Automotive Aftermarket Industry

Automotive Aftermarket Industry Size, Share, Growth & Industry Analysis, By Replacement Parts (Tires, Batteries, Brake Pads, Filters, Lighting & Electronic Components, and Others), By Distribution Channel (Warehouse Distributors, Online Retailers, OEM Parts, and Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : July 2024

Report ID: KR851

Automotive Aftermarket Industry size

The global Automotive Aftermarket Industry size was valued at USD 780.36 billion in 2023 and is projected to grow from USD 819.14 billion in 2024 to USD 1,207.72 billion by 2031, exhibiting a CAGR of 5.70% during the forecast period. The expansion of the industry is driven by the increasing vehicle longevity, rising number of vehicles, advancements in technology, and growing consumer demand for maintenance, customization, and online accessibility.

In the scope of work, the report includes solutions offered by companies such as 3M, Continental Automotive Technologies GmbH, Phinia Inc., Robert Bosch GmbH, The Goodyear Tire & Rubber Company, DENSO CORPORATION., DRiV Automotive Inc., HELLA GmbH & Co. KGaA, VALEO SERVICE, ZF Friedrichshafen AG, and others.

The development of the automotive aftermarket industry is fueled by the increasing number of vehicles on the road, particularly in emerging economies. This contributes to higher demand for maintenance and repair services. Moreover, the rising average age of vehicles leads to more frequent part replacements. Technological advancements in automotive components, along with the increasing complexity of vehicle systems, spur market growth.

Furthermore, the growing trend of vehicle customization and performance enhancement fuels the need for aftermarket parts. Additionally, the proliferation of e-commerce platforms has made it easier for consumers to access a wide range of automotive aftermarket products, thus boosting sales and stimulating market expansion.

The industry encompasses a broad spectrum of products and services aimed at vehicle maintenance, repair, and enhancement. The market is highly fragmented, comprising numerous players ranging from small, specialized businesses to large, multinational corporations. Digitalization and e-commerce are significantly reshaping the landscape, offering consumers enhanced convenience and a broader array of choices.

Moreover, the industry is influenced by stringent regulatory standards and ongoing technological advancements. These factors govern the quality and compatibility of aftermarket products, thereby ensuring vehicle safety and enhancing performance.

The automotive aftermarket industry refers to the secondary market within the automotive sector. It involves the manufacturing, remanufacturing, distribution, retailing, and installation of all vehicle parts, equipment, and accessories subsequent to the initial sale of the vehicle by the original equipment manufacturer (OEM). It includes products for both passenger and commercial vehicles.

The aftermarket provides consumers with various options for repair, maintenance, and customization of their vehicles, thereby extending the vehicle's life and enhancing its performance. This sector is crucial for supporting the lifecycle of vehicles beyond the warranty period offered by OEMs, thereby ensuring sustained vehicle operation and enhancing owner satisfaction.

Analyst’s Review

The automotive aftermarket industry is witnessing significant advancements as manufacturers focus on innovation and quality improvement. These efforts include the development of technologically advanced products, such as smart diagnostic tools and eco-friendly parts, to meet the evolving needs of modern vehicles. Companies are further expanding their online presence and optimizing supply chains to enhance customer accessibility and service efficiency.

Introducing new products tailored for electric and hybrid vehicles is increasingly gaining popularity, addressing the rising demand in this segment. Businesses that prioritize investment in training programs for technicians to handle advanced automotive systems and leverage digital marketing strategies to capture the growing online consumer base are likely to experience rapid growth in the market. Emphasizing sustainability and innovation is likely to play a crucial role.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), the global production of motor vehicles increased at a rate of 10.27% in 2023 from 2022.

Automotive Aftermarket Industry Growth Factors

Increasing the longevity of vehicles is a key factor supporting the growth of the automotive aftermarket industry. As cars and trucks are built to last longer, the need for maintenance, repair, and replacement parts is continuously rising. Consumers are increasingly opting to keep their vehicles for extended periods, often surpassing the warranty period offered by manufacturers.

This trend is fueling the demand for aftermarket products and services, as older vehicles require more frequent maintenance to sustain optimal operational performance. The expansion of digital tools and resources is enhancing consumer access to aftermarket parts, enabling more informed purchasing decisions and boosting market growth.

The increasing complexity of modern vehicles, particularly with the advent of advanced driver-assistance systems (ADAS) and electric vehicles (EVs), present a key challenge to the development of the automotive aftermarket industry. This complexity requires specialized knowledge and tools for proper maintenance and repair, posing a significant barrier for traditional repair shops.

To overcome this challenge, investment in training and education for technicians is essential. Developing comprehensive certification programs and providing access to the latest diagnostic tools and software ensures that repair shops stay current with technological advancements. Additionally, fostering partnerships between aftermarket providers and automotive technology companies facilitates the sharing of expertise and resources, addressing the challenge effectively.

Automotive Aftermarket Industry Trends

The growing adoption of e-commerce platforms is on the rise, as consumers are increasingly purchasing automotive parts and accessories online due to the convenience, wide selection, and competitive pricing these platforms offer. E-commerce allows customers to easily compare products, read reviews, and access detailed information, thereby simplifying the process of making informed decisions.

This is further benefiting businesses by expanding their reach beyond local markets to a global customer base. Companies are focusing on strengthening their online presence and digital marketing strategies to target this growing market segment, thereby enhancing the overall efficiency and responsiveness of the supply chain.

The increasing focus on sustainability impacts the automotive aftermarket industry. Consumers and businesses are becoming more environmentally conscious, leading to increased demand for eco-friendly products and services. This includes the use of recycled materials, remanufactured parts, and environmentally safe chemicals in maintenance processes.

Additionally, the rise of electric vehicles (EVs) is prompting the development of specialized aftermarket products tailored to these vehicles. Companies are investing in research and development to create sustainable solutions that adhere to regulatory standards and cater to consumer preferences. This focus on sustainability is reshaping the industry, promoting innovation, and contributing to a greener future.

- OEMs in Europe initiated requests for CO2e commitments from suppliers ahead of regulatory mandates. By 2025, CO2e labeling and reporting on the product level is likely to be enforced, along with maximum footprint thresholds. Over the long-term, manufacturers are anticipated to implement CO2e data exchange via energy measurement and encrypted data transfer. Increased reporting requirements are paired with CO2e reduction plans and roadmaps for each supplied component.

Segmentation Analysis

The global industry is segmented based on replacement parts, distribution channel, and geography.

By Replacement Parts

Based on replacement parts, the market is categorized into tires, batteries, brake pads, filters (air, oil, cabin), and lighting & electronic components, and others. The tires segment led the automotive aftermarket industry in 2023, reaching a valuation of USD 282.88 billion. This expansion is propelled by the increasing number of vehicles on the road, leading to surging demand for replacement tires. As the average age of vehicles increases, there is a rising need for tire replacement rises, thereby fueling segmental growth.

Additionally, advancements in tire technology, such as improved durability and performance, are prompting consumers to invest in new tires. The growing trend toward electric vehicles, which often require specialized tires, is further contributing to the expansion of the segment. Furthermore, rising consumer awareness regarding the importance of tire maintenance for safety and fuel efficiency is boosting sales.

By Distribution Channel

Based on distribution channel, the automotive aftermarket industry is classified into warehouse distributors, online retailers, original equipment manufacturers (OEM) parts, and others. The online retailers segment is likely to witness significant growth at a CAGR of 7.23% through the forecast period (2024-2031). This expansion is stimulated by the growing consumer preference for the convenience and accessibility offered by online shopping.

E-commerce platforms provide a wider selection of products, competitive pricing, and detailed product information, thereby enhancing the customer experience. The ability to easily compare products and read reviews is further appealing to consumers. Due to this, companies are increasingly allocating resources to bolster their online presence and enhance their digital marketing strategies to capture a larger portion of this growing segment.

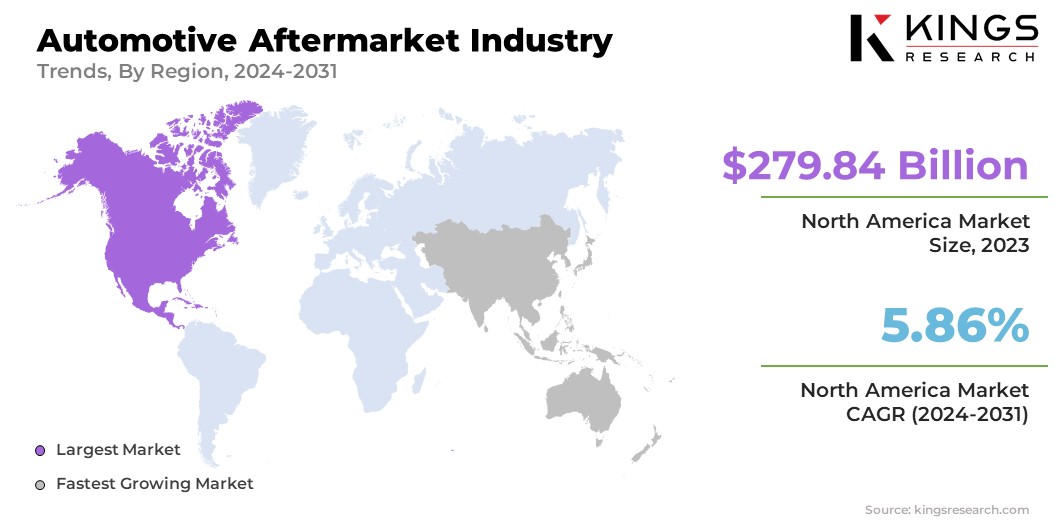

Automotive Aftermarket Industry Regional Analysis

Based on region, the global industry is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America automotive aftermarket industry share stood around 35.86% in 2023 in the global market, with a valuation of USD USD 279.84 billion. The region exhibits a notable prevalence of vehicle ownership and a significant number of aging vehicles, thereby augmenting the demand for maintenance and replacement parts.

Additionally, the presence of major automotive manufacturers and a well-established distribution network enhances regional market efficiency. Technological advancements and a strong focus on innovation contribute to the development of high-quality aftermarket products. Moreover, rising consumer awareness regarding vehicle maintenance and the availability of a wide range of products and services boost the North America industry.

Asia-Pacific is poised to experience significant growth at a CAGR of 6.32% through the estimated timeframe. This rapid growth is attributed to the rising proliferation of vehicles, particularly in emerging economies such as China and India. Rising disposable incomes and rapid urbanization are leading to higher vehicle ownership rates, thereby boosting demand for aftermarket products and services.

The region is witnessing a surge in e-commerce platforms, making it easier for consumers to access a wide variety of automotive parts. Additionally, the growing focus on vehicle safety and maintenance is supporting the expansion of the Asia-Pacific industry.

- According to the Society of Indian Automobile Manufacturers (SIAM), the total passenger vehicle sales in India increased by 26.73% during the FY 2022-2023 compared to the previous fiscal year.

Competitive Landscape

The global automotive aftermarket industry report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Automotive Aftermarket Industry

- 3M

- Continental Automotive Technologies GmbH

- Phinia Inc.

- Robert Bosch GmbH

- The Goodyear Tire & Rubber Company

- DENSO CORPORATION.

- DRiV Automotive Inc.

- HELLA GmbH & Co. KGaA

- VALEO SERVICE

- ZF Friedrichshafen AG

Key Industry Developments

- December 2023 (Launch): ZF Aftermarket launched 16 new SACHS CDC part numbers for passenger vehicles in the U.S. and Canada. This expansion included a range of BMW models and followed the initial launch at AAPEX 2023. ZF planned to unveil more CDC part numbers in early 2024. With over 34 million CDC dampers produced globally, ZF anticipated growing demand for their advanced damping technology in the aftermarket.

- September 2023 (Launch): Valeo expanded its FullPack DMFs line by introducing 24 new part numbers designed for major European and Asian vehicle models. The company had already been offering over 200 part numbers since mid-2023, providing comprehensive solutions for replacing Dual Mass Flywheels. Valeo emphasized its presence in German, French, and Asian applications, ensuring availability across main web catalogs. Additionally, Valeo recommended checking clutch kits and hydraulic bearings alongside flywheel replacements for optimal performance.

The global automotive aftermarket industry is segmented as:

By Replacement Parts

- Tires

- Batteries

- Brake pads

- Filters (Air, Oil, Cabin)

- Lighting & Electronic Components

- Others

By Distribution Channel

- Warehouse Distributors

- Online Retailers

- Original Equipment Manufacturers (OEM) Parts

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership