Healthcare Medical Devices Biotechnology

Anemia Drugs Market

Anemia Drugs Market Size, Share, Growth & Industry Analysis, By Type (Sickle Cell Anemia, Plastic Anemia, Iron-deficiency Anemia), By Therapy Type (Oral Iron Therapy, Red Blood Cell Transfusion, Parental Iron Therapy), By End User (Clinic, Healthcare, Home Healthcare), and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : April 2025

Report ID: KR1745

Market Definition

The market encompasses the research, development, production, and distribution of pharmaceutical therapies for the treatment and management of anemia, a hematological disorder characterized by insufficient red blood cell or hemoglobin levels.

This market includes various drug classes, such as iron supplements, erythropoiesis-stimulating agents (ESAs), vitamin & mineral formulations, and advanced biologics designed to enhance erythropoiesis and oxygen transport.

The report presents a comprehensive analysis of the key market drivers, emerging trends, and the competitive landscape, which are expected to determine the growth dynamics throughout the forecast period.

Anemia Drugs Market Overview

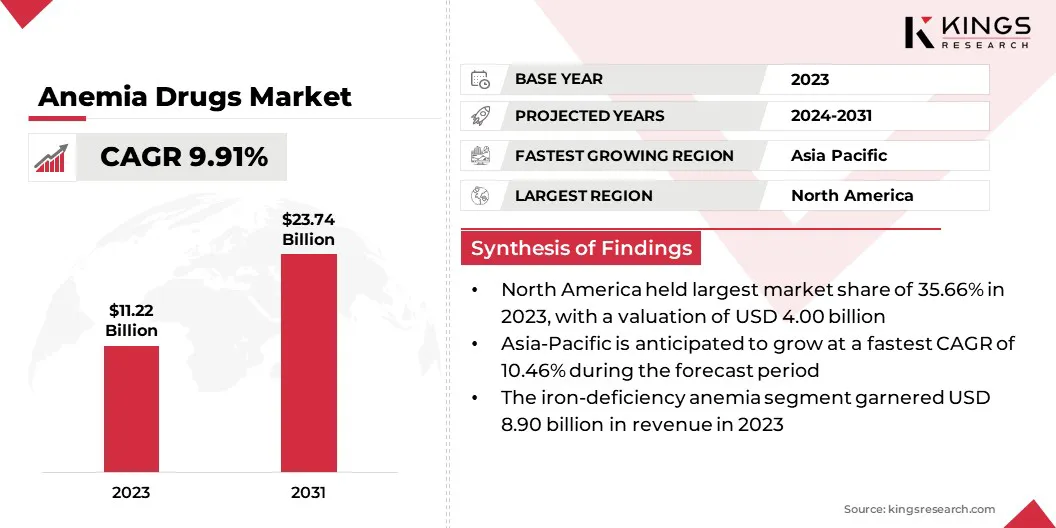

The global anemia drugs market size was valued at USD 11.22 billion in 2023 and is projected to grow from USD 12.25 billion in 2024 to USD 23.74 billion by 2031, exhibiting a CAGR of 9.91% during the forecast period.

This market is registering significant growth, due to the increasing prevalence of anemia globally, particularly among individuals with chronic diseases such as Chronic Kidney Disease (CKD), cancer, and gastrointestinal disorders.

Growing awareness of anemia management, progress in pharmaceutical formulations, and the emergence of novel biologic therapies are expected to accelerate market expansion.

Major companies operating in the anemia drugs industry are Amgen Inc., Torrent Pharmaceuticals Ltd., AbbVie Inc., Sanofi, GSK plc, Akebia Therapeutics, Cipla Limited, Lilly USA, LLC, PHARMACOSMOS A/S, bluebird bio, Inc., Biocon, Takeda Pharmaceutical Company Limited, REGEN BIOPHARMA, INC., Pieris Pharmaceuticals, Inc, and Sun Pharmaceutical Industries Ltd.

The expanding geriatric population, which is more susceptible to anemia, along with improved access to healthcare services and innovative treatment modalities, is anticipated to drive the demand for anemia drugs.

North America dominates the market with advanced healthcare infrastructure and high adoption of novel therapies, while the market in Asia-Pacific is poised for significant growth due to rising healthcare investments, increasing disposable incomes, and a growing anemia burden.

- In February 2023, the U.S. Food and Drug Administration (FDA) approved the first oral treatment for anemia caused due to CKD in adults on dialysis. This approval provides a new therapeutic option for patients, offering a more convenient alternative to injectable treatments, thereby improving anemia management in CKD patients.

Key Highlights

- The anemia drugs industry size was valued at USD 11.22 billion in 2023.

- The market is projected to grow at a CAGR of 9.91% from 2024 to 2031.

- North America held a market share of 35.66% in 2023, with a valuation of USD 4.00 billion.

- The iron-deficiency anemia segment garnered USD 8.90 billion in revenue in 2023.

- The oral iron therapy segment is expected to reach USD 11.87 billion by 2031.

- The clinic segment is anticipated to register the fastest CAGR of 10.04% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.46% during the forecast period.

Market Driver

"Increasing Global Burden of Anemia"

Anemia represents a significant global health concern, impacting millions of individuals across diverse demographic groups, with particularly high prevalence among children, pregnant women, and the elderly.

The condition is frequently linked to chronic illnesses such as CKD, cancer, and gastrointestinal disorders, as well as deficiencies in essential nutrients, including iron, vitamin B12, and folic acid.

Furthermore, the increasing prevalence of lifestyle-related disorders, such as diabetes and obesity, has exacerbated the incidence of anemia. Socioeconomic factors, food insecurity, and insufficient awareness of preventive healthcare further contribute to the condition’s widespread impact.

- According to the World Health Organization (WHO), anemia affects approximately 40% of children aged 6–59 months, 37% of pregnant women, and 30% of women aged 15–49 years. In 2019, it accounted for 50 million years of healthy life lost due to disability, with key contributing factors including dietary iron deficiency, thalassemia, sickle cell trait, and malaria.

- In September 2023, the U.S. FDA approved Ojjaara (momelotinib) by GSK as the first and only treatment for myelofibrosis patients with anemia. This approval provides a novel therapeutic option that addresses both the underlying disease and anemia symptoms, improving treatment outcomes for affected patients.

Market Challenge

"Adverse Effects of Anemia Medications"

Anemia treatments often cause significant side effects, impacting patient adherence and outcomes. Oral iron supplements, commonly used for iron-deficiency anemia, frequently cause gastrointestinal disturbances such as constipation, nausea, abdominal discomfort, and altered stool coloration, leading to poor compliance.

Intravenous iron formulations, while more effective for severe anemia, present risks of hypersensitivity reactions, hypotension, and anaphylaxis. Erythropoiesis-stimulating agents (ESAs), widely prescribed for anemia related to CKD and cancer, have been linked to increased risks of cardiovascular events, hypertension, and thromboembolism. Excessive iron supplementation can also result in iron overload and organ damage.

Advancements in drug formulations with improved bioavailability and reduced side effects are essential. Alternative delivery methods, such as controlled-release and transdermal therapies, can minimize adverse reactions. Personalized treatment plans tailored to patient-specific factors enhance efficacy while reducing risks.

Optimized dosage regimens and supportive therapies, including gastroprotective agents and dietary adjustments, improve tolerability. Regular monitoring of iron levels and cardiovascular markers helps prevent complications like iron overload.

Market Trend

"Increasing Demand for Oral and Intravenous Iron Therapies"

The rising prevalence of iron-deficiency anemia, particularly among patients with CKD, cancer, and gastrointestinal disorders, is driving the demand for oral and intravenous (IV) iron therapies.

Oral iron remains the first-line treatment; however, issues like poor absorption and gastrointestinal side effects have spurred the development of improved formulations. IV iron provides rapid replenishment with minimal gastrointestinal side effects for patients with severe anemia or those unable to tolerate oral therapy.

Advanced formulations like ferric carboxymaltose and iron isomaltoside enable high-dose administration while reducing infusion-related reactions, enhancing treatment effectiveness.

The increasing recognition of IV iron’s effectiveness in rapidly correcting hemoglobin levels, particularly in hospital and outpatient settings, coupled with improved accessibility in emerging markets, is accelerating the market growth.

- In March 2024, Cadila Pharmaceuticals introduced Redshot FCM, an innovative intravenous iron injection designed to treat iron deficiency anemia in adults and pediatric patients aged over one, particularly those intolerant to oral iron. This development underscores Cadila Pharmaceuticals' commitment to enhancing anemia treatment by offering a rapid and efficient method to replenish iron stores and improve hemoglobin levels.

Anemia Drugs Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Sickle Cell Anemia, Plastic Anemia, Iron-deficiency Anemia |

|

By Therapy Type |

Oral Iron Therapy, Red Blood Cell Transfusion, Parental Iron Therapy |

|

By End User |

Clinic, Healthcare, Home Healthcare |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Sickle Cell Anemia, Plastic Anemia, Iron-deficiency Anemia): The iron-deficiency anemia segment earned USD 8.90 billion in 2023, due to its high prevalence, increasing diagnosis rates, and growing demand for effective treatment options.

- By Therapy Type (Oral Iron Therapy, Red Blood Cell Transfusion, Parental Iron Therapy): The oral iron therapy segment held 49.74% share of the market in 2023, due to its cost-effectiveness, ease of administration, widespread availability, and preference as the first-line treatment for iron-deficiency anemia.

- By End User (Clinic, Healthcare, Home Healthcare): The clinic segment is projected to reach USD 13.13 billion by 2031, owing to the increasing number of outpatient visits, growing preference for non-hospital treatments, and improved accessibility to specialized anemia care.

Anemia Drugs Market Regional Analysis

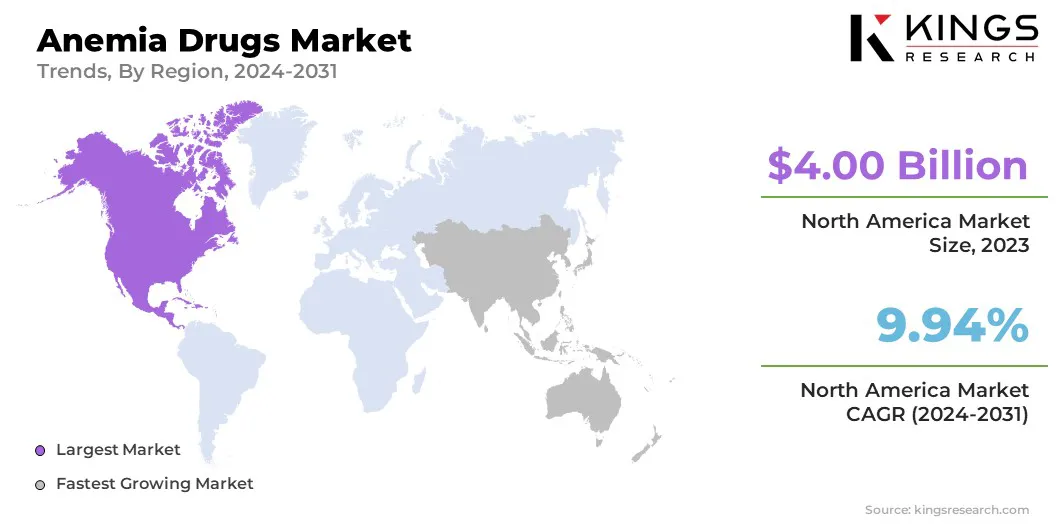

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America anemia drugs market share stood at around 35.66% in 2023, with a valuation of USD 4.00 billion. High growth of the market in North America is a result of the well-established healthcare infrastructure, high adoption of advanced anemia treatments, and strong presence of leading pharmaceutical companies in the region.

Additionally, supportive reimbursement policies, heightened awareness of anemia management, and the increasing incidence of chronic conditions such as CKD and cancer further drive growth.

Ongoing research and development, coupled with regulatory approvals for innovative therapies, reinforce North America’s leading position in the market.

- In August 2023, the U.S. FDA approved Reblozyl (luspatercept-aamt) by Bristol Myers Squibb as the first-line treatment for anemia in adults with lower-risk myelodysplastic syndromes (MDS) requiring transfusions. This approval represents a major advancement in anemia management, significantly reducing patients' dependence on red blood cell transfusions.

The anemia drugs industry in Asia-Pacific is poised for significant growth at a robust CAGR of 10.46% over the forecast period. This region's rapid growth is fueled by increasing healthcare investments, improved access to medical services, and a rising prevalence of anemia, particularly in developing economies.

The growing geriatric population, higher incidence of nutritional deficiencies, and improving diagnostic capabilities in the region further fuel the market. Government initiatives to combat anemia, entry of global pharmaceutical companies, and the rising demand for cost-effective treatment solutions further support the strong growth trajectory of the market.

- In September 2024, the Press Information Bureau (PIB) of India reported that a study published in the Indian Journal of Traditional Knowledge found that a combination of Siddha medicines— Mātuḷai maṇappāku, Aṉṉapēti centūram, Bāvaṉa kaṭukkāy, Mātuḷai maṇappāku, and Nellikkāy lēkiyam (ABMN)—effectively reduces anemia in adolescent girls. The study observed 2,648 participants, with 2,300 completing a 45-day treatment regimen, resulting in significant improvements in hemoglobin levels and reductions in anemia symptoms.

Regulatory Frameworks

- In the U.S., the National Center for Biotechnology Information (NCBI) study (PMC, 2016) examines the pathophysiology, diagnosis, and treatment of anemia, offering valuable insights into its underlying mechanisms and emerging therapeutic strategies to improve patient outcomes.

- In the EU, Regulation (EC) No. 726/2004 establishes the framework for the authorization and supervision of medicinal products, including anemia drugs, by creating the European Medicines Agency (EMA) to ensure their safety, efficacy, and quality.

- In India, the Drugs and Cosmetics Act, 1940, regulated by the Central Drugs Standard Control Organization (CDSCO), oversees the approval, manufacture, and distribution of pharmaceutical products, including anemia drugs, to ensure their safety, efficacy, and quality.

Competitive Landscape

The anemia drugs industry is characterized by the presence of several leading pharmaceutical companies actively engaged in the research, development, and commercialization of innovative therapies. Market players are focusing on strategic collaborations, partnerships and acquisitions to strengthen their market position and expand their product portfolios.

Increasing investments in biologics, biosimilars, and advanced drug formulations are driving competition, with companies striving to enhance treatment efficacy and reduce side effects.

Moreover, the approval of novel therapies, along with an increasing number of patent expirations, is shaping market dynamics and facilitating the entry of generic drug manufacturers.

- In March 2024, Akebia Therapeutics received U.S. FDA approval for Vafseo (vadadustat) tablets to treat anemia caused by CKD in adults on dialysis. This approval introduces a new oral treatment option, providing an alternative to traditional injectable erythropoiesis-stimulating agents (ESAs) for CKD-related anemia management.

List of Key Companies in Anemia Drugs Market:

- Amgen Inc.

- Torrent Pharmaceuticals Ltd.

- AbbVie Inc.

- Sanofi

- GSK plc

- Akebia Therapeutics

- Cipla Limited

- Lilly USA, LLC

- PHARMACOSMOS A/S

- bluebird bio, Inc.

- Biocon

- Takeda Pharmaceutical Company Limited

- REGEN BIOPHARMA, INC.

- Pieris Pharmaceuticals, Inc

- Sun Pharmaceutical Industries Ltd.

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In February 2024, Johnson & Johnson announced that the U.S. FDA granted Breakthrough Therapy Designation for nipocalimab to treat high-risk hemolytic disease of the fetus and newborn (HDFN), a rare condition that can cause severe anemia in fetuses and newborns.

- In April 2024, Rocket Pharmaceuticals, Inc. announced that the European Medicines Agency (EMA) granted Priority Medicines (PRIME) designation for its investigational gene therapy for Pyruvate Kinase Deficiency (PKD)-related anemia. This designation supports the accelerated development of the therapy, aiming to address the unmet medical needs of patients with severe anemia caused by PKD.

- In November 2023, Agios Pharmaceuticals, Inc. announced positive clinical proof-of-concept results from its Phase 2a trial of AG-946, an investigational therapy for anemia. The trial demonstrated promising safety and efficacy outcomes, supporting further development of AG-946 as a potential treatment for patients with anemia-related disorders.

- In February 2023, GSK received U.S. FDA approval for Jesduvroq (daprodustat) to treat anemia caused by CKD in adults on dialysis. This approval introduces a new oral hypoxia-inducible factor prolyl hydroxylase inhibitor (HIF-PHI), providing an alternative to injectable treatments for CKD-related anemia.

- In February 2023, Astellas Pharma DMCC introduced a novel oral treatment in Egypt for adults with anemia associated with CKD. This therapy activates the body's natural response to reduced oxygen levels, enhancing iron absorption and red blood cell production.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)