ICT-IOT

Application Management Service Market

Application Management Service Market Size, Share, Growth & Industry Analysis, By Service Type (Application Development and Maintenance, Application Support, Application Hosting, Application Integration, Application Testing), By Deployment Type (On-Premises, Cloud), By End-User, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1102

Application Management Service Market Size

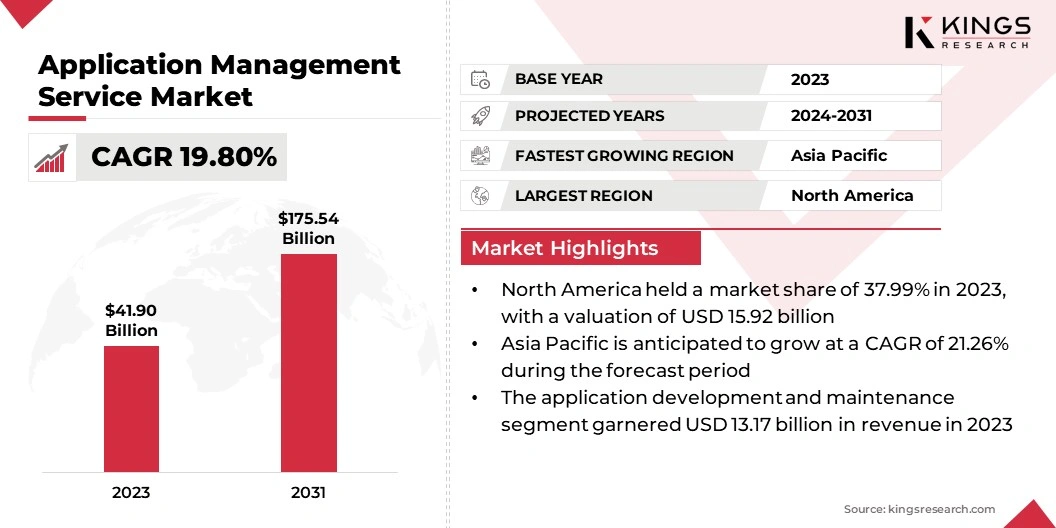

The global Application Management Service Market size was valued at USD 41.90 billion in 2023 and is projected to grow from USD 49.57 billion in 2024 to USD 175.54 billion by 2031, exhibiting a CAGR of 19.80% during the forecast period. The globalization of business operations and the expansion into emerging markets are fueling the expansion of the market.

Companies operating in multiple geographic regions require consistent, high-quality application management to ensure their operations remain synchronized and optimized across borders. Application management service providers offer global support with localized expertise to address region-specific compliance, languages, and market requirements.

In the scope of work, the report includes services offered by companies such as IBM Corporation, Infosys Limited, TATA Consultancy Services Limited, Wipro, Capgemini, Cognizant, Accenture, HCL Technologies Limited, FUJITSU AMERICA, INC, Atos SE, and others.

Moreover, the shift toward cloud computing is aiding the growth of the application management service market. Organizations are transitioning from traditional on-premise applications to cloud-based infrastructures for scalable, flexible, and cost efficiency. AMS providers deliver cloud-specific services, ensuring smooth integration, deployment, and ongoing management of cloud applications.

- In September 2024, IBM expanded its management services and solutions to help clients maximize the value of Oracle's cloud applications and technology. This initiative aims to enhance generative AI through an open and orchestrated approach.

Application management services (AMS) refer to a comprehensive suite of services designed to manage, monitor, and optimize software applications throughout their lifecycle. These services encompass application deployment, performance monitoring, maintenance, updates, and support.

By leveraging AMS, organizations can enhance application performance, ensure seamless integration with existing systems, and achieve greater operational efficiency. These services are tailored to meet specific business needs, whether utilizing on-premises solutions or cloud-based models.

AMS drives digital transformation by fostering innovation and adaptability, enabling businesses to stay aligned with technological advancements, reduce downtime, and improve overall user experience.

Analyst’s Review

Leading technology providers and AMS firms are increasingly forming alliances to deliver integrated solutions that address complex business needs. By partnering with cloud providers, software vendors, and industry-specific specialists, AMS providers are offering more comprehensive services, improve innovation, and expand their reach.

These collaborations are enabling businesses to access a wider range of expertise, including cloud integration and cybersecurity, ensuring the seamless management of applications. Such partnerships propel application management service market growth by enhancing service offerings and promoting cross-industry adoption.

- In September 2023, IT giant Infosys Ltd. expanded its strategic collaboration with Posti, a leading logistics provider in Finland, Sweden, and the Baltics. This partnership aims to improve Posti's customer experience and operational efficiency through an AI-first approach, utilizing Infosys' Topaz platform.

Moreover, collaborations with AI and automation solution providers allow AMS firms to integrate advanced tools such as machine learning algorithms and predictive analytics into their service offerings, enhancing operational efficiency for clients.

Partnerships enhance service scalability and customer-centricity by providing companies with flexible, customized services tailored to specific business requirements. This approach leads to faster, more reliable, and innovative application management solutions critical for maintaining competitiveness in the digital economy.

Application Management Service Market Growth Factors

Rising cybersecurity concerns and stringent regulatory requirements are contributing to the development of the application management market. The rising incidence of cyber threats and data breaches requires that businesses implement robust security measures to protect their applications and sensitive information.

Additionally, industries such as finance, healthcare, and retail face increasing compliance pressures to meet government regulations and industry standards. AMS providers offer specialized services that maintain application security, compliance, and regularly updates with security patches.

- A 2024 study by the National University reveals a 75% increase in cloud environment intrusions in 2023. More than 72% of businesses globally were impacted by ransomware attacks that year. Additionally, 82% of data breaches involved cloud-based data, with ransomware identified as the primary threat. Furthermore, 52% of organizations experienced ransomware attacks that significantly impacted their business systems and operations.

Moreover, the need for 24/7 application monitoring and support is fueling the expansion of the application management service market. Modern businesses, particularly those operating in global markets or providing customer-facing services, require continuous availability and performance optimization of their applications.

AMS providers deliver continuous monitoring, proactive issue detection, and real-time troubleshooting to maintain operational continuity, miniize downtime, enhances user experience, and safeguards revenue streams.

However, the substantial initial investment present a major challenge to the development of the market, particularly for small and medium-sized enterprises (SMEs). These costs, including service fees and necessary infrastructure upgrades, may deter potential adopters and hinder market expansion.

To mitigate this challenge and sustain market growth, businesses are offering flexible pricing models, such as pay-as-you-go or subscription-based services, which lower upfront costs for SMEs. Additionally, providers are increasingly bundling services to deliver comprehensive solutions at competitive rates, making them more attractive to smaller organizations.

By adopting these approaches, organizations are anticipated to mitigate initial expenditures concerns while still benefiting from advanced application management solutions.

Application Management Service Industry Trends

The expansion of mobile and remote workforces has significantly impacted the market. As more organizations adopt remote working models and equip employees with mobile applications, there is an increased need for specialized application management services.

AMS providers optimize mobile applications for performance, security, and accessibility across diverse devices and locations. This enables businesses to support a geographically dispersed workforce without compromising on application quality.

- For instance, NVIDIA, a leader in the AI revolution, has adopted a flexible work arrangements as a crucial strategy for attracting and retaining top talent.

Moreover, the need for customization and integration of enterprise applications augments the growth of the application management service market. Organizations require tailored solutions to meet specific business needs and enhance operational workflows.

AMS providers offer application customization services that tailor software to meet unique organizational requirements, improving functionality and user experience. Additionally, as businesses implement new software, integrating it with existing systems is essential. AMS services facilitate seamless integration across diverse platforms, thereby reducing complexity and improving operational efficiency.

Segmentation Analysis

The global market has been segmented based on service type, deployment type, end-user, and geography.

By Service Type

Based on service type, the market has been segmented into application development and maintenance, application support, application hosting, application integration, and application testing. The application development and maintenance segment led the application management service market in 2023, reaching a valuation of USD 13.17 billion.

This growth is attributed to the increasing need for businesses to build and sustain customized, scalable applications that improve competitive advantage.

Organizations are prioritizing rapid development cycles and continuous updates to adapt to evolving market conditions and customer expectations. Maintenance plays a critical role in ensuring application performance, security, and regulatory compliance, thereby reducing operational risks.

As application ecosystems become more complex, companies are increasingly outsourcing these functions to AMS providers to reduce costs and focus on core competencies.

By Deployment Type

Based on deployment type, the market has been bifurcated into on-premises and cloud. The cloud segment secured the largest revenue share of 67.31% in 2023. Businesses increasingly opt for cloud-based AMS to reduce infrastructure costs and improve operational agility.

Cloud deployment offers seamless updates, automated maintenance, and real-time monitoring, allowing companies to manage complex applications without requiring extensive IT resources.

Additionally, the rising adoption of hybrid and multi-cloud strategies has boosted the demand for cloud AMS, facilitating seamless application performance across diverse environments. Cloud-based solutions further support remote access, essential for businesses implementing flexible or distributed work models, thus augmenting segmental growth.

By End-User

Based on end-user, the market is divided into IT and telecommunications, healthcare, banking, financial services, and insurance, retail and consumer goods, manufacturing, and others. The IT and telecommunications segment is poised to witness significant growth at a robust CAGR of 21.26% through the forecast period.

This expansion is primarily fueled by the sector's growing reliance on complex, large-scale applications that require continuous monitoring, optimization, and support.

IT and telecom companies handle vast amounts of data in large-scale operations and need reliable system management to ensure uninterrupted service delivery. Rapid technological advancements, including 5G, cloud computing, and IoT, have increased application complexity, necessitating efficient management essential to maintain performance and security.

Application Management Service Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America application management service market captured a notable share of around 37.99% in 2023, with a valuation of USD 15.92 billion. The rising number of cyberattacks and data breaches in North America has led to increased focus on cybersecurity and data privacy regulations.

Strict regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) compel businesses are compelled to invest in secure application management. AMS providers in the region offer services that ensure applications comply with these regulations, while implementing robust security measures to protect sensitive data.

This growing concern for cybersecurity is contributing significantly to the expansion of the North America the AMS market.

- In March 2024, Microsoft revealed that hackers linked to Russia's foreign intelligence were once again attempting to infiltrate its systems. The attackers leveraged data obtained from corporate emails to regain access to the company, whose products are widely utilized in the U.S. national security

This underscores the persistent threat of cyberattacks targeting critical technology providers and highlights the ongoing vulnerability of global corporations to state-sponsored espionage, further comtributing to the market growth in the region.

Asia Pacific is poised to witness significant growth, recording a robust CAGR of 21.26% over the forecast period. This growth is propelled by the largest mobile and internet user bases , with countries such as China and India experiencing significant growth in mobile and web applications. As businesses expand their digital presence, there is a growing demand for AMS providers to manage, monitor, and optimize these applications.

- According to the 2023 reports by the World Economic Forum, South Asian countries are increasingly adopting digitalization. By 2030, Southeast Asia's internet economy is projected to reach USD 1 trillion, fueled by a rapidly expanding base of digital consumers and applications.

The growing need to ensure the performance, security, and scalability of mobile and web applications is positively impacting the Asia Pacific market, particularly in industries such as e-commerce, banking, and entertainment.

Competitive Landscape

The global application management service market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Application Management Service Market

- IBM Corporation

- Infosys Limited

- TATA Consultancy Services Limited

- Wipro

- Capgemini

- Cognizant

- Accenture

- HCL Technologies Limited

- FUJITSU AMERICA, INC

- Atos SE

Key Industry Developments

- August 2024 (Partnership): Accenture and Google Cloud announced that their strategic partnership is gaining significant momentum across industries, focusing on two key areas: generative AI and cybersecurity. This collaboration aims to deliver innovative solutions for enterprise clients in these critical domains.

- January 2024 (Collaboration): Cognizant announced an expanded collaboration with Takeda, a global biopharmaceutical leader, to strengthen the company's infrastructure and application management, enhancing its technological initiatives. This collaboration intends to support and accelerate Takeda's innovation and digital growth efforts.

The global application management service market has been segmented as:

By Service Type

- Application Development and Maintenance

- Application Support

- Application Hosting

- Application Integration

- Application Testing

By Deployment Type

- On-Premises

- Cloud

By End-User

- IT and Telecommunications

- Healthcare

- Banking, Financial Services, and Insurance

- Retail and Consumer Goods

- Manufacturing

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership