Automotive and Transportation

Autonomous Bus Market

Autonomous Bus Market Size, Share, Growth & Industry Analysis, By Level of Autonomy (Level 3, Level 4, Level 5), By Propulsion (Diesel, Electric, Hybrid), By Application (Intercity, Intracity), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : March 2025

Report ID: KR1441

Market Definition

The autonomous bus market refers to the industry focused on the development, production, and deployment of self-driving buses equipped with advanced technologies such as artificial intelligence, LiDAR, radar, and GPS for autonomous navigation.

These buses operate with minimal or no human intervention, enhancing efficiency, safety, and sustainability in public transportation systems. The market encompasses various levels of automation, from driver-assisted to fully autonomous buses, catering to urban, intercity, and shuttle-based transit applications.

Autonomous Bus Market Overview

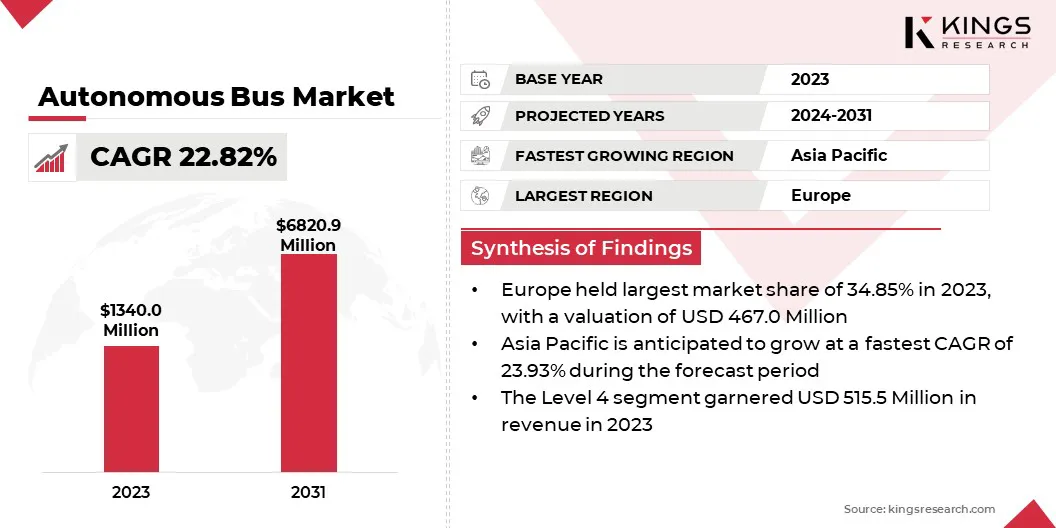

The global autonomous bus market size was valued at USD 1340.0 million in 2023 and is projected to grow from USD 1617.5 million in 2024 to USD 6820.9 million by 2031, exhibiting a CAGR of 22.82% during the forecast period.

The market is driven by advancements in AI-powered autonomous driving systems, enabling improved safety, efficiency, and reliability in public transportation. Government initiatives supporting smart mobility and sustainability, along with substantial investments in intelligent transport infrastructure, are accelerating adoption.

Additionally, rising urbanization and increasing demand for cost-effective, high-capacity transit solutions are fostering the deployment of autonomous buses across global metropolitan areas.

Major companies operating in the global autonomous bus industry are AB Volvo, Navya, SA, TRON ENERGY TECHNOLOGY CORPORATION, Baidu, Transdev, EasyMile, New Flyer, Yutong Bus Co., Ltd., Fusion Processing, May Mobility, Keolis, and ioki GmbH.

Regulatory support and government initiatives are driving the market. Authorities are introducing legislation that facilitates the testing and deployment of autonomous public transport systems.

Subsidies and incentives for electric and autonomous vehicle development are encouraging fleet operators to transition toward automation. Infrastructure investments, including dedicated lanes, smart traffic signals, and real-time monitoring systems, are enhancing operational efficiency.

