Advanced Materials and Chemicals

Benzyl Alcohol Market

Benzyl Alcohol Market Size, Share, Growth & Industry Analysis, By Form (Powder/Crystalline, Liquid), By Application (Personal Care, Fragrance, Coatings & Paintings, Pharmaceuticals, Chemical Synthesis, Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1096

Benzyl Alcohol Market Size

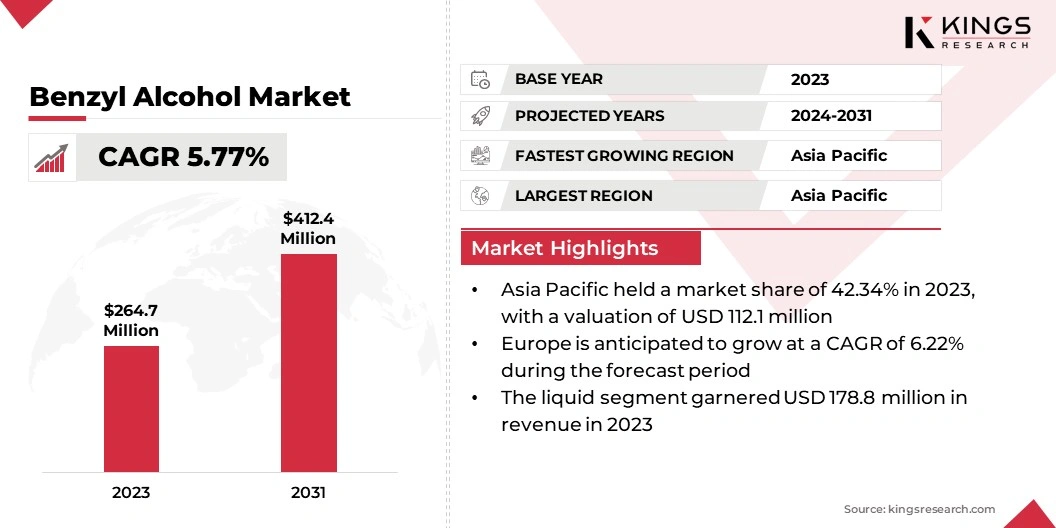

Global Benzyl Alcohol Market size was recorded at USD 264.7 million in 2023, which is estimated to be valued at USD 278.4 million in 2024 and is projected to reach USD 412.4 million by 2031, growing at a CAGR of 5.77% from 2024 to 2031.

The market is benefitting from increased demand across various end-use industries, including pharmaceuticals, cosmetics, and manufacturing. In pharmaceuticals, benzyl alcohol is utilized as a solvent and preservative in injectable medications, driving substantial growth of the benzyl alcohol market. Additionally, its application in cosmetics and personal care products for preservation and fragrance fuels market expansion.

In the scope of work, the report includes products offered by companies such as Merck KGaA, Thermo Fisher Scientific Inc., Hubei Greenhome Materials Technology,INC., Synerzine Inc., Pharmco by Greenfield Global, LANXESS, Valtris Specialty Chemicals, Wuhan Biet Co., Ltd., WUHAN YOUJI , Elan Chemical Company Inc., and others.

Moreover, the burgeoning global cosmetics and personal care industry propels the development of the market. The compound’s role as a preservative and its integration into formulations for its fragrance properties further boost demand. As consumer preferences shift toward premium and niche beauty products, the demand for benzyl alcohol in this sector is expected to rise.

- According to the Cosmetic Executive Woman (CEW) report in April 2024, China's beauty sales for January and February 2024 saw a 5.5% year-over-year increase.

Benzyl alcohol is an aromatic alcohol with the chemical formula C₇H₈O. It is a colorless liquid with a mild, pleasant odor. Benzyl alcohol is commonly used as a solvent in various industrial applications, including pharmaceuticals, cosmetics, and paints. It serves as an intermediate in the production of other chemicals and as a preservative in certain formulations due to its antimicrobial properties. In addition, benzyl alcohol is employed as a fragrance and flavoring agent in food and personal care products. Its versatility and functional properties make it a valuable compound across multiple industries.

Analyst’s Review

The revision and approval of the harmonized standard for benzyl alcohol by global pharmaceutical bodies strengthen its regulatory framework. This results in enhanced quality assurance, compliance, and standardization, which increases adoption in pharmaceuticals and cosmetics. Such regulatory clarity boosts confidence among manufacturers and consumers , fueling market growth as companies align with international standards for safety and efficacy.

A revision to the harmonized standard for benzyl alcohol was approved by the Pharmacopeial Discussion Group (PDG) in December 2022, advancing it to Stage 4 of the PDG process. This development ensures that the benzyl alcohol monograph is aligned with global regulatory standards, and it has been formally approved by the USP Simple Excipients Expert Committee.

The update, part of the 2020–2025 Council of Experts' agenda, strengthens the quality and safety standards for benzyl alcohol to ensure compliance with international pharmaceutical regulations.

Benzyl Alcohol Market Growth Factors

The increasing production and significant investments in the industrial coatings sector are boosting the growth of the market. As industries such as automotive, aerospace, and construction expand, the demand for high-performance coatings rises. Benzyl alcohol, used as a solvent in these coatings due to its stability and effectiveness, is experiencing higher demand. Additionally, investments in advanced coatings technologies are fueling market expansion.

- In February 2024, BASF, a leading chemical company, announced an expansion of its production capacity for high-quality automotive coatings at its Munster site in Germany. This investment seeks to address the rising customer demand for sustainable coating solutions while reinforcing BASF's position as a key player in the global automotive coatings market.

Benzyl alcohol is used as a flavoring agent and preservative in the food and beverage sector. The rising global demand for processed and packaged foods, along with a growing preference for natural and safe preservatives, is aiding market expansion. This growing use is expected to increase as consumers seek products with extended shelf life and enhanced safety.

Moreover, advancements in chemical processing technologies and the development of new applications for benzyl alcohol contribute to market expansion. Innovations that improve the efficiency and environmental footprint of benzyl alcohol production and usage are anticipated to bolster benzyl alcohol market growth.

However, stringent environmental regulations pose a significant challenge to the development of the market by increasing operational costs. To address this, companies are investing in cleaner, more advanced technologies to align with regulatory standards while minimizing environmental impact.

Enhanced compliance programs are being implemented to ensure adherence to regulations and avoid fines or disruptions. Engaging in industry advocacy allows companies to influence the development of practical regulatory frameworks, which supports market growth.

Benzyl Alcohol Market Trends

Advancements in chemical processing technologies and new applications for benzyl alcohol are contributing to market expansion. Innovations that improve the efficiency and environmental footprint of benzyl alcohol production and usage are anticipated to bolster market growth.

Additionally, emerging economies are becoming significant players in the global pharmaceutical market, with increasing exports of pharmaceutical products. As pharmaceutical manufacturing expands in these regions, the demand for benzyl alcohol as a key ingredient in various formulations rises.

- The Association of the British Pharmaceutical Industry (ABPI) reveals that in 2023, over USD 28.67 billion worth of medicinal and pharmaceutical products were exported globally, making it the third largest goods sector in the UK economy. This represents an 8% growth over the past five years, reflecting the increasing global demand for pharmaceutical exports.

Moreover, investment in research and development (R&D) for new applications and improvements in benzyl alcohol formulations is driving market growth. R&D activities are exploring innovative uses of benzyl alcohol in pharmaceuticals, personal care, and other industrial applications, presenting new avenues for benzyl alcohol market expansion.

Segmentation Analysis

The global market has been segmented based on form, application, and geography.

By Form

Based on form, the market has been bifurcated into powder/crystalline and liquid. The liquid segment led the benzyl alcohol market in 2023, reaching a valuation of USD 178.8 million. As a solvent, benzyl alcohol in liquid form is highly valued in the pharmaceutical, cosmetic, and personal care sectors for dissolving active ingredients and ensuring formulation stability.

Additionally, its growing use as a preservative in injectable drugs and skincare products has led to increased demand. The liquid form further facilitates ease of handling and mixing in industrial applications such as coatings and paints, serving as a solvent and viscosity controller.

By Application

Based on application, the market has been classified into personal care, fragrance, paints & coatings, pharmaceuticals, chemical synthesis, and others. The paints & coatings segment is poised to witness significant growth at a robust CAGR of 7.54% through the forecast period. Benzyl alcohol is widely used as a solvent and preservative in paints and coatings to enhance their performance and shelf life.

Its role as a solvent aids in the uniform dispersion of pigments and resins, improving the consistency and application properties of coatings. Additionally, benzyl alcohol's antimicrobial properties make it an effective preservative, thereby extending the usability of paint products. The increasing demand for high-quality and durable finishes in residential, commercial, and industrial applications is further bolstering the growth of the segment.

Benzyl Alcohol Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia Pacific benzyl alcohol market accounted for a notable share of around 42.34% in 2023, with a valuation of USD 112.1 million. The APAC region, with its large and diverse consumer base, is witnessing a boom in the cosmetics and personal care market.

The increasing demand for beauty and personal care products, combined with benzyl alcohol's role as a preservative and fragrance component, is fueling regional market growth. This trend is especially prominent in countries such as Japan, South Korea, and China.

- According to data from the National Bureau of Statistics of China, the retail sales of cosmetic products in 2023 were valued at USD 58.40 billion, reflecting a year-on-year growth rate of 5.1%.

This increase highlights the growing demand for beauty and personal care products in China, supported by rising consumer spending, evolving beauty trends, and the expansion of premium and niche cosmetic brands in the market. This steady growth underscores the significant potential for further regional market expansion, particularly as consumers increasingly prioritize skincare, beauty, and wellness products.

Europe is poised to witness significant growth at a robust CAGR of 6.22% over the forecast period. European Union (EU) regulations, enforced by the European Medicines Agency (EMA) and the European Chemicals Agency (ECHA), ensure high standards for chemical usage in pharmaceuticals, cosmetics, and food industries. Benzyl alcohol's established safety profile aligns with these regulatory standards, increasing its demand across various industries.

Additionally, the Europe market is witnessing increased strategic activities such as mergers, acquisitions, and partnerships among key players. These collaborations are aimed at expanding production capacities, enhancing distribution networks, and driving innovation, all of which contribute to Europe benzyl alcohol market growth.

Competitive Landscape

The global benzyl alcohol market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Benzyl Alcohol Market

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Hubei Greenhome Materials Technology,INC.

- Synerzine Inc.

- Pharmco by Greenfield Global

- LANXESS

- Valtris Specialty Chemicals

- Wuhan Biet Co., Ltd.

- WUHAN YOUJI

- Elan Chemical Company Inc.

Key Industry Developments

- May 2023 (Business Expansion): LANXESS, a leading chemicals company doubled its benzyl alcohol production capacity at its Kalama, Washington facilityto better support its growing customer base in the Americas. This facility acts as the central hub in a global network of four facilities dedicated to producing high-purity benzyl alcohol.

The global benzyl alcohol market is segmented as:

By Form

- Powder/Crystalline

- Liquid

By Application

- Personal Care

- Fragrance

- Coatings & Paintings

- Pharmaceuticals

- Chemical Synthesis

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership