Food and Beverages

Bromelain Market

Bromelain Market Size, Share, Growth & Industry Analysis, By End-User (Food & Beverage Industry, Pharmaceutical & Healthcare, Dietary Supplement, Animal Feed, Other), By Type (Powder, Liquid), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : January 2025

Report ID: KR1224

Market Definition

The bromelain market involves the production, distribution, and use of bromelain, a natural enzyme derived primarily from pineapples. It is utilized across various sectors, including food and beverages, dietary supplements, healthcare, and pharmaceuticals, mainly due to its anti-inflammatory, digestive, and therapeutic properties.

The enzyme is commonly extracted from the stem and fruit of pineapples. As a natural alternative to synthetic enzymes, bromelain has gained attention for its potential health benefits, establishing a steady presence in both consumer and industrial markets worldwide.

Bromelain Market Overview

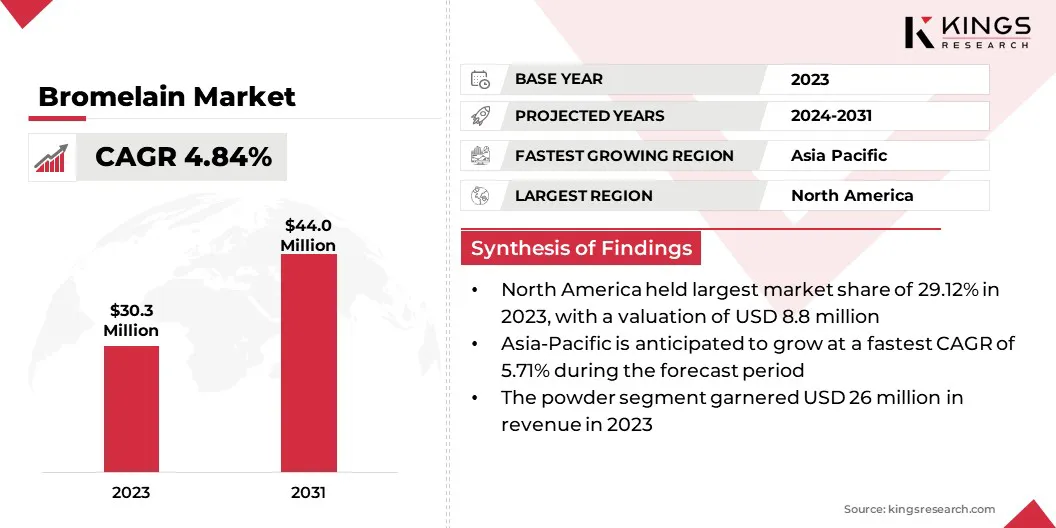

The global bromelain market size was valued at USD 30.3 million in 2023 and is projected to grow from USD 31.6 million in 2024 to USD 44.0 million by 2031, exhibiting a CAGR of 4.84% during the forecast period.

The growing demand for eco-friendly and sustainable products is driving interest in naturally sourced enzymes such as bromelain. As consumers prioritize environmentally conscious choices, bromelain’s natural origin makes it an attractive alternative to synthetic ingredients in various industries.

Major companies operating in the global bromelain industry are ENZYBEL GROUP (Part of Natix S.A.), Hong Mao Biochemicals Co., Ltd., Challenge Bioproducts Co., Ltd., Enzyme Development Corporation, Advanced Enzyme Technologies, Bio-gen Extracts Pvt. Ltd, Great Food Group of Companies, BIOZYM (Society for Enzyme Technology mbH), BIOLAXI CORPORATION, MITUSHI BIO PHARMA, Undersun Biomedtech Corp, Krishna Enzytech Pvt ltd, Creative Enzymes., Medikonda Nutrients, Antozyme Biotech Pvt Ltd, and others.

The bromelain market is witnessing substantial growth, mainly due to its versatile applications across multiple industries. As a natural enzyme with therapeutic and functional benefits, it is gaining recognition for its potential to enhance product offerings. Its adoption is influenced by a shift toward natural, sustainable ingredients, aligning with broader consumer preferences.

This reflects a growing interest in alternative solutions that emphasize health-conscious, eco-friendly choices, thereby fostering the expansion and integration of bromelain into diverse product categories.

- In March 2023, Walmart launched its Clean Beauty platform, highlighting growing consumer demand for natural, eco-conscious products. This trend mirrors the growth of the market, propelled by rising consumer preference for sustainable, natural ingredients in health, wellness, and beauty products.

Key Highlights:

- The global bromelain market size was recorded at USD 30.3 million in 2023.

- The market is projected to grow at a CAGR of 4.84% from 2024 to 2031.

- North America held a share of 29.12% in 2023, valued at USD 8.8 million.

- The food & beverage industry segment garnered a revenue of USD 12.2 million in 2023.

- The powder segment is expected to reach USD 37.5 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 5.71% through the forecast period.

Market Driver

"Rising Consumer Demand for Natural Solutions"

The growing consumer preference for natural and plant-based products has significantly contributed to the expansion of the bromelain market. As individuals become more health-conscious and seek alternatives to synthetic ingredients, the demand for natural enzymes such as bromelain in food, supplements, and cosmetics has surged.

This shift toward plant-based and natural solutions is supported by the demand for healthier, eco-friendly options, positioning bromelain as a key ingredient in meeting these evolving consumer preferences.

- In November 2024, the Agriculture and Horticulture Development Board (AHDB) highlighted that Gen Z’s increasing preference for health-conscious, plant-based products aligns with the rising demand for natural ingredients such as bromelain.

Market Challenge

"Limited Raw Material Supply Poses Challenge"

Limited raw material availability presents a significant challenge to the expansion of the bromelain industry, as it relies on pineapples for extraction. Fluctuations in pineapple harvests, due to factors like climate change or crop diseases, can disrupt the supply of bromelain.

- In January 2025, the World Meteorological Organization (WMO) reported that 2024 was the hottest year on record, with global temperatures 1.55°C above pre-industrial levels. This unprecedented heat, fueled by climate change, is impacting agricultural systems, including pineapple cultivation for bromelain production.

To mitigate this challenge, companies can explore diversifying their sourcing methods by growing pineapples in controlled environments or partnering with multiple suppliers globally. Additionally, improving extraction efficiency and exploring synthetic or alternative enzyme sources may reduce reliance on fluctuating raw material supplies, ensuring market stability.

Market Trend

"Enhanced Regulatory Frameworks Drive Broader Adoption of Natural Ingredients"

Enhanced regulatory frameworks are emerging as a key trend influencing the bromelain market. As regulations around natural ingredients evolve, bromelain is expected to gain approval for use in food, health supplements, and cosmetics. Stricter quality control measures and standardized certifications are prompting manufacturers to adopt bromelain, boosting its acceptance across various industries.

This trend is expected to expand its presence in global markets, aligning with growing consumer demand for natural, safe ingredients.

- In March 2024, the U.S. Food and Drug Administration (FDA) requested funding of USD 7.2 billion to modernize regulations, including those for food, medical products, and cosmetics. This investment aims to enhance regulatory frameworks, facilitating broader market approval for natural ingredients such asbromelain in food, health, and cosmetic applications, supporting the industry's trend toward enhanced regulation.

Bromelain Market Report Snapshot

| Segmentation | Details |

| By End-User | Food & Beverage Industry, Pharmaceutical & Healthcare, Dietary Supplement, Animal Feed, Other |

| By Type | Powder, Liquid |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By End-User (food & beverage industry, pharmaceutical & healthcare, dietary supplement, animal feed, and other): The food & beverage industry segment generated a revenue of USD 12.2 billion in 2023 due to its natural ability to tenderize meat, aid digestion, and enhance flavor, making it a popular ingredient in products that promote health, wellness, and culinary functionality.

- By Type (powder and liquid): The powder segment held a share of 85.67% in 2023, largely attributed to its convenience, longer shelf life, and ease of incorporation into dietary supplements, functional foods, and cosmetics.

Bromelain Market Regional Analysis

The North America bromelain market accounted for a share of around 29.12% in 2023, valued at USD 8.8 million. This growth is mainly propelled by high demand for natural supplements and increasing consumer awareness regarding the health benefits of bromelain.

The region’s advanced healthcare systems and well-established dietary supplement industry support its widespread use in products targeting inflammation, pain relief, and digestive health.

Additionally, the growing trend of natural and plant-based products further fuels the demand for bromelain, particularly in the U.S. and Canada. Strong regulatory frameworks and increasing consumer preferences for safe, effective alternatives reinforce North America's market leadership.

Asia-Pacific bromelain market is estimated to witness significant growth, registering a CAGR of 5.71% through the projection period. This growth is largely attributed to rising health awareness, increasing disposable incomes, and growing demand for natural supplements.

Countries such as India, China, and Japan are witnessing growing use of bromelain in dietary supplements, skincare, and pharmaceutical applications. The region’s large population, coupled with the shift toward natural, plant-based solutions for health issues such as inflammation, digestive problems, and joint pain, is boosting demand for bromelain.

Moreover, the expansion of e-commerce platforms and greater product availability are accelerating the growth of the Asia-Pacific market.

- In June 2023, researchers from universities in Thailand and Malaysia developed an eco-friendly bioplastic from pineapple stems, demonstrating the potential of bromelain industry byproducts.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the FDA regulates both finished dietary supplement products and dietary ingredients through the Human Foods Program’s Office of Food Chemical Safety, Dietary Supplements, and Innovation.

- In Europe, the European Commission (EU) governs the food supplement market under Directive 2002/46/EC,which aims to protect consumers from potential health risks and prevent misleading information about these products.

Competitive Landscape

The global market is characterized by a large number of participants, including both established corporations and rising organizations.

Key players in the bromelain market are forming strategic partnerships to expand product offerings, enhance distribution networks, and leverage technological advancements, aiming to strengthen their market position and meet the growing demand for natural, plant-based solutions across various industries.

- In February 2024, Bharat Serums and Vaccines (BSV) signed an exclusive distribution agreement with MediWound to introduce NexoBrid, a groundbreaking burn treatment, in India. NexoBrid, a proteolytic enzyme concentrate enriched with bromelain, is used topically for severe burn care.

List of Key Companies in Bromelain Market:

- ENZYBEL GROUP (Part of Natix S.A.)

- Hong Mao Biochemicals Co., Ltd.

- Challenge Bioproducts Co., Ltd.

- Enzyme Development Corporation

- Advanced Enzyme Technologies

- Bio-gen Extracts Pvt. Ltd

- Great Food Group of Companies

- BIOZYM (Society for Enzyme Technology mbH)

- BIOLAXI CORPORATION

- MITUSHI BIO PHARMA

- Undersun Biomedtech Corp

- Krishna Enzytech Pvt ltd

- Creative Enzymes.

- Medikonda Nutrients

- Antozyme Biotech Pvt Ltd

Recent Developments

- In January 2023, Sun Pharmaceutical Industries Limited acquired the brands Disperzyme, Disperzyme-CD, and Phlogam from Aksigen Hospital Care. These products, containing Trypsin, Bromelain, and Rutoside, are approved by the Drugs Controller General of India (DCGI) for treating post-operative inflammation. This acquisition enhances Sun Pharma’s anti-inflammatory portfolio and expands its presence in India's proteolytic enzyme market, focusing on healing and pain management.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership