Healthcare Medical Devices Biotechnology

Biomarkers Market

Biomarkers Market Size, Share, Growth & Industry Analysis, By Type (Protein Biomarkers, Genetic Biomarkers, Metabolic Biomarkers, Imaging Biomarkers), By Application (Disease Diagnosis, Disease Prognosis, Drug Discovery and Development, Personalized Medicine), By Disease Indication (Cancer, Infectious Disease, Others), and Regional Analysis, 2024 - 2031

Pages : 190

Base Year : 2023

Release : February 2025

Report ID: KR1259

Market Definition

The market includes the development and application of indicators that signal biological processes, diseases, or effects of drug. This sector is crucial for advancing diagnostics, personalized medicine, and drug discovery, with significant growth projected due to the rising prevalence of chronic disease.

Biomarkers Market Overview

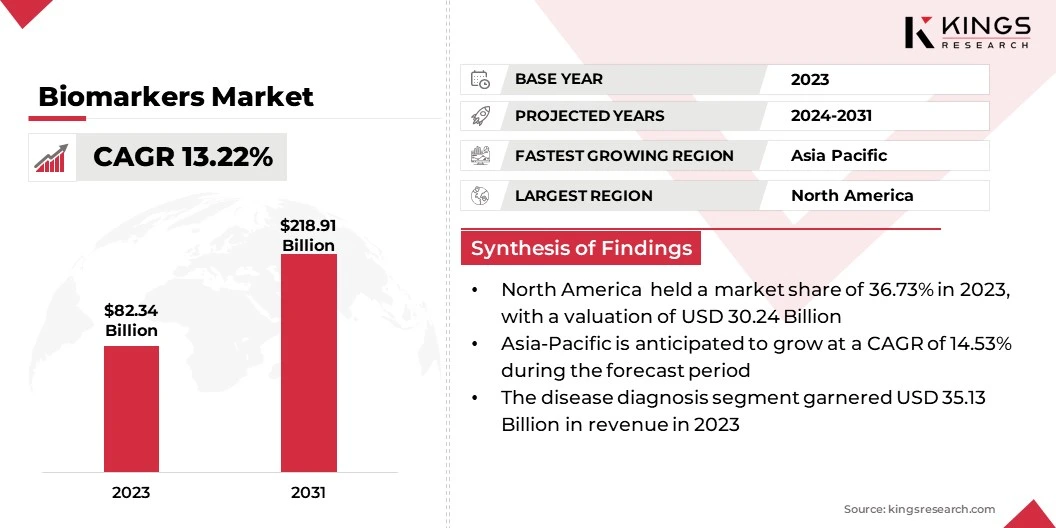

Global biomarkers market size was valued at USD 82.34 billion in 2023, which is estimated to expand from USD 91.80 billion in 2024 to USD 218.91 billion by 2031, growing at a CAGR of 13.22% from 2024 to 2031.

The market is growing rapidly due to the increasing prevalence of chronic diseases and advancement in biotechnology. Biomarkers play a crucial role in early disease detection, diagnosis, and monitoring, facilitating personalized medicine and improving the drug development process.

Major companies operating in the biomarkers market are Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Siemens, QIAGEN, PerkinElmer Inc., BIOMÉRIEUX, Fujirebio, GE HealthCare, Almac Group, Caris Life Sciences., Denovo Biopharma LLC, Eurofins Scientific, MESO SCALE DIAGNOSTICS, LLC., and others.

Major applications include diagnostics, drug discovery, and clinical research, with a significant contribution from pharmaceutical companies and diagnostic laboratories. Continuous innovations, advancements in biomarker technologies, and expanding applications across different therapeutic areas are aiding market expansion.

- For instance, in October 2024, the Advanced Research Projects Agency for Health (ARPA-H) launched a program to create a tear-based biomarker measurement platform. This innovative system aims to enable continuous health monitoring and personalized treatment by utilizing an implantable device in the tear duct for precise medication delivery.

Key Highlights:

- The global biomarkers industry size was recorded at USD 82.34 billion in 2023.

- The market is projected to grow at a CAGR of 13.22% from 2024 to 2031.

- North America held a share of 36.73% in 2023, valued at USD 30.24 billion.

- The protein biomarkers segment garnered USD 32.43 billion in revenue in 2023.

- The disease diagnosis segment is expected to reach USD 87.42 billion by 2031.

- The cancer segment is anticipated to witness the fastest CAGR of 15.32% through the forecast period.

- Asia Pacific is anticipated to grow at a robust CAGR of 14.53% over the projection period.

Market Driver

"Rising Chronic Diseases and Advances in Personalized Medicine"

The biomarkers market is experiencing notable growth, mainly due to the increasing prevalence of chronic diseases such as cancer and diabetes, which require early detection and personalized treatment approaches. Furthermore, advances in biotechnology and genomics are accelerating biomarker discovery, while growing R&D investments foster innovation.

This rising demand for biomarkers is further supported by the shift toward personalized medicine, allowing for tailored therapies that improve patient outcomes. Regulatory recognition of biomarker identification tests further enhances patient access to precision therapies.

- For instance, in August 2024, the Food and Drug Administration (FDA) approved Illumina, Inc.’s TruSight Oncology Comprehensive test, an advanced in vitro diagnostic tool. This test analyzes over 500 genes to identify immuno-oncology biomarkers and clinically actionable targets, enhancing patient access to precision therapies and clinical trials.

Market Challenge

"High Initial Investment"

The biomarkers market faces significant challenges, primarily due to high development costs. The complex process of discovering, validating, and commercializing biomarkers demands substantial financial investment and resources.

In addition to this, companies must navigate an increasingly competitive landscape, where technological advancements drive the need for continuous innovation. Companies must allocate significant R&D budgets to stay ahead of emerging trends, such as AI-driven biomarker discovery.

To overcome challenges in the biomarkers industry, businesses can adopt strategic partnerships to optimize R&D investments, integrate AI and automation for enhanced efficiency, drive industry-wide standardization, and secure diverse funding sources such as grants, venture capital, and licensing agreements.

Market Trend

"Demand for Early Disease Detection and Non-Invasive Testing Solutions"

Increasing demand for early disease detection and personalized medicine is emerging as a notable trend influencing the biomarkers market. The rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions is fueling the need for advanced diagnostic tools.

Biomarkers are becoming integral to precision medicine, allowing for tailored treatment plans that improve patient outcomes. Additionally, non-invasive testing methods are gaining traction, offering significant advantages in patient care by enabling earlier intervention and reducing healthcare costs.

- For instance, in October 2024, LG and Hanmi Pharmaceutical invested USD 5 million in MEDiC Life Sciences to support the advancement of their cancer biomarker discovery technology. MEDiC's MCATTM platform is essential for finding key biomarkers for solid tumors, enhancing cancer therapy development, and improving patient outcomes

- In May 2024, Lantern Pharma and Oregon Therapeutics initiated an AI collaboration to optimize the development of XCE853, a cancer metabolism inhibitor. Leveraging RADR's AI capabilities and over 200 machine learning algorithms, the partnership aims to identify key biomarkers, enhance drug efficacy, and define optimal combination regimens for XCE853.

Biomarkers Market Report Snapshot

| Segmentation | Details |

| By Type | Protein Biomarkers, Genetic Biomarkers, Metabolic Biomarkers, Imaging Biomarkers |

| By Application | Disease Diagnosis, Disease Prognosis, Drug Discovery and Development, Personalized Medicine |

| By Disease Indication | Cancer, Infectious Disease, Immunological Disorder, Cardiovascular Disorder, Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Protein Biomarkers, Genetic Biomarkers, Metabolic Biomarkers, and Imaging Biomarkers): The protein biomarkers segment earned USD 32.43 billion in 2023 due to their essential role in disease detection and personalized treatments, particularly in oncology.

- By Application (Disease Diagnosis, Disease Prognosis, Drug Discovery and Development, and Personalized Medicine): The disease diagnosis segment held a share of 42.66% in 2023, largely attributed to the rising demand for accurate, early diagnostics in chronic diseases.

- By Disease Indication (Cancer, Infectious Disease, Immunological Disorder, Cardiovascular Disorder, and Others): The cancer segment is projected to reach USD 86.43 billion by 2031, fueled by increasing incidence of cancer and advancements in biomarker research for early detection and targeted therapies.

Biomarkers Market Regional Analysis

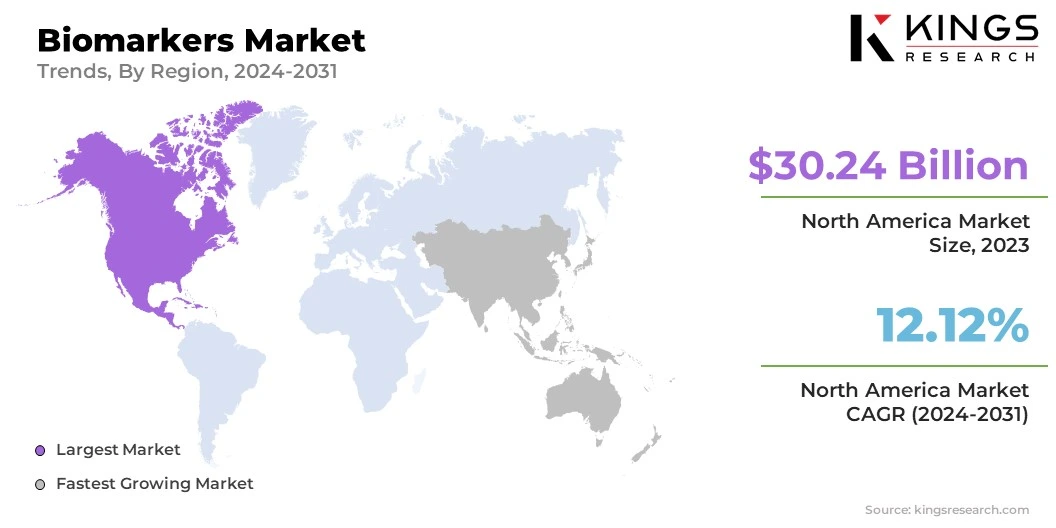

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America biomarkers market accounted for a share of around 36.73% in 2023, valued at USD 30.24 billion. This dominance is bolstered by the region’s strong focus on research and development, growing prevalence of chronic diseases, and increasing demand for personalized medicine and advanced diagnostic solutions.

The U.S. at the forefront, mainly due to advanced healthcare infrastructure, increased R&D investments, favorable government initiatives, and widespread adoption of innovative technologies such as AI, genomics, and proteomics in disease diagnosis and personalized medicine.

- For instance, in July 2024, American Lung Association launched a new biomarker education and awareness program called Biomarker, Education, Awareness and Testing (BEAT) Lung Cancer to increase biomarker testing in communities disproportionately affected by lung cancer disparities.

Asia-Pacific is anticipated to grow the fastest CAGR of 14.53% through the estimated timeframe. This rapid growth is propelled by increasing healthcare investments, the rising prevalence of chronic diseases, the growing demand for advanced diagnostics, and improvements in research capabilities, particularly China and India.

This growth is further supported by a major emphasis on improving healthcare access and quality.

- According to the World Health Organization, new cancer cases in the South-East Asia Region are expected to increase by 85.7% by 2050, contributing significantly to the rapidly increasing cancer burden in Region.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the Food and Drug Administration (FDA) oversees biomarker regulation and issues a final determination on the qualification of the biomarker, essential for validating diagnostics and therapeutics in targeted medical applications.

- In Europe, the European Medicines Agency (EMA) regulates biomarkers, with advice from the Committee for Medicinal Products for Human Use (CHMP) on the basis of recommendations from the Scientific Advice Working Party (SAWP). This process leads to a CHMP qualification opinion or advice.

- In APAC, China's National Medical Products Administration (NMPA) regulates biomarkers, oversseing the approval and monitoring of companion diagnostics and biomarker testing to ensure compliance with national health standards.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA), in collaboration with the Ministry of Health, Labour and Welfare (MHLW), regulates biomarkers.

Competitive Landscape:

The biomarkers market is characterized by a large number of participants, including both established corporations and rising organizations. To gain a competitive edge in the rapidly evolving market, organizations are actively engaging in a wide range of strategic initiatives to enhance their market position and drive growth.

Key strategies include developing of innovative products, forming strategic collaborations and alliances, expanding through geographic diversification and market penetration, and pursuing mergers and acquisitions to strengthen capabilities, expand product portfolios, and achieve economies of scale.

Additionally, numerous organizations are investing in cutting-edge technologies and enhancing research and development efforts to capitalize on emerging opportunities in personalized medicine, diagnostic advancements, and precision therapies.

- In October 2024, SandboxAQ partnered with Sanofi to enhance biomarker identification during clinical development. Utilizing advanced Quantitative AI models, this collaboration aims to improve understanding of human biology and facilitate the demonstration of investigational medicines' efficacy and safety.

List of Key Companies in Biomarkers Market:

- Thermo Fisher Scientific Inc.

- Hoffmann-La Roche Ltd

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Siemens

- QIAGEN

- PerkinElmer Inc.

- BIOMÉRIEUX

- Fujirebio

- GE HealthCare

- Almac Group

- Caris Life Sciences.

- Denovo Biopharma LLC

- Eurofins Scientific

- MESO SCALE DIAGNOSTICS, LLC

Recent Developments:

- In January 2025, Enigma Biomedical USA and the University of Wisconsin–Madison formed a partnership to develop next-generation imaging and fluid biomarkers, enhancing the understanding and management of neurodegenerative diseases through advanced diagnostic technologies.

- In January 2025, Tempus AI, Inc. entered a multi-year partnership with Genialis to create RNA-based biomarker algorithms for cancer treatment by utilizing Tempus' extensive multimodal dataset to enhance precision medicine efforts.

- In January 2025, Quanterix Corporation acquired Akoya Biosciences to develop an integrated solution for the ultra-sensitive detection of protein biomarkers in blood and tissue samples. This strategic alliance aims to accelerate the transition of biomarkers from research to clinical applications, creating new growth opportunities for both companies.

- In November 2024, Alamar Biosciences partnered with The Michael J. Fox Foundation to develop advanced biomarker assays for Parkinson's disease by leveraging Alamar's proteomics technology to enhance biological classification and support targeted therapeutic development.

- In July 2024, Becton, Dickinson and Company and Quest Diagnostics formed a global partnership to develop and commercialize flow cytometry-based companion diagnostics. This partnership will combine their combined expertise in biomarker and assay development to enhance personalized medicine and improve patient treatment selection.

- In May 2024, Boston Consulting Group formed a strategic alliance with Merck to utilize AI and generative AI for the discovery of novel biomarkers. The collaboration seeks to analyze omics data to explore the relationships between biomarkers and disease biology, thereby enhancing drug target identification for chronic and degenerative diseases.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)