Biomass Boiler Market

Biomass Boiler Market Size, Share, Growth & Industry Analysis, By Feedstock (Woody Biomass, Agricultural & Forest Residue & Others), By Type (Fully Automated Biomass Boilers, Semi-Automated Biomass Boilers & Others), By End-Use (Residential, Commercial, Industrial), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR948

Biomass Boiler Market Size

The global Biomass Boiler Market size was valued at USD 5,275.6 million in 2023 and is projected to grow from USD 5,920.4 million in 2024 to USD 14,975.6 million by 2031, exhibiting a CAGR of 14.18% during the forecast period. The market is expanding rapidly due to rising global efforts toward sustainable energy solutions.

Government incentives and technological advancements are driving the adoption of biomass boilers, making them increasingly popular due to their efficiency and environmental benefits. As industries worldwide shift toward renewable energy sources, biomass boilers play a crucial role in reducing carbon footprints and meeting international climate commitments.

In the scope of work, the report includes solutions offered by companies such as Babcock & Wilcox, Amec Foster Wheeler, Thermax Limited, Siemens Energy, IHI Corporation, Doosan Lentjes, Thyssenkrupp, Hurst Boiler & Welding Co, Inc., ANDRITZ, Ansaldo, and others.

The biomass boiler market is experiencing robust growth, mainly propelled by increasing environmental concerns and the transition toward renewable energy sources.

- Additionally, the REmap analysis conducted by IRENA, in collaboration with the European Commission and international experts, projects that the EU could potentially increase its renewable energy share from 17% in 2015 to 34% by 2030. The report underscores the feasibility of achieving this target using existing technologies and emphasizes the associated economic advantages.

This transition aligns with the EU's emissions reduction goals under the Paris Agreement, marking a significant stride toward sustainable energy practices and thereby boosting the demand for biomass boilers.

Governments worldwide are providing incentives and subsidies to promote the adoption of biomass boilers, which utilize organic materials for cleaner energy production. Technological advancements in efficiency and automation are making these systems more attractive, reliable, and cost-effective.

As industries and consumers seek sustainable alternatives to fossil fuels, the demand for biomass boilers is rising. This market expansion is further supported by the global commitment to reducing carbon emissions and achieving net-zero targets, positioning biomass boilers as a key component in the renewable energy landscape.

Biomass boilers are heating systems that utilize organic materials such as wood pellets, agricultural residues, or biomass to produce heat or electricity. These systems combust biomass in controlled environments to generate energy, offering a sustainable alternative to traditional fossil fuels.

Biomass boilers are employed in various sectors, including residential, commercial, and industrial applications, where they contribute to reducing greenhouse gas emissions and promoting environmental sustainability. Their use helps mitigate reliance on non-renewable energy sources while supporting local economies through the utilization of locally sourced biomass materials. As governments and industries prioritize clean energy solutions, biomass boilers play a vital role in the transition toward a greener future.

Analyst’s Review

Governments worldwide are progressively implementing initiatives to promote environmental sustainability and advancing greener practices, thereby stimulating the biomass boiler market growth in renewable energy sectors.

- For instance, the UK government's Boiler Upgrade Scheme (BUS) encourages property owners to shift from fossil fuel dependency to cleaner heating systems. This initiative offers USD 6,456.9 on the cost and installation of biomass boilers, particularly benefiting rural households.

- Similarly, in July 2024, the European Investment Bank (EIB) partnered with Cepsa to finance a USD 309.701 million loan for constructing an advanced biofuels plant in Andalusia, Spain.

Such investments promote the development of renewable energy infrastructure, reduce carbon footprints, and support economic sustainability across various regions.

These government initiatives, such as the UK's Boiler Upgrade Scheme and the EIB's financing for biofuel plants, are boosting market growth by incentivizing the adoption of renewable energy solutions. These programs are increasing demand for cleaner technologies, reducing carbon footprints, and fostering innovation in sustainable energy sectors, thereby positioning it for substantial expansion in the coming years.

Biomass Boiler Market Growth Factors

The growing concern for environmental issues and the urgent need to reduce carbon emissions are significantly boosting the adoption of biomass boilers. Governments and organizations worldwide are striving to meet climate goals and decrease reliance on fossil fuels, thereby making biomass boilers an attractive alternative for sustainable energy production.

By utilizing organic materials such as wood pellets and agricultural residues, these boilers generate heat and power in a cleaner, renewable manner. This shift reduces the carbon footprint and promotes the use of locally sourced biomass, thus supporting regional economies and sustainable agricultural practices. Moreover, environmental concerns and regulatory pressures are further contributing to the increased adoption of biomass boilers.

High initial installation and maintenance costs are hindering the growth of the biomass boiler market, as these expenses are acting as a significant barrier for potential users. This financial burden is often deterring both industries and consumers from investing in biomass technology, despite its long-term benefits.

Additionally, the complexity of integrating biomass systems with existing infrastructure is further impeding adoption rates. To address these challenges, key players are investing heavily in technological advancements to enhance efficiency and reduce overall costs. They are further collaborating with governments to leverage incentives and subsidies, thus lowering the financial burden on consumers.

Furthermore, companies are offering financing options and promoting the long-term economic and environmental benefits of biomass boilers to promote adoption, which is slated to augment market growth in coming years.

Biomass Boiler Market Trends

Increasing government incentives and subsidies for renewable energy projects are propelling the expansion of the biomass boiler market.

- According to Invest India, the country has set a target to reduce the carbon intensity of it's economy by at least 45% by the end of the decade. Additionally, India aims to achieve 50 percent of its cumulative electric power capacity from renewable sources by 2030 and to attain net-zero carbon emissions by 2070.

These financial supports lower the initial costs associated with biomass boiler installation, making the technology more accessible and attractive to both consumers and businesses. Due to this, more entities are investing heavily in biomass boilers, thus expanding their adoption across various sectors.

Additionally, subsidies and incentives promote innovation and technological advancements within the industry, leading to the development of more efficient and cost-effective biomass boiler systems. This enhanced adoption and innovation cycle further stimulates market expansion, as both existing and potential users recognize the economic and environmental benefits of biomass boilers.

Technological advancements in biomass boiler efficiency and automation are fostering market growth. Modern biomass boilers, equipped with advanced control systems and automation features, are optimizing fuel usage and reducing emissions. Innovations such as automated feed systems, real-time monitoring, and smart controls are enhancing performance and energy output.

These improvements are making biomass boilers more reliable, easier to operate, and cost-effective, leading to higher energy savings and lower operational costs. An increasing number of industries and consumers are adopting these advanced systems, recognizing their benefits, and contributing to market expansion.

Segmentation Analysis

The global market is segmented based feedstock, type, end-use, and geography.

By Feedstock

Based on feedstock, the biomass boiler market is categorized into woody biomass, agricultural & forest residue, urban residue, and biogas & energy crops. The woody biomass segment garnered the highest revenue of USD 2,176.2 million in 2023. Woody biomass is increasingly being recognized for its renewable nature and its potential to reduce greenhouse gas emissions compared to fossil fuels.

Advancements in technology are enhancing the efficiency and cost-effectiveness of converting woody biomass into energy, making it a competitive alternative in the energy market. Additionally, supportive government policies and incentives worldwide are fostering investment and widespread adoption of woody biomass technologies. These factors are aiding the growth of the woody biomass segment, fostering a transition toward greener energy solutions.

By Type

Based on type, the market is categorized into fully automated biomass boilers, semi-automated biomass boilers, and combined heat and power system. The fully automated biomass boilers segment captured the largest biomass boiler market share of 45.62% in 2023. These boilers are increasingly favored for their operational efficiency and reduced maintenance requirements due to advanced automation features.

Businesses and homeowners are increasingly opting for fully automated systems to streamline operations and ensure consistent performance. Moreover, technological advancements in automation are continually enhancing these boilers' reliability and energy efficiency, thus attracting more consumers. The fully automated biomass boilers segment is expanding rapidly, mainly due to the growing demand for sustainable and cost-effective heating solutions in residential, commercial, and industrial sectors.

By End-Use

Based on end-use, the market is categorized into residential, commercial, and industrial. The industrial segment is expected to garner the highest revenue of USD 7,169.4 million by 2031. Industrial facilities are increasingly adopting biomass boilers due to their ability to provide reliable, cost-effective, and sustainable energy solutions.

These boilers offer significant operational benefits such as reduced fuel costs, lower emissions, and compliance with environmental regulations. Moreover, advancements in biomass boiler technology, including enhanced efficiency and scalability, are catering to the diverse needs of industrial applications.

Government incentives and policies that support the adoption of renewable energy further compel industries to invest in biomass boilers, thereby bolstering segmental expansion. As industrial sectors prioritize sustainability and operational efficiency, the demand for biomass boilers is rising, thus fueling the growth of the segment.

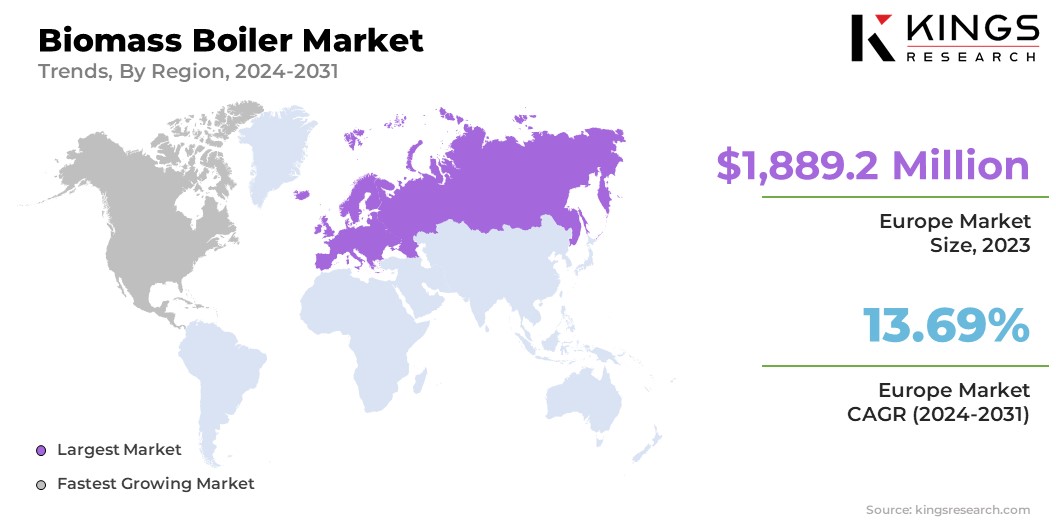

Biomass Boiler Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Europe biomass boiler market share stood around 35.81% in 2023 in the global market, with a valuation of USD 1,889.2 million. Rising investments is contibuting to the market growth.

- For instance, EUROAPI has announced a €24 million investment to construct a state-of-the-art biomass boiler at its Saint-Aubin-lès-Elbeuf site in France, with the project set to commence operations in 2025. This initiative aims to increase vitamin B12 production capacity, reduce CO2 emissions by nearly 76% by 2026 compared to 2020, and enhance the company's energy autonomy strategy.

Such investments underscore the region's commitment to sustainable practices and renewable energy solutions. Technological advancements in biomass boiler efficiency and automation further enhance their attractiveness in the European market, fostering sustained growth and innovation.

North America is anticipated to witness substantial growth at a staggering CAGR of 16.10% over the forecast period. Governments and organizations across the region are increasingly focusing on reducing carbon emissions and promoting renewable energy sources, which has led to supportive policies and incentives for biomass boiler adoption.

Technological advancements in biomass combustion and efficiency are making these systems more attractive and cost-effective for various applications, including residential, commercial, and industrial sectors. Additionally, growing awareness among consumers and businesses regarding the environmental benefits associated with biomass boilers is fueling demand.

North America is witnessing a notable increase in biomass boiler installations, which is playing a key role in advancing the region's transition to a sustainable energy future.

Competitive Landscape

The global biomass boiler market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Biomass Boiler Market

- Babcock & Wilcox

- Amec Foster Wheeler

- Thermax Limited

- Siemens Energy

- IHI Corporation

- Doosan Lentjes

- Thyssenkrupp

- Hurst Boiler & Welding Co, Inc.

- ANDRITZ

- Ansaldo

Key Industry Development

- June 2022 (Partnership): Danone partnered with Berkeley Energy Commercial Industrial Solutions (BECIS) to build and operate a Biomass Boiler fueled by rice husk, aimed at reducing its carbon footprint by up to 32% from production activities in Prambanan. This initiative reflects Danone Indonesia’s commitment to mitigating climate change, aligning with its goals to achieve 100% renewable electricity by 2030 and carbon neutrality by 2050. Additionally, the partnership supports government objectives to increase the renewable energy mix to 25% and achieve carbon neutrality by 2060, underscoring Danone’s proactive role in promoting sustainable energy solutions and environmental stewardship.

The global biomass boiler market is segmented as:

By Feedstock

- Woody Biomass

- Agricultural & Forest Residue

- Urban Residue

- Biogas & Energy Crops

By Type

- Fully Automated Biomass Boilers

- Semi-Automated Biomass Boilers

- Combined Heat and Power System (CHP)

By End-Use

- Residential

- Commercial

- Industrial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership