Automotive and Transportation

Automotive E-Tailing Market

Automotive E-Tailing Market Size, Share, Growth & Industry Analysis, By Component (Electrical Components, Infotainment and Multimedia, Engine Components, Tires and Wheel, Others), By Vendor (OEM, Third Party Vendors), By Vehicle (Two Wheeler, Passenger Car), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : March 2025

Report ID: KR1513

Market Definition

The automotive e-tailing market involves the online retailing of automotive components, accessories, and services through digital platforms. This market encompasses a structured process where manufacturers, suppliers, and third-party vendors list products on e-commerce websites, allowing consumers, repair shops, and businesses to browse, compare, and purchase parts remotely.

Automotive e-tailing covers a wide range of products, including replacement parts, performance-enhancing components, lubricants, and electronic accessories, catering to both routine maintenance and vehicle customization.

Advanced digital tools, such as AI-driven recommendations and virtual fitment guides, streamline purchasing decisions, ensuring compatibility and efficiency. Applications span passenger and commercial vehicles, enhancing accessibility and convenience.

Automotive E-Tailing Market Overview

The global automotive e-tailing market size was valued at USD 45.42 billion in 2023 and is projected to grow from USD 52.54 billion in 2024 to USD 156.58 billion by 2031, exhibiting a CAGR of 16.88% during the forecast period. This growth is driven by the rising adoption of digital platforms, enabling seamless online purchasing and streamlined procurement processes.

The increasing preference for the convenience of e-commerce in auto parts supports market expansion, while advancements in logistics and supply chain management enhance delivery efficiency. The growing demand for cost-effective and certified refurbished auto components further supports this growth.

Major companies operating in the global automotive e-tailing industry are Amazon.com, Inc., Alibaba Group Holding Limited, eBay Inc., AutoZone, Inc., Advance Auto Parts, Inc., O'Reilly Automotive, Inc., Walmart Inc., Delticom AG, CARiD.com, RockAuto, LLC, K&N Engineering, Inc., CarParts.com, Inc., PartsGeek, JEGS High Performance, Genuine Parts Company, and others.

The increasing penetration of e-commerce platforms has accelerated market growth. Consumers are increasingly opting for online purchases due to the convenience of browsing extensive product catalogs, comparing prices, and accessing detailed specifications.

Digital payment solutions, user-friendly interfaces, and secure transactions enhance the customer experience. The expansion of third-party marketplaces, direct-to-consumer (DTC) channels, and specialized automotive e-tailing platforms is fueling market expansion.

Companies are leveraging digital tools, such as AI-driven recommendations and personalized marketing strategies, to optimize sales conversions and improve customer retention.

- According to the International Trade Administration report, global B2C e-commerce revenue is projected to reach USD 5.5 trillion by 2027, expanding at a steady CAGR of 14.4%. During the same period, the global retail e-commerce market is expected to grow at an estimated CAGR of 11.16%.

Key Highlights:

- The global automotive e-tailing market size was recorded at USD 45.42 billion in 2023.

- The market is projected to grow at a CAGR of 16.88% from 2024 to 2031.

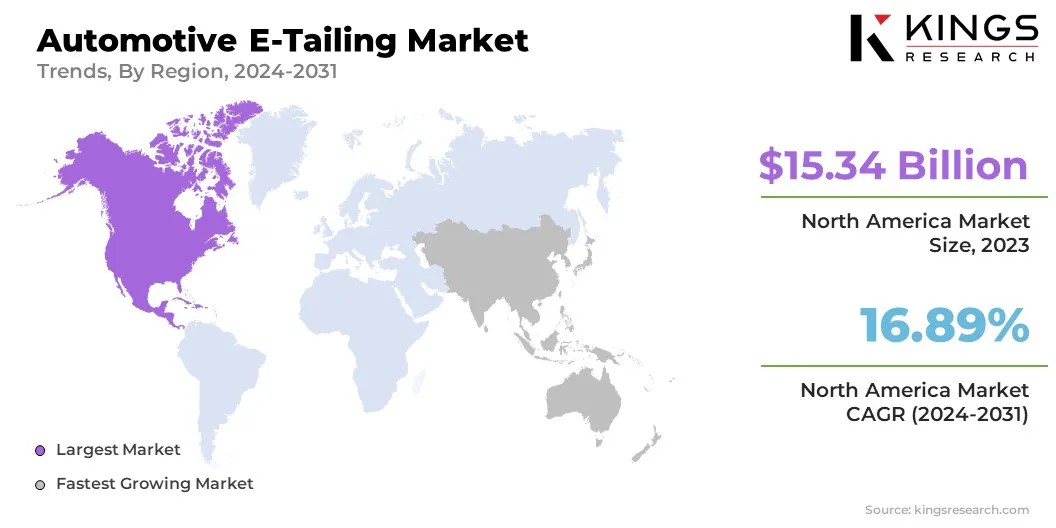

- North America held a share of 33.78% in 2023, valued at USD 15.34 billion.

- The electrical components segment garnered USD 12.17 billion in revenue in 2023.

- The third party vendors segment is expected to reach USD 90.77 billion by 2031.

- The two wheeler is poised to grow at a robust CAGR of 16.92% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 17.90% through the estimated timeframe.

Market Driver

"Rising Demand for Aftermarket Automotive Components"

The growing demand for replacement parts and performance-enhancing accessories is propelling the growth of the automotive e-tailing market. Extended vehicle lifespan and ownership have created a strong demand for cost-effective aftermarket components.

Consumers prefer e-tailing platforms due to their extensive product offerings and competitive pricing compared to traditional retail stores. The availability of a wide range of genuine, OEM, and third-party replacement parts has positioned e-tailing platforms as a preferred channel for vehicle maintenance and customization. The convinience of sourcing rare components and doorstep delivery further fosters adoption.

- In June 2024, the Auto Care Association, in partnership with MEMA Aftermarket Suppliers, reported that U.S. aftermarket sales grew by 8.6% in 2023, reaching USD 391 billion. The market is expected to expand further, with a projected 5.9% increase in 2024, and an average annual growth rate of 4.5% from 2025 to 2027.

Market Challenge

"Supply Chain Disruptions Impacting Product Availability"

Supply chain disruptions pose a significant challenge to the growth of the automotive e-tailing market, affecting inventory management and timely product deliveries. Fluctuations in raw material availability, logistical bottlenecks, and transportation delays hinder market expansion.

To address these issues, companies are investing in advanced inventory management systems, expanding regional distribution centers, and forming strategic partnerships with logistics providers.

Additionally, the adoption of artificial intelligence (AI) and data analytics enhances demand forecasting, reducing stock shortages and optimizing supply chain efficiency. These measures ensure a seamless product flow, improving customer satisfaction and sustaining market growth.

Market Trend

"Rising Demand for Electric Vehicle (EV) Components"

The expansion of the EV sector has created a strong demand for EV-specific components, influencing the automotive e-tailing market. Consumers require specialized parts such as high-performance batteries, charging accessories, and powertrain components.

E-tailing platforms are expanding their product portfolios to cater to EV owners, ensuring convenient access to certified replacement parts and performance upgrades.

The increasing availability of online resources, including installation guides and compatibility tools, has simplified the purchasing process. The growing adoption of EVs and continuous innovations in component technology are expected to support market growth.

- The International Energy Agency's 2024 report highlights that rising EV sales continue to increase battery demand. In 2023, global EV battery demand exceeded 750 GWh, reflecting a 40% increase from 2022. Approximately 95% of this growth was attributed to higher EV sales, while the remaining 5% resulted from larger average battery sizes, supported by the growing share of SUVs.

Automotive E-Tailing Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Electrical Components, Infotainment and Multimedia, Engine Components, Tires and Wheel, Others |

|

By Vendor |

OEM, Third Party Vendors |

|

By Vehicle |

Two Wheeler, Passenger Car, Commercial Vehicle |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Component (Electrical Components, Infotainment and Multimedia, Engine Components, Tires and Wheel, and Others): The electrical components segment earned USD 12.17 billion in 2023 due to the rising demand for advanced vehicle electronics, including sensors, batteries, and infotainment systems, amid increasing vehicle electrification and technological advancements.

- By Vendor (OEM and Third Party Vendors): The third party vendors segment held a share of 57.91% in 2023, mainly propelled by its extensive product variety, competitive pricing, and established logistics networks, enabling wider consumer reach and seamless order fulfillment.

- By Vehicle (Two Wheeler, Passenger Car, and Commercial Vehicle): The passenger car segment is projected to reach USD 60.23 billion by 2031, owing to the high vehicle ownership rate, increasing consumer preference for online auto parts purchases, and the growing demand for cost-effective maintenance solutions, driving consistent aftermarket sales.

Automotive E-Tailing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America automotive e-tailing market share stood at around 33.78% in 2023, valued at USD 15.34 billion. This growth is influenced by established e-commerce giants such as Amazon, eBay Motors, and RockAuto, which have transformed online auto parts purchasing.

These platforms offer extensive product catalogs, competitive pricing, and fast delivery, making them preferred choices for vehicle owners and repair shops. Their advanced AI-driven recommendation engines and seamless return policies have reinforced consumer trust.

This dominance has intensified competition among traditional auto retailers, compelling them to enhance their digital presence and optimize their supply chains to meet evolving customer expectations.

Additionally, major North American automakers, including General Motors, Ford, and Stellantis, have been expanding their direct-to-consumer (DTC) online parts stores. These platforms allow customers to purchase genuine OEM parts directly from manufacturers, ensuring quality and warranty-backed products.

GM’s ACDelco and FordParts.com have gained traction by offering exclusive online promotions and direct shipping options. This shift has reduced dependency on third-party distributors and strengthened brand loyalty.

The ability to access manufacturer-verified components without visiting dealerships has positioned OEM-backed e-commerce platforms as a major factor fueling regional market growth.

Asia Pacific automotive e-tailing industry is set to grow at a robust CAGR of 17.90% over the forecast period. Countries such as China, India, Japan, and South Korea have emerged as global manufacturing hubs for automotive parts, supplying both OEM and aftermarket components.

China leads in mass production, benefiting from economies of scale, while Japan and South Korea specialize in advanced automotive technologies, including electric drivetrains and precision engineering.

India’s auto component sector is expanding due to government-led incentives, such as the Production-Linked Incentive (PLI) scheme, fostering domestic manufacturing and export growth.

- According to the 2024 report by the India Brand Equity Foundation, the Indian automobile component industry recorded a turnover of USD 74.1 billion in FY24, reflecting a 9.8% revenue increase compared to FY23. The aftermarket segment for auto components expanded by 10.0% during FY24, reaching USD 11.3 billion. Between FY16 and FY24, the industry experienced a compound annual growth rate (CAGR) of 8.63%.

Furthermore, the increasing cross-border trade of automotive parts in Asia-Pacific, facilitated by regional trade agreements such as the Regional Comprehensive Economic Partnership (RCEP), has boosted regional market expansion.

Chinese manufacturers are expanding their presence in markets sucjh as Indonesia, Vietnam, and Thailand through online platforms, offering cost-effective spare parts to independent repair shops and end consumers.

Additionally, Japanese suppliers are leveraging e-commerce to reach emerging markets, ensuring steady supply chain integration. The seamless digitalization of international trade networks has enabled faster delivery times and enhanced market access for automotive components across the region.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) enforces regulations to ensure fair business practices and data security in e-commerce transactions. These guidelines apply to automotive e-tailing platforms, mandating transparency in advertising, pricing, and consumer rights. In January 2025, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) issued a final rule addressing national security risks associated with connected vehicles and their supply chains. This rule requires heightened attention and proactive compliance from industry participants, impacting the importation and use of vehicle components with potential links to foreign adversaries.

- The EU's E-Commerce Directive establishes a legal framework for online services, including automotive e-tailing, ensuring the free movement of information society services between member states. Automotive components sold online must comply with EU safety and environmental standards.

- China's E-Commerce Law regulates online commercial activities, requiring automotive e-tailers to ensure product authenticity, protect consumer rights, and comply with cybersecurity measures.

- Japan enforces the Act on Specified Commercial Transactions to regulate e-commerce, ensuring transparency and consumer protection in online automotive parts sales.

Competitive Landscape

Key players operating in the automotive e-tailing market are implementing strategic initiatives to enhance their competitive edge and drive market expansion. Companies are increasingly focusing on e-commerce integrations that streamline procurement for dealers through pre-negotiated pricing.

Such platforms enhance operational efficiency and foster stronger vendor relationshipst. Additionally, businesses are leveraging digital transformation, strategic partnerships, and advanced logistics solutions to optimize the online retail experience, ensuring seamless transactions and improved customer engagement.

- In January 2024, FordDirect introduced "The Shop," an e-commerce platform enabling dealers to procure products and services at pre-negotiated prices. By providing access to vetted vendors, the platform streamlines procurement, reducing time spent on vendor searches and rate negotiations.

List of Key Companies in Automotive E-Tailing Market:

- Amazon.com, Inc.

- Alibaba Group Holding Limited

- eBay Inc.

- AutoZone, Inc.

- Advance Auto Parts, Inc.

- O'Reilly Automotive, Inc.

- Walmart Inc.

- Delticom AG

- CARiD.com

- RockAuto, LLC

- K&N Engineering, Inc.

- com, Inc.

- PartsGeek

- JEGS High Performance

- Genuine Parts Company

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In February 2025, Stellantis expanded its business-to-business (B2B) e-commerce platform in North America, enabling repair shops, dealerships, and fleet operators to access one million reconditioned service parts across 35 product lines. As part of this expansion, the company enhanced B-Parts’ e-commerce capabilities, simplifying the procurement process for certified used auto parts.

- In May 2024, Genuine Parts Company acquired Motor Parts & Equipment Corporation (MPEC), the largest independent owner of NAPA Auto Parts stores in the U.S., to strengthen its automotive business. This strategic move enhances market presence, improves distribution capabilities, expands product availability, and streamlins supply chain operations.

- In December 2023, Garrett Motion introduced Garrett Marketplace, an advanced e-commerce platform launched by Garrett Performance, providing racing enthusiasts direct access to its engineering expertise. Now available in the U.S., Europe, and Australia, the platform enhances customer engagement and expands the company's digital presence in the automotive e-tailing market.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership