Consumer Goods

Automatic Doors Market

Automatic doors Market Size, Share, Growth & Industry Analysis, By Type (Sliding, Swinging, Folding, Others), By Function (Sensor based, Motion based, Push button, Access control), By End User (Residential, Commercial, Industrial), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2025

Report ID: KR431

Market Definition

The market involves the production, distribution, and installation of doors that operate without manual intervention, using technologies such as motion sensors, pressure sensors, infrared sensors, and biometric access systems.

These doors are widely used across various sectors, including commercial spaces like shopping malls, offices, and hotels; industrial facilities such as factories and warehouses; healthcare institutions like hospitals and cleanrooms; and transportation hubs including airports and metro stations.

The market includes different types of automatic doors, such as sliding, swing, revolving, folding, and hermetic doors, each designed for specific applications to enhance accessibility, security, energy efficiency, and user convenience.

Automatic Doors Market Overview

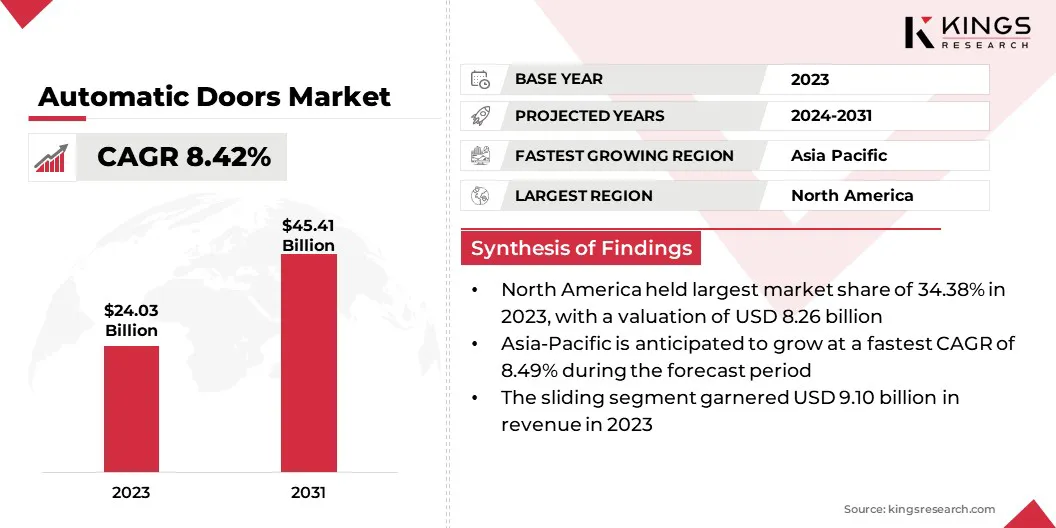

The global automatic doors market size was valued at USD 24.03 billion in 2023 and is projected to grow from USD 25.79 billion in 2024 to USD 45.41 billion by 2031, exhibiting a CAGR of 8.42% during the forecast period.

The market is driven by the increasing demand for energy-efficient solutions, advancements in sensor technology, and the rising adoption of automatic doors across various sectors such as healthcare, retail, and commercial buildings.

Major companies operating in the automatic doors industry are ASSA ABLOY, dormakaba Group, Nabtesco Corporation, ALLEGION ACCESS TECHNOLOGIES LLC, Horton Automatics, TORMAX, GEZE India Private Ltd, Portalp France SAS, Ningbo OWNIC Technology Co., Ltd, Stanley Black & Decker, Inc, SANWA HOLDINGS CORPORATION., Royal Boon Edam International B.V., Deutschtec, Rite-Hite, and Manusa .

Companies are focusing on enhancing product offerings with advanced features and customized solutions as several industries continue to adopt automation for safety and convenience. This dynamic market is expected to evolve rapidly, with major players driving innovation through strategic partnerships and product developments, ultimately catering to a broader range of industries and applications.

Key Highlights:

Key Highlights:

- The automatic doors industry size was valued at USD 24.03 billion in 2023.

- The market is projected to grow at a CAGR of 8.42% from 2024 to 2031.

- North America held a market share of 34.38% in 2023, with a valuation of USD 8.26 billion.

- The sliding segment garnered USD 9.10 billion in revenue in 2023.

- The sensor based segment is expected to reach USD 18.02 billion by 2031.

- The industrial segment is anticipated to witness the fastest CAGR of 8.49% during the forecast period

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.49% during the forecast period.

Market Driver

“Increasing emphasis on hygiene and contact-free access”

The increasing emphasis on hygiene and contactless access is a key driver of the automatic doors market, particularly following the COVID-19 pandemic, which heightened the awareness of germ transmission through frequently touched surfaces.

Businesses, healthcare facilities, and public institutions are increasingly adopting automated entry solutions to enhance safety and hygiene. In medical environments, automatic doors are crucial in operating rooms, ICUs, and patient areas to reduce contamination risks.

- For instance, in June 2024, the Madrid hospital upgraded its facilities by installing automatic doors from ASSA ABLOY, enhancing hygiene, accessibility, and efficiency. The move aims to reduce contact points, improving infection control while ensuring seamless movement for patients and staff. These doors also contribute to energy efficiency by maintaining indoor climate control.

Commercial establishments such as shopping malls, supermarkets, offices, and hotels are implementing touchless doors to ensure a more sanitary environment. This growing preference for hands-free access, coupled with advancements in sensor technology and stricter hygiene regulations, continues to drive the demand for automatic doors across various industries.

Market Challenge

“High Installation and Maintenance Costs”

A significant challenge in the automatic doors market is the high installation and maintenance costs. These systems require advanced sensors, motors, and control mechanisms, making them more expensive than traditional doors.

Furthermore, regular maintenance is essential to ensure optimal functionality, as technical malfunctions or sensor failures can result in costly repairs. These financial burdens may discourage small businesses and budget-conscious buyers, limiting market adoption, particularly in developing regions where budget constraints and infrastructure limitations further impede widespread implementation.

Manufacturers can develop cost-effective, energy-efficient systems with modular designs to address high installation and maintenance costs in the market. Businesses can adopt preventive maintenance programs to reduce long-term expenses, while government incentives can encourage wider adoption.

Advancements in self-diagnosing sensors and AI-driven predictive maintenance further enhance efficiency by preventing costly repairs. Additionally, increased competition and improved production techniques can help lower costs, making automatic doors more accessible.

Market Trend

“Integration of Smart Technologies”

The integration of smart technologies is significantly advancing the automatic doors market by improving convenience, security, and operational efficiency. IoT-enabled remote monitoring allows facility managers to control doors through smartphones or centralized systems, track performance metrics, and receive maintenance alerts, thereby minimizing downtime.

AI-driven predictive maintenance analyzes usage patterns to identify potential malfunctions before they occur, enhancing reliability and extending the lifespan of door mechanisms.

- In February 2024, Marvin introduced Marvin Connected Home, a smart automation system for skylights, windows, and doors. This solution integrates with Amazon Alexa, Crestron Home, and Control4, allowing users to control air, light, and views with voice commands or mobile apps. Features include automated responses to outdoor conditions, rain sensors, and customizable schedules for enhanced convenience and security. This innovation highlights Marvin’s commitment to smart home technology.

Cloud-based access control strengthens security by enabling integration with biometric authentication, facial recognition, and RFID scanners, making these systems particularly suitable for offices, airports, and high-security facilities.

Furthermore, adaptive automation enables automatic doors to adjust their opening speed, width, and sensitivity based on foot traffic, environmental conditions, or user preferences, thereby optimizing efficiency and enhancing the overall user experience.

Automatic Doors Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Sliding, Swinging, Folding, Others |

|

By Function |

Sensor based, Motion based, Push button, Access control |

|

By End-User |

Residential, Commercial (HoReCa, Shopping malls, Airports, Hospitals, Others) Industrial (Warehouse, Manufacturing facilities) |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Sliding, Swinging, Folding, Others): The sliding segment earned USD 9.10 billion in 2023, due to its space-saving design, ease of use, esthetic appeal, and advancements in automation technology.

- By Function (Sensor based, Motion based, Push button, Access control): The sensor based segment held 39.88% share of the market in 2023, driven by its enhanced convenience, improved hygiene through touchless operation, widespread adoption in healthcare & commercial spaces, and advancements in sensor technology for increased accuracy and reliability.

- By End User (Residential, Commercial (HoReCa, Shopping malls, Airports, Hospitals, Others) Industrial (Warehouse, Manufacturing facilities)): The commercial companies segment is projected to reach USD 20.24 billion by 2031, owing to the rising demand for touchless entry, smart infrastructure investments, and strict safety & energy efficiency regulations.

Automatic Doors Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

.webp) North America accounted for around 34.38% market share in 2023, with a valuation of USD 8.26 billion. The automatic doors market in the region registered significant growth, driven by urbanization, infrastructure development, and an increasing emphasis on accessibility and security.

North America accounted for around 34.38% market share in 2023, with a valuation of USD 8.26 billion. The automatic doors market in the region registered significant growth, driven by urbanization, infrastructure development, and an increasing emphasis on accessibility and security.

The U.S. has played a pivotal role in this expansion, with widespread adoption across commercial, healthcare, and transportation sectors. Sliding doors have remained the preferred choice, due to their space efficiency and suitability for high-traffic environments.

Looking ahead, the market is expected to continue expanding, supported by advancements in automation technology, growing demand for touchless access solutions, and implementation of stringent building regulations.

- In February 2024, NABCO introduced the NATRUS+e W, an advanced door system equipped with Image Sensing W technology. This innovation enhances energy efficiency by minimizing unnecessary openings, improving accessibility, and ensuring a comfortable indoor environment. The system optimizes door operation by predicting pedestrian flow and adjusting opening speed accordingly, making it ideal for airports, hospitals, and commercial facilities.

The automatic doors market in Asia Pacific is poised for significant growth at a robust CAGR of 8.49% over the forecast period. This growth is fueled by rapid urbanization, large-scale infrastructure development, and an increasing emphasis on energy-efficient and accessible building solutions.

The widespread adoption of automatic doors across commercial, residential, and industrial sectors highlights the region's dedication to modernization and technological advancement. Notably, China and India are leading this expansion, driven by strong economic progress and ambitious urban development initiatives.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The Supply of Machinery (Safety) Regulations 2008 in Great Britain set essential safety requirements for machinery, including automatic doors, before they are placed on the market. It mandates compliance with health and safety standards, risk assessments, proper documentation, and CE marking to indicate conformity. These regulations align with UK product safety laws and aim to prevent hazards associated with machinery use.

- The Consumer Product Safety Commission (CPSC) enforces safety standards for automatic residential garage door operators in the U.S. The Safety Standard for Automatic Residential Garage Door Operators aims to prevent accidents by requiring entrapment protection mechanisms, such as automatic reversal systems and external sensors. These regulations align with UL 325, ensuring compliance with stringent safety protocols.

- The ANSI/BHMA (American National Standards Institute/Builders Hardware Manufacturers Association) A156.10-2017 standard outlines safety requirements for power-operated pedestrian doors in commercial and public buildings. It includes guidelines for reducing injury risks, ensuring smooth functionality, and maintaining compliance with accessibility regulations. This standard applies to automatic sliding, swinging, and folding doors but excludes those used in industrial settings.

- The American National Standards Institute (ANSI) and the International Code Council (ICC) establish safety and accessibility regulations for automatic doors through standards such as ANSI/BHMA A156.10 and the International Building Code (IBC). The 2024 IBC includes updates to enhance egress, accessibility, and energy efficiency requirements for automated entry systems. These regulations ensure compliance with safety protocols in commercial and public buildings.

Competitive Landscape:

The global automatic doors industry is characterized by several participants, including established corporations and rising organizations. Companies should focus on innovations, including integrating smart building systems and energy-efficient designs, to gain a competitive advantage in the evolving market.

Emphasizing advanced sensors, safety features, and faster response times can enhance security and functionality, especially in high-traffic areas. Offering customized solutions for specific industries and expanding product offerings to include various designs and options will enable companies to meet market demands and strengthen their position in the industry.

- In September 2023, NABCO Entrances introduced the NABCO SWING, a new swing door operator designed for converting manual doors into automatic ones. The product features a sleek, low-profile design, non-handed gear assembly, and remote access via the NABCO Connect app. It is ideal for healthcare, hospitality, retail, and educational sectors, offering easy installation, low maintenance costs, and a long service life. The NABCO SWING has been tested for over 1 million cycles to ensure reliability.

List of Key Companies in Automatic Doors Market:

- ASSA ABLOY

- dormakaba Group

- Nabtesco Corporation

- ALLEGION ACCESS TECHNOLOGIES LLC

- Horton Automatics

- TORMAX

- GEZE India Private Ltd

- Ningbo OWNIC Technology Co., Ltd

- Stanley Black & Decker, Inc

- SANWA HOLDINGS CORPORATION.

- Royal Boon Edam International B.V.

- Deutschtec

- Rite-Hite

- Manusa

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In February 2025, Allegion plc acquired Next Door Company, enhancing its specialty door solutions portfolio. The acquisition strengthens Allegion’s existing product offerings and expands its reach in the U.S. market. Justin Schechter, owner of Next Door, will join Allegion to support growth and integration. Terms of the transaction were not disclosed.

- In June 2024, NABCO Entrances introduced a new ICU Automatic Telescopic Sliding Door series designed for healthcare environments. These doors are specifically built to meet the needs of critical care areas, offering smooth, reliable performance while maximizing space efficiency. The design prioritizes patient safety, ease of access, and infection control, making it an ideal solution for hospitals and medical facilities.

- In January 2024, ASSA ABLOY announced the acquisition of Uhlmann & Zacher GmbH, a German company specializing in electronic locking solutions. This acquisition strengthens ASSA ABLOY’s position in the access solutions market by expanding its portfolio of electronic locks and security solutions. The move aligns with the company’s strategy to enhance its smart access offerings and grow its presence in the European market.

- In January 2023, Overhead Door Corporation acquired Door Control, Inc. and Door Concepts, Inc., expanding its footprint in New England. These companies specialize in the service and installation of automatic doors and will continue operating under Horton Pedestrian Access Solutions, a division of Overhead Door Corporation. This acquisition strengthens Overhead Door’s position in the market and enhances its service capabilities.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)