Healthcare Medical Devices Biotechnology

Biotherapeutics Cell Line Development Market

Biotherapeutics Cell Line Development Market Size, Share, Growth & Industry Analysis, By Product (Reagent and Media, Equipment, Cell Lines, and Other Products), By Source (Mammalian Cell Line and Non-Mammalian Cell Line), By Application, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : July 2024

Report ID: KR854

Biotherapeutics Cell Line Development Market Size

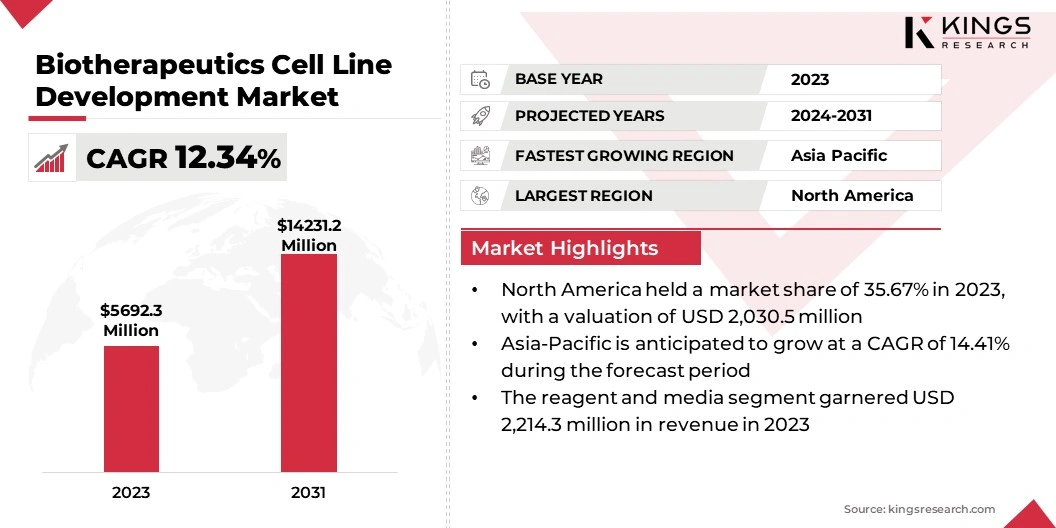

The global Biotherapeutics Cell Line Development Market size was valued at USD 5,692.3 million in 2023 and is projected to grow from USD 6,303.0 million in 2024 to USD 14,231.2 million by 2031, exhibiting a CAGR of 12.34% during the forecast period. Advancements in biotechnology, the increasing prevalence of chronic diseases, and the rising demand for biopharmaceuticals are driving the growth of the market.

In the scope of work, the report includes solutions offered by companies such as Corning Incorporated, Lonza, Merck KGaA, Promega Corporation., Sartorius AG, Selexis SA., WuXi Biologics, ATCC, DH Life Sciences, LLC., FUJIFILM Diosynth Biotechnologies., and others.

The expansion of the market is driven by the increasing prevalence of chronic diseases, such as cancer and autoimmune disorders, which significantly boosts the demand for biotherapeutics. Technological advancements in cell line development, including gene editing and expression systems, enhance efficiency and yield, thereby propelling market growth.

Regulatory support and favorable reimbursement policies further contribute to market expansion. Additionally, the growing biopharmaceutical sector, coupled with increased investment in research and development by pharmaceutical companies, fuels the demand for robust and reliable cell lines. These factors collectively create a dynamic environment for the growth of the biotherapeutics cell line development market.

The market is experiencing significant growth, mainly due to advancements in biotechnology and increasing demand for biopharmaceuticals. This market involves the development of stable and high-yield cell lines used in the production of biologics, including monoclonal antibodies, vaccines, and recombinant proteins.

Players in the industry are actively focusing on innovation and collaboration to enhance their offerings and gain a competitive edge. The market is characterized by the presence of well-established companies and a growing number of startups, creating an environment that is both competitive and collaborative. North America dominates the market, followed by Europe and Asia-Pacific, due to robust healthcare infrastructure and substantial investment in biopharmaceutical research.

- For Instance, in 2023, the US Food and Drug Administration’s Center for Drug Evaluation and Research (CDER) approved over 55 new drugs that were detailed in their annual New Drug Therapy Approvals report.

The biotherapeutics cell line development market pertains to the creation of cell lines that are genetically engineered to produce therapeutic proteins. These cell lines are crucial for the manufacturing of biologics, encompassing a wide range of products such as monoclonal antibodies, cytokines, and growth factors, which are used in the treatment of various diseases.

The process involves selecting and engineering cells to express the desired protein at high levels, while also ensuring stability and scalability for commercial production. This market encompasses various stages, including cell line selection, genetic modification, screening, and validation, aimed at producing effective and safe biotherapeutic products for clinical and commercial use.

Analyst’s Review

Manufacturers in the biotherapeutics cell line development market are intensifying their efforts to innovate and streamline processes. The adoption of advanced technologies, including CRISPR for precise genetic editing and AI for optimizing cell line selection, is on the rise. New product launches, particularly in the reagents and media segment, are addressing specific needs for higher efficiency and performance. Companies are continuing to invest in R&D to maintain competitive advantage and focusing on strategic partnerships to enhance technological capabilities.

Additionally, expanding presence in emerging markets such as Asia-Pacific, due to the region's significant growth potential, is crucial. Maintaining regulatory compliance and improving cost-effectiveness through automation and single-use technologies are likely to contribute to sustaining a leading position in the market.

Biotherapeutics Cell Line Development Market Growth Factors

The rising prevalence of chronic diseases, particularly cancer and autoimmune disorders, is propelling the growth of the market. This is highlighting the demand for advanced biologics, including monoclonal antibodies and recombinant proteins. As traditional small-molecule drugs often prove to be inadequate in treating these conditions, biotherapeutics offer targeted and effective treatment options.

Pharmaceutical companies, in collaboration with governments, are investing heavily in research and development to create innovative therapies, which necessitates the development of stable and high-yielding cell lines. This surge in demand for biologics is stimulating the growth of the biotherapeutics cell line development market, thereby fostering advancements in technology and process optimization to meet clinical and commercial needs.

- For Instance, in 2022, the National Institute of Health invested over USD 35 billion in biomedical research throughout the United States and globally, distributed through over 55,000 competitive grants.

The high cost and complexity associated with developing stable cell lines pose a major challenge to the growth of the market. The process of cell line development is time-consuming and resource-intensive, often requiring advanced technology and expertise. Overcoming this challenge involves adopting innovative technologies such as CRISPR/Cas9 for precise genetic editing and high-throughput screening methods to identify optimal cell lines efficiently.

Additionally, strategic collaborations between academic institutions and biopharmaceutical companies enable the pooling of resources and expertise, thereby accelerating the development process. Implementation of automation and artificial intelligence in cell line development workflows further reduces costs and improves efficiency, thus addressing the challenges of high cost and complexity in this market.

Biotherapeutics Cell Line Development Market Trends

A significant trend in the biotherapeutics cell line development market is the widespread adoption of single-use technologies. These technologies are transforming the manufacturing process by reducing the risk of contamination and increasing flexibility. Single-use systems are particularly beneficial for small-scale and multiproduct facilities, as they eliminate the need for extensive cleaning and sterilization between batches.

This trend is further fueled by the growing need for cost-effective and time-efficient production methods. Additionally, single-use technologies support faster turnaround times and scalability, which are crucial in responding to rising demands and accelerating time-to-market for biotherapeutic products. In response to this, an increasing number of companies are integrating single-use systems into their cell line development processes.

Another prominent factor supporting the growth of the biotherapeutics cell line development market is the rising use of artificial intelligence (AI) and machine learning (ML). These technologies are enhancing the efficiency and precision of cell line development by enabling predictive modeling and data analysis. AI and ML algorithms are used to analyze large datasets, identify optimal cell lines, and predict their performance.

This trend is further propelled by the growing need to shorten development timelines and improve the accuracy of cell line selection. By integrating AI and ML into their workflows, companies are striving to streamline the development process, reduce costs, and enhance the overall success rate of biotherapeutic production, thereby gaining a competitive edge in the market.

Segmentation Analysis

The global market is segmented based on product, source, application, and geography.

By Product

Based on product, the market is categorized into reagent and media, equipment, cell lines, and other products. The reagent and media segment led the biotherapeutics cell line development market in 2023, reaching a valuation of USD 2,214.3 million. This expansion is attributable to the crucial role reagents and media play in cell culture processes. High-quality reagents and media are essential for maintaining cell viability, growth, and productivity, directly impacting the efficiency of biotherapeutic production.

The increasing complexity of biotherapeutic molecules necessitates advanced media formulations tailored to specific cell lines. Additionally, ongoing advancements in media formulations, including serum-free and chemically defined media, are enhancing product performance. The continuous demand for reliable and high-performance reagents and media is contributing significantly to the growth of the segment.

By Source

Based on source, the market is classified into mammalian cell line and non-mammalian cell line. The non-mammalian cell line segment is set to record significant growth at a robust CAGR of 12.73% through the forecast period (2024-2031). Non-mammalian cell lines, such as insect and yeast cells, offer high protein expression levels and simpler growth media requirements.

These characteristics make them attractive for large-scale production of biotherapeutics. Additionally, advancements in genetic engineering and expression systems are enhancing the capabilities of non-mammalian cells, broadening their application in biopharmaceutical production. This is leading to their widespread adoption thereby bolstering the growth of the segment.

By Application

Based on application, the market is segmented into recombinant protein expression, hybridomas technology, vaccine production, drug discovery, and other applications. The drug discovery segment secured the largest biotherapeutics cell line development market share of 31.98% in 2023. This growth is propelled by the critical role of cell lines in identifying and validating new therapeutic targets. Cell lines are integral to high-throughput screening processes, allowing researchers to test thousands of compounds efficiently.

The growing emphasis on personalized medicine and the development of targeted therapies are fueling the demand for advanced cell line models in drug discovery. Additionally, biopharmaceutical companies are investing heavily in research and development to accelerate the discovery of novel drugs. This focus on innovation and efficiency in drug discovery processes is significantly contributing to the expansion of the segment.

Biotherapeutics Cell Line Development Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America biotherapeutics cell line development market share stood around 35.67% in 2023 in the global market, with a valuation of USD 2,030.5 million. This dominance is attributed to several factors, including a well-established biopharmaceutical industry and robust healthcare infrastructure. The region benefits from significant investment in research and development, mainly due to both government initiatives and private sector funding.

Additionally, North America houses numerous leading biopharmaceutical companies and research institutions, thereby fostering innovation and technological advancements. Favorable regulatory policies and strong intellectual property protection further bolster regional market growth.

Asia-Pacific is poised to experience notable growth at a staggering CAGR of 14.41% through the estimated timeframe. This rapid expansion is boosted by increasing healthcare expenditure, the growing biopharmaceutical industry, and the rising prevalence of chronic diseases in the region. Governments are investing heavily in healthcare infrastructure and biotechnology research, thereby creating a conducive environment for domestic market growth.

The region is witnessing a surge in collaborations and partnerships between local and international biopharmaceutical companies, resulting in enhanced technological capabilities and expertise. Additionally, lower production costs and a large pool of skilled professionals make Asia-Pacific an attractive market for biotherapeutics cell line development.

Competitive Landscape

The biotherapeutics cell line development market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Biotherapeutics Cell Line Development Market

- Corning Incorporated

- Lonza

- Merck KGaA

- Promega Corporation.

- Sartorius AG

- Selexis SA.

- WuXi Biologics

- ATCC

- DH Life Sciences, LLC.

- FUJIFILM Diosynth Biotechnologies.

Key Industry Developments

- June 2024 (Expansion): AGC Biologics announced the completion of its new manufacturing facility at its Copenhagen campus. This facility successfully increased its annual drug product batch production by 150 and doubled its single-use bioreactor capacity for mammalian services. The expansion added a 19,000-meter square of space and included a large manufacturing floor, utilities, a dedicated warehouse, and expanded labs. The new facility was developed at an approximate cost of around $200 million.

- January 2024 (Launch): Abzena launched the AbZelect and AbZelectPRO cell line development platforms to expedite the production of cell lines for antibodies and recombinant proteins. These platforms designed specifically to accelerate customers’ biologic drug programs toward clinical trials and reduce risks associated with IND applications. While AbZelect focused on traditional proteins, AbZelectPRO combined with ProteoNic’s technology to enhance production levels, thereby reducing the timeline from DNA to research cell banks to 15 weeks.

The global biotherapeutics cell line development market is segmented as:

By Product

- Reagent and Media

- Equipment

- Cell Lines

- Other Products

By Source

- Mammalian Cell Line

- Non-mammalian Cell Line

By Application

- Recombinant Protein Expression

- Hybridomas Technology

- Vaccine Production

- Drug Discovery

- Other Applications

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership