Biopesticides Market Size

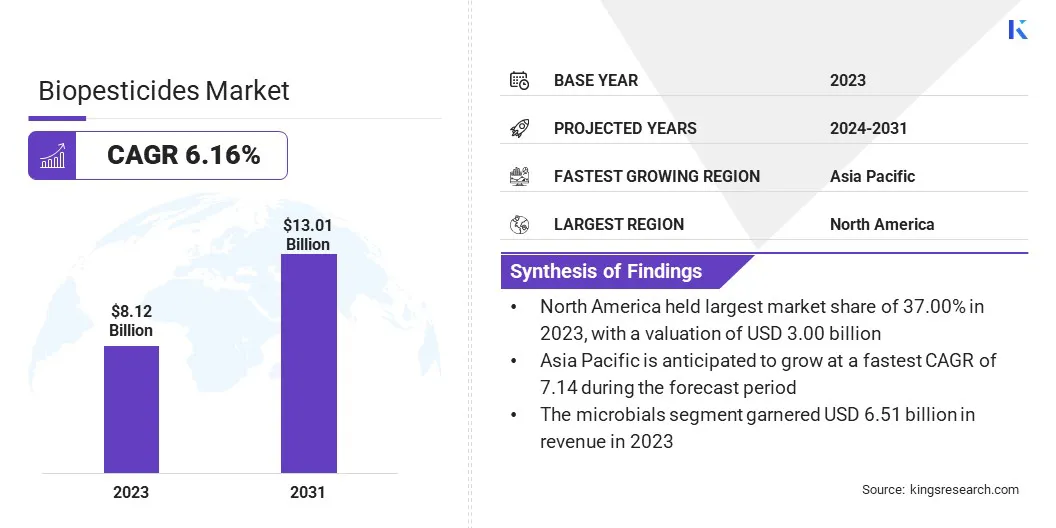

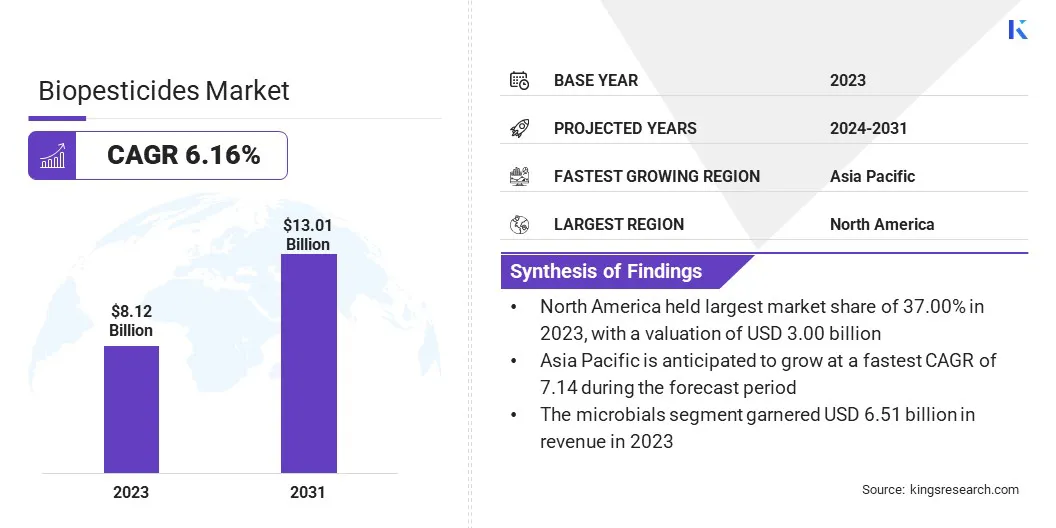

The global Biopesticides Market size was valued at USD 8.12 billion in 2023 and is projected to grow from USD 8.56 billion in 2024 to USD 13.01 billion by 2031, exhibiting a CAGR of 6.16% during the forecast period. The transition to sustainable agricultural practices is significantly influencing the market.

Farmers and producers are focusing on minimizing the environmental impact of farming activities while maintaining crop productivity. Biopesticides offer a safer alternative to synthetic pesticides, promoting soil health and reducing chemical residues in crops. Their ability to integrate into eco-friendly farming systems aligns with global sustainability goals.

In the scope of work, the report includes products offered by companies such as BASF, Bayer AG, Syngenta Crop Protection AG, Sumitomo Chemical Co., Ltd., FMC Corporation, Certis USA L.L.C., Bioceres Crop Solutions, UPL, Gowan Group, Corteva, and others.

Biopesticides employ diverse modes of action, which reduce the risk of pests developing resistance. This feature is particularly critical for integrated pest management strategies, ensuring long-term sustainability in crop protection. The ability to address resistance challenges while maintaining crop yield and quality is fueling the growth of the biopesticides market across various agricultural sectors.

Biopesticides are natural or biologically derived agents used in agriculture to control pests, weeds, and plant diseases. They are typically derived from microorganisms such as bacteria, fungi, and viruses, or from natural substances such as plant extracts and minerals.

Biopesticides are considered environmentally friendly alternatives to synthetic chemical pesticides, offering targeted action with minimal impact on non-target species and ecosystems. These eco-friendly solutions enhance sustainable agricultural by reducing chemical residues, promoting soil health, and mitigating pest resistance, and maintaining crop productivity.

Analyst’s Review

Companies in the biopesticides industry are adopting several strategic initiatives to boost growth and expand their market presence. They are forming collaborations with agricultural institutions, research organizations, and universities to foster innovation in biopesticide formulations.

These partnerships enable companies to enhance product efficacy and develop new solutions tailored to the evolving needs of farmers.

- In February 2024, Biotalys, an agtech company specializing in protein-based biocontrol solutions for crop protection, announced academic collaborations with renowned plant pathology researchers in both Europe and the U.S. These partnerships aim to advance the development of biocontrol products to assist growers in protecting their crops from pests and diseases.

Additionally, companies are forming strategic alliances with governments and NGOs to promote the adoption of biopesticides through awareness campaigns and training programs, addressing education and accessibility barriers.

- In January 2024, the Asia-Pacific Association of Agricultural Research Institutions (APAARI) launched the "Asia Pesticide Residue Mitigation through the Promotion of Biopesticides and Enhancement of Trade Opportunities" project workshop. The workshop aimed to foster collaboration among stakeholders to advance agricultural sustainability and promote the widespread use of biopesticides across the Asia-Pacific region.

By improving distribution networks and increasing availability, companies are expanding their reach, positioning biopesticides as a key solution in sustainable agriculture and eco-friendly farming practices.

Biopesticides Market Growth Factors

The rapid expansion of organic farming practices worldwide is fueling the growth of the biopesticides market. Governments and international organizations are promoting organic farming to address sustainability challenges, leading farmers to adopt biopesticides to meet organic certification standards. These products protect crops while preserving the ecological integrity of farming systems.

- According to the 2024 data from the Food and Agriculture Association (FAO), organic agriculture is practiced in 188 countries, covering over 96 million hectares of land managed by approximately 4.5 million farmers. In 2022, global sales of organic food and beverages nearly reached 135 billion euros.

With organic food production gaining traction globally, especially in regions such as Europe and North America, the demand for biopesticides is witnessing significant growth.

The need for climate-resilient agricultural practices is boosting the adoption of biopesticides globally. Extreme weather events and changing climatic conditions are impacting pest behavior, prompting farmers to adopt biopesticides for their adaptability and effectiveness in varying conditions.

These products help mitigate the adverse effects of climate change on crop health, promoting sustainable farming practices. Their ability to maintain pest control efficiency under diverse environmental conditions is fostering the growth of the biopesticides market.

However, the higher cost of production of biopesticides compared to traditional chemical pesticides is posing significant challenge to the market growth. Biopesticides involve complex formulations and require advanced technologies, leading to higher development and manufacturing expenses.

This cost barrier limits adoption among small-scale farmers in developing regions. To address this challenge, companies are investing in cost-reduction strategies, such as automation and scaling up manufacturing processes.

Additionally, partnerships with governments and NGOs are being explored to provide financial support, subsidies, and education programs, enhancing accessibility for a broader range of farmers.

Biopesticides Industry Trends

Rising investments in the agricultural sector of emerging economies are supporting the expansion of the biopesticides market. Countries in Asia-Pacific, Latin America, and Africa are witnessing a rise in funding for sustainable farming technologies, including biopesticides.

- In March 2023, the Global Agriculture and Food Security Program (GAFSP), a multilateral global fund, announced USD 220 million in agricultural investment grants for 15 countries. These grants aim to support nations in developing and implementing solutions that align with their existing agricultural sustainability and food security strategies.

Government programs, private sector involvement, and international collaborations are focusing on improving agricultural productivity while addressing environmental concerns.

Rising consumer awareness regarding health risks associated with synthetic pesticide residues in food is boosting the demand for biopesticides. Consumers are increasingly favoring produce grown with natural and safe pest control solutions, influencing farmers to transition to biopesticides.

Growing concerns over the environmental impact of traditional farming methods are further supporting the expansion of the market. Food retailers and agricultural organizations are capitalizing on this trend by promoting biopesticide-based farming as a safer and healthier alternative, thereby enhancing market penetration across regions.

Segmentation Analysis

The global market has been segmented based on type, form, crop type, source, application and geography.

By Type

Based on type, the market has been segmented into bioinsecticides, biofungicides, bionematicides, bioherbicides, and others. The bioinsecticides segment led the biopesticides market in 2023, reaching a valuation of USD 3.58 billion.

This growth is mainly due to their effectiveness in controlling a wide range of pests, which makes them highly sought after by farmers globally. Rising concerns regarding chemical pesticide residues and their impact on health and the environment rise have led to increased adoption of bioinsecticides as a safer alternative, environmentally friendly pest control solution.

Additionally, bioinsecticides are increasingly used in organic farming, which is experiencing rapid growth, particularly in developed regions. Their ability to target specific pests without harming beneficial insects further enhances their appeal, fueling segmental expansion.

By Form

Based on form, the market has been classified into powder/pallets/granules and liquid. The powder/pallets/granules segment secured the largest revenue share of 82.34% in 2023.

These forms offer significant advantages in terms of storage, transportation, and handling, making them highly preferred by farmers. Granules and pellets, in particular, allow for controlled release, ensuring prolonged protection against pests and diseases. The powders are versatile and can be easily mixed with water, making them suitable for application methods such as spraying and dusting.

Additionally, the granular and pellet formulations minimize the risk of environmental contamination, appealing to environmentally conscious consumers and regulatory bodies

By Crop Type

Based on crop type, the market has been divided into cereals & grains, fruits & vegetables, oilseeds & pulses, and non-food crops. The fruits & vegetables segment is set to witness significant growth, registering a robust CAGR of 7.16% through the forecast period.

This growth is largely attributed to increasing consumer demand for pesticide-free produce and the growing preference for organic farming practices. These crops are highly susceptible to pest attacks, making effective pest management crucial for ensuring crop quality and yield.

Biopesticides offer an environmentally friendly solution that meets consumer demand for cleaner, safer food. Additionally, the rising export demand for organic fruits and vegetables, especially in developed markets, fosters their adoption.

Biopesticides Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

North America biopesticides market held a substantial share of around 37.00% in 2023, with a valuation of USD 3.00 billion. Novel pesticide technologies are aiding this notable growth. Innovative alternatives to traditional chemical-based pesticides, including biopesticides, RNA-based pesticides, and pheromone-based controls, offer more targeted and sustainable pest management solutions.

- In December 2023, the U.S. Environmental Protection Agency (EPA) approved biopesticide products containing Ledprona, a a natural mechanism-based pesticide. Ledprona is a sprayable double-stranded ribonucleic acid (dsRNA) solution designed to target the Colorado potato beetle (CPB), a significant pest affecting potato crops in the U.S and other regions.

By focusing on specific pests without harming beneficial organisms or the environment, these technologies align with the region's increasing emphasis on environmentally friendly agricultural practices.

As farmers seek safer, more effective crop protection methods, the integration of these advanced technologies into pest management strategies is significantly contributing to the expansion of the North America market.

The region's established distribution infrastructure ensures easy accessibility of biopesticides to farmers across various organic, conventional, and large-scale commercial farming sectors. The increasing number of biopesticide manufacturers and suppliers in North America has further enhanced product availability, spurring competition and innovation.

Asia Pacific market is poised to witness significant growth, registering a robust CAGR of 7.14% over the forecast period. Asia-Pacific countries, especially India, China, and Japan, are investing heavily in research and development (R&D) to advance biopesticide technologies.

Partnerships between agricultural universities, research institutions, and private companies are resulting in more effective and user-friendly biopesticide formulations.

- In May 2024, APAARI launched the Asia-Pacific Biopesticide Community of Practice (ABCoP), a dynamic platform designed to unite key stakeholders in the biopesticide sector, including industry leaders, researchers, policymakers, government agencies, NGOs, and other relevant parties from the Asia-Pacific region and beyond. The main goal of ABCoP is to facilitate knowledge exchange, promote collaboration, and promote the advancement and trade of biopesticides in the region.

These collaborative efforts are fueling the rapid growth of the Asia-Pacific biopesticides market.

Competitive Landscape

The global biopesticides market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Biopesticides Market

- BASF

- Bayer AG

- Syngenta Crop Protection AG

- Sumitomo Chemical Co., Ltd.

- FMC Corporation

- Certis USA L.L.C.

- Bioceres Crop Solutions

- UPL

- Gowan Group

- Corteva

Key Industry Developments

- October 2024 (Partnership): BASF announced a strategic partnership with AgroSpheres, a biotechnology leader in sustainable crop protection and crop health, to develop a groundbreaking novel bioinsecticide. This collaboration represents a pivotal advancement in sustainable agricultural solutions, focusing on improving crop protection and promoting environmentally friendly farming practices.

- April 2024 (Launch): Bayer secured an exclusive license from UK-based AlphaBio Control for a novel biological insecticide. This innovative product, designed for arable crops such as oilseed rape and cereals is the first of its kind and shows significant potential in controlling coleoptera pests, including the cabbage stem flea beetle (CSFB), a major threat to oilseed rape crops

The global biopesticides market has been segmented as:

By Type

- Bioinsecticides

- Biofungicides

- Bionematicides

- Bioherbicides

- Others

By Form

- Powder/Pallets/Granules

- Liquid

By Crop Type

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Non-food Crops

By Source

- Microbials

- Bacillus Thuringiensis

- Bacillus Subtilis

- Trichoderma

- Beauveria Bassiana

- Others

- Biochemicals

- Plant-Based Extracts

- Insect Pheromones

- Oils & Organic Acids

- Others

- Others

By Application

- Soil Treatment

- Foliar Spray

- Seed Treatment

- Post-Harvest Treatment

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America