Food and Beverages

Bottled Water Market

Bottled Water Market Size, Share, Growth & Industry Analysis, By Type (Spring Water, Mineral Water, Purified Water, Sparkling Water, Flavored Water, Still Water, Functional Water, Others), By Distribution Channel (On-trade, Off-Trade), and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : January 2025

Report ID: KR1219

Bottled Water Market Size

The global bottled water market size was valued at USD 268.66 billion in 2023 and is projected to grow from USD 300.95 billion in 2024 to USD 743.33 billion by 2031, exhibiting a CAGR of 13.79% during the forecast period.

The global increase in bottled water demand can be attributed to its convenience and potability, lack of access to clean water, growth of tourism and hospitality industry, and increasing product innovation and diversification.

In the scope of work, the report includes products offered by companies such as Danone, Smeraldina Corporation, The Coca-Cola Company, FIJI Water Company LLC, Nestlé, Bisleri International Pvt. Ltd., Perrier, SANPELLEGRINO, Volvic, Icelandic Glacial, and others.

Given numerous global and local players in the bottled water market, companies are increasingly prioritizing product differentiation. Bottled water companies are establishing direct-to-consumer (DTC) channels through their online stores to expand their reach and engage a broader consumer base.

This strategy provides greater control over the customer experience, enables direct communication with consumers, and bypasses traditional retail intermediaries. Offering subscription services for regular bottled water delivery further enhances consumer convenience and generates recurring revenue streams for companies.

- For instance, in November 2024, Water Delivery Solutions launched a new water delivery management software platform designed to streamline delivery operations for manufacturers. This subscription-based SaaS model aims to enhance the customer experience by automating delivery schedules with real-time tracking and optimizing last-mile logistics.

The market presents a diverse product portfolio, encompassing spring water, mineral water, purified water, sparkling water, flavored water, and others.

The inherent portability and extensive distribution network of bottled water enhance its convenience, particularly for individuals with active lifestyles. Furthermore, in regions where water quality is a concern, bottled water is often seen as a safer alternative.

Analyst’s Review

To capitalize on the increasing demand for bottled water, manufacturers are diversifying their product portfolios to include flavored water, vitamin-infused water, electrolyte-enhanced water, and other value-added offerings.

They are also introducing new bottle sizes, multipacks, and alternative packaging formats to cater to diverse consumer needs and consumption patterns. These strategies enable them to differentiate their products from local competitors.

Bottled water manufacturers increasingly focus on incorporating recycled plastic into their bottles to reduce reliance on virgin plastic and promote a circular economy. Many companies invest in research and development and adopting plant-based plastics derived from renewable resources.

To further mitigate plastic usage, bottled water is also being offered in alternative packaging formats such as aluminum cans, cartons, and refillable systems.

- In October 2023, Chlorophyll Water, a U.S. based plant-powered bottled water provider, launched a new product line packaged in 100% recycled polyethylene terephthalate (rPET). The company utilizes Avery Dennison’s CleanFlake technology to optimize the recycling process for these bottles.

Bottled Water Market Growth Factors

Global demand for bottled water has increased significantly in recent years, primarily due to concerns surrounding water scarcity and contamination. In numerous developing economies, including India, Brazil, Mexico, and South Africa, tap water is often contaminated with bacteria, viruses, pesticides, and industrial chemicals, rendering it unsafe for consumption.

Inadequate or non-existent water treatment infrastructure in these regions further exacerbates the problem, limiting access to safe and reliable tap water and driving consumer reliance on alternative sources such as bottled water.

- According to a report published by the World Bank in May 2024, over 2 billion people lack access to clean water, contributing to at least 1.4 million deaths annually and impacting 50% of global malnutrition cases. Furthermore, over 800 million people worldwide face a high risk of drought. This reinforces the significant market demand for bottled water and other water solutions.

The bottled water market, while experiencing strong growth, faces several challenges including, substantial plastic waste generation and subsequent environmental pollution. The prevalent use of single-use plastic bottles in the bottled water industry contributes significantly to ocean pollution and overall plastic waste accumulation.

To mitigate these risks, manufacturers are implementing sustainable packaging solutions and investing in recycling infrastructureto collect and recycle used plastic bottles.

Bottled Water Industry Trends

Bottled water manufacturers are increasingly transitioning to sustainable packaging solutions due to growing environmental awareness and stricter regulations concerning plastic usage. This shift involves exploring and adopting plant-based plastics derived from renewable resources such as sugarcane and cornstarch, offering potential biodegradability or composability.

Additionally, alternative packaging formats, including aluminum cans, cartons, and glass bottles, are gaining traction as sustainable alternatives compared to traditional plastic bottles.

- In March 2024, SOURCE, an Arizona-based atmospheric water generation company using solar energy, launched canned drinking water in the U.S. This launch aims to raise awareness of the company's hydropanel technology and promote sustainable water sourcing practices.

Furthermore, the bottled water market has witnessed a growing trend of premiumization and brand differentiation. Brands are increasingly emphasizing the natural origin and purity of their water, highlighting specific springs or aquifers as their source.

Premium packaging, including high-quality glass bottles, uniquely designed plastic bottles, and sophisticated labeling, is being used to convey a sense of luxury and exclusivity, thereby stimulating demand for bottled water within the premium segment.

Segmentation Analysis

The global market has been segmented based on type, distribution channel, and geography.

By Type

Based on type, the bottled water industry has been categorized into spring water, mineral water, purified water, sparkling water, flavored water, still water, functional water, and others. The functional water segment is anticipated to grow at a staggering CAGR of 17.23% over the forecast period.

The increasing demand for functional water, encompassing electrolyte water, vitamin-enriched water, herbal-infused water, and others, is will likely grow due to growing health consciousness, evolving lifestyles, and shifting dietary habits.

These functional beverages often target specific health needs, offering enhanced hydration, electrolyte replenishment, immune support, energy enhancement, and digestive health. Consumers are becoming proactive in managing their health and well-being, seeking products that provide added health benefits beyond basic hydration.

By Distribution Channels

Based on the distribution channels, the market has been bifurcated into on-trade and off-trade. The off-trade segment led the bottled water market in 2023, reaching a revenue of USD 268.66 billion.

The off-trade distribution channel involves the sale of goods intended for consumption off premises of the retail establishment such as supermarkets, hypermarkets, convenience stores, online retail, specialty stores, and others.

This segment generates substantial revenue due to a wide product assortment, competitive pricing, and enhanced consumer convenience. Furthermore, the widespread availability of bottled water across these retail outlets contributes to its high purchase frequency among consumers.

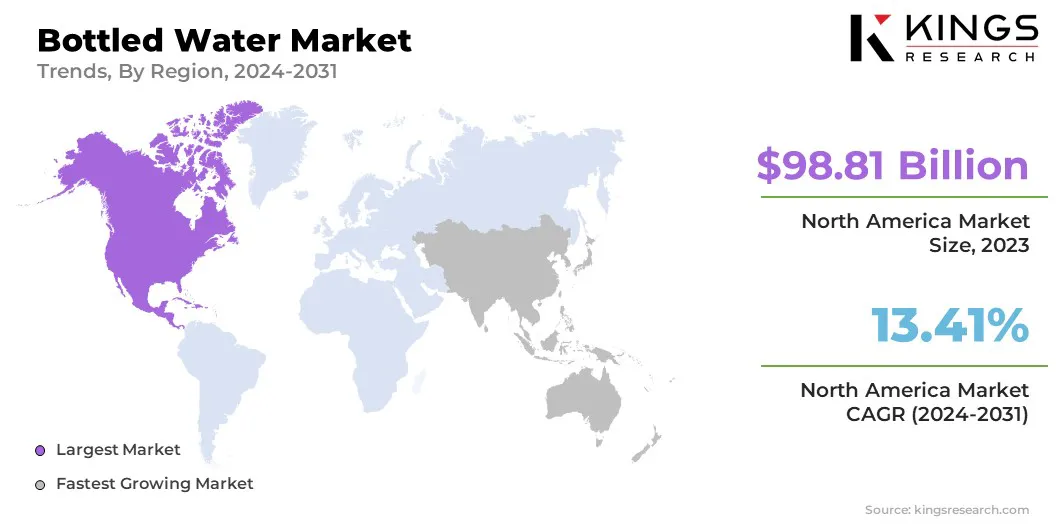

Bottled Water Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

North American bottled water market share accounted for 36.78% of the global market, valued at USD 98.81 billion in 2023. The region benefits from a well-established retail infrastructure, characterized by widespread availability of bottled water across diverse retail formats, including supermarkets, convenience stores, gas stations, and other outlets.

These outlets commonly offer single-serve bottles catering to on-the-go consumer segment. Furthermore, bottled water manufacturers have developed efficient supply chains and robust distribution networks to ensure timely and reliable product delivery to retailers throughout the continent.

The Asia-Pacific is experiencing rapid growth, with projected revenue reaching USD 213.41 billion by 2031. This expansion is primarily attributable to the limited availability of potable water for the region's growing tourism sector.

As a major tourist destination attracting a number of international and domestic tourists, the Asia-Pacific region generates substantial demand for bottled water.The tourism boom has further led to rapid development of the hospitality sector, with hotels, resorts, and other accommodation facilities commonly providing bottled water as a standard amenity for guests, thereby significantly contributing to bottled water sales.

- A report published by the Pacific Asia Travel Association (PATA) in October 2024 revealed that international visitor arrivals reached 522 million across 47 Asia-Pacific destinations, representing a 94.3% increase year-over-year. This substantial growth in international tourism is expected to drive increased demand for bottled water.

Competitive Landscape

The global bottled water market report provides valuable insights with a major emphasis on the fragmented nature of the industry. Prominent players focus on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies implement numerous strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in the Bottled Water Market

- Danone

- Smeraldina Corporation

- The Coca‑Cola Company

- FIJI Water Company LLC

- Nestlé

- Bisleri International Pvt. Ltd.

- Perrier

- SANPELLEGRINO

- Volvic

- Icelandic Glacial.

Key Industry Developments

- November 2024 (Acquisition): Ecolab, a global leader in hygiene, water, and infection prevention solutions, acquired Barclay Water Management, a provider of water safety solutions for institutional and industrial clients. Notably, Barclay Water Management's client base includes numerous bottled water manufacturers.

- June 2024 (Merger): Primo Water and BlueTriton announced a merger to create a leading North American healthy hydration company. The newly formed entity Primo Brands, with projected net revenues of USD 6.50 billion, will include brands such as Poland Spring, Deer Park, Ozarka, Ice Mountain, and Pure Life.

- April 2024 (Rebranding): Nestlé Waters North America (NWNA) announced its new corporate name BlueTriton Brands, following its acquisition by One Rock Capital Partners, LLC and Metropoulos & Co. This rebranding reflects the company’s commitment to sustainable resource management and its role as a provider of fresh water.

The global bottled water market has been segmented:

By Type

- Spring Water

- Mineral Water

- Purified Water

- Sparkling Water

- Flavored Water

- Still Water

- Functional Water

- Others

By Distribution Channel

- On-Trade

- Off-Trade

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership