Automotive and Transportation

Automotive Head Up Display Market

Automotive Head Up Display Market Size, Share, Growth & Industry Analysis, By Type (Combiner HUD, Windshield HUD), By Dimension Type (2D HUD, 3D HUD), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Propulsion Type, and Regional Analysis, 2024-2031

Pages : 140

Base Year : 2023

Release : March 2025

Report ID: KR1422

Market Definition

The automotive Head Up Display (HUD) market focuses on systems that project important driving information onto the windshield, allowing drivers to access data without diverting attention from the road.

The market includes hardware, software, and services, driven by the rising demand for advanced safety features, convenience, and cutting-edge in-car technologies. The market growth is attributed to the trends in autonomous driving and electric vehicles (EVs).

Automotive Head Up Display Market Overview

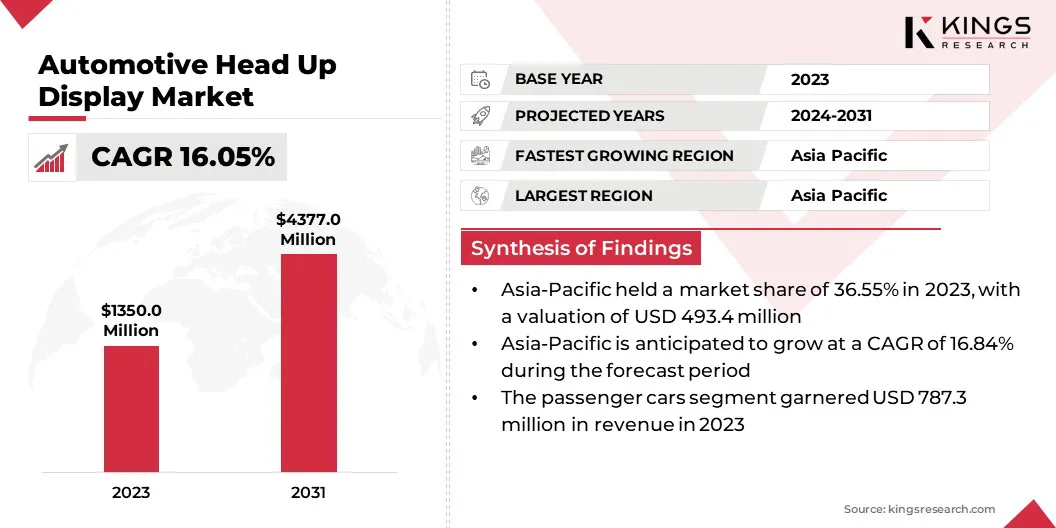

The global automotive head up display market size was valued at USD 1,350.0 million in 2023, which is estimated to be valued at USD 1,543.8 million in 2024 and reach USD 4,377.0 million by 2031, growing at a CAGR of 16.05% from 2024 to 2031.

The growing demand for advanced safety features, such as collision avoidance, lane-keeping assistance, and real-time alerts, is driving the automotive HUD market. These systems enhance driver awareness, reduce distractions, and improve overall safety, making HUD technology a crucial feature in modern vehicles.

Major companies operating in the global automotive head up display industry are Nippon Seiki Co., Ltd., Panasonic Corporation, VALEO, Continental AG, YAZAKI Corporation, DENSO INTERNATIONAL AMERICA, INC, Foryou Corporation, Visteon Corporation, Huawei Technologies Co., Ltd., LG Electronics, Garmin Ltd., Texas Instruments Incorporated, Toshiba Electronic Devices & Storage Corporation, NVIDIA, and Mitsubishi Motors Corporation.

The market is transforming the way drivers interact with their vehicles, offering a more intuitive and safer driving experience. HUD technology projects essential information directly onto the windshield, allowing drivers to maintain focus on the road while receiving real-time data.

This innovation enhances vehicle safety, convenience, and overall user experience. As automotive technology continues to evolve, HUD systems are becoming integral to modern vehicles, providing a seamless blend of functionality and futuristic design.

- In October 2024, HARMAN's Ready Vision QVUE was named the “Head-Up Display (HUD) Solution of the Year” at the AutoTech Breakthrough Awards. This innovative HUD technology uses Samsung’s Neo QLED to project vivid, high-resolution information on the lower windshield, enhancing driver safety and experience by providing real-time data like EV charging status and weather updates, all in the driver’s line of sight.

Key Highlights:

- The global automotive head up display market size was valued at USD 1,350.0 million in 2023.

- The market is projected to grow at a CAGR of 16.05% from 2024 to 2031.

- Asia Pacific held a market share of 36.55% in 2023, with a valuation of USD 493.4 million.

- The windshield HUD segment garnered USD 746.1 million in revenue in 2023.

- The 2D HUD segment is expected to reach USD 2,384.0 million by 2031.

- The passenger cars segment held a market share of 58.32% in 2023.

- The Electric Vehicles (EVs) segment is expected to register a CAGR of 17.91% during the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 16.64% during the forecast period.

Market Driver

"Consumer Demand for Enhanced In-car Technology"

Rising consumer preference for advanced in-car technologies is a significant growth driver of the automotive HUD market. HUDs provide a seamless and safer way to access essential information as drivers seek more convenience and intuitive features.

HUD systems enhance the overall driving experience by displaying real-time data like navigation, speed, and safety alerts directly on the windshield. This demand for smarter, user-friendly tech solutions in vehicles continues to propel the adoption of HUD technologies globally.

- In September 2024, Mojo Vision partnered with CY Vision to develop next-gen AR HUDs using micro-LED technology. These HUDs offer immersive, high-resolution displays, enhancing driver safety & experience and aligning with growing consumer demand for advanced, convenient in-car technologies.

Market Challenge

"Display Clarity in Varied Lighting Conditions"

A key challenge in the automotive HUD market is maintaining clear display visibility under different lighting conditions, especially in bright sunlight. Advanced technologies like micro-LED displays with high brightness, superior contrast, and resolution are used to meet this challenge.

These improvements ensure that vital information remains visible to drivers, reducing glare and preventing issues like color distortion, regardless of environmental lighting.

Market Trend

"Technological Advancements"

The automotive HUD market is registering significant technological advancements, particularly with the integration of augmented reality (AR) and micro-LED displays. These innovations enhance user experience by providing high-resolution, interactive, and immersive data projections on the windshield.

Additionally, HUD systems are becoming more energy-efficient and adaptable, with improved visibility in diverse lighting conditions. Such advancements are making HUDs more intuitive, safer, and visually appealing, driving the evolution of in-car technology and transforming the driving experience.

- In January 2025, Hyundai Mobis unveiled a groundbreaking Holographic HUD, offering a transparent display for all vehicle information. Developed in collaboration with ZEISS, this technology, set for release by 2027, marks a major advancement in automotive display innovation.

Automotive Head Up Display Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Combiner HUD, Windshield HUD |

|

By Dimension Type |

2D HUD, 3D HUD |

|

By Vehicle Type |

Passenger Cars, Commercial Vehicles |

|

By Propulsion Type |

Internal Combustion Engine (ICE) Vehicles, Electric Vehicles (EVs) |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Combiner HUD, Windshield HUD): The windshield HUD segment earned USD 746.1 million in 2023, due to its ability to provide clear, real-time information directly on the windshield, improving driver convenience and safety.

- By Dimension Type (2D HUD, 3D HUD): The 2D HUD segment held 57.53% share of the market in 2023, due to its simpler, cost-effective design and widespread use in mainstream vehicles for basic display functionality.

- By Vehicle Type (Passenger Cars, Commercial Vehicles): The passenger cars segment is projected to reach USD 2,562.0 million by 2031, owing to the increased demand for advanced technology and safety features in personal vehicles.

- By Propulsion Type [Internal Combustion Engine (ICE) Vehicles, Electric Vehicles (EVs)]: The Electric Vehicles (EVs) segment is anticipated to register a CAGR of 17.91% during the forecast period, driven by the rising adoption of high-tech features and sustainability trends in EVs.

Automotive Head Up Display Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

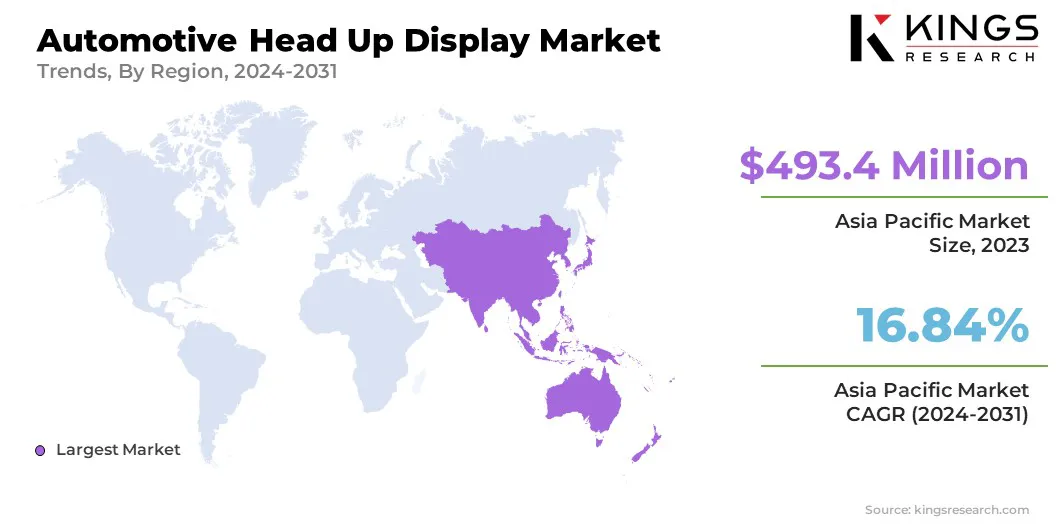

Asia Pacific accounted for a automotive head up display market share of around 36.55% in 2023, with a valuation of USD 493.4 million. Asia Pacific holds the largest share of the automotive HUD market, due to the high demand for advanced in-car technologies, especially in countries like China, Japan, and South Korea.

The region's strong automotive manufacturing base, combined with increasing consumer interest in smart, connected vehicles, is driving growth. Additionally, the rise in EV adoption, along with technological advancements in HUDs, further supports Asia Pacific's dominance in the global automotive HUD market.

- In September 2024, Smartkem showcased its disruptive organic thin-film transistor (OTFT) technology at both the PlayNitride 2024 MicroLED Technology Forum and SEMICON Taiwan 2024, highlighting its potential for next-generation displays, including automotive HUDs.

The automotive head up display industry in Europe is poised for significant growth at a robust CAGR of 16.64% over the forecast period. Europe is the fastest-growing region in the market, fueled by the rapid adoption of advanced safety and infotainment technologies.

Strong presence of premium and luxury car manufacturers focused on enhancing driver experience is boosting the demand for HUD systems in the region. Consumer demand for cutting-edge automotive innovations, coupled with stringent safety regulations in the region, is driving this growth. The increasing push for EVs and the integration of AR further accelerate the regional market growth.

- In October 2024, Hyundai Mobis partnered with ZEISS, a German company, to develop the "Holographic Windshield Display," transforming the entire windshield into a full-display screen. This innovative technology replaces traditional instrument clusters and AVNs, enhancing user experience with driving information, navigation, and convenience features.

Regulatory Frameworks

- The National Highway Traffic Safety Administration is responsible for keeping people safe on America's roadways. Through enforcing vehicle performance standards and partnerships with state and local governments, NHTSA reduces deaths, injuries and economic losses from motor vehicle crashes.

- In India, the Bureau of Indian Standards (BIS) sets regulations for HUDs, including display size, clarity, and integration with safety features like collision warnings.

Competitive Landscape:

The global automotive head up display market is characterized by a large number of participants, including established corporations and rising organizations. Partnerships between companies in the automotive head-up display market are crucial for advancing technology and driving innovation.

These collaborations focus on enhancing display clarity, integrating AR, and improving energy efficiency. Companies aim to deliver cutting-edge solutions that enhance driver safety, user experience, and overall vehicle performance by combining their expertise in display technology, sensors, and software development.

- In September 2024, TriLite secured over USD 20.9 million in Series A funding, with strategic investments from Continental and a global electronics supplier. This funding will enhance the development of TriLite's Trixel 3 projection display, advancing its applications in automotive HUD systems and AR and driving innovation in both markets.

List of Key Companies in Automotive Head Up Display Market:

- Nippon Seiki Co., Ltd.

- Panasonic Corporation

- VALEO

- Continental AG

- YAZAKI Corporation

- DENSO INTERNATIONAL AMERICA, INC

- Foryou Corporation

- Visteon Corporation

- Huawei Technologies Co., Ltd.

- LG Electronics

- Garmin Ltd.

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

- NVIDIA

- Mitsubishi Motors Corporation

Recent Developments (Launch/Partnership)

- In January 2023, HARMAN unveiled the Ready Vision AR HUD, offering a large field-of-view and wedgeless design. This innovative HUD provides immersive audio-visual experiences, delivering timely, non-intrusive information for enhanced driver safety and awareness, integrating sensors, and real-time alerts.

- In March 2024, Panasonic announced the installation of full-display meters in Mazda's CX-70. This 12.3-inch display system enhances driver safety with 3D stereoscopic graphics, customizable modes, and seamless transitions, elevating the driving experience with timely, high-quality visual information tailored to driving conditions.

- In July 2023, FPT Software partnered with Nippon Seiki to develop software for its automotive HUD products. This strategic alliance will enhance human-machine interfaces and accelerate technological innovation, focusing on delivering high-quality products for vehicle manufacturers globally.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership