Aluminum Oxide Market

Global Aluminum Oxide Market Size, Share, Growth & Industry Analysis, By Form (Nanoparticles, Powder, Pellets, and Others), By End-Use (Healthcare, Electronics, Automotive, Aerospace, and Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : June 2024

Report ID: KR784

Aluminum Oxide Market Size

Global Aluminum Oxide Market size was recorded at USD 4.77 billion in 2023, which is estimated to be at USD 4.99 billion in 2024 and projected to reach USD 7.14 billion by 2031, growing at a CAGR of 5.24% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Alcoa Corporation, Rio Tinto, Norsk Hydro ASA, RusAL, Aluminium Corp, BHP, Sumitomo Chemical Co., Ltd., Shandong Xinfa Aluminum Co., Ltd., NALCO India, Hindalco Industries Ltd. (Aditya Birla Group), and others. Rising construction activities are significantly propelling the demand for aluminum oxide in various construction materials and ceramics.

The rising construction activities in rapidly developing economies is fostering market growth. Aluminum oxide, known for its hardness, high melting point, and resistance to wear and corrosion, is an essential component in construction materials such as refractory bricks, cement, and concrete. In ceramics, it is used to produce tiles, sanitary wares, and other high-performance ceramic products due to its excellent thermal stability and strength. These properties make alumina-based materials ideal for use in high-stress environments such as kilns, furnaces, and industrial processes, ensuring the longevity and durability of the structures.

- Furthermore, the global shift toward sustainable construction practices is increasing the demand for advanced ceramics and high-performance materials that contribute to energy efficiency and reduced environmental impact. The expansion of the construction industry is facilitated by a strong demand for aluminum oxide.

Aluminum oxide, also known as alumina, is a white, crystalline substance and serves as the primary oxide of aluminum. It naturally occurs in its crystalline polymorphic phase, referred to as corundum, found in minerals such as sapphire and ruby, where trace impurities give these gemstones their characteristic colors. In its industrial form, aluminum oxide is produced from bauxite ore through the Bayer process, which involves refining the ore to extract pure alumina. This versatile compound is available in various forms, including powders, nanoparticles, and sintered ceramics, each tailored to specific industrial applications.

In the aluminum production industry, alumina is a crucial intermediate used in the electrolytic smelting of aluminum metal. Its properties make it indispensable in the manufacture of refractory materials that withstand high temperatures and mechanical stress in industries such as steel and glass production. Additionally, aluminum oxide’s hardness and abrasion resistance render it an essential component in abrasive products such as sandpapers and grinding wheels. The electronics industry utilizes high-purity alumina for insulating components and substrates due to its excellent electrical insulating properties and thermal conductivity.

Analyst’s Review

The aluminum oxide market is poised to witness substantial growth in the near future, mainly driven by its extensive applications across various industries. Key market players are employing multifaceted strategies to maintain competitiveness and capitalize on emerging opportunities. One prominent strategy is substantial investment in research and development to innovate and improve the quality and performance of alumina products. By developing advanced materials such as high-purity alumina and nano-alumina, these companies meet the specific needs of high-tech industries, including the electronics and renewable energy sectors.

Additionally, companies are increasingly adopting eco-friendly production techniques to reduce their carbon footprint and comply with stringent environmental regulations. The expanding production capacities in strategically located regions with abundant raw material availability ensures a stable supply chain and cost efficiency.

Aluminum Oxide Market Growth Factors

The rising demand for automotive vehicles is a major factor fueing the demand for aluminum oxide, especially for the production of lightweight and durable components. As the automotive industry seeks to enhance fuel efficiency and reduce emissions, there is a notable shift toward lightweight materials without compromising on strength or durability. Aluminum oxide, with its high strength-to-weight ratio, corrosion resistance, and thermal stability, is increasingly used in manufacturing engine components, brake systems, and other critical parts. This shift is supported by regulatory pressures aimed at meeting stringent fuel economy standards and rising consumer demand for high-performance vehicles.

- Additionally, electric vehicles (EVs), which are gaining popularity, benefit immensely from the utilization of alumina-based materials in their battery components and thermal management systems. The use of aluminum oxide helps reduce the overall vehicle weight, thereby extending the operational range of EVs and enhancing their efficiency.

Fluctuating raw material prices, particularly of bauxite, pose a significant challenge to the development of the aluminum oxide market. Bauxite, the primary ore used to produce alumina, is subject to price volatility due to various factors including geopolitical tensions, mining regulations, and supply chain disruptions. Moreover, environmental regulations and sustainable mining practices add layers of complexity and costs to the process of bauxite extraction, thereby contributing to price fluctuations. This volatility affects production costs profit margins and pricing strategies of companies involved in the alumina supply chain.

Manufacturers are often compelled to adjust their operations, explore alternative raw material sources, or invest in technological advancements to mitigate these impacts. Consistent raw material price instability necessitates robust risk management and strategic planning, presenting an ongoing challenge in maintaining a competitive advantage in the aluminum oxide market.

Aluminum Oxide Market Trends

The rising development and adoption of nano-alumina represent a significant trend in the aluminum oxide market, driven by its enhanced properties and expanding applications. Nano-alumina, characterized by its extremely small particle size, exhibits superior mechanical strength, high surface area, and excellent thermal and chemical stability compared to its bulk counterpart. These attributes make it particularly valuable in high-tech applications such as electronics, biomedical devices, and advanced coatings.

- For instance, in the electronics industry, nano-alumina is used to improve the performance and durability of semiconductors and insulating materials. In biomedical fields, it plays a crucial role in drug delivery systems and as a component of prosthetic devices due to its biocompatibility.

The development of nano-alumina further aligns with the broader trend toward miniaturization and the creation of materials tailored with specific functionalities. As industries increasingly recognize the potential of nano-alumina, there is a rise in investments in research and development, thereby fostering innovation and stimulating market growth. This trend underscores the transformative impact of nanotechnology on traditional materials and its expanding role in various industrial applications.

Segmentation Analysis

The global market is segmented based on form, end-use, and geography.

By Form

Based on form, the market is segmented into nanoparticles, powder, pellets, and others. The powder segment captured the largest aluminum oxide market share of 39.65% in 2023 due to its extensive applications across diverse industries. Aluminum oxide in powder form is highly versatile and easily incorporated into various manufacturing processes. Its fine particle size and high purity make it ideal for use in the production of advanced ceramics, offering exceptional thermal stability, hardness, and wear resistance.

Additionally, the powder form is crucial in the production of refractories used in high-temperature industrial processes, including steelmaking and glass manufacturing. It's abrasiveness makes it a key component in abrasive products such as sandpapers, grinding wheels, and blasting media. Moreover, its application in the electronics industry, particularly in insulating materials and substrates, boosts its demand. The growing demand for lightweight, high-strength materials in the automotive and aerospace industries further contributes to the prominence of the segment.

By End-Use

Based on end-use, the aluminum oxide market is classified into healthcare, electronics, automotive, aerospace, and others. The electronics segment is poised to record a staggering CAGR of 6.07% through the forecast period, mainly fueled by the rapid expansion and technological advancements within the electronics industry. High-purity aluminum oxide is integral to the production of electronic components such as semiconductors, insulators, and substrates. Its excellent dielectric properties, thermal stability, and resistance to corrosion make it an essential material for ensuring the reliability and performance of electronic devices.

The proliferation of consumer electronics, including smartphones, tablets, and wearable devices, significantly fuels the demand for high-quality alumina. Additionally, the rise of the Internet of Things (IoT) and the increasing complexity of electronic systems necessitate advanced materials that meet stringent performance criteria. The ongoing development of 5G technology and the growing focus on renewable energy systems, such as photovoltaic cells and battery storage, boost the demand for aluminum oxide in the electronics sector.

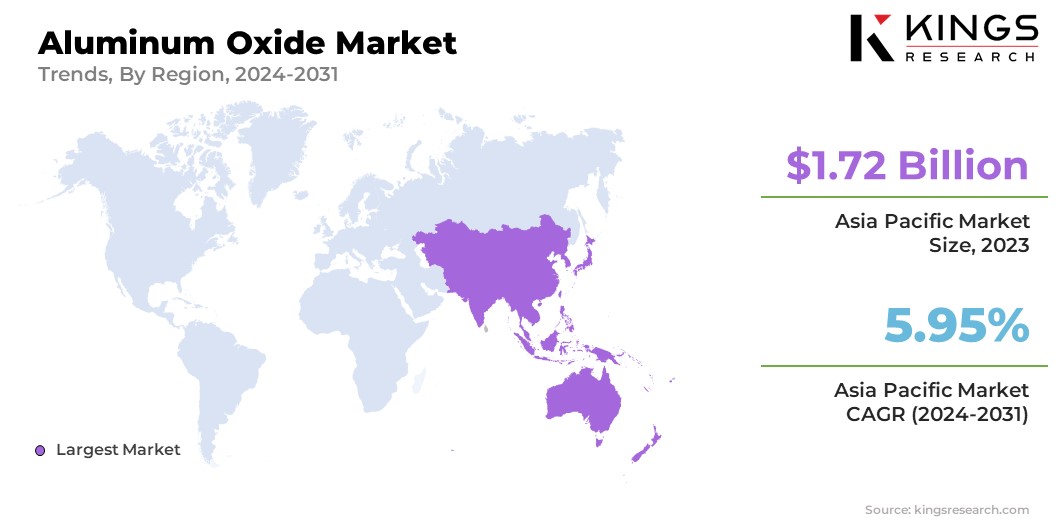

Aluminum Oxide Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia-Pacific Aluminum Oxide Market share stood around 36.06% in 2023 in the global market, with a valuation of USD 1.72 billion, due to the region's robust industrial activities. The automotive, electronics, and construction industries in these countries are expanding rapidly, leading to an increased demand for aluminum oxide.

Additionally, the presence of numerous manufacturing facilities and the availability of raw materials such as bauxite at relatively lower costs contribute to the region's position in the market. Increased iInvestments in technological advancements and the widespread adoption of sustainable practices bolster the regional market's growth. Several companies are focusing on investing in the production of aluminum oxide for battery applications.

- For instance, in February 2023, Evonik invested in the expansion of its production plant for fumed aluminum oxide at its Yokkaichi site in Japan. This facility is the company's inaugural alumina plant in Asia, dedicated to producing specialty solutions for lithium-ion battery technologies, primarily for use in electric vehicles.

Moreover, government initiatives supporting industrial growth and foreign investments play a crucial role in supporting regional market expansion. Asia-Pacific maintains its status as a prominent manufacturing hub, maintaining a substantial market share in aluminum oxide production fostered by continuous industrial growth and innovation.

Europe is poised to grow at a staggering CAGR of 5.59% in the foreseeable future. The European aluminum oxide market benefits from a strong industrial base, particularly in countries such as Germany, France, and the United Kingdom, which have well-established automotive, aerospace, and electronics sectors. The region's focus on sustainable development and green technologies is fostering demand for high-purity alumina in diverse applications such as electric vehicles and renewable energy systems, including solar panels and battery storage solutions.

Additionally, stringent environmental regulations in Europe are compelling industries to adopt advanced materials and cleaner production processes, thereby propelling the demand for aluminum oxide. The region's emphasis on research and development, coupled with significant investments in technological innovations, further contributes to domestic market growth.

Competitive Landscape

The aluminum oxide market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Aluminum Oxide Market

- Alcoa Corporation

- Rio Tinto

- Norsk Hydro ASA

- RusAL

- Aluminium Corp

- BHP

- Sumitomo Chemical Co., Ltd.

- Shandong Xinfa Aluminum Co., Ltd.

- NALCO India

- Hindalco Industries Ltd. (Aditya Birla Group)

Key Industry Developments

- May 2024 (Acquisition): Alcoa Corp announced the execution of a Deed of Amendment and Restatement to the Scheme Implementation Deed, aimed at expanding both its geographical reach andproduct portfolio.

- September 2023 (Expansion): Hindalco Industries Limited partnered with Italy-based Metra SpA to produce large-size aluminum extrusions and fabrication technology for high-speed rail coaches in India,. This collaboration supports the Indian Government's vision for advanced domestic manufacturing capabilities.

The Global Aluminum Oxide Market is Segmented as:

By Form

- Nanoparticles

- Powder

- Pellets

- Others

By End-Use

- Healthcare

- Electronics

- Automotive

- Aerospace

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)