Consumer Goods

Animation Toys Market

Animation Toys Market Size, Share, Growth & Industry Analysis, By Type (Anime Dolls, Anime Gacha, Anime Figure, Cartoon Plush Toys, Others), By Age Group, By Category (Recreational Toys, Learning Toys), By Sales Channel and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2025

Report ID: KR453

Market Definition

Animation toys refer to toys that are inspired by animated characters, films, television series, or digital media. These toys are designed to replicate popular animated figures, scenes, or storylines, often incorporating interactive features such as voice activation, motion sensors, or Augmented Reality (AR) to enhance engagement.

They include action figures, plush toys, collectible figurines, playsets, and smart toys that align with animated franchises. The animation toys industry is driven by consumer demand for merchandise linked to popular animation content, strategic licensing agreements, and technological advancements that enhance play experiences.

Animation Toys Market Overview

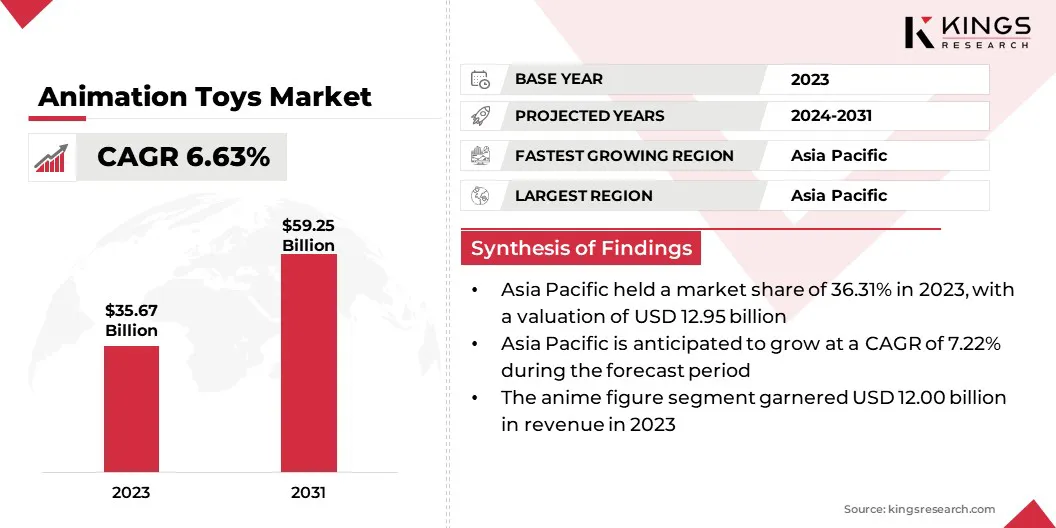

The global animation toys market size was valued at USD 35.67 billion in 2023, which is estimated to be valued at USD 37.79 billion in 2024 and reach USD 59.25 billion by 2031, growing at a CAGR of 6.63% from 2024 to 2031.

The market is driven by increasing collaborations between toy manufacturers and entertainment franchises, enhancing brand visibility and consumer engagement. Additionally, the integration of technology, such as AR and Artificial Intelligence (AI), is transforming traditional toys into interactive experiences, attracting tech-savvy consumers.

Companies are also adopting sustainable manufacturing practices, responding to rising consumer demand for eco-friendly products and aligning with global environmental regulations.

Major companies operating in the animation toys industry are Stopmotion Explosion, ZuLogic Ltd, TinToyArcade.com LLC, Brainstorm Ltd, Animation Toolkit LTD, TOEI ANIMATION Co., Ltd., Roblox Corporation, GOOD SMILE COMPANY, Bandai Namco, JAKKS Pacific, Inc., ALTER, Crunchyroll LLC, JianChuang., Funko, and CustomPlushMaker.

The widespread influence of social media and viral pop culture trends is reshaping consumer preferences in the market. Platforms such as YouTube, Instagram, and TikTok have become essential marketing channels, where toy unboxings, influencer endorsements, and animated content drive purchasing decisions.

Fan communities and online discussions create strong brand loyalty, fueling demand for limited-edition toys and collectibles. Manufacturers are leveraging social media trends to introduce exclusive releases and collaborations that resonate with consumers. The ability to rapidly adapt to digital trends is providing toy companies with new opportunities to capitalize on emerging market preferences.

- In June 2024, Moose Toys introduced its latest product line, MrBeast Lab, developed in collaboration with MrBeast, also known as Jimmy Donaldson—the world's most-subscribed YouTuber and a well-known philanthropist. The MrBeast Lab collection includes small-scale collectibles, action figures, vinyl figures, and collector’s editions. Enhancing its appeal, the product line features varying levels of rarity across different items and is available in display-ready packaging, adding to its collectability.

Key Highlights:

Key Highlights:

- The animation toys industry size was valued at USD 35.67 billion in 2023.

- The market is projected to grow at a CAGR of 6.63% from 2024 to 2031.

- Asia Pacific held a market share of 36.31% in 2023, with a valuation of USD 12.95 billion.

- The anime figure segment garnered USD 12.00 billion in revenue in 2023.

- The 2-8 years segment is expected to reach USD 22.01 billion by 2031.

- The recreational toys segment held 57.55% share of the market in 2023.

- The online retailers segment is poised for a robust CAGR of 7.69% through the forecast period

- The market in North America is anticipated to grow at a CAGR of 6.38% during the forecast period.

Market Driver

"Rising Popularity of Educational and STEM-based Animation Toys Boosting Market"

Increasing demand for toys that promote cognitive development & learning is driving the adoption of educational animation toys, which is boosting the animation toys market. Parents and educators are prioritizing products that incorporate science, technology, engineering, and mathematics (STEM) concepts, reinforcing the importance of skill-building through play.

Animation toys that integrate storytelling with interactive learning experiences are gaining traction among consumers seeking developmental benefits. Manufacturers are focusing on innovative product designs that enhance problem-solving skills and creativity, appealing to both children and educational institutions. The growing emphasis on educational entertainment is fostering a strong market for animation toys with learning-based functionalities.

- In October 2024, Wondery announced the retail debut of a groundbreaking toy and consumer product line inspired by the science podcast Wow in the World, designed for both kids and their parents. The Wondery Kids & Wow in the World collection introduced innovative and enriching products that reinvent classic toys and play patterns for today's generation. By enhancing the play experience, this new lineup offers children and their parents an exciting and interactive way to engage with learning and creativity.

Market Challenge

"Intellectual Property (IP) Infringement and Counterfeit Products Poses Challenge"

The widespread availability of counterfeit animation toys presents a significant challenge to the animation toys market, undermining brand value and reducing revenue for legitimate manufacturers. Unauthorized replicas flood online marketplaces, often sold at lower prices, leading to concerns over product quality and safety.

Companies are implementing advanced anti-counterfeiting measures, such as blockchain-based authentication, holographic labeling, and RFID tracking. Additionally, firms are strengthening collaborations with e-commerce platforms and law enforcement agencies to remove counterfeit listings. Investing in direct-to-consumer (DTC) sales channels and exclusive licensing agreements further helps safeguard brand integrity and maintain consumer trust.

Market Trend

"Strategic Licensing and Brand Collaborations Augments Market Expansion"

The integration of advanced animation techniques with toy manufacturing is accelerating the growth of the animation toys market. The incorporation of AI, AR, and motion-sensing technology has enhanced the interactivity of toys, creating an immersive play experience.

These innovations have led to the development of smart toys that respond to voice commands, gestures, and real-time interactions, increasing their appeal among tech-savvy consumers.

Manufacturers are investing in Research and Development (R&D) to introduce high-tech features, strengthening their competitive edge. The demand for interactive and intelligent toys is increasing, reinforcing the global market.

- In October 2024, Moose Toys signed an entertainment development agreement with Man of Action Entertainment (MOA), a renowned creative studio and writing collective. Under this partnership, MOA will create an animated series based on Moose Toys' original brand, Heroes of Goo Jit Zu. This collaboration underscores Moose Toys’ commitment to expanding its story-driven brands across multiple entertainment platforms and transforming its strategic intellectual property into full-fledged franchises.

Animation Toys Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Anime Dolls, Anime Gacha, Anime Figure, Cartoon Plush Toys, Others |

|

By Age Group |

0-2 Years, 2-8 Years, 8-14 Years, 14 Years and Above |

|

By Category |

Recreational Toys, Learning Toys |

|

By Sales Channel |

Toy Stores, Departmental Stores, Online Retailers, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Anime Dolls, Anime Gacha, Anime Figure, Cartoon Plush Toys, and Others): The anime figure segment earned USD 12.00 billion in 2023, due to strong consumer demand for high-quality collectible figures, and increasing e-commerce platforms that enhance accessibility for collectors.

- By Age Group (0-2 Years, 2-8 Years, 8-14 Years, and 14 Years and Above): The 2-8 Years segment held 37.12% share of the market in 2023, due to strong consumer demand for character-based toys and interactive figures, driven by high engagement with animated content and increasing parental spending on developmental toys.

- By Category (Recreational Toys, Learning Toys): The recreational toys segment is projected to reach USD 33.00 billion by 2031, owing to its strong consumer appeal, driven by interactive play experiences, integration with popular entertainment franchises, and increasing demand for technologically enhanced toys that offer immersive engagement.

- By Sales Channel (Toy Stores, Departmental Stores, Online Retailers, Others): The online retailers segment is poised for significant growth at a CAGR of 7.69% through the forecast period, due to the increasing consumer preference for convenient shopping, wider product availability, and exclusive digital launches, enabling brands to reach global audiences.

Animation Toys Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

.webp) Asia Pacific accounted for around 36.31% share of the animation toys market in 2023, with a valuation of USD 12.95 billion. Asia Pacific is registering significant growth in e-commerce, with online marketplaces becoming the preferred shopping destination for animation toys.

Asia Pacific accounted for around 36.31% share of the animation toys market in 2023, with a valuation of USD 12.95 billion. Asia Pacific is registering significant growth in e-commerce, with online marketplaces becoming the preferred shopping destination for animation toys.

The widespread adoption of digital payment solutions and mobile commerce is driving sales, making toys more accessible to consumers across urban and rural areas. Leading e-commerce platforms, such as Alibaba, JD.com, Flipkart, and Shopee, are partnering with toy brands to offer exclusive online collections and promotions.

Social commerce, driven by platforms like TikTok, WeChat, and Instagram, is further enhancing visibility and consumer engagement. The digital retail boom is creating growth avenues for animation toy manufacturers.

Furthermore, the deep-rooted popularity of anime and manga in Asia Pacific is significantly boosting the market. Japan remains a global leader in anime production, with franchises like Pokémon, Dragon Ball, and One Piece driving toy sales. The influence of Japanese anime extends across the region, with a strong fan base in China, South Korea, India, and Southeast Asia.

The growing demand for anime-inspired action figures, collectibles, and role-playing toys is generating several market opportunities. Manufacturers are capitalizing on the global appeal of anime by introducing high-quality, intricately designed products catering to both children and adult collectors.

The animation toys industry in North America is poised for significant growth at a robust CAGR of 6.38% over the forecast period. North America is home to some of the most influential animation studios, including Disney, Pixar, DreamWorks, and Warner Bros., which continuously produce blockbuster animated films and television series.

The widespread popularity of these franchises is driving the demand for licensed animation toys, as children and collectors seek merchandise based on beloved characters.

Streaming platforms such as Disney+, Netflix, and HBO Max are further increasing the visibility of animated content, sustaining interest in character-based toys. The success of superhero and fantasy-themed animations is also strengthening toy sales, positioning North America as a key market for animation merchandise.

Additionally, the demand for collectible animation toys is gaining momentum in North America, driven by adult collectors and nostalgia-driven consumers. Limited-edition action figures, high-end statues, and vintage toy re-releases linked to classic animated franchises are registering strong sales.

- For instance, events such as San Diego Comic-Con and New York Toy Fair play a crucial role in showcasing exclusive collectible toys, creating hype among enthusiasts.

Manufacturers are capitalizing on this trend by introducing premium-quality figures with intricate detailing, targeting dedicated fans of iconic franchises like Star Wars, Transformers, and Teenage Mutant Ninja Turtles.

Regulatory Frameworks:

- In the U.S., the Consumer Product Safety Improvement Act (CPSIA) of 2008 mandates that toys comply with the ASTM F963 Toy Safety Standard. The Consumer Product Safety Commission (CPSC) enforces these regulations, which set limits on lead, phthalates, and other hazardous substances, and establish standards for mechanical and physical properties.

- In Europe, the Toy Safety Directive (2009/48/EC) establishes comprehensive safety criteria for toys sold within the EU. Compliance with this directive is indicated by the CE mark, signifying adherence to standards such as EN 71, which addresses mechanical, physical, and chemical properties of toys.

- In China, the China Compulsory Certification (CCC) system mandates that toys meet specific safety standards before they can be manufactured, sold, or imported. Since June 2007, all toy products without CCC certification have been prohibited from entering the market.

- The Japan Toy Association administers the ST Mark Safety Toy Program, which certifies toys that comply with national safety standards, including tests for flammability, mechanical safety, and chemical composition.

- In India, the Bureau of Indian Standards (BIS) sets safety standards for toys under IS 9873, covering aspects such as mechanical and physical properties, flammability, and migration of certain elements. Compliance with these standards is mandatory for all toys sold in India.

- In South Korea, the Korea Toy Industry Association oversees toy safety regulations, ensuring compliance with standards that address mechanical, chemical, and electrical safety. Toys must undergo testing and certification before entering the South Korean market.

Competitive Landscape:

The global animation toys market is characterized by several participants, including established corporations and rising organizations. Market players are increasingly adopting vertical integration strategies by aligning content creation with toy manufacturing to strengthen brand engagement and drive revenue growth in the market.

By developing toys based on their intellectual properties (IP) and managing production in-house, companies gain better control over product design, distribution, and market positioning. This approach enhances storytelling continuity, ensuring that toys accurately reflect the characters and narratives that resonate with audiences.

- In January 2025, Epic Story Media launched its toy division, Epic Story Toys (EST), to expand its reach in the toy industry. EST is developing toy lines for both its proprietary and third-party properties, including the preschool series Vegesaurs, for which it has secured the Global Master Toy partner designation. Additionally, it is creating merchandise for Slugterra and its original IP, Bubble’s Hotel.

List of Key Companies in Animation Toys Market:

- Stopmotion Explosion

- ZuLogic Ltd

- TinToyArcade.com LLC

- Brainstorm Ltd

- Animation Toolkit LTD

- TOEI ANIMATION Co., Ltd.

- Roblox Corporation

- GOOD SMILE COMPANY

- Bandai Namco

- JAKKS Pacific, Inc.

- ALTER

- Crunchyroll LLC

- JianChuang.

- Funko

- CustomPlushMaker

Recent Developments (Partnerships /New Product Launch)

- In January 2025, Brainstorm is set to unveil a range of products and will exclusively introduce one of its exciting distribution lines at the London Toy Fair. The Halftoys collection, featuring a minimalist design, is expected to captivate interest with its distinctive play value. This charming assortment of animal figures offers an open-ended play experience, engaging multiple senses and fostering creativity.

- In February 2024, KessCo revealed its licensing partnership with renowned anime studio Toei Animation for the popular franchises One Piece and Digimon. Through this collaboration, the company plans to launch two upcoming tabletop games along with a range of outdoor spring/summer toys, all set for release between 2024 and 2025.

- In August 2024, Good Smile Company introduced the "Huggy Good Smile" series, featuring new Evangelion figures and collectibles that also function as magnets. Inspired by the franchise's latest films, the collection offers various options, including two distinct versions of Asuka and Rei.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership