Advanced Materials and Chemicals

Anisotropic Conductive Film Market

Anisotropic Conductive Film Market Size, Share, Growth & Industry Analysis, By Product (Epoxy-Based, Acrylic-Based), By Technology (Displays, Electronic components, Automotive, Aerospace, Others), By End-Use (Chip-on-glass (COG), Chip-on-board (COB), Flex-on-glass (FOG), Flex-on-board (FOB), Others) and Regional Analysis, 2023-2030

Pages : 120

Base Year : 2022

Release : September 2023

Report ID: KR138

Anisotropic Conductive Film Market Size

The global Anisotropic Conductive Film Market size was valued at USD 2.65 billion in 2022 and is projected to reach USD 4.15 billion by 2030, growing at a CAGR of 5.88% from 2023 to 2030. In the scope of work, the report includes products offered by companies such as 3M, SunRay Scientific, PVA TePla America, DELO Industrial Adhesives LLC, Pixel Interconnect, Dexerials Corporation, Henkel AG & Co. KGaA, Showa Denko Materials Co., Ltd., BTECHCORP and Others.

The technological advancement in anisotropic conductive film technology is likely to propel the market growth. For instance, work is underway to develop self-healable and recyclable ACFs using novel materials such as liquid crystal elastomers. This approach could offer significant benefits to the environment by reducing the amount of electronic waste generated.

Additionally, research is being conducted to optimize the properties of ACF, including exploring new materials for the conductive particles and finding ways to increase the electrical conductivity of the particles, among other endeavors. With these developments, ACF technology will likely remain an important aspect of modern electronics for years to come.

Analyst’s Review

One major trend in the anisotropic conductive film market is the increasing requirement for high-speed and high-frequency interconnects as electronic devices become more sophisticated. ACF manufacturers are responding to this demand by developing new conductive materials and methods to improve the performance of their products.

Additionally, ACF manufacturers are exploring new applications for their products. While ACF technology has been primarily used in LCD displays and other flat panel displays, it is being increasingly used in varied areas, such as automotive electronics, medical devices, and wearables. As these new markets continue to grow, ACF manufacturers are likely to continue innovating and developing new products to meet the unique challenges and requirements of each application.

Market Definition

Anisotropic conductive film (ACF) is an adhesive interconnect system that is commonly used in liquid crystal displays and other electronic devices. It consists of a resin adhesive and fine conductive particles, such as metal-coated polymer spheres or metal-coated glass beads, that allow for electrical conduction in the thickness direction. ACF is commonly used to connect driver ICs to flat panel displays, as well as in other applications where a reliable, low-cost method of electrical interconnection is needed. Research is also being conducted on developing self-healable and recyclable ACFs using liquid crystal elastomers and other innovative materials.

The ACF technology relies on conductive particles within a resin adhesive that permits electrical conduction in the thickness direction. These particles may consist of metal-coated polymer spheres or metal-coated glass beads, and their size and shape can impact the electrical conductivity of the ACF.

One of the major applications of ACF is in connecting driver-integrated circuits (ICs) to flat panel displays. This method of interconnection is cost-effective and provides reliable electrical contact, helping to ensure stable and accurate display performance. ACF is also used in other electronic devices that require low-cost, reliable interconnects. With the ongoing advancements in electronic technology and the continued demand for smaller, lighter, and more sophisticated devices, the use of ACF is likely to become more prevalent.

Market Dynamics

The anisotropic conductive film market is experiencing notable growth due to the increasing demand for LCD applications across various industries. This technology offers a reliable and cost-effective solution for interconnecting components, which is essential for ensuring stable and accurate performance in advanced electronic devices. For instance, ACF bonding technology is being extensively utilized in the automotive industry to improve the safety and performance of LCD displays in cars.

Additionally, ACF is increasingly being used in medical devices, wearable devices, and other electronics applications, where it is used to interconnect displays, sensors, and batteries. As more industries continue to adopt LCD displays and electronic devices become more sophisticated, the demand for ACF is expected to grow, creating new opportunities for businesses operating in this sector.

The availability of cost-effective alternatives, such as silver nanowires or silver paste, is likely to hamper market growth. Additionally, the production cost of anisotropic conductive film (ACF) is a significant consideration for businesses looking to adopt this technology. Due to the complexity of the manufacturing process, ACF can have a higher cost of production than some alternative materials, which may impact the overall competitiveness of the anisotropic conductive film market.

Segmentation Analysis

The global market is segmented based on product, application, end-use, and geography.

By Product

Based on product, the anisotropic conductive film market is bifurcated into epoxy-based and acrylic-based. The epoxy-based segment held the largest market share of 55.5% in 2022. Epoxy-based anisotropic conductive film (ACF) is a commonly used adhesive interconnect system in industries such as liquid crystal displays. Businesses that are considering using ACF in their operations should carefully evaluate the cost and potential benefits of this technology, relative to other available materials.

By Technology

Based on technology, the market is categorized into Chip-On-Glass (COG), Chip-on-board (COB), Flex-on-glass (FOG), Flex-on-board (FOB), Chip-on-flex (COF) and Flex-on-flex (FOF). The chip-on-glass segment accumulated the largest anisotropic conductive film market share of 34.36% in 2022 owing to the rising demand for anisotropic conductive film (ACF) in chip-on-glass (COG) packaging technologies. COG connects the liquid crystal display panel directly to the glass substrate, and ACF is a reliable and effective means of interconnecting components in this technology.

By End-Use

Based on end-use, the market is bifurcated into displays, electronic components, automotive, aerospace, and others. The displays segment held the largest market share of 66.4% in 2022. The increasing prevalence of displays in wearable technology could lead to a rise in the demand for anisotropic conductive film (ACF), which is commonly used as an adhesive interconnect system in industries such as liquid crystal displays.

Anisotropic Conductive Film Market Regional Analysis

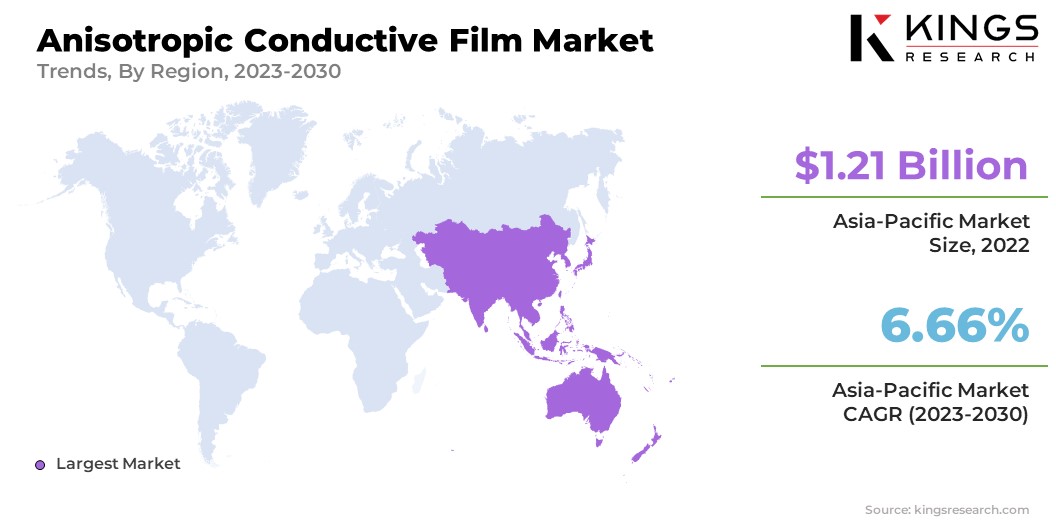

For regional analysis, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia-Pacific Anisotropic Conductive Film Market share stood around 45.66% in 2022 in the global market, with a valuation of USD 1.21 billion, due to expanding manufacturing industries, particularly electronics and consumer goods, which require the use of ACF as an adhesive interconnect system. Additionally, the growing demand for advanced display technologies, such as those found in wearable devices, may also be a contributing factor to the mounting popularity of ACF in the region.

Competitive Landscape

The anisotropic conductive film market report will provide valuable insight with an emphasis on the fragmented nature of the global market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their respective market shares across different regions. Expansion & investments are the major strategic initiatives. Industry players are investing in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Anisotropic Conductive Film Market

- 3M

- SunRay Scientific

- PVA TePla America

- DELO Industrial Adhesives LLC

- Pixel Interconnect

- Dexerials Corporation

- Henkel AG & Co. KGaA

- Showa Denko Materials Co., Ltd.

- BTECHCORP

Key Industry Developments

- February 2022 (Launch): DELO debuted the DELO PHOTOBOND UV acrylates for optoelectronics. These acrylates allow for quick and precise bonding of holographic films supplied by Covestro, one of the top suppliers of films used in various holographic applications. With this innovative product, DELO is paving the way for faster and more efficient production processes in the optoelectronics industry.

- December 2021 (Launch): Dexerials Corporation launched its pre-cut anisotropic conductive film product. With a unique ability to be efficiently mounted even in non-linear pad layouts, this product is ideal for use in connecting camera modules and sensor modules that don't have linearly arranged pads.

The Global Anisotropic Conductive Film Market is Segmented as:

By Product

- Epoxy-based

- Acrylic-based

By Technology

- Chip-on-glass (COG)

- Chip-on-board (COB)

- Flex-on-glass (FOG)

- Flex-on-board (FOB)

- Chip-on-flex (COF)

- Flex-on-flex (FOF)

By End-Use

- Displays

- Electronic components

- Automotive

- Aerospace

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)