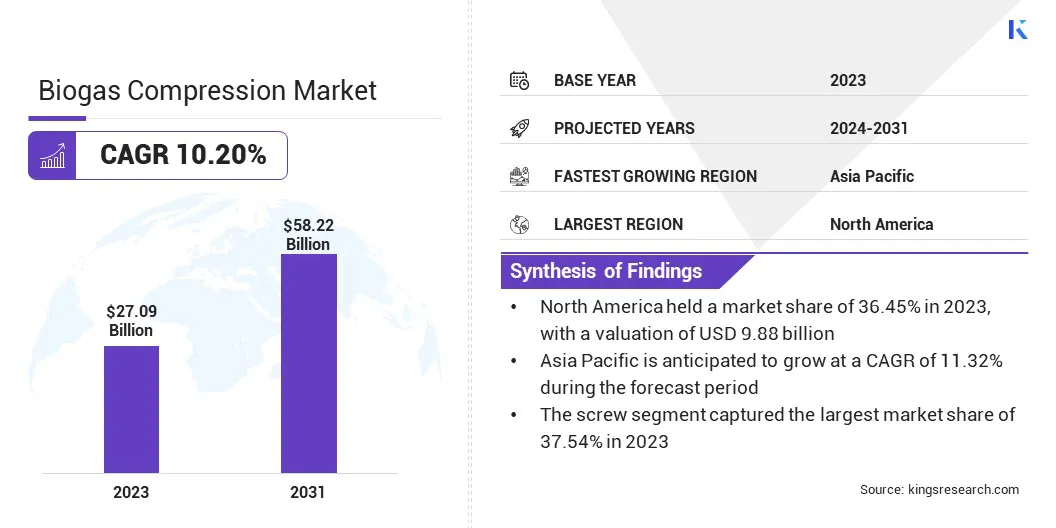

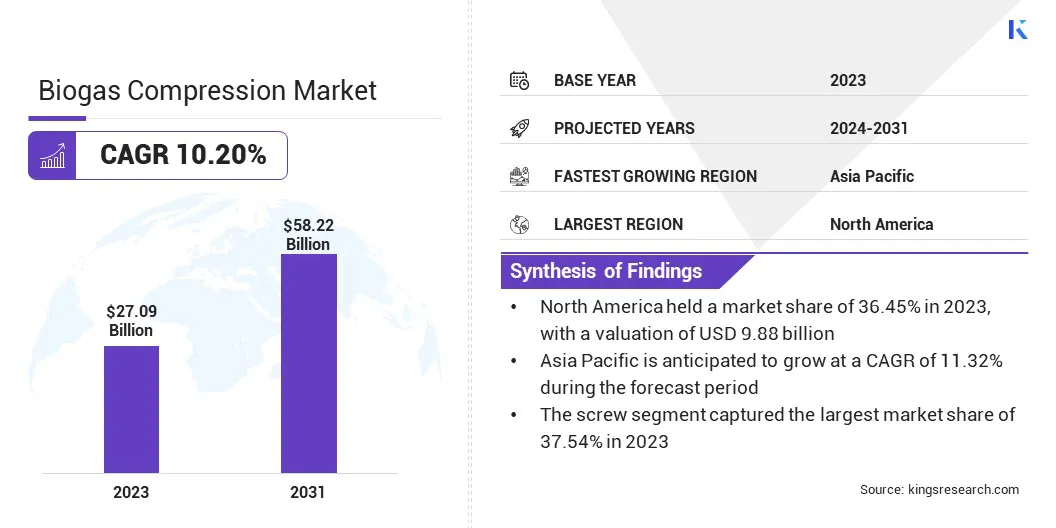

Biogas Compression Market Size

The global Biogas Compression Market size was valued at USD 27.09 billion in 2023 and is projected to grow from USD 29.50 billion in 2024 to USD 58.22 billion by 2031, exhibiting a CAGR of 10.20% during the forecast period. Growing investments in biogas infrastructure and increasing demand for clean energy are augmenting the market.

In the scope of work, the report includes services offered by the following companies: Aerzener Maschinenfabrik GmbH, Sollant, Atlas Copco AB, Burckhardt Compression AG, Ro-Flo, Mehrer Compression GmbH, Ingersoll Rand, Pietro Fiorentini S.p.a., NEUMAN & ESSER GROUP, HAUG Sauer Kompressoren AG, and others.

The expansion of biogas production in emerging economies is driven by the growing need for sustainable energy sources and the desire to reduce dependence on imported fossil fuels. Emerging markets such as Europe, and Southeast Asian nations are heavily investing in biogas infrastructure, recognizing its potential to generate renewable energy from organic waste.

- In 2023, according to European Biogas Association, Europe currently produces 21 bcm of biogas and biomethane. By 2030, production is projected to double to 35-45 bcm, and by 2050, it could increase fivefold to 167 bcm. This would account for up to 40% of 2021's gas consumption, and potentially cover 61% of reduced demand by 2050.

- The International Energy Agency (IEA) projects a 32% growth in the biogas sector between 2023 and 2028. In Europe, investments in biogas increased by one-third in 2024, with 950 new biomethane plants expected by 2030.

Additionally, government policies such as subsidies, tax incentives, and grants for renewable energy projects, are encouraging investment in biogas facilities. Furthermore, biogas can contribute to reducing greenhouse gas emissions, making it a vital component of global climate change mitigation efforts.

Emerging economies are prioritizing energy diversification, which is expected to fuel biogas production and drive the demand for efficient biogas compression technologies to store and transport biogas effectively.

Biogas compression is the process of increasing the pressure of biogas to enable its storage, transportation, and/or use in various applications. Biogas is primarily composed of methane (CH4) and carbon dioxide (CO2), and is produced from organic waste through anaerobic digestion.

Compressing biogas is necessary because raw biogas has a low energy density, making it inefficient to transport or store without compression. There are different types of biogas compression systems, including reciprocating compressors, centrifugal compressors, and diaphragm compressors.

Reciprocating compressors are widely used for small to medium-scale biogas plants due to their high-pressure capabilities, while centrifugal compressors are suited for large-scale operations requiring continuous gas flow.

Biogas compression is essential for injecting into the natural gas grid, as a vehicle fuel (biomethane), or for power generation in combined heat and power (CHP) plants. Effective biogas compression ensures that the energy potential of biogas is fully utilized, reducing the environmental impact while supporting clean energy initiatives.

Analyst’s Review

Key players in the biogas compression industry are focusing on strategies that prioritize technological innovation, market expansion, and strategic partnerships. One of the central growth strategies is the development of highly efficient, low-maintenance compressors that can handle varying biogas compositions while reducing operational costs.

Companies are increasingly investing in research and development to enhance the performance of biogas compression systems, making them more suitable for both small-scale and large-scale biogas facilities.

- In January 2024, Hindustan Petroleum Corporation Limited’s Compressed Biogas (CBG) plant in Badaun, Uttar Pradesh, India commenced operations, processing 100 MTPD of rice straw and generating 14 MTPD of CBG and 65 MTPD of solid manure. The plant, built with an investment of INR 133 crore, spans approximately 50 acres.

For market expansion, key players are targeting emerging markets where biogas production is poised to grow rapidly due to favorable government policies and abundant feedstock availability. Collaboration with local governments and industrial players in these regions are also helping companies expand their footprint.

Furthermore, key imperatives for growth include navigating the challenges of regulatory compliance and ensuring the flexibility of compression systems to accommodate different biogas applications. These efforts will be crucial as companies seek to gain a competitive edge and position themselves as leaders in the growing renewable energy market.

Biogas Compression Market Growth Factors

Growing investments in biogas infrastructure are transforming the renewable energy landscape, driving the expansion of biogas compression market. Government, national, and international organizations are allocating significant resources for developing biogas plants, upgrading biogas storage facilities, and enhancing distribution networks.

These investments are pivotal in scaling up the adoption of biogas as a mainstream energy source.

Also, the construction of new biogas plants in agricultural and urban areas allows for the efficient conversion of organic waste into renewable energy.

- In September 2024, The Indian Biogas Association has anticipated INR 1,600 crore in sector investments during Renewable Energy India Expo 2024. The biogas sector is expected to play a critical role in India’s energy future by 2030, driving growth and sustainability.

Additionally, investments in advanced compression and purification technologies are essential for improving the quality and usability of biogas. These developments ensure that biogas is suitable for injecting into natural gas grids or for using as vehicle fuel.

Furthermore, infrastructure investments are leading to new job creation, which is boosting economic growth, and helping countries meet their environmental targets.

As countries seek to diversify their energy mix and reduce carbon emissions, ongoing investments in biogas infrastructure are laying the foundation for long-term growth in the sector. However, the complexity in upgrading and purifying biogas presents a significant challenge for its widespread adoption.

Raw biogas contains impurities like carbon dioxide (CO2), hydrogen sulfide (H2S), and water vapor, which must be removed to meet the quality standards required for its use in various applications.

The upgrading process involves several stages, including gas drying, desulfurization, and CO2 removal, each of which requires sophisticated technology and operational expertise.

Additionally, the high costs associated with installing and maintaining biogas purification systems add further challenges, especially for smaller-scale producers. The variability in the composition of raw biogas depending on feedstock also complicates the purification process. This requires customized solutions for each facility.

However, these challenges will be mitigated through increased technological innovation, cost-effective purification systems, and government incentives that lower financial barriers for biogas producers. The focus on enhancing purification efficiency will be essential for scaling biogas adoption in both developed and developing markets.

Biogas Compression Industry Trends

The growing use of biogas in the transportation sector is a key trend that is reshaping the biogas compression market. As countries push to reduce greenhouse gas emissions and improve air quality, biogas has emerged as a clean, renewable alternative to traditional fossil fuels in the transportation industry.

Biogas, when upgraded to biomethane, exhibits properties similar to natural gas, making it an ideal fuel for vehicles. Public transportation systems, logistics companies, and even private car owners are now turning to biomethane-powered vehicles due to their lower emissions and cost-effectiveness.

- In 2023, according to the World Biogas Association, in the U.S., biomethane now constitutes 48% of gaseous transport fuels, the highest globally. Support schemes like the Renewable Fuel Standard (RFS) and state-level incentives in California and Washington are bolstering biomethane production from low-cost sources like landfill gas.

This trend is supported by government initiatives promoting the use of renewable fuels, including incentives for vehicle manufacturers to develop biogas-compatible engines. Additionally, the expansion of biomethane refueling infrastructure is accelerating the transition to biogas in transportation applications.

With added environmental benefits, such as reduced dependency on diesel and gasoline, biogas is expected to play a critical role in the decarbonization of the global transportation sector over the forecast period.

Segmentation Analysis

The global market has been segmented based on type, application, and geography.

By Type

Based on type, the biogas compression market has been segmented into piston, screw, vane, and others. The screw segment captured the largest market share of 37.54% in 2023, largely attributed to its superior operational efficiency, versatility, and widespread use in biogas compression systems.

Screw compressors are highly efficient in handling large volumes of gas with minimal energy consumption. Therefore, they are ideal for both small-scale and large-scale biogas facilities. Their ability to handle varying gas compositions, including biogas, without significant performance degradation makes them a preferred choice in the market.

Additionally, screw compressors are known for their robust design, low maintenance requirements, and longer service life compared to other types of compressors. These characteristics make them especially suitable for biogas applications, where reliability and cost-efficiency are critical.

The screw segment's dominance is further supported by technology advancements that enhance its ability to optimize compression pressure and increase throughput. With the growth of biogas production, screw compressors are expected to remain a key component in biogas infrastructure, reinforcing their strong market position in the coming years.

By Application

Based on application, the biogas compression market has been classified into transportation, power generation, heat generation, residential use, and others. The transportation segment is poised to grow at a staggering CAGR of 11.94% throughout the forecast period, driven by the increasing demand for clean, renewable energy in the global transportation industry.

Governments worldwide are implementing stricter emission regulations and promoting the use of alternative fuels to reduce the carbon footprint of vehicles. Biogas, when upgraded to biomethane, serves as a viable alternative to traditional fossil fuels, offering lower greenhouse gas emissions and enhanced fuel efficiency.

The increasing adoption of biomethane-powered vehicles, particularly in public transportation fleets, logistics, and heavy-duty transportation sectors, is a key factor behind the robust growth of the transportation segment.

Additionally, the expansion of refueling infrastructure for biomethane, coupled with government incentives and subsidies, is accelerating the shift toward biogas as a transportation fuel.

The increased focus on sustainability, along with the economic benefits of biogas, positions the transportation segment for significant growth, making it one of the most dynamic end users in the biogas market.

Biogas Compression Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

North America biogas compression market share accounted for 36.45% and was valued at USD 9.88 billion in 2023, driven by a strong focus on renewable energy initiatives and robust biogas infrastructure.

The U.S. and Canada have been at the forefront of adopting biogas technologies, using the support of government regulations promoting clean energy and waste-to-energy solutions. North America’s advanced agricultural, industrial, and municipal waste management systems provide abundant feedstock for biogas production, further bolstering the demand for biogas compression systems.

Key government programs, such as the U.S. Renewable Fuel Standard and Clean Fuel Standard Canada, have incentivized biogas production, positioning North America as a global leader in the biogas sector. The region’s well-established natural gas grid also supports the injection of upgraded biogas (biomethane), which requires efficient compression systems.

Additionally, ongoing investments in upgrading aging biogas plants and enhancing storage facilities are contributing to the market’s growth.

Asia Pacific is projected to grow at the highest CAGR of 11.32% over the forecast period, driven by rapid industrialization, urbanization, and increasing energy demands across the region.

China, India, and Southeast Asian countries are heavily investing in renewable energy sources, with biogas emerging as a key component of their energy transition strategies. Governments in Asia-Pacific are implementing various policies, offering subsidies and incentives to support biogas plant development and waste-to-energy projects, which are expected to drive significant market growth.

- In October 2023, according to the Institute for Energy Economics & Financial Analysis, the Government of India introduced policy changes to accelerate biogas sector growth, including the E20 rollout (20% ethanol in gasoline) and plans to establish 500 Waste-to-Wealth plants under the GOBARdhan scheme, positioning biofuels as a strategic focus.

The abundance of agricultural waste and organic byproducts in the region creates ample feedstock for biogas production, contributing to the increased demand for biogas compression systems. Moreover, the focus on improving rural electrification and reducing greenhouse gas emissions aligns with the region’s growing emphasis on sustainability.

Public-private partnerships and international collaborations are further accelerating the development of biogas infrastructure in Asia-Pacific.

Competitive Landscape

The biogas compression industry report provides valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players focus on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Biogas Compression Market

- Aerzener Maschinenfabrik GmbH

- Sollant

- Atlas Copco AB

- Burckhardt Compression AG

- Ro-Flo

- Mehrer Compression GmbH

- Ingersoll Rand

- Pietro Fiorentini S.p.a.

- NEUMAN & ESSER GROUP

- HAUG Sauer Kompressoren AG

Key Industry Developments

- July 2024 (Expansion): Burckhardt Compression secured 45 biogas installations in India during the last fiscal year. These orders, including 82 Standard High-Pressure Compressors, will help the company’s expansion in sustainable energy solutions, reinforcing its leadership in the biogas sector.

- March 2024 (Launch): Adani TotalEnergies Biomass Limited (ATBL) began the phase 1 of its Barsana Biogas Plant in Mathura, Uttar Pradesh. Upon full completion, the plant will become India's largest agri-waste-based bio-CNG facility, generating 42 TPD of Compressed Bio Gas and 217 TPD of organic fertilizer.

The global biogas compression market has been segmented:

By Type

By Application

- Transportation

- Power Generation

- Heat Generation

- Residential Use

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America