- In May 2024, Malaysia’s state-run 5G network, Digital Nasional Berhad (DNB), partnered with Ericsson and eMooVit Technology to enhance the country's autonomous bus experience through 5G technology. The collaboration aims to test multiple 5G-enabled applications on an electric autonomous bus, including in-vehicle public Wi-Fi, real-time remote monitoring, journey log collection, and onboard CCTV. These advancements are designed to improve passenger safety, enhance reliability, and optimize operational cost efficiency.

Collaborations between regulatory bodies and industry leaders are refining safety protocols, ensuring seamless integration into existing transit networks. Favorable policies and strategic urban planning are reinforcing market expansion.

Key Highlights:

- The global autonomous bus market size was valued at USD 1340.0 million in 2023.

- The market is projected to grow at a CAGR of 22.82% from 2024 to 2031.

- Europe held a market share of 34.85% in 2023, with a valuation of USD 467.0 million.

- The Level 4 segment garnered USD 515.5 million in revenue in 2023.

- The diesel segment secured the largest revenue share of 39.86% in 2023.

- The intracity segment is poised for a robust CAGR of 23.07% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 23.93% during the forecast period.

Market Driver

"Rising Demand for Smart and Sustainable Public Transport"

The shift toward intelligent and sustainable transportation solutions is accelerating the growth of the autonomous bus market. Expanding urban populations and increasing traffic congestion are creating demand for efficient public transit options that reduce environmental impact.

Autonomous buses, particularly those powered by electric drivetrains, offer an effective solution for lowering carbon emissions and improving fuel efficiency. Government-backed smart city projects are incorporating these buses into urban mobility networks, addressing last-mile connectivity challenges.

Investments in intelligent transport systems (ITS) and eco-friendly mobility solutions are strengthening adoption, positioning autonomous buses as a cornerstone of future public transit infrastructure.

- In February 2025, Singapore is advancing its vision for smart and sustainable transportation with a new initiative from the Land Transport Authority (LTA). The agency has issued a Request for Proposal (RFP), inviting industry participants to submit proposals for the pilot deployment of autonomous public buses. As part of this three-year program, LTA plans to introduce six autonomous buses by mid-2026, operating alongside conventional services to assess performance, efficiency, and passenger experience. If the trial proves successful, the initiative could expand with the acquisition of up to 14 additional autonomous buses, extending coverage to two more public bus routes.

Market Challenge

"Regulatory and Safety Compliance Challenges"

Stringent regulatory frameworks and safety concerns pose significant challenges to the growth of the autonomous bus market. Governments require rigorous testing, certification, and compliance with evolving safety standards before granting approvals for public deployment. Ensuring cybersecurity and liability frameworks further complicates adoption.

Companies are addressing these challenges by collaborating with regulatory bodies to establish standardized safety protocols and cybersecurity measures. Investments in advanced AI-driven monitoring systems and redundant fail-safe mechanisms enhance operational safety.

Additionally, strategic pilot programs and partnerships with public transit agencies help refine autonomous bus technology while demonstrating reliability in real-world conditions.

Market Trend

"Expansion of Pilot Projects and Real-world Deployments"

The expansion of pilot projects and real-world deployments is accelerating the growth of the autonomous bus market. Cities and transportation authorities globally are launching trial programs to evaluate the feasibility of self-driving buses in real-world conditions.

These projects are providing valuable insights into vehicle performance, passenger acceptance, and regulatory challenges, paving the way for full-scale implementation. Partnerships between public and private stakeholders are ensuring seamless integration with existing transit networks.

Successful trials are leading to increased investments and commercial rollouts, demonstrating the viability of autonomous buses in addressing urban mobility challenges and driving long-term market adoption.

- As part of the MINGA research project (Munich's Automated Local Transport with Ridepooling, Solo Bus, and Bus Platoons), MAN and Stadtwerke München plan to test an automated, fully electric MAN Lion’s City E along a route passing through the Olympic Park, primarily serving tourists, leisure seekers, and recreational visitors. The pilot operation for the automated city bus is set to begin in 2025. Equipped with an advanced Automated Driving System (ADS) from Mobileye, the eBus leverages highly sophisticated sensor technology to enhance autonomous navigation and operational efficiency.

Autonomous Bus Market Report Snapshot

|

Segmentation |

Details |

|

By Level of Autonomy |

Level 3, Level 4, Level 5 |

|

By Propulsion |

Diesel, Electric, Hybrid |

|

By Application |

Intercity, Intracity |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Level of Autonomy (Level 3, Level 4, and Level 5): The Level 4 segment earned USD 515.5 million in 2023, due to its ability to operate without human intervention in predefined conditions, improving operational efficiency, reducing labor costs, and accelerating large-scale deployment in urban transit networks.

- By Propulsion (Diesel, Electric, and Hybrid,): The diesel segment held 39.86% share of the market in 2023, due to its well-established refueling infrastructure, cost-effectiveness for long-haul operations, and higher energy density, ensuring extended range and reliability in autonomous transit systems.

- By Application (Intercity and Intracity): The intracity segment is poised for significant growth at a CAGR of 23.07% through the forecast period, attributed to rising urbanization and increasing demand for efficient, sustainable public transport solutions.

Autonomous Bus Market Regional Analysis

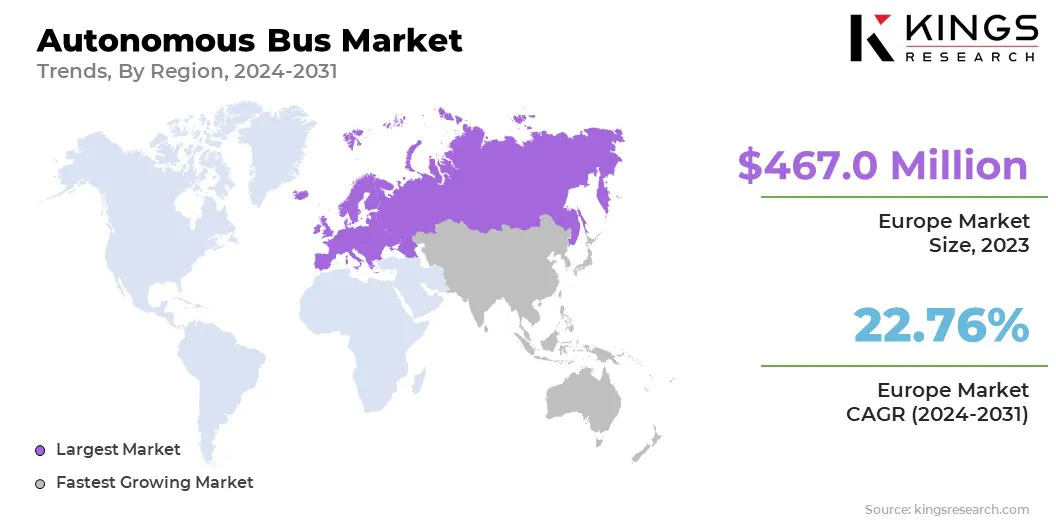

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Europe accounted for a autonomous bus market share of around 34.85% in 2023, with a valuation of USD 467.0 million. Collaborations between governments, technology providers, and public transport operators are accelerating autonomous bus deployments across Europe.

Countries such as Germany, France, and the Netherlands are hosting large-scale pilot programs to assess the feasibility of self-driving buses in urban and suburban environments.

Joint ventures between automotive manufacturers, AI developers, and telecom companies are facilitating advancements in autonomous driving technologies. These partnerships are enabling real-world trials, improving public trust in autonomous mobility, and paving the way for commercial rollouts, driving the market in Europe.

- In December 2024, Karsan announced plans to introduce Sweden’s first Level-4 autonomous bus into passenger service in Gothenburg by August 2025. The Karsan Autonomous e-ATAK will operate between Gothenburg’s Central Station and Liseberg Station, enhancing transportation efficiency in the Gårda region. As the world’s first and only Level-4 autonomous bus designed for ticketed passengers in open traffic, it will be integrated into Sweden’s public transportation network through a collaboration with Västtrafik, Vy Buss, ADASTEC, and Applied Autonomy.

Furthermore, Nordic nations are establishing dedicated corridors for autonomous buses, strengthening their position in the European market. Finland’s capital, Helsinki, has integrated autonomous shuttles into its public transit network through the FABULOS project, demonstrating real-world viability.

Gothenburg is deploying self-driving electric buses as part of the S3 project, focusing on sustainable and efficient urban mobility. The increasing implementation of dedicated autonomous bus corridors is setting a strong foundation for the commercial adoption of autonomous buses across Northern Europe.

The autonomous bus industry in Asia Pacific is poised for significant growth at a robust CAGR of 23.93% over the forecast period. Governments across Asia Pacific are actively promoting the adoption of autonomous buses through strategic policies and investments in smart mobility.

China’s Ministry of Transport and Japan’s Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) have introduced regulatory frameworks supporting autonomous vehicle trials. Singapore's Land Transport Authority (LTA) is leading multiple autonomous bus pilot programs, including the deployment of self-driving buses on public roads.

South Korea is expanding smart city projects, integrating autonomous shuttles into urban transit networks. These government-backed initiatives are accelerating commercialization, fostering technological advancements, and driving the market in the region.

- In July 2024, Shenzhen unveiled plans to introduce 20 autonomous buses by the end of the year, aligning with China’s efforts to advance self-driving technology despite concerns regarding safety and job displacement. This initiative is supported by the Ministry of Industry and Information Technology in collaboration with four other government departments. The autonomous minibuses will be equipped with high-definition cameras and LiDAR sensors, ensuring enhanced navigation capabilities. A safety supervisor will remain on board to take control if necessary, reinforcing operational security during the deployment phase.

Additionally, the rapid adoption of Level-4 autonomous buses is accelerating the growth of the market in Asia Pacific. Governments and industry players are enhancing real-time traffic monitoring, predictive analytics, and intelligent sensor fusion to optimize decision-making and operational safety.

Infrastructure developments, such as dedicated autonomous lanes and smart intersections, are further facilitating large-scale deployment. The increasing reliability and scalability of Level-4 autonomous buses are strengthening their integration into public transportation systems, boosting the market across the region.

Regulatory Frameworks

- In the U.S., autonomous vehicle (AV) regulations are primarily managed at the state level, leading to a diverse regulatory environment. The National Highway Traffic Safety Administration (NHTSA) provides federal guidelines, but states have the authority to permit AV testing and deployment. As of January 2023, several states have enacted legislation to allow the operation of autonomous buses under specific conditions, focusing on safety standards and operational protocols. Additionally, the U.S. Commerce Department has proposed rules to ban imports of vehicles and components from certain countries, such as China and Russia, due to cybersecurity concerns.

- The European Union (EU) has established a harmonized regulatory framework for autonomous vehicles. As of January 2023, the EU adopted UN Regulation No. 157, permitting Level 3 autonomous driving systems with a maximum speed of 130 km/h on highways, including lane-changing capabilities. Future regulatory efforts are focused on developing standards for Level 4 and Level 5 autonomous vehicles.

- Germany has implemented legislation permitting autonomous vehicles to operate on public roads under specific conditions. The country has established a legal framework that allows for Level 4 autonomous vehicles to operate in defined areas, subject to stringent safety and technical standards. This framework includes requirements for vehicle approval, infrastructure adaptations, and the presence of a technical supervisor.

- China is actively promoting the development and deployment of autonomous vehicles. As of December 2024, Beijing announced regulations to support autonomous driving technology, including public buses and taxis. Effective from April 1, 2025, approved autonomous vehicles are permitted to conduct road trials. The city aims to enhance intelligent road infrastructure to support various autonomous vehicles.

- Japan has established a regulatory framework to facilitate the deployment of autonomous vehicles. The country has adopted UN Regulation No. 157, allowing Level 3 autonomous driving systems with specific operational conditions. Efforts are underway to develop regulations for higher levels of autonomy, focusing on safety standards, infrastructure readiness, and public acceptance.

- South Korea has implemented policies to encourage the development of autonomous vehicles. The government has designated specific zones for autonomous vehicle testing and is developing a legal framework to support commercial deployment. Regulations focus on safety certification, data handling, and infrastructure compatibility to facilitate the integration of autonomous buses into public transportation systems.

Competitive Landscape:

The global autonomous bus market is characterized by several participants, including established corporations and rising organizations. Market players are actively pursuing strategies centered on the development and commercialization of advanced self-driving buses, including Level-4 autonomous buses, to enhance operational efficiency and meet the growing demand for autonomous public transportation.

Investments in cutting-edge technologies such as AI-powered perception systems, LiDAR-based navigation, and V2X (Vehicle-to-Everything) communication are enabling the deployment of highly automated buses capable of handling complex driving scenarios with minimal human intervention.

These advancements are not only improving passenger safety and mobility solutions but are also fostering collaborations between automakers, technology firms, and government bodies, further accelerating the growth of the market.

- In November 2024, Japanese autonomous vehicle technology company Tier IV introduced the Minibus 2.0, engineered to meet the Japanese government's Level-4 autonomous driving standards. The vehicle integrates an advanced suite of sensors, including long- and short-range LiDARs, object and traffic light detection cameras, radars, an inertial measurement unit, and a global navigation satellite system sensor. These components seamlessly interface with Tier IV’s electronic and vehicle control units, enhancing autonomous driving capabilities and ensuring optimal performance.

List of Key Companies in Autonomous Bus Market:

- AB Volvo

- Navya, SA

- TRON ENERGY TECHNOLOGY CORPORATION

- Baidu

- Transdev

- EasyMile

- New Flyer

- Yutong Bus Co., Ltd.

- Fusion Processing

- May Mobility

- Keolis

- ioki GmbH

Recent Developments (Partnerships/ Product Launch)

- In February 2025, Fusion Processing introduced the first Alexander Dennis Enviro100AEV autonomous electric bus, featuring its CAVstar automated drive system. The project is supported by funding and oversight from the UK government’s Centre for Connected & Autonomous Vehicles (CCAV). Following the completion of track testing, the bus will be deployed in Cambridge, with its official launch scheduled later in the year at the Cambridge Biomedical Campus.

- In February 2025, Karsan’s Autonomous e-ATAK bus was showcased in Leganés, Madrid, allowing residents to experience autonomous public transportation firsthand. The vehicle operated for a week along a designated 2.3-kilometer route in open traffic, successfully navigating various conditions, including heavy rain. Karsan reported strong public interest in the demonstration, with positive feedback from both residents and city officials.

- In January 2025, May Mobility expanded its portfolio of autonomous vehicle applications at CES 2025 through a partnership with Tecnobus, a prominent European electric minibus manufacturer. This collaboration introduces a new autonomous minibus platform, providing greater flexibility for fleet operators and transit agencies in both domestic and international markets. The newly developed autonomous electric minibus will accommodate up to 30 passengers and feature wheelchair accessibility, strengthening May Mobility’s mobility-as-a-service (MaaS) offerings while promoting sustainable transportation solutions.

- In May 2022, Deutsche Bahn (DB) introduced two new autonomous e-shuttles in the Lower Bavarian spa town of Bad Birnbach, offering on-demand transportation for passengers. These shuttles can be booked via a mobile app, allowing users to select customized start and destination stops. Designed to enhance accessibility, the service aims to improve connectivity to health facilities and essential retail destinations, providing a more convenient and flexible mobility solution.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership