Advanced Materials and Chemicals

Automotive Chromium Market

Automotive Chromium Market Size, Share, Growth & Industry Analysis, By Application (Decorative Plating, Functional Plating), By End Use (Passenger Vehicles, Commercial Vehicles, Two-Wheelers), and Regional Analysis, 2024-2031

Pages : 140

Base Year : 2023

Release : January 2025

Report ID: KR1242

Automotive Chromium Market Size

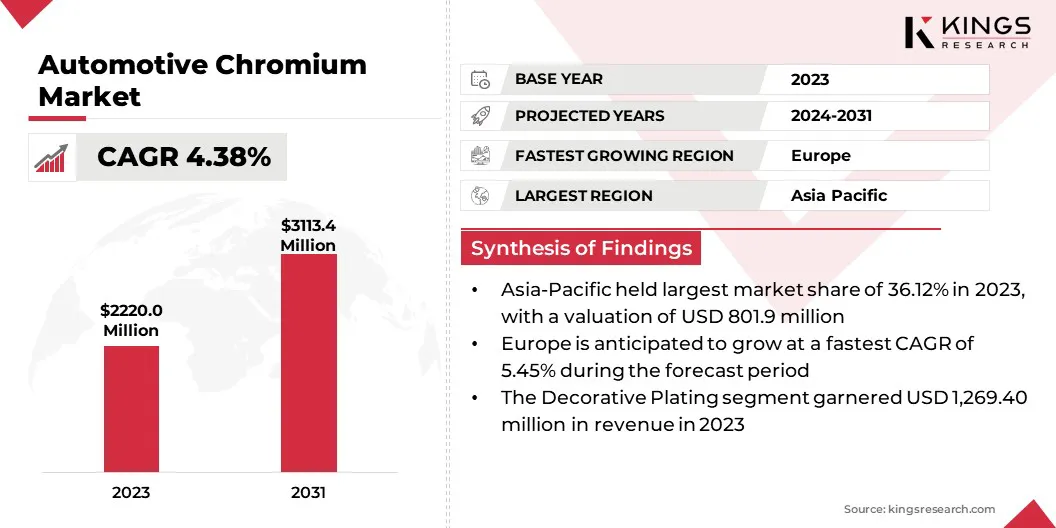

The global automotive chromium market size was valued at USD 2,220.0 million in 2023 and is projected to grow from USD 2,306.0 million in 2024 to USD 3,113.4 million by 2031, exhibiting a CAGR of 4.38% during the forecast period. The market is registering steady growth, due to the increasing demand for chrome plating and rising urbanization & industrialization in developing regions.

In the scope of work, the report includes service offered by companies such as American Electroplating Company, Arlington Plating Company, Borough, MICRO METAL FINISHING, Ashford Chroming, Royal Plating, Allied Finishing, Inc., Galva Decoparts Pvt. Ltd., Element Solutions Inc., and Plamingo d.o.o.

Rising production activities in the automotive sector are driving the automotive chromium market. The demand for vehicles continues to rise as automotive manufacturers are increasing their production to fulfil customer needs. Chromium, known for its durability, corrosion resistance, and esthetic appeal, is utilized in automotive applications such as electroplated components, trim, and alloys.

The shift to lightweight and fuel-efficient vehicles increases the adoption of chromium-plated parts, due to their ability to boost performance.

- According to the Society of Indian Automobile Manufacturers, around 28.4 million vehicles were produced in 2023-24.

The growing popularity of electric vehicles (EVs) is creating opportunities for chromium applications in inventive designs and advanced components.

Automotive chromium companies use chrome plating, an electroplating technique that applies a thin layer of chromium on metal surfaces like copper, stainless steel, and aluminum. The remaining product, chrome, is used for functional and decorative purposes. Chrome plating increases corrosion resistance, reduces cleaning time, and improves surface hardness.

Chrome plating is mainly used for plating vehicle components such as grills, bumpers, inner & outer door handle, and other parts. The chromium plating process involves cleaning dirt & impurities and degreasing. Several initiatives and regulations are imposed to lower the environmental impact of chromium plating.

Analyst’s Review

Rising demand for lightweight materials in EVs and commercial & passenger vehicles are boosting the demand for chromium. Companies are manufacturing chrome plating for all parts of vehicles.

They are utilizing metal plating such as nickel chrome plating, copper plating, and electroless nickel plating. Key automotive manufacturers use chromium for designing their vehicles. Companies offer services for interior as well as exterior parts of vehicles.

Several companies depend on raw materials such as hexavalent chromium compounds for electroplating. Regulations imposed by governments to reduce the environmental impact of chromium waste materials are driving the market.

- The EPA regulates chromium and its compounds through multiple statutes, including the Clean Air Act, Clean Water Act, CERCLA, RCRA, EPCRA, FIFRA, SDWA, and TSCA. These laws directly govern chromium in various industries and environments. Their main impact on CERCLA is the National Oil and Hazardous Substances Pollution Contingency Plan (NCP) requirement to consider chromium as a potential applicable or relevant and appropriate requirement (ARAR).

Automotive Chromium Market Growth Factors

The increasing demand for decorative chrome plating on account of its durability and corrosion resistance is driving the automotive chromium market. Automotive manufacturers are adopting decorative chrome finishes for vehicle’s interior and exterior components such as trims, grilles, and wheel accents, logos, and door handles.

The expanding automotive sector, mainly in developing regions, is increasing the demand for decorative chrome plating. This chrome plating offering superior corrosion resistance and wear durability. Advancements in plating technologies further are further boosting the market.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), total 92.7 million vehicles were sold in 2023.

The market faces challenges related to the harmful effect on environment and human health. Chemical compounds utilize in electroplating processes are toxic and their prolonged exposure causes skin irritation, respiratory problems, and risk of lung cancer. The improper disposal of contaminated waste pollutes soil and water, damaging aquatic ecosystems and contaminating water supplies.

Key market players are utilizing safer alternatives, which is environment friendly and less toxic. Sufficient ventilation at workplace and regular health monitoring aid in reducing health risks.

Automotive Chromium Market Trends

A shift toward eco-friendly processes, along with the rising awareness of environmental sustainability for cleaner and sustainable manufacturing practices, is driving the market. Chromium, used as a protective coating for automotive components, is undergoing transformation in terms of production methods.

Advancements emphasize on lowering the environmental impact of chromium plating processes, like the adoption of trivalent chromium plating over hexavalent chromium. Trivalent chromium offers durability and aesthetic appeal.

Manufacturers are investing in advanced closed-loop systems and enhanced filtration technologies to reduce pollutants and waste generated during plating processes. .

The growing adoption of EVs and increasing demand for unique and inventive designs are driving the market. Manufacturers emphasize on customization and esthetics to attract environmentally concerned customers. Chromium plating and finishes are increasingly being used to improve the appearance of EV components such as grilles, trims, wheels, and interiors.

The durability, corrosion resistance, and ability of chromium to offer a sleek, premium look make it a preferred material for developing distinctive EV designs. Inclination toward lightweight materials in EVs increases the use of chromium coatings. The need for chromium is anticipated to increase as the EV market grows.

- For instance, according to the International Energy Agency (IEA), in 2023 total 14 million EVs are sold, with 95% of these sales from the U.S., China, and Europe .

Segmentation Analysis

The global market has been segmented based on application, end use, and geography.

By Application

Based on application, the market has been bifurcated into decorative plating and functional plating. The decorative plating segment led the automotive chromium industry in 2023, reaching a valuation of USD 1,269.4 million. It is a high-performance coating used in vehicles to increase functionality and durability.

They are tough and long-lasting, offering corrosion resistance, chemical resistance, and good lubricity. They are used for decorative applications. They provide protection from environmental conditions. Additionally, they are useful for enhancing the sheet life.

By End Use

Based on end use, the automotive chromium market has been segmented into passenger vehicles, commercial vehicles, and two-wheelers. The passenger vehicles segment captured the largest market share of 47.32% in 2023. Chromium is used in passenger vehicles to enhance design and esthetics by chrome plating on a vehicle’s exterior parts, such as mirrors, grills, and door handles.

Automotive manufacturers utilize thin coatings to lower costs and environmental impact. It protects a vehicle’s components from corrosion, increases the lifespan of exterior parts of vehicles, and enhances the durability of components like trims and bumpers.

Automotive Chromium Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific Automotive Chromium Market held a substantial share of around 36.12% in 2023, valued at USD 801.9 million. Rapid growth in the automotive sector in developing countries is fostering the growth of the market. China is the largest consumer of automotive chromium, due to the rising number of EVs in the country.

South Korea and Japan have advanced automotive technologies, which increases the demand for chromium products for their vehicle parts, mainly in passenger and electric vehicles. The growing number of EVs and chromium manufacturing units is driving the market.

The market in Europe is anticipated to register the fastest growth at a CAGR of 5.45% over the forecast period. Rising demand for EVs & luxury vehicles and the increasing adoption of chromium are propelling the market.

The utilization of chrome plating to increase visual appeal has boosted vehicle sales. Germany has a robust automotive manufacturing presence in commercial and passenger vehicle production. Regulations in the region have propelled innovation in chromium-free and low-emission alternatives, thereby driving the market in the region.

Competitive Landscape

The global automotive chromium market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in R&D, establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create opportunities for market growth.

List of Key Companies in Automotive Chromium Market

- American Electroplating Company

- Arlington Plating Company

- Borough

- MICRO METAL FINISHING

- Ashford Chroming

- Royal Plating

- Allied Finishing, Inc.

- Galva Decoparts Pvt. Ltd.

- Element Solutions Inc.

- Plamingo d.o.o.

Key Industry Developments

- September 2023 (Expansion): MacDermid Enthone expanded its footprint in Japan by establishing a second facility in Nagoya. This new facility will offer technical services to Tier 1 and Tier 2 suppliers, as well as other enterprises, thereby increasing continuity and sustainability.

- August 2023 (Launch): Toyota Kirloskar Motor, an Indian automaker, launched the Toyota Rumion. This variant has a distinctive Toyota MPV front grille, a chrome-finished front bumper, LED tail lights with a chrome garnish on the rear door, and a stylish two-tone interior design.

The global automotive chromium market is segmented as:

By Application

- Decorative Plating

- Functional Plating

By End Use

- Passenger Vehicles

- Commercial Vehicles

- Two-wheelers

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership