestic segment accounted for the largest market share, reaching an impressive USD 523.30 billion. This dominance can be attributed to several factors, including the resurgence of domestic travel post-pandemic restrictions, increased demand for short-haul flights for business and leisure purposes, and government initiatives to stimulate local tourism.

By Service Type

Based on service type, the airlines market is bifurcated into passenger airlines and cargo airlines. The passenger airlines segment secured a commanding share of 89.22% in 2023. The gradual recovery of global travel post-pandemic, coupled with the Russia-Ukraine war, has spurred a resurgence in passenger demand for both leisure and business purposes.

Additionally, the expansion of low-cost carriers, along with the introduction of innovative services has enhanced accessibility and affordability, thereby driving passenger traffic. Moreover, the continuous growth of urbanization and globalization has amplified the need for efficient passenger transportation, solidifying the dominance of this segment.

By Fleet Type

Based on fleet type, the airlines market is classified into narrow-body aircraft and wide-body aircraft. The wide-body aircraft segment is forecasted to experience robust growth, with a remarkable CAGR of 8.03% from 2024 to 2031.

This anticipated surge is likely to be fueled by several factors, including increasing demand for long-haul international travel, expansion of global routes by major airlines, and rising preference for larger aircraft to accommodate growing passenger volumes efficiently.

Additionally, advancements in aircraft technology, such as fuel efficiency and enhanced passenger amenities, are likely to further drive the adoption of wide-body aircraft, thereby fueling their growth trajectory in the upcoming years.

Airlines Market Regional Analysis

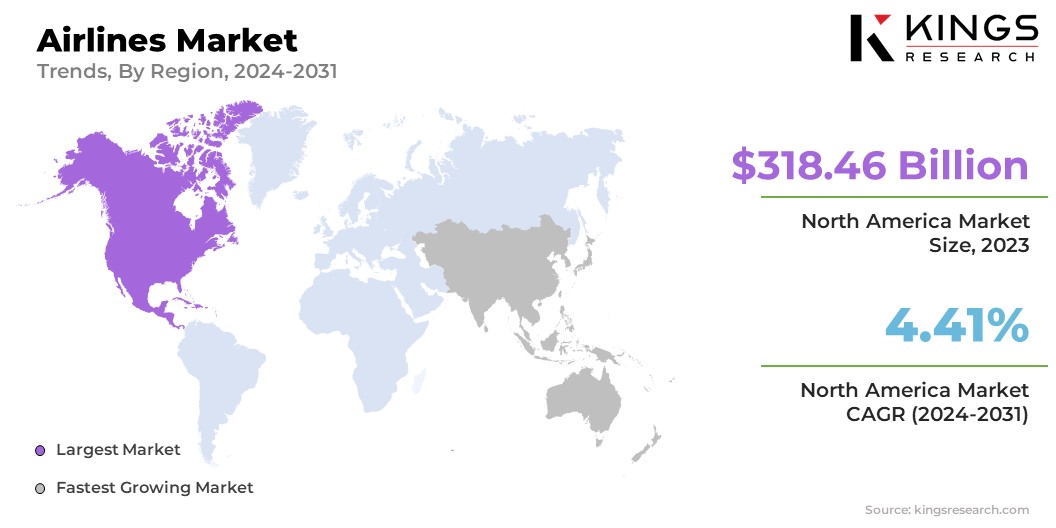

Based on region, the global airlines market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Airlines Market share stood around 54.64% in 2023 in the global market, with a valuation of USD 318.46 billion. The region's supremacy in the market is mainly propelled by the presence of major airline players, robust infrastructure, and a growing demand for air travel.

With a diverse range of carriers offering extensive domestic and international services, North America stands as a key hub for the global airlines industry. The region's economic strength, coupled with a well-established regulatory framework, contributes to its leading position, making it a focal point for strategic initiatives, innovations, and market trends in the airline sector.

Asia Pacific is set to emerge as the fastest-growing region in the global airlines market from 2024 to 2031, registering a CAGR of 7.95%. This rapid growth is underpinned by various factors such as increasing urbanization, rising disposable incomes, and a burgeoning middle-class population with a growing interest in air travel.

The region's dynamic economic landscape, characterized by thriving emerging markets, positions it as a hotspot for airline expansion and investment. Strategic partnerships, technological advancements, and the development of aviation infrastructure contribute to Asia Pacific's ascent as a major region in the global airline industry.

Competitive Landscape

The global airlines market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their airlines market shares across different regions.

Expansion & investments involve a range of strategic initiatives including, investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, which could pose new opportunities for market growth.

List of Key Companies in the Airlines Market

- Delta Air Lines, Inc.

- American Airlines Group Inc.

- United Airlines Holdings, Inc.

- Lufthansa Group

- Air France-KLM

- International Airlines Group (IAG)

- Southwest Airlines Co.

- China Southern Airlines Company Limited

- Emirates Group

- Qantas Airways Limited

Key Industry Developments

- December 2023 (Partnership): Marriott International and Singapore Airlines strengthened their partnership, offering enhanced benefits to their loyalty program members. The collaboration aimed to provide unique experiences and privileges, combining the strengths of both brands in hospitality and aviation. The deepened alliance sought to elevate the overall travel experience for members through exclusive perks and rewards across Marriott's hotel portfolio and Singapore Airlines' global network.

- November 2023 (Partnership): Air India entered into an interline partnership with Alaska Airlines, improving connectivity for passengers traveling between India and the United States. The agreement facilitated smoother transfers, coordinated flight schedules, and enhanced the overall travel experience. This collaboration aimed to strengthen global connectivity, providing passengers with increased travel options and convenience across the extensive networks of both airlines.

The Global Airlines Market is Segmented as:

By Transport Type

- Domestic

- International

By Service Type

- Passenger Airlines

- Cargo Airlines

By Fleet Type

- Narrow-Body Aircraft

- Wide-Body Aircraft

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)