Automotive and Transportation

Automotive E Compressor Market

Automotive E Compressor Market Size, Share, Growth & Industry Analysis, By Vehicle Type (Electric Vehicles (EVs), Hybrid Vehicles (HEVs), Internal Combustion Engine (ICE) Vehicles), By Component (Electric Motor, Compressor Housing), By Technology, By End User, and Regional Analysis, 2024-2031

Pages : 200

Base Year : 2023

Release : March 2025

Report ID: KR1432

Market Definition

The automotive e compressor market involves the production, distribution, and innovation of electric compressors used in vehicle air conditioning and thermal management systems. Unlike conventional belt-driven compressors, E-compressors are electrically powered, making them essential for hybrid and electric vehicles (EVs).

These compressors enhance cooling performance, optimize battery life, and contribute to overall vehicle energy efficiency. The market includes OEMs, component suppliers, and aftermarket players, with the market growth fueled by rising EV demand, technological advancements, and sustainability initiatives.

Automotive E Compressor Market Overview

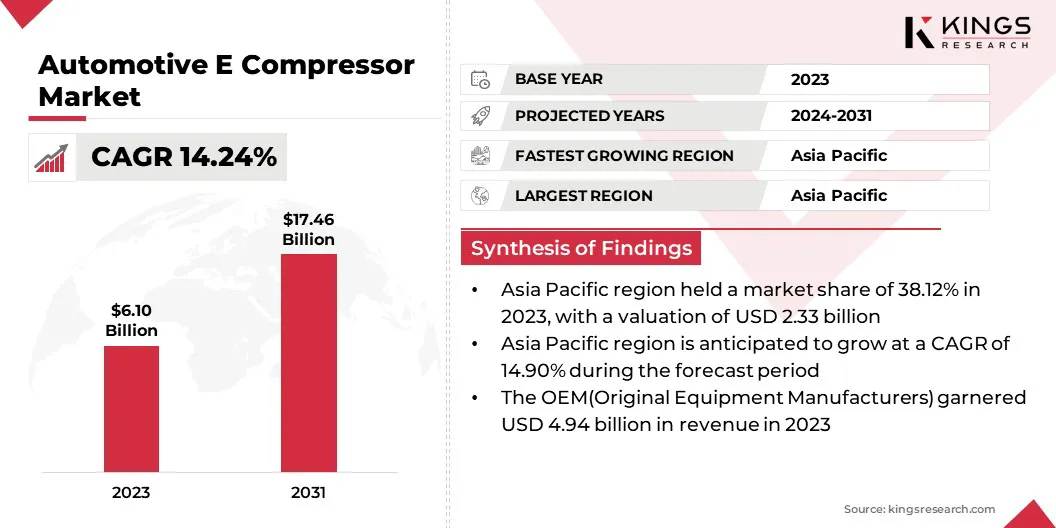

The global automotive e compressor market size was valued at USD 6.10 billion in 2023 and is projected to grow from USD 6.88 billion in 2024 to USD 17.46 billion by 2031, exhibiting a CAGR of 14.24% during the forecast period.

The market is driven by the increasing adoption of electric and hybrid vehicles, rising demand for energy-efficient HVAC systems, and advancements in vehicle thermal management technologies.

Stringent emission regulations and government incentives promoting EV production further fuel the demand for e-compressors. Continuous innovation in variable-speed and smart e-compressor technology is expected to enhance efficiency, further boosting the market globally.

Major companies operating in the global automotive e compressor industry are MITSUBISHI HEAVY INDUSTRIES, LTD., ZF Friedrichshafen AG, Hanon Systems, SCHOTT AG, Highly Marelli, Valeo, DENSO, Ingersoll Rand, Toyota Industries Corporation, Gardner Denver Transport, MAHLE GmbH, Robert Bosch GmbH, TCCI Manufacturing, SANDEN CORPORATION, and BorgWarner Inc.

Major automakers and component manufacturers are investing in next-generation thermal management solutions to enhance vehicle performance. Additionally, government incentives supporting EV adoption and expanding EV charging infrastructure are fueling the market, positioning e-compressors as a crucial component in the future of mobility.

Key Highlights:

- The global automotive e compressor market size was valued at USD 6.10 billion in 2023.

- The market is projected to grow at a CAGR of 14.24% from 2024 to 2031.

- Asia Pacific held a market share of 38.12% in 2023, with a valuation of USD 2.33 billion.

- The electric vehicles (EVs) segment garnered USD 3.42 billion in revenue in 2023.

- The electric motor segment is expected to reach USD 11.46 billion by 2031.

- The brushless DC (BLDC) motors segment is expected to reach USD 14.02 billion by 2031.

- The OEM (Original Equipment Manufacturers) segment is expected to reach USD 13.79 billion by 2031.

- The market in North America is anticipated to grow at a CAGR of 14.21% during the forecast period.

Market Driver

"Growing Electrification in the Automotive Industry"

The automotive e compressor market is registering significant growth, due to the increasing adoption of electric and hybrid vehicles (EVs and HEVs). Governments are implementing stringent emission regulations and incentivizing EV production, prompting automakers to shift toward electrification, fueling the demand for energy-efficient components like e-compressors.

Unlike traditional belt-driven compressors, e-compressors operate independently of the internal combustion engine, making them essential for EVs that rely on battery-powered HVAC systems.

Additionally, e-compressors enhance vehicle efficiency by reducing energy consumption and optimizing thermal management, thereby improving battery performance and extending driving range. As EV adoption continues to rise globally, the market is poised for sustained expansion, driven by technological advancements and regulatory support.

- In 2023, according to the International Energy Agency (IEA), nearly 14 million new electric cars were registered globally, reaching 40 million on the roads and marking a 35% year-on-year growth, accelerating the trend of EV adoption in the market.

Market Challenge

"High Initial Cost of E Compressors"

One of the key challenges in the automotive e compressor market is the high initial cost associated with electric compressors compared to conventional systems. E-compressors require advanced electronics, precision engineering, and integration with vehicle battery management systems, leading to higher production costs.

This cost factor can hinder widespread adoption, particularly in price-sensitive markets. Automakers and suppliers are focusing on economies of scale and technological innovations to reduce manufacturing costs.

Investments in next-generation materials, improved energy efficiency, and modular designs are helping bring costs down. Additionally, government incentives and subsidies for EV adoption indirectly support the affordability of e-compressors, making them a viable option for a broader market.

Market Trend

"Integration of E Compressor with Advanced Thermal Management Systems"

A significant trend in the automotive e compressor market is the increasing integration of e-compressors with advanced thermal management systems in electric and hybrid vehicles. As EV adoption accelerates, efficient thermal management is becoming a critical focus for automakers to enhance battery performance, prevent overheating, and improve overall vehicle efficiency.

E-compressors are now being integrated with liquid cooling systems, heat pumps, and intelligent HVAC controls to provide optimized temperature regulation for both the cabin and powertrain components.

This trend is particularly important as extreme temperatures can significantly impact battery efficiency and vehicle range. Additionally, the adoption of heat pump technology in EVs, which utilizes e-compressors to enhance heating efficiency in colder climates, is further driving the market.

Automotive E Compressor Market Report Snapshot

|

Segmentation |

Details |

|

By Vehicle Type |

Electric Vehicles (EVs), Hybrid Vehicles (HEVs), Internal Combustion Engine (ICE) Vehicles |

|

By Component |

Electric Motor, Compressor Housing |

|

By Technology |

Brushless DC (BLDC) Motors, Synchronous Motors |

|

By End User |

OEM (Original Equipment Manufacturers), Aftermarket |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Vehicle Type (Electric Vehicles (EVs), Hybrid Vehicles (HEVs), Internal Combustion Engine (ICE) Vehicles): The electric vehicles (EVs) segment earned USD 3.42 billion in 2023, due to the growing adoption of EVs, government incentives for EV manufacturing, and the need for efficient thermal management systems to optimize battery performance and driving range.

- By Component (Electric Motor, Compressor Housing): The electric motor segment held 68.09% share of the market in 2023, due to the high efficiency, improved durability, and reduced maintenance requirements of electric motors compared to conventional alternatives.

- By Technology (Brushless DC (BLDC) Motors, Synchronous Motors): The brushless dc (BLDC) motors segment is projected to reach USD 14.02 billion by 2031, owing to its superior energy efficiency, longer lifespan, and ability to deliver variable-speed operation, which optimizes cooling performance in EVs and HEVs.

- By End User (OEM (Original Equipment Manufacturers), Aftermarket): The OEM (Original Equipment Manufacturers) segment is projected to reach USD 13.79 billion by 2031, owing to the rising production of electric and hybrid vehicles, increasing partnerships between automakers and e-compressor manufacturers, and growing investments in next-generation HVAC systems.

Automotive E Compressor Market Regional Analysis

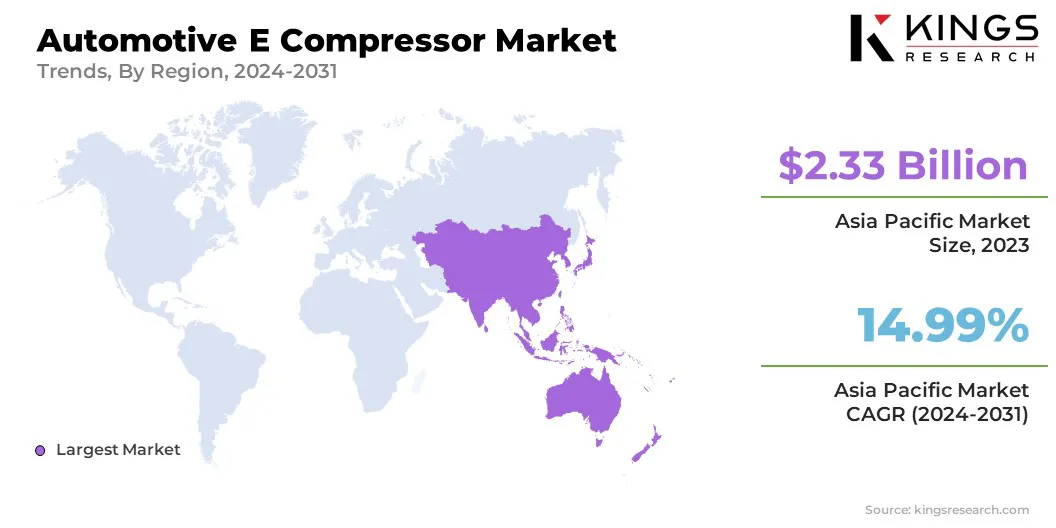

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a automotive e compressor market share of around 38.12% in 2023, with a valuation of USD 2.33 billion. The market is driven by the rapid expansion of electric and hybrid vehicle production in China, Japan, and South Korea.

Government incentives, subsidies, and strict emission regulations are encouraging automakers to adopt energy-efficient thermal management solutions. The presence of leading EV manufacturers and component suppliers further strengthens market growth. Asia Pacific remains adominant region in the market, due to increasing investments in EV infrastructure and smart automotive technologies.

- In China, the 35% surge in new electric car registrations, reaching 8.1 million in 2023, has significantly boosted the demand for advanced e-compressors. This rapid EV expansion is driving innovation in energy-efficient thermal management solutions, strengthening market opportunities for automotive e compressor manufacturers catering to the growing electrification trend.

The automotive e compressor industry in North America is poised to grow at a significant growth at a CAGR of 14.21% over the forecast period, driven by the rising adoption of EVs, stringent emission regulations, and increasing investments in advanced automotive technologies.

The presence of major automakers such as Tesla, General Motors, and Ford is accelerating the demand for high-efficiency e-compressors to optimize vehicle performance and battery life.

Additionally, government policies and incentives supporting EV adoption, coupled with advancements in next-generation thermal management systems, are fueling the market. The growing focus on sustainability and energy efficiency positions North America as a key growth region in the market.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates the market by enforcing environmental standards that govern vehicle emissions, refrigerant usage, and overall energy efficiency. The EPA also sets guidelines for manufacturers to develop energy-efficient components, including electric compressors, which play a critical role in improving vehicle performance while minimizing environmental impact.

- In Europe, the European Commission regulates the automotive e compressor market, ensuring compliance with industry standards, safety requirements, and technological advancements.

Competitive Landscape:

The global automotive e compressor market is characterized by a large number of participants, including established corporations and emerging organizations. Leading automotive component manufacturers are investing in R&D, strategic partnerships, and production capacity expansion to strengthen their position.

Key players focus on developing advanced e-compressors with higher energy efficiency, reduced noise levels, and improved thermal management capabilities. Additionally, increasing mergers, acquisitions, and collaborations are shaping the competitive landscape as companies aim to enhance their technological expertise and global reach.

Companies are also focusing on lightweight designs, eco-friendly refrigerants, and AI-driven thermal management systems to gain a competitive edge. Asia Pacific dominates manufacturing, with key suppliers expanding operations to meet the growing EV demand.

Additionally, regulatory compliance and cost optimization remain critical factors that influence market positioning. Continuous technological advancements and product differentiation will drive competition further. Rising EV adoption is expected to intensify competition, driving continuous innovation in automotive e compressor solutions.

- In October 2024, thyssenkrupp AG unveils cutting-edge innovations for EVs at the International Suppliers Fair (IZB), highlighting advancements in e-mobility solutions. These developments, including next-generation e-compressors, showcase the industry's commitment to enhancing thermal management efficiency and driving the transition toward vehicle electrification.

List of Key Companies in Automotive E Compressor Market:

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- ZF Friedrichshafen AG

- Hanon Systems

- SCHOTT AG

- Highly Marelli

- Valeo

- DENSO

- Ingersoll Rand

- Toyota Industries Corporation

- Gardner Denver Transport

- MAHLE GmbH

- Robert Bosch GmbH

- TCCI Manufacturing

- SANDEN CORPORATION

- BorgWarner Inc.

Recent Developments (New Product Launch)

- In June 2024, Vibracoustic launched an advanced NVH solution for thermal management systems in EVs, enhancing e-compressor performance by reducing noise and vibration. This innovation aligns with the growing demand for efficient and quieter e-compressors, reinforcing the market’s shift toward high-performance thermal management solutions in EVs.

- In February 2024, Cummins Inc. launched its first e-compressor for fuel cell engines, reinforcing the growing demand for advanced thermal management solutions in zero-emission vehicles. This strategic move strengthens its position in the market, aligning with the industry’s shift toward electrification and sustainable mobility.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)