Consumer Goods

Athleisure Market

Athleisure Market Size, Share, Growth & Industry Analysis, By Product (Yoga Apparel, Shirts, Leggings, Shorts, Others), By End User (Men, Women, Children,), By Distribution Channel (Online, Offline,), and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : January 2025

Report ID: KR1267

Market Definition

The athleisure industry encompasses apparel designed for both athletic performance and everyday wear, combining functionality, comfort, and style, offering clothing suitable for exercise, casual outings, and leisure activities. It caters to consumers seeking versatile attire that seamlessly transitions between exercise, casual outings, and daily activities.

Athleisure Market Overview

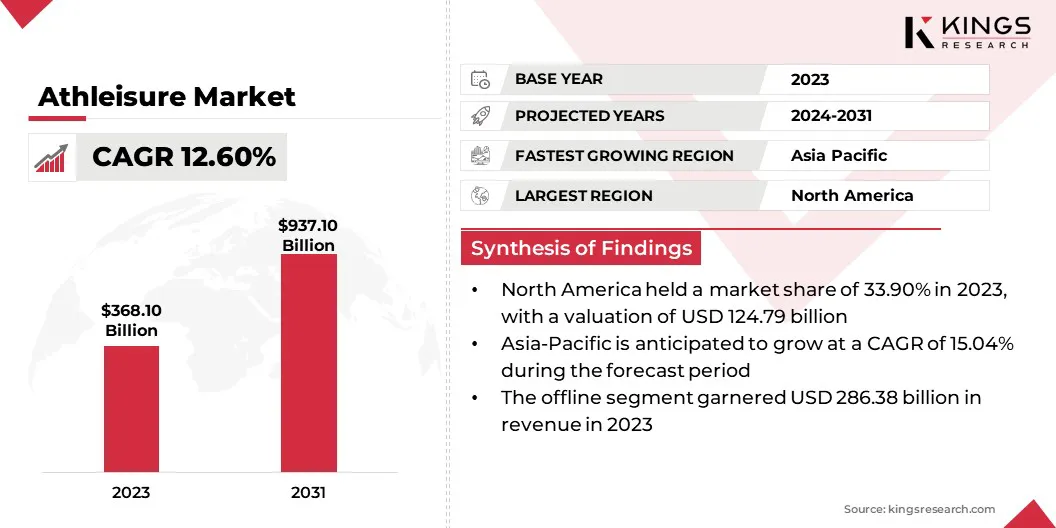

Global athleisure market size was valued at USD 368.10 billion in 2023, which is estimated to grow to USD 408.31 billion in 2024 and reach USD 937.10 billion by 2031, growing at a CAGR of 12.60% from 2024 to 2031.

The growing consumer preferences for comfort-driven fashion is contributing significantly to the growth of the market. Consumers increasingly seek versatile apparel that combines style, practicality, and comfort, making athleisure ideal for both active and everyday wear.

Major companies operating in the global athleisure market are lululemon athletica, adidas AG, Under Armour, Inc., HANESBRANDS INC, Vuori, Inc, Outerknown, LLC, Pangaia Group, PUMA SE, Nike, Inc, Zivame, H & M Hennes & Mauritz AB., Modenik Lifestyle Pvt. Ltd. (Enamor), Outdoor Voices, Inc, TEN THOUSAND, INC., ASICS Corporation, and others.

The market has emerged as a dynamic and influential sector within the global apparel industry, characterized by a seamless blend of fashion, functionality, and comfort.

It reflects a cultural shift toward more active lifestyles and greater demand for versatile clothing that adapts to both fitness and daily activities. The market cater to diverse consumer needs, offering a wide range of products that support performance while remaining fashionable and accessible for daily use.

- In October 2023, Reliance Brands Limited (RBL) expanded its partnership with Superdry PLC by acquiring majority ownership of Superdry’s intellectual property for India, Sri Lanka, and Bangladesh. This strategic move aligns with the growing demand for athleisure and activewear in these markets.

Key Highlights:

- The global athleisure industry size was recorded at USD 368.10 billion in 2023.

- The market is projected to grow at a CAGR of 12.60% from 2024 to 2031.

- North America held a share of 33.90% in 2023, valued USD 124.79 billion.

- The yoga apparel segment garnered USD 110.80 billion in revenue in 2023.

- The women segment is expected to reach USD 392.29 billion by 2031.

- The online segment is anticipated to witness fastest CAGR of 14.82% through the projection period

- Asia Pacific is anticipated to grow at a CAGR of 15.04% over the forecast period.

Market Driver

"Increasing Health and Fitness Awareness"

The increasing awareness of health and fitness is boosting the growth of the athleisure market. The growing emphasis on physical well-being and active lifestyles is fueling demand for functional, performance-oriented activewear.

- In June 2024, the WHO reported that 31% of the global adult population (1.8 billion people) is physically inactive, with this rate projected to rise to 35% by 2030. This underscores the urgent need for increased awareness and intervention.

Consumers seek clothing that suits both fitness routines and daily wear, boosting the demand for versatile, comfortable, and stylish athleisure products. This trend is further fueled by the surging popularity of fitness regimes such as yoga, running, and gym workouts, leading to greater consumption of activewear for both performance and leisure.

- In April 2024, The Beachbody Company introduced an initiative allowing customers to buy popular fitness programs, such as P90X and 21 DAY FIX without a subscription. This strategy addresses the growing demand for flexible fitness solutions, aligning with the growth of the athleisure industry.

Market Challenge

"Sustainability Concerns"

Rising focus on sustainability is emerging as a significant challenge to the expansion of the athleisure market, as the environmental impact of fast fashion and synthetic materials concerns eco-conscious consumers. The production of synthetic fabrics, often used in athleisure, contributes to pollution and waste.

- According to an Earth.org article from January 2025, the fast fashion industry is the second-largest consumer of water and accounts for 10% of global carbon emissions. It depletes water sources, pollutes rivers, and contributes to the annual disposal of 85% of textiles in landfills. Additionally, washing clothes releases 500,000 tons of microfibers into the ocean each year.

To address this challenge, brands are shifting toward eco-friendly materials, such as recycled fabrics, organic cotton, and biodegradable options.

Additionally, adopting sustainable manufacturing practices and promoting circular economy models such as like clothing recycling and upcycling can help reduce the carbon footprint and meet growing consumer demand for greener alternatives.

- In January 2025, Siemens partnered with Spinnova to revolutionize textile manufacturing. Spinnova’s sustainable fibers, produced with minimal CO₂ emissions and water usage, are scalable through Siemens Xcelerator technology, promoting eco-friendly practices in athleisure fabric production.

Market Trend

"Rise of Luxury Athleisure"

A prominent trend in the athleisure market is the rise of luxury athleisure, where high-end brands are offering premium products that combine stylish designs with superior functionality.

Catering to affluent consumers, these brands provide versatile, high-quality apparel that transitions effortlessly from workouts to everyday activities, combining comfort and sophistication.

- In May 2024, Alo Yoga opened its flagship store at Doha Festival City, marking its entry into Qatar. The 410 sqm store, in partnership with Alshaya Group, features the brand’s high-performance activewear and leisurewear, enhancing its growing presence across the GCC.

Athleisure Market Report Snapshot

| Segmentation | Details |

| By Product | Yoga Apparel (Tops, Pants, Shorts, Unitards, Capris, Others), Shirts, Leggings, Shorts, Others |

| By End User | Men, Women, Children |

| By Distribution Channel | Online, Offline |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product (Yoga Apparel, Shirts, Leggings, Shorts, and Others): The yoga apparel segment earned USD 110.80 billion in 2023 due to increased interest in fitness and wellness.

- By End User (Men, Women, and Children): The women segment held a share of 43.08% in 2023, mainly fueled by the growing athleisure adoption and rising demand for versatile activewear.

- By Distribution Channel (Online and Offline): The offline segment is projected to reach USD 705.32 billion by 2031, largely attributed to the sustained demand for in-store experiences and product trials.

Athleisure Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America athleisure market held a substantial share of around 33.90% in 2023, valued at USD 124.79 billion. This dominance is reinforced by a growing health and fitness culture, rising demand for versatile and stylish clothing and a strong consumer base.

The increasing participation in fitness activities and emphasis on wellness, along with the expansion of retail and e-commerce platforms have further bolstered its position. Additionally, the influence of celebrities and athletes has contributed to the growth of the North America market.

Asia Pacific athleisure market is set to witness significant growth, registering a robust CAGR of 15.04% over the forecast period. This rapid growth is propelled by an increasing focus on health and wellness, rising disposable incomes, and a growing middle-class population.

Consumers in countries such as China, India, and Japan are becoming increasingly health-conscious, fueling the demand for versatile, stylish activewear. Additionally, the region’s young, fashion-forward population is adopting athleisure as part of their daily wardrobe, further fueling regional market growth. The expansion of e-commerce and international brands is further contributing to this trend.

- In September 2024, PUMA inaugurated its largest store in Asia, the PUMA Sunway Flagship, located at Sunway Pyramid Mall in Kuala Lumpur. Spanning 12,000 square feet, the store offers a unique shopping experience that combines innovation, style, and local Malaysian culture.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The Textile Fiber Products Identification Act in the U.S. mandatesy content disclosure on labels, invoices, and advertisements of textile fiber products. It makes misbranding, false invoicing, and deceptive advertising unlawful.

- In the EU, the REACH Regulation governs the registration, evaluation, authorization, and restriction of chemicals (REACH), safeguarding human health and the environment from chemical risks in textiles.

- The Bureau of Indian Standards develops and publishes Indian standards, oversees conformity assessment, manages testing laboratories, implements hallmarking, empowers consumers, conducts quality assurance training, and represents India in ISO & IEC.

Competitive Landscape:

The global athleisure market is characterized by a number of participants, including both established corporations and rising organizations. Companies in the athleisure field are increasingly forming strategic partnerships to enhance brand reach and product offerings.

Collaborations with influencers, sports teams, and high-fashion designers help tap into new consumer segments. These alliances drive innovation in product design, expand marketing efforts, and foster brand loyalty, ensuring sustained market growth.

- In September 2023, lululemon and Peloton announced a five-year global partnership, where Peloton becomes the exclusive digital fitness content provider for lululemon, while lululemon becomes Peloton’s primary apparel partner. The collaboration aims to offer co-branded apparel, exclusive fitness content, and unique experiences, aimed at expanding brand reach and engagement.

List of Key Companies in Athleisure Market:

- lululemon athletica

- adidas AG

- Under Armour, Inc.

- HANESBRANDS INC

- Vuori, Inc

- Outerknown, LLC

- Pangaia Group

- PUMA SE

- Nike, Inc

- Zivame

- H & M Hennes & Mauritz AB.

- Modenik Lifestyle Pvt. Ltd. (Enamor)

- Outdoor Voices, Inc

- TEN THOUSAND, INC.

- ASICS Corporation

Recent Developments:

- In August 2024, Pvolve expanded its partnership with Vuori through a nationwide tour, featuring exclusive Vuori apparel at Pvolve studios. The collaboration includes engaging events and branded products, offering Pvolve members unique access to Vuori’s activewear and promoting active lifestyles.

- In May 2023, PANGAIA extended its plant-based Motion collection with new capsule pieces for men and additional colorways for women. Featuring 99.99% plant-based EVO Nylon, the collection offers seamless, sustainable activewear designed for comfort, stretch, and eco-conscious performance.

- In February 2024, lululemon unveiled its 2024 spring and summer footwear collection, including its first men’s line. It features the Cityverse casual sneaker and Beyondfeel performance running models. Designed for superior comfort and fit, the shoes incorporate extensive research, wear-testing, and biomechanical insights for optimal performance. Available in both men’s and women’s styles, the collection will be sold online and in select stores across North America, Europe, and China.

- In March 2024, Gap Inc. and Ambercycle formed a partnership to integrate textile-to-textile recycled materials in Athleta products. Starting in 2026, Athleta plans to use Ambercycle's cycora regenerated polyester, a high-performance material made from end-of-life textiles, making it the first performance apparel brand to do so.

- In December 2024, PUMA collaborated with Spinnova to develop proof-of-concept products using wood-based SPINNOVA fibre for future collections, focusing on Sportstyle. This partnership aims to secure fibre volumes through Spinnova’s joint venture, Woodspin Oy.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership