Advanced Materials and Chemicals

Biodegradable Packaging Market

Biodegradable Packaging Market Size, Share, Growth and Industry Analysis, By Packaging Format (Bottles and Jars, Boxes and Cartons, Cans, Trays and Clamshells, Cups and Bowls, Pouches and Bags & Others), By End-Use Industry, By Material Type, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR957

Biodegradable Packaging Market Size

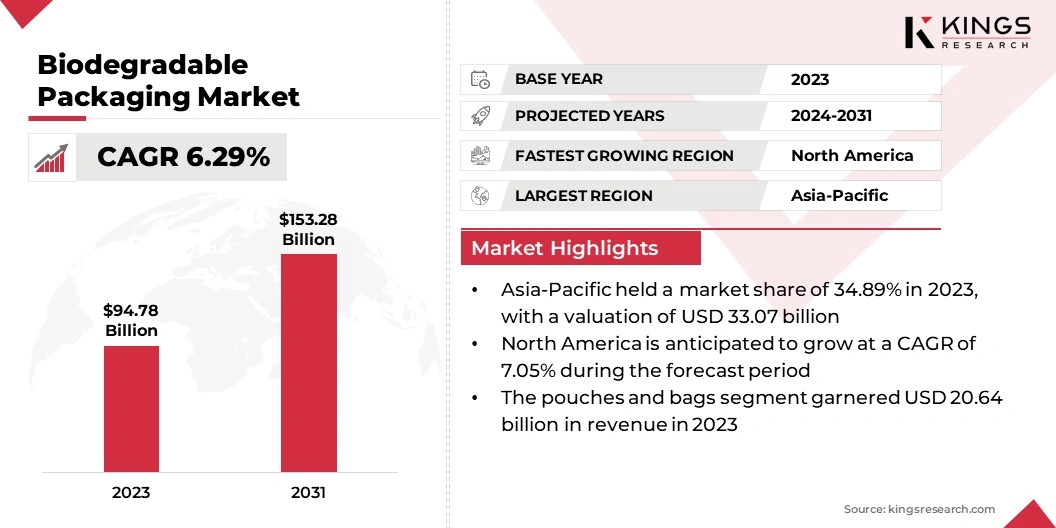

The global Biodegradable Packaging Market size was valued at USD 94.78 billion in 2023 and is projected to grow from USD 100.04 billion in 2024 to USD 153.28 billion by 2031, exhibiting a CAGR of 6.29% during the forecast period. The market is expanding significantly due to ongoing advancements in material science and growing investment in sustainable technologies.

Increased consumer preference for eco-friendly products and corporate sustainability initiatives are driving adoption. Additionally, rising awareness of environmental issues and the transition to circular economy practices contribute to market growth. The availability of innovative biodegradable materials and improved production processes further support industry expansion.

In the scope of work, the report includes solutions offered by companies such as Tetra Pak International SA, Amcor plc, Mondi, Sealed Air, Elevate Packaging, Kruger Inc., SOLUT, Smurfit Westrock, Greenpack, Ranpak, and others.

The market is experiencing robust growth, mainly due to increasing environmental regulations and rising consumer demand for sustainable alternatives. As governments worldwide implement bans and restrictions on single-use plastics, there is a growing shift toward biodegradable solutions.

Innovations in materials such as plant-based plastics and biodegradable polymers are enhancing the functionality and appeal of these products. As industries seek to comply with stringent regulations and address environmental concerns, the biodegradable packaging market is expanding rapidly. This growth is further fueled by the broader adoption of eco-friendly practices across various sectors, including food and beverage, retail, and healthcare.

- According to European Bioplastics and the Nova-Institute, global production capacity for biodegradable plastics is projected to rise significantly, increasing from approximately 2.18 million tonnes in 2023 to around 7.43 million tonnes by 2028.

This substantial growth in production capacity is anticipated to boost a corresponding surge in demand for biodegradable plastics, as industries and consumers increasingly turn to sustainable packaging solutions.

Biodegradable packaging is designed to decompose naturally and break down into non-toxic components when subjected to environmental conditions. Unlike conventional plastics, which may remain in the environment for hundreds of years, biodegradable packaging is made from materials such as plant-based plastics, biodegradable polymers, or natural fibers.

These materials are engineered to be decomposed by microorganisms into water, carbon dioxide, and organic matter, thereby significantly reducing their environmental impact. By minimizing landfill waste and pollution, biodegradable packaging contributes to more sustainable waste management practices and supports efforts to combat plastic pollution.

Analyst’s Review

The introduction of innovative bio-based compostable packaging solutions is propelling market growth by addressing the rising demand for sustainable and environmentally friendly options.

- For instance, in January 2024, SEE’s introduced the world’s first bio-based industrial compostable tray designed for protein packaging. This innovative tray features a USDA-certified bio-based content of 54% derived from renewable wood cellulose, which exemplifies this trend.

This advancement meets the rigorous needs of modern food processing facilities while supporting sustainability goals, thereby fostering broader adoption and stimulating market growth. Key players are leveraging innovations such as bio-based compostable packaging to bolster market growth by meeting increasing consumer and regulatory demands for sustainability.

By developing advanced, eco-friendly solutions and obtaining certifications, companies position themselves as leaders in sustainable packaging, thus facilitating market expansion and setting industry standards.

Biodegradable Packaging Market Growth Factors

Increasing awareness regarding plastic pollution and its environmental impact is significantly boosting the demand for biodegradable packaging solutions. As plastic waste continues to accumulate in oceans and landfills, both consumers and companies are actively seeking sustainable alternatives to minimize their ecological footprint.

This increased environmental consciousness is prompting a shift toward packaging materials that decompose naturally, thus reducing long-term waste and pollution. In response to this, businesses are adopting biodegradable packaging to align with regulatory requirements and meet growing consumer expectations for eco-friendly practices. This trend reflects a broader commitment to environmental responsibility and sustainable development, thereby fueling the growth of the biodegradable packaging market.

A major challenge impeding the development of the market is the higher production cost compared to traditional plastics, which is limiting adoption among cost-sensitive businesses and consumers. This increased cost is arising from the use of advanced materials and complex manufacturing processes.

To address this challenge, key players are investing heavily in research and development to improve production efficiency and reduce costs. They are expanding their operations and forming strategic partnerships to achieve economies of scale, thereby making biodegradable packaging more affordable and competitive. These efforts are addressing cost barriers and striving to enhance market acceptance and promote growth.

Biodegradable Packaging Market Trends

The ongoing innovation in biodegradable materials, such as plant-based plastics and biodegradable polymers, is propelling market growth by meeting the increasing demand for sustainable packaging solutions. These advanced materials reduce environmental impact and align with stringent government regulations and evolving consumer preferences for eco-friendly products.

Improved functional properties, such as durability and decomposition rates, make biodegradable packaging more appealing to businesses aiming to bolster their environmental reputation. As major brands and companies adopt these innovative materials, the market is experiencing significant expansion.

The transition by various countries and organizations to eliminate single-use plastic packaging is aiding the growth of the biodegradable packaging market. In nations such as India, where the increase in packaging waste has led to stringent bans on single-use plastics, there is a notable shift toward adopting sustainable alternatives.

- The Centre for Science and Environment reports that, starting July 1, 2022, India enforced a nationwide ban on the production, distribution, storage, sale, and use of 19 specific single-use plastic items. These items include cutlery, straws, sticks, and thermocol used for decorations. Moreover, new regulations mandate that carry bags be at least 120 microns thick, and banners be at least 100 microns thick.

This stringent regulatory action highlights countries' proactive approach to addressing plastic waste issues and promoting the development of biodegradable packaging solutions by creating a strong demand for environmentally friendly alternatives. These regulatory measures generate a robust demand for biodegradable packaging solutions, as both businesses and consumers increasingly seek eco-friendly options to comply with new laws and reduce their environmental footprint, which is slated to boost market expansion in the coming years.

Segmentation Analysis

The global market is segmented based on packaging format, end-use industry, material type, and geography.

By Packaging Format

Based on packaging format, the market is categorized into bottles and jars, boxes and cartons, cans, trays and clamshells, cups and bowls, pouches and bags, films and wraps, labels and tapes, and others. The pouches and bags segment led the biodegradable packaging market in 2023, reaching a valuation of USD 20.64 billion, primarily due to their versatility and widespread use across various industries, including food and beverage, retail, and healthcare.

These packaging solutions offer convenience, flexibility, and durability while aligning with sustainability goals. Increasing consumer demand for eco-friendly alternatives and regulatory pressures to reduce plastic waste are prompting companies to adopt biodegradable pouches and bags.

Innovations in materials, such as plant-based resins and compostable films, further support the growth of the segment. As businesses and consumers increasingly prioritize environmental responsibility, the adoption of biodegradable pouches and bags is bolstering segmental growth.

By End-Use industry

Based on end-use industry, the market is categorized into food and beverage, personal care and cosmetics, pharmaceuticals, homecare products, and others. The food and beverage segment captured the largest biodegradable packaging market share of 31.90% in 2023. Consumers are increasingly seeking eco-friendly alternatives to traditional plastic packaging due to growing concerns regarding environmental impact and food safety.

This shift is prompting food and beverage companies to adopt biodegradable packaging to align with sustainability goals and meet regulatory requirements. Innovations in materials, such as compostable films and plant-based containers, are enhancing the functionality and appeal of biodegradable packaging. As the food and beverage industry adopts these solutions, the demand for biodegradable packaging continues to rise.

By Material Type

Based on material type, the market is categorized into paper and paperboard, bio-plastic, and bagasse. The bio-plastic segment is expected to garner the highest revenue of USD 74.70 billion by 2031. This growth is propelled by increasing environmental awareness, the widespread adoption of bio-based materials, and evolving regulations focused on sustainable resource management.

Consumers are increasingly preferring eco-friendly options, which is fueling the demand for biodegradable plastics. These materials are gaining traction in the packaging industry due to their reduced environmental impact, enhanced recyclability, and alignment with government initiatives aimed at effective waste management.

As companies and consumers place growing emphasis on sustainability and environmental responsibility, the demand for bio-plastic packaging solutions is surging. This trend is expected to sustain and foster segmental growth, reflecting a broader shift toward more sustainable and responsible packaging practices.

Biodegradable Packaging Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific biodegradable packaging market share stood around 34.89% in 2023 in the global market, with a valuation of USD 33.07 billion. The demand for biodegradable packaging is increasing as a result of favorable government initiatives and rising environmental awareness.

- In India, the Ministry of Environment, Forest and Climate Change reports that the country generates 62 million tons of waste annually, encompassing solid, plastic, and e-waste, with a 4% average annual growth rate.

This growing waste generation underscores the need for sustainable packaging solutions, presenting opportunities for converting waste into bioplastic packaging. Moreover, Japan's packaging trends are shifting toward reducing container weight and using recyclable materials, reflecting an increased environmental consciousness. These regional developments highlight a broader commitment to sustainability and efficient packaging practices across Asia-Pacific, thereby fostering regional market growth.

North America is anticipated to witness substantial growth at a robust CAGR of 7.05% over the forecast period. The demand for biodegradable packaging is spurred by stringent environmental regulations and increasing consumer preference for sustainable products. Governments and regulatory bodies are implementing policies to reduce plastic waste, promoting companies to adopt eco-friendly packaging solutions.

The rising focus on sustainability is prompting innovations in biodegradable materials and packaging technologies. Additionally, the growing awareness of the environmental impact of packaging waste is leading businesses to seek alternatives to traditional plastics. As companies align with sustainability goals and regulatory requirements, the North America market is expanding, reflecting a broader commitment to environmental responsibility and innovation in packaging practices.

Competitive Landscape

The global biodegradable packaging market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Biodegradable Packaging Market

- Tetra Pak International SA

- Amcor plc

- Mondi

- Sealed Air

- Elevate Packaging

- Kruger Inc.

- SOLUT

- Smurfit Westrock

- Greenpack

- Ranpak

Key Industry Development

- September 2023 (Partnership): Mondi, in partnership with rice supplier Veetee, launched a new recyclable paper-based packaging for dry rice. This innovative packaging is designed to protect against moisture and has been tailored to ensure stability on retail shelves.

The global biodegradable packaging market is segmented as:

By Packaging Format

- Bottles and Jars

- Boxes and Cartons

- Cans

- Trays and Clamshells

- Cups and Bowls

- Pouches and Bags

- Films and Wraps

- Labels and Tapes

- Others (Stick pack, Sachets, etc.)

By End-Use Industry

- Food and Beverage

- Personal Care and Cosmetics

- Pharmaceuticals

- Homecare Products

- Others

By Material Type

- Paper and Paperboard

- Bio-plastic

- Bagasse

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East and Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East and Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership