Healthcare Medical Devices Biotechnology

Breast Cancer Diagnostics Market

Breast Cancer Diagnostics Market Size, Share, Growth & Industry Analysis, By Test Type (Imaging Tests, Biopsy Tests, Genetic Tests, Blood Tests), By Product Type (Instruments, Reagents & Kits, Software & Services), By End-User (Hospitals, Diagnostic Laboratories), By Technology, and Regional Analysis, 2024-2031

Pages : 210

Base Year : 2023

Release : January 2025

Report ID: KR1256

Market Definition

Breast cancer diagnostics encompasses a variety of diagnostic procedures, including mammography, ultrasound, MRI, and biopsy techniques, with an increasing focus on personalized and precision medicine.

Moreover, advances in artificial intelligence (AI) and machine learning (ML) are significantly boosting diagnosis accuracy, resulting in better patient outcomes and market growth.

Breast Cancer Diagnostics Market Overview

Global Breast Cancer Diagnostics Market size was valued at USD 4703.20 billion in 2023, which is estimated to be valued at USD 5,032.31 billion in 2024 and reach USD 8,546.09 billion by 2031, growing at a CAGR of 7.86% from 2024 to 2031.

The market for breast cancer diagnostics is expanding rapidly, aided by advances in imaging technology, biomarkers, and genetic testing. Increased awareness, early detection measures, and a rising global prevalence of breast cancer are all key drivers of demand.

Major companies operating in the breast cancer diagnostics market are Hologic, Inc., Siemens Healthineers AG, GE HealthCare, Becton, Dickinson and Company, Koninklijke Philips N.V., FUJIFILM, Thermo Fisher Scientific Inc., Exact Sciences Corporation, Bruker Spatial Biology, Inc., F. Hoffmann-La Roche Ltd, Illumina, Inc., Quest Diagnostics, Dilon Technologies, AURORA HEALTHCARE US CORP, Bio-Rad Laboratories, Inc., and others.

The market covers a variety of techniques, technologies, and services for detecting and diagnosing breast cancer at different stages. This market encompasses imaging modalities like mammography and MRI, as well as biopsy techniques and molecular diagnostics that help detect the presence, type, and stage of breast cancer.

This market growth is attributed to the rising cases of breast cancer around the globe, which is being aided by factors such as an aging population and advances in diagnostic technology.

- For instance, in July 2024, according to American Cancer Society, approximately one in every eight women in the U.S. (13.1%) will be detected with invasive breast cancer, and one in every 43 (2.3%) will succumb to cancer from the disease.

Key Highlights:

- The global breast cancer diagnostics industry size was recorded at USD 4703.20 billion in 2023.

- The market is projected to grow at a CAGR of 7.86% from 2024 to 2031.

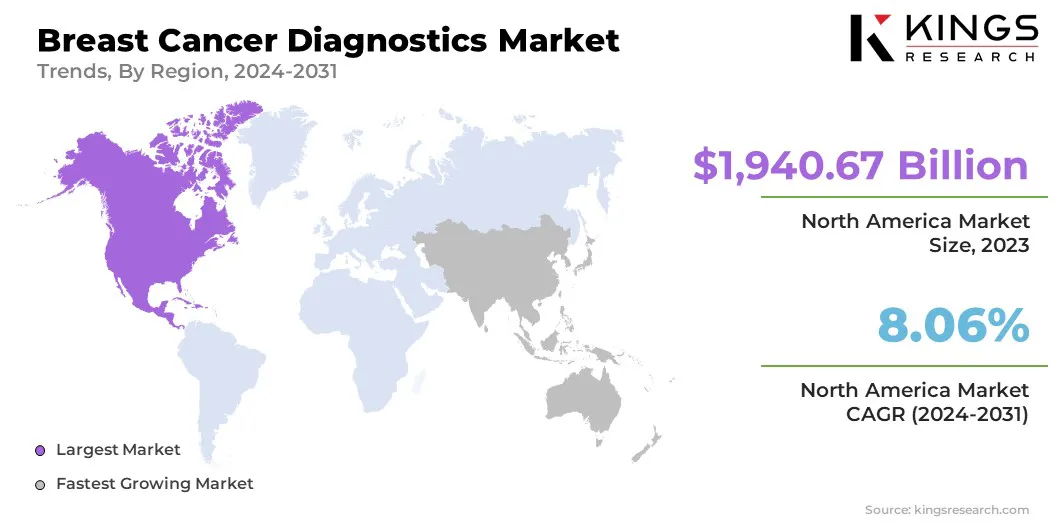

- North America held a market share of 41.26% in 2023, with a valuation of USD 1940.67 billion.

- The imaging tests segment garnered USD 1830.39 billion in revenue in 2023.

- The reagents & kits segment is expected to reach USD 4018.37 billion by 2031.

- The ambulatory surgical centers segment is anticipated to grow at a CAGR of 9.93% during the forecast period.

- The immunohistochemistry (IHC) segment is expected to reach USD 2126.25 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.94% during the forecast period.

Market Driver

"Government Initiatives and Aging Population"

Government initiatives and financing have a huge impact on the breast cancer diagnostics market. Increased government assistance drives progress in this field. Research funding helps to speed the development of new and improved diagnostic technologies such as more sensitive imaging techniques, enhanced genetic testing, and liquid biopsies.

Furthermore, government-sponsored screening programs, such as mammography campaigns, play an important role in improving access to diagnostic services for a larger population. The aging global population is a significant driver of the market. This demographic transition results in a steady and increasing demand for diagnostic services.

To successfully manage their elevated risk, the aged population requires more regular examinations, better imaging techniques, and genetic testing. This requires a strong and increasing healthcare infrastructure to fulfill the changing diagnostic needs of this vulnerable population.

- For instance, in November 2024, as part of its Breast Cancer program, the Union for International Cancer Control has awarded 19 grants to its members to support evidence-based initiatives aimed at enhancing the accessibility and availability of early breast cancer detection.

Market Challenge

"Stringent Regulatory Standards and Economic Uncertainty"

The breast cancer diagnostics market entails numerous serious hurdles. Stringent regulatory standards can cause delays in the approval of new diagnostic devices, limiting innovation and market penetration.

Inadequate reimbursement rules may limit healthcare provider’s investments in innovative diagnostic systems, hence restraining market growth. Economic uncertainty and budget limits can lead to lower diagnostic service spending, while technology barriers, such as test sensitivity and specificity limitations, might impact correct detection and diagnosis.

Moreover, popular misconceptions regarding the value of early detection can lead to decreased patient compliance with screening recommendations, which limits market expansion

Market Trend

"Advancements in Diagnostic Technologies and Demand for Early Detection"

The breast cancer diagnostics market is registering significant growth driven by several key factors. The increasing incidence of breast cancer and heightened awareness surrounding the significance of early detection are primary factors driving the market.

Moreover, the rising demand for non-invasive diagnostic procedures and personalized treatment options further supports market expansion, resulting in innovations and investment in this sector. Advancements in diagnostic technologies including imaging, genetic testing, and the integration of AI are enhancing diagnostic accuracy and operational efficiency.

- For instance, in October 2024, DeepHealth announced the acquisition of Kheiron Medical Technologies Limited, enhancing its portfolio with Kheiron’s Mia AI solutions for breast cancer detection, thereby accelerating the deployment of AI-powered diagnostic tools in Europe.

- For instance, in May 2024, Lunit Inc. announced the acquisition of Volpara Health Limited. enhancing its AI-driven cancer diagnostics capabilities. This strategic move integrates Volpara's advanced breast health platform with Lunit's existing solutions, significantly strengthening its position in breast cancer screening.

Breast Cancer Diagnostics Market Report Snapshot

| Segmentation | Details |

| By Test Type | Imaging Tests (Mammography, Ultrasound, MRI, PET/CT), Biopsy Tests (Fine Needle Aspiration Biopsy, Core Needle Biopsy, Surgical Biopsy), Genetic Tests (BRCA Gene Testing, HER2 Testing, Other Genomic Assays), Blood Tests (CA 15-3 Test, CEA Test, Others.) |

| By Product Type | Instruments, Reagents & Kits, Software & Services |

| By End-User | Hospitals, Diagnostic Laboratories, Ambulatory Surgical Centers, Specialty Clinics, Research Institutes |

| By Technology | Immunohistochemistry (IHC), Fluorescence In Situ Hybridization (FISH), Digital Pathology, Next-Generation Sequencing (NGS), Liquid Biopsy, Other Technologies |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Test Type (Imaging Tests, Biopsy Tests, Genetic Tests, Blood Tests): The imaging tests segment earned USD 1830.38 billion in 2023, due to increased utilization of advanced imaging technologies for early detection.

- By Product Type (Instruments, Reagents & Kits, Software & Services): The reagents & kits segment held 45.41% share of the market in 2023, due to their essential role in diagnostic procedures and testing accuracy.

- By End-User (Hospitals, Diagnostic Laboratories, Ambulatory Surgical Centers, Specialty Clinics and Research Institutes): The hospitals segment is projected to reach USD 4111.52 billion by 2031, owing to growing patient volumes and demand for comprehensive diagnostic services.

- By Technology (Immunohistochemistry (IHC), Fluorescence in Situ Hybridization (FISH), Digital Pathology, Next-Generation Sequencing (NGS), Liquid Biopsy, Other Technologies): The immunohistochemistry (IHC) kits segment held 25.07% of the market share in 2023, due to their effectiveness in analyzing tumor characteristics and guiding treatment decisions.

Breast Cancer Diagnostics Market Regional Analysis

North America accounted for a significant breast cancer diagnostics market share of around 41.26% in 2023, valued at USD 1,940.67 billion, driven by increased rates, government initiatives, advances in technology, established healthcare infrastructure, and increased demand for improved diagnostics.

The U.S. dominates this region, due to large expenditure in healthcare, presence of key market participants, advanced cancer diagnostic technologies, and a high GDP that allows for extensive research and development activities in breast cancer diagnostics.

- For instance, in 2023, according to the U.S. Centers for Medicare & Medicaid Services, US healthcare spending increased by 7.5% to USD 4.9 trillion, or USD 14,570 per person. Health spending accounted for 17.6 percent of the nation's GDP.

However, the market in Asia Pacific is anticipated to experience the fastest growth, at a projected CAGR of 8.94%. Countries such as China, India, and Japan are driving this expansion, owing to enormous populations, rising healthcare costs, and increased acceptance of novel diagnostic technologies.

Improved public health and initiatives & collaborations between the government and business sectors are also contributing to the region's rapid increase in breast cancer diagnoses.

- In 2023, according to the UN, Asia Pacific is home to around 4.7 billion people, accounting for 60% of the global population. By 2050, the population is expected to reach 5.2 billion.

Meanwhile, the breast cancer diagnostics market in Asia Pacific is registering rapid growth, due to increased awareness of breast cancer, more healthcare investments, an older population, and advances in healthcare infrastructure that allow for improved access to diagnostic services.

Furthermore, the development of breakthrough diagnostic technologies and government initiatives targeted at improving screening programs drive the market in the region.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The U.S. follows the Food and Drug Administration (FDA) guidelines for cancer diagnostics, which includes laboratory developed tests (LDTs) and oncology therapeutic & diagnostistics. The National Cancer Institute (NCI) regulates breast cancer through drug approvals, testing requirements, and other guidelines.

- In Europe, the European Medicines Agency (EMA) and European Commission (EC) sets guidelines and quality standards for breast cancer screening and diagnostic services across the European Union. The (EMA) primarily focuses on approving new drugs used to treat breast cancer.

- In APAC, The National Medical Products Administration (NMPA) of China supervises medical equipment and in-vitro diagnostic reagents, particularly those used in cancer diagnosis.

- In Japan, The Pharmaceuticals and Medical Devices Agency (PMDA) of Japan monitors medical devices and pharmaceuticals, particularly those used in cancer diagnostics.

Competitive Landscape:

The breast cancer diagnostics market is characterized by a number of participants, including both established corporations and rising organizations.

To achieve a competitive advantage in this rapidly evolving breast diagnostics market, these organizations aggressively pursue a variety of strategic initiatives. Major strategies include new product launches, collaborations and alliances, corporate expansions, and mergers and acquisitions.

- For instance, in December 2024, Siemens Healthineers and DeepHealth have established a strategic partnership to improve breast cancer diagnosis using AI-powered ultrasound technology, thereby increasing operational efficiency and patient care while solving workforce difficulties in high-volume imaging environments.

List of Key Companies in Breast Cancer Diagnostics Market:

- Hologic, Inc.

- Siemens Healthineers AG

- GE HealthCare

- Becton, Dickinson and Company

- Koninklijke Philips N.V.

- FUJIFILM

- Thermo Fisher Scientific Inc.

- Exact Sciences Corporation

- Bruker Spatial Biology, Inc.

- Hoffmann-La Roche Ltd

- Illumina, Inc.

- Quest Diagnostics

- Dilon Technologies

- AURORA HEALTHCARE US CORP

- Bio-Rad Laboratories, Inc., and

- Others

Recent Developments:

- In January 2025, Screen Point Medical acquired Biomediq A/S, enhancing its Breast AI, Transpara, with advanced breast cancer risk assessment capabilities. This strategic move strengthens Screen Point’s position in the diagnostics market.

- In January 2025, Eli Lilly and Company entered into a definitive agreement to acquire Scorpion's STX-478, a once-daily oral PI3Kα inhibitor currently undergoing Phase 1/2 clinical trials for breast cancer and advanced solid tumors. This acquisition of STX-478 will enhance its oncology portfolio, strategically positioning the company to address unmet needs in breast cancer diagnostics

- In January 2024, Johnson & Johnson Services, Inc. announced a definitive agreement to acquire Ambrx Biopharma, Inc. Ambrx is developing a targeted portfolio of clinical and preclinical programs aimed at enhancing the efficacy and safety of its therapeutic candidates across various cancer types, including advanced treatments for breast cancers.

- In October 2024, Owkin, Inc. partnered with AstraZeneca to create an AI-driven gBRCA pre-screening solution for breast cancer, analyzing digitized pathology slides for gBRCA mutations. This initiative, part of a collaboration with Gustave Roussy and The Centre Léon Bérard under the PortrAIt consortium, aims to enhance access to gBRCA testing for patients.

- In June 2024, Lantheus Holdings, Inc. acquired global rights to Life Molecular Imaging’s RM2, a radiotheranostic targeting the gastrin-releasing peptide receptor. This strategic acquisition enhances Lantheus' portfolio in prostate cancer and broadens its pipeline to include breast cancer.

- In August 2024, Izotropic Corporation announced its strategic intent to advance IzoView, a breast CT imaging system, through regulatory pathways in the U.S. and the EU. This initiative aims to position IzoView as a diagnostic tool for patients with dense breast tissue, which is linked to a higher risk of breast cancer, complementing existing digital breast tomosynthesis technologies.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)