Advanced Materials and Chemicals

Architectural Coatings Market

Architectural Coatings Market Size, Share, Growth & Industry Analysis, By Resin Type (Acrylic, Alkyd, Polyurethane, Epoxy, Others), By Technology (Solvent-borne, Water-borne), By Function (Ceramics, Paints, Lacquers, Primers, Others), By End User and Regional Analysis, 2024-2031

Pages : 150

Base Year : 2023

Release : January 2025

Report ID: KR1175

Architectural Coatings Market Size

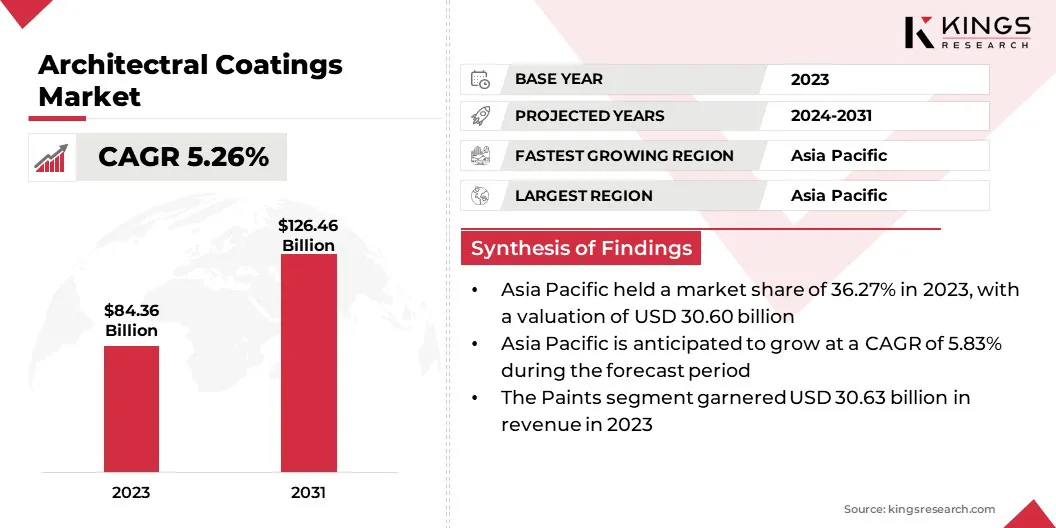

The architectural coatings market size was valued at USD 84.36 billion in 2023 and is projected to grow from USD 88.33 billion in 2024 to USD 126.46 billion by 2031, exhibiting a CAGR of 5.26% during the forecast period.

Rapid infrastructure development in emerging economies is propelling the market. Countries in Asia Pacific and the Middle East & Africa are investing heavily in large-scale projects, including housing, transportation, and commercial developments. Architectural coatings are indispensable in these projects, offering durability, weather resistance, and visual appeal.

In the scope of work, the report includes products offered by companies such as The Sherwin-Williams Company, PPG Industries, Inc., AkzoNobel N.V., BASF, Jotun, Nippon Paint Holding Co., Ltd, Kansai Paint Co., Ltd, Axalta Coating Systems, LLC, Coval Group, RPM International Inc., and others.

Government-backed initiatives, such as smart city developments and urbanization plans, are further boosting the demand for architectural coatings. This increasing focus on infrastructure upgrades and new construction supports the long-term expansion of the architectural coatings market in these high-growth regions.

Architectural coatings refer to a broad category of paints, primers, and other coatings applied to buildings and structures for both decorative and protective purposes. These coatings are designed to enhance the esthetics of surfaces such as walls, ceilings, floors, and roofs while providing resistance against environmental factors like UV radiation, moisture, and temperature fluctuations.

Commonly used in residential, commercial, and industrial construction, architectural coatings include products such as water-based paints, solvent-based paints, and specialty finishes like textured or heat-reflective coatings. Increasingly, they incorporate eco-friendly and low-VOC formulations to align with sustainability goals and regulatory standards in modern construction practices.

Analyst’s Review

Government organizations across the globe are actively promoting sustainable building practices, creating a substantial impact on the adoption of architectural coatings. Policies aimed at reducing the carbon footprint of construction projects prioritize eco-friendly materials, such as low-VOC and zero-VOC coatings, which meet strict environmental compliance standards.

Incentive programs, including tax benefits and subsidies, encourage developers to adopt sustainable materials in both new constructions and renovation projects. Green building initiatives integrate these coatings to enhance energy efficiency and overall sustainability. Regulatory mandates and growing consumer awareness about environmentally responsible solutions are propelling this trend, positioning sustainable coatings as a key catalyst for the long-term expansion of the architectural coatings market.

- The Indian Green Building Council (IGBC) hosted the 22nd Green Building Week in September 2024 supported by the WorldGBC and its global network of GBCs. This initiative aims to steer the building and construction sector toward a resilient, zero-carbon future. With GBCs operating in over 75 countries, representing 60% of the world’s building stock and 65% of global GDP, the campaign addresses 72% of global built environment emissions. This global push for sustainability positively affects the adoption of architectural coatings globally.

Governments are investing in research and development (R&D) programs to advance sustainable coating technologies, including energy-efficient and bio-based coatings, further boosting the market.

Architectural Coatings Market Growth Factors

The global construction industry is witnessing robust growth, fueled by increasing urbanization, population expansion, and industrialization in emerging economies.

- According to the 2023 reports from the National Action Plans (NAPs) on Business and Human Rights, the global construction industry is projected to grow by USD 4.5 trillion, reaching USD 15.2 trillion over the next decade. China, India, the US, and Indonesia are expected to contribute 58.3% of this anticipated growth.

Residential, commercial, and industrial construction projects are driving the demand for architectural coatings to enhance esthetics and provide surface protection. Renovation and refurbishment activities in developed markets, where aging infrastructure requires upgrades, further support market expansion. Additionally, government investments in housing and infrastructure projects contribute significantly to the growth of the architectural coatings market.

The hospitality and tourism sectors are driving the demand for architectural coatings, particularly in regions with high tourist influx. Construction and refurbishment of hotels, resorts, and recreational facilities require high-performance coatings to achieve long-lasting and esthetically pleasing results.

These coatings aid in maintaining the visual appeal and structural integrity of hospitality buildings. Additionally, increasing investments in tourism infrastructure in regions like the Middle East and Asia Pacific are significantly contributing to the growth of the market.

However, the growth of the architectural coatings market is restrained by the volatility in raw material prices. Fluctuations in the costs of key ingredients such as pigments, resins, and solvents can lead to unpredictable pricing, making it difficult for manufacturers to maintain competitive pricing and margins.

Thus, companies are increasingly investing in the development of alternative materials and sustainable sourcing strategies. Several companies are also enhancing supply chain efficiency and building stronger supplier relationships to reduce dependency on volatile raw materials. Furthermore, innovations in recycling and reusing coatings materials help mitigate cost pressures while supporting sustainability efforts.

Architectural Coatings Industry Trends

The increasing need for protective coatings designed to withstand harsh environmental conditions is contributing to the growth of the architectural coatings market. Industrial areas, where structures face exposure to extreme heat, chemicals, and other corrosive elements, require specialized coatings to prevent surface degradation and corrosion.

Architectural coatings with advanced protective properties increase the durability and lifespan of infrastructure in such environments.

- In August 2024, PPG introduced the PPG PITT-THERM 909 spray-on insulation (SOI) coating, specifically designed for high-heat environments within the oil & gas, chemical, petrochemical, and other critical infrastructure sectors. This advanced coating offers enhanced safety, asset protection, and operational efficiency, providing superior performance over traditional thermal insulative materials.

Furthermore, innovations in resistant and insulation coatings have created new growth avenues to meet the demanding requirements of industries operating in challenging environmental conditions. These advancements ensure the continued expansion of the market globally.

The growing trend of renovation and remodeling activities, especially in developed economies, is driving the demand for architectural coatings. Homeowners and businesses are investing in refurbishing interiors and exteriors to enhance property value and appeal.

Coatings tailored for surface restoration and decorative finishes are highly sought after in this segment. This trend is further supported by government incentives for energy-efficient retrofitting, which often involves using advanced coatings. The rise in renovation activities continues to contribute significantly to the growth of the market globally.

Segmentation Analysis

The global market has been segmented based on resin type, technology, function, end user, and geography.

By Resin Type

Based on resin type, the market has been segmented into acrylic, alkyd, polyurethane, epoxy, and others. The acrylic segment led the architectural coatings market in 2023, reaching the valuation of USD 29.93 billion.

Acrylic resins offer excellent weather resistance, color retention, and UV stability, making them ideal for both interior and exterior applications. These resins are widely used in residential, commercial, and industrial coatings, due to their ability to withstand harsh environmental conditions without significant degradation.

Additionally, acrylic coatings are easy to apply, fast-drying, and provide a smooth, glossy finish, which enhances the esthetic appeal of structures. The growing demand for eco-friendly, low-VOC, and sustainable coatings further drives the dominance of acrylic-based formulations in the market.

By Technology

Based on technology, the market has been classified into solvent-borne and water-borne. The water-borne segment secured the largest revenue share of 59.62% in 2023. Water-borne coatings are highly preferred, as they are environmentally friendly and contain lower levels of volatile organic compounds (VOCs), which helps meet stringent regulatory standards.

The increasing emphasis on sustainability and green building practices has made water-borne coatings a top choice for consumers and businesses alike. Additionally, these coatings offer superior ease of application, faster drying times, and lower maintenance costs.

By Function

Based on function, the market has been divided into ceramics, paints, lacquers, primers, and others. The paints segment is poised for significant growth at a robust CAGR of 5.93% through the forecast period. Paints are essential for both protective and esthetic purposes, making them a preferred choice across residential, commercial, and industrial sectors.

Their ability to provide surface protection against environmental factors such as moisture, UV radiation, and pollution, while enhancing the visual appeal of buildings, contributes significantly to their demand. Additionally, innovations in paint technologies, such as anti-microbial and energy-efficient coatings, have expanded their functionality, further driving the market.

Architectural Coatings Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 36.27% share of the architectural coatings market in 2023, with a valuation of USD 30.60 million. Asia Pacific is registering significant urbanization, with rapid population growth driving the demand for residential, commercial, and industrial construction.

- The United Nations Human Settlements Programme reports that Asia is home to over 54% of the global urban population, equating to more than 2.2 billion people. By 2050, the region’s urban population is projected to expand by an additional 1.2 billion, reflecting a 50% increase.

The expansion in urban infrastructure is boosting the need for architectural coatings to protect and enhance the esthetics and durability of buildings. As cities continue to grow, architectural coatings are essential to meet the performance standards required for new and renovated buildings, contributing to the expansion of the market.

Additionally, the construction and real estate sectors in Asia Pacific are booming, with significant investments in both residential and commercial properties. Major cities are witnessing large-scale projects, including high-rise buildings, office complexes, and malls, all of which require the application of premium architectural coatings.

The architectural coatings market in Europe is poised for significant growth at a robust CAGR of 5.55% over the forecast period. Europe is at the forefront of environmental sustainability, with stringent regulations promoting the use of eco-friendly and low-VOC coatings.

Government policies such as the European Green Deal and local regulations across European countries are pushing for greener construction practices. These regulations encourage the adoption of sustainable architectural coatings, which is significantly boosting the market. The renovation and retrofitting industry in Europe is growing rapidly, driven by the need to modernize aging infrastructure and improve energy efficiency.

- The World Green Building Council highlights that 24 European cities, including Madrid, Rome, and Zagreb, have united to explore how evaluating the comprehensive benefits of renovation can enhance their climate action strategies. These cities are actively participating in the EU-funded BUILD UPON2 project, which utilizes the BUILD UPON2 Framework as a crucial tool to support the EU's Renovation Wave. This ambitious strategy aims to double the European Union’s renovation rate by 2030, driving significant progress in sustainable building practices across the region.

Architectural coatings play a crucial role in these projects, offering protective and esthetic benefits. As European countries invest in the renovation of older buildings to meet modern standards, the demand for high-performance coatings continues to rise.

Competitive Landscape

The architectural coatings market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create opportunities for the market growth.

List of Key Companies in Architectural Coatings Market

- The Sherwin-Williams Company

- PPG Industries, Inc

- AkzoNobel N.V.

- BASF

- Jotun

- Nippon Paint Holding Co., Ltd

- Kansai Paint Co., Ltd

- Axalta Coating Systems, LLC

- Coval Group

- RPM International Inc.

Key Industry Developments

- February 2024 (Expansion): AkzoNobel completed the expansion of its largest powder coatings plant in Como, Italy. This expansion is anticipated to enhance the company's ability to meet the growing demand from customers across Europe, the Middle East, and Africa (EMEA). The Como site remains AkzoNobel's largest facility for powder coatings production.

- May 2024 (Launch): Coval Group launched the Coval Matting Agent, designed to be added to the gloss finish of Coval coatings to achieve a satin or matte appearance. This new matting agent offers enhanced versatility and ease of use for installers, distributors, and end users.

The global architectural coatings market has been segmented as:

By Resin Type

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Others

By Technology

- Solvent-borne

- Water-borne

By Function

- Ceramics

- Paints

- Lacquers

- Primers

- Others

By End User

- Residential

- Non-residential

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership