ICT-IOT

Blockchain Technology Market

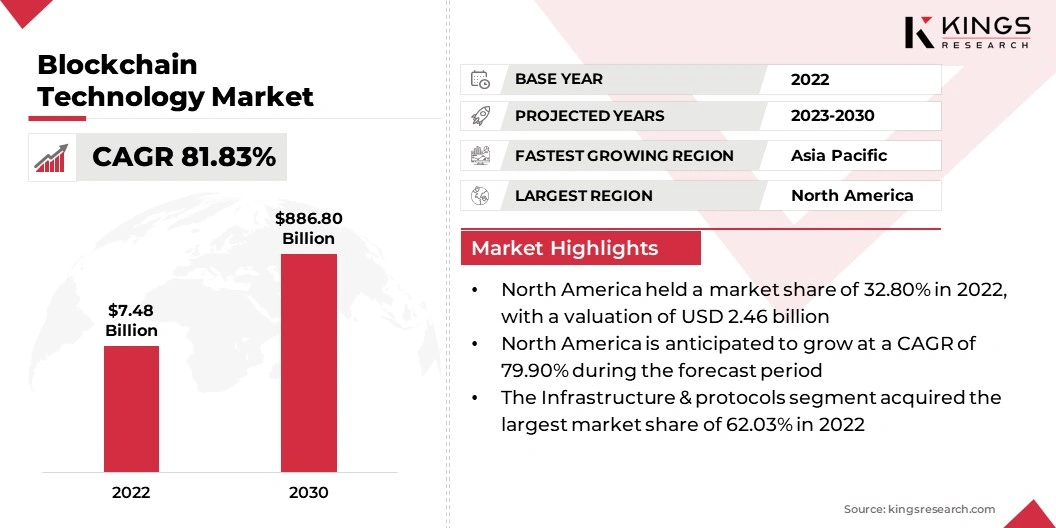

Blockchain Technology Market Size, Share, Growth & Industry Analysis, By Component (Application & Solution, Infrastructure & Protocols), By Type (Public Cloud, Private Cloud, Hybrid Cloud), By Application (Digital Identity, Exchanges, Payments, Smart Contracts, Others), By Technology, By End Use and Regional Analysis, 2023-2030

Pages : 120

Base Year : 2022

Release : March 2024

Report ID: KR540

Blockchain Technology Market Size

The global Blockchain Technology Market size was valued at USD 7.48 billion in 2022 and is projected to reach USD 886.80 billion by 2030, growing at a CAGR of 81.83% from 2023 to 2030. The blockchain technology market is experiencing exponential growth and innovation as various industries embrace this disruptive technology. This growth can be attributed to the increasing demand for secure and transparent transactions. In the scope of work, the report includes products offered by companies such as IBM, Microsoft, Oracle, SAP SE, Amazon Web Services, Tableau Software, SiSense Inc,, Zoho Corporation, Data Sciences, Datameer Inc and others.

Businesses are drawn to the cost efficiency and operational improvements that blockchain technology offers, boosting its adoption across a wide range of sectors. Finance, supply chain management, and healthcare industries are exploring how blockchain can enhance data security and establish trust among participants. Additionally, financial institutions are utilizing blockchain for efficient and secure cross-border payments, while supply chain operations are leveraging it for traceability and authentication of goods.

In the healthcare sector, blockchain enables secure exchange and storage of patient information, ensuring privacy and data integrity. The increasing recognition of the value of blockchain is anticipated to lead to a wider implementation, thus fostering additional advancements and revolutionizing digital business methodologies. Consequently, by streamlining procedures and diminishing instances of deceit and mistakes, blockchain is establishing the groundwork for a globally interconnected and dependable economy. As it progresses and is implemented across diverse industries, the potential of blockchain technology is boundless.

Analyst’s Review

The expansion of blockchain technology across multiple sectors is expanding the market. Enterprises are increasingly leveraging blockchain to enhance operational efficiency and security protocols. Notably, the adoption of blockchain within supply chain management has yielded significant advancements, fostering increased transparency and operational efficiency. Furthermore, the financial industry has rapidly deployed blockchain, benefiting from accelerated and more secure transactions. The market for blockchain technology is likely to observe continued growth as an increasing number of companies acknowledge its advantage.

In addition, blockchain technology has catalyzed a paradigm shift within the healthcare sector by offering a secure and streamlined framework for the management and exchange of patient information. This innovation has contributed to elevated standards of patient care alongside a reduction in administrative expenditures for healthcare providers.

Moreover, the real estate industry is adopting blockchain to facilitate property transactions, enhancing the transparency and security of these exchanges for all parties involved. Therefore, with its extensive applicability and potential to stimulate innovation, blockchain is positioned to effect significant change across numerous industries in the near term.

Market Definition

Blockchain technology is a decentralized and distributed ledger system, that facilitates secure transactions across a network of computers, enabling the transfer of digital assets without central oversight. Its applications span several industries, including finance, supply chain management, healthcare, and real estate, highlighting its versatility and potential for widespread adoption.

Furthermore, regulatory perspectives on blockchain vary globally, with some jurisdictions embracing the technology, while others enforce stringent controls. For instance, the European Union has introduced the General Data Protection Regulation (GDPR) to safeguard personal data within the blockchain ecosystem, exemplifying efforts to harmonize technological innovation with data security.

Conversely, nations such as China have imposed restrictions on cryptocurrencies and initial coin offerings (ICOs), citing concerns over fraud and financial stability. Despite these regulatory disparities, there is a collective acknowledgment of blockchain's capacity to transform industries by enhancing efficiency and transparency. As blockchain technology advances, regulatory bodies face the challenge of fostering innovation while ensuring consumer protection and data privacy. The trajectory of blockchain regulation is poised for continuous dialogue and adaptation, aiming to optimize the benefits of technology while mitigating associated risks.

Market Dynamics

The growth of the blockchain technology market is primarily fueled by the increased demand for transparency in various industries. As consumers become more concerned about the origins and supply chains of products, companies are facing pressure to provide accurate and verifiable information. Blockchain technology offers a secure and immutable method for recording transactions and data, enabling enhanced transparency and traceability. This increase in transparency not only fosters trust among consumers but also helps companies optimize their operations and mitigate the risk of fraud.

Additionally, blockchain technology empowers businesses to track and authenticate products throughout the entire supply chain, ensuring compliance with regulatory standards and ethical sourcing requirements. Thus, by leveraging decentralized and tamper-proof transaction records, companies can demonstrate their commitment to accountability and sustainability. Overall, the adoption of blockchain technology is revolutionizing industry practices and consumer interactions, driving greater marketplace efficiency and trust. This innovative technology also facilitates improved traceability, enabling companies to promptly identify and address any supply chain issues that may arise, which is driving the growth of the market.

However, the limited scalability of blockchain technology has emerged as a significant obstacle to its widespread adoption and market growth. The primary challenge faced by blockchain networks is their limited capacity to process a limited number of transactions per second. This limitation results in longer transaction times, higher fees, and overall inefficiencies within the system. Furthermore, as more users join the network, the strain on resources intensifies, exacerbating these scalability issues and impeding the potential of blockchain technology for mass adoption.

Segmentation Analysis

The global blockchain technology market is segmented based on component, type, application, enterprise size, end use, and geography.

By Component

Based on component, the blockchain technology market is bifurcated into application & solution, infrastructure & protocols, and middleware. The Infrastructure & protocols segment acquired the largest market share of 62.03% in 2022, due to its crucial role in providing the foundational framework for blockchain networks. These protocols establish the rules and standards that govern the interaction between different nodes in a decentralized system, ensuring security, transparency, and efficiency.

Additionally, infrastructure solutions such as scalable networks, consensus algorithms, and smart contract platforms are essential for the successful implementation of blockchain technology across various industries. With more companies and organizations recognizing the importance of a robust infrastructure for harnessing the full potential of blockchain technology, the segment is estimated to grow considerably in the coming years.

By Type

Based on type, the blockchain technology market is bifurcated into public cloud, private cloud, and hybrid cloud. Public cloud has emerged as a dominant segment in the market, accounting for a revenue share of 55.55% in 2022, backed by its scalability, flexibility, and cost-effectiveness. Additionally, public cloud providers offer a range of services that allow businesses to easily integrate blockchain technology into their existing infrastructure without the need for significant investment in hardware or software.

Furthermore, public cloud platforms provide a secure and reliable environment for storing and managing blockchain data, ensuring the integrity and confidentiality of transactions. This accessibility and efficiency have made the public cloud the preferred choice for organizations looking to leverage blockchain technology for various applications.

By Application

Based on application, the blockchain technology market is bifurcated into digital identity, exchanges, payments, smart contracts, supply chain management, and others. The payments segment has emerged as a dominant segment in the market, holding a share of 32.56% in 2022, due to its ability to revolutionize traditional financial systems.

Additionally, by utilizing blockchain technology, payments can be processed faster, more securely, and with lower fees compared to traditional banking methods. This has led to increased adoption by both businesses and consumers looking for more efficient and cost-effective ways to transfer funds. Additionally, the transparency and immutability of blockchain technology provide a level of trust and accountability that is lacking in traditional payment systems. These factors are propelling the growth of the payments segment.

Blockchain Technology Market Regional Analysis

Based on region, the global blockchain technology market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America Blockchain Technology Market share stood around 32.80% in 2022 in the global market, with a valuation of USD 2.46 billion, due to its strong regulatory framework and supportive government policies that encourage innovation and investment in the sector. Additionally, the region has a high number of tech-savvy professionals and leading blockchain companies, creating a vibrant ecosystem for growth in the industry. This, coupled with a large market size and a culture of entrepreneurship and risk-taking, has positioned North America as a global leader in blockchain technology.

Asia-Pacific blockchain technology market is expected to register the highest CAGR over the forecast period driven by the increasing demand for secure and efficient transactions. Additionally, governments in countries such as China, Singapore, and South Korea are widely implementing blockchain technology, leading to a surge in investment and innovation in the region.

Furthermore, the growing middle class population is driving demand for secure and efficient digital transactions, making blockchain technology an attractive solution for businesses and consumers alike. Moreover, government initiatives and support for blockchain development in countries such as Singapore and Australia are also contributing to the region's rapid growth in this sector.

Competitive Landscape

The global blockchain technology market study will provide valuable insights with an emphasis on the fragmented nature of the global industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers & acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their respective market shares across different regions. Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing heavily in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Blockchain Technology Market

- IBM

- Microsoft

- Oracle

- SAP SE

- Amazon Web Services

- Tableau Software

- SiSense Inc,

- Zoho Corporation

- Data Sciences

- Datameer Inc

Key Industry Developments

- December 2023 (Partnership): RYVYL, a blockchain ledger-based payments platform, partnered with R3, a distributed ledger technology company. The partnership is expected to create innovative and cost-effective solutions, simplifying the adoption of blockchain technology for businesses in banking, payments, and high-volume processing environments

- October 2023 (Acquisition): DTCC, a global financial services industry leader, announced the acquisition of a digital asset infrastructure developer, Securrency Inc. With this acquisition, DTCC sought to leverage Securrencys technology to embed digital assets within its existing services and products, develop regulatory-compliant and new blockchain-based offerings, and explore new use cases within the industry.

The Global Blockchain Technology Market is Segmented as:

By Component

- Application & Solution

- Infrastructure & Protocols

- Middle Ware

By Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End Use

- Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail

- Transportation & Logistics

- Travel

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership