Canola Oil Market

Canola Oil Market Size, Share, Growth & Industry Analysis, By Nature (Organic and Conventional), By End-Use Industry (Food Processing Industry, Foodservice Industry, Retail/Household, and Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : June 2024

Report ID: KR786

Canola Oil Market Size

Global Canola Oil Market size was recorded at USD 34.87 billion in 2023, which is estimated to be at USD 36.70 billion in 2024 and projected to reach USD 54.77 billion by 2031, growing at a CAGR of 5.89% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as ADM, American Vegetable Oils, Inc., Associated British Foods Plc., Bunge, Cargill, Incorporated., Highwood Crossing Foods Ltd., Jivo Wellness Pvt. Ltd, La Tourangelle, Louis Dreyfus Company, Wilmar International Ltd and others.

Growing consumer awareness regarding health benefits, increasing demand for natural and organic products, and versatile applications in various industries are driving the growth of the canola oil market. The growing awareness of health benefits associated with canola oil, such as its low saturated fat content and high levels of omega-3 fatty acids, is increasing consumer demand. Additionally, the rising prevalence of chronic diseases such as cardiovascular conditions promotes a shift toward healthier cooking oils.

The expanding food processing industry further fuels market growth, as canola oil is a wiely used ingredient in various food products. Furthermore, advancements in agricultural practices and the development of genetically modified crops have enhanced yield and oil quality, thereby boosting the overall supply. Moreover, increasing disposable incomes in developing regions lead to higher consumption of premium edible oils, including canola oil.

The global market is experiencing steady growth, mainly fueled by health-conscious consumers and innovations in agricultural practices. The Asia-Pacific region is witnessing rapid growth due to rapid urbanization and rising incomes. Prominent players in the industry include major agribusinesses and food companies that are gradually shifting their focus toward product innovation and sustainable practices. The market is confronted with several challenges such as fluctuating raw material prices and competition from other edible oils.

Canola oil is a type of vegetable oil derived from the seeds of the canola plant, a cultivar of rapeseed. It is characterized by its low saturated fat content and high levels of monounsaturated fats and omega-3 fatty acids, making it a heart-healthy oil option. This oil is widely used in cooking, baking, and food processing due to its neutral flavor and high smoke point. Canola oil is also utilized in industrial applications such as biodiesel production.

Analyst’s Review

Manufacturers are intensifying their efforts to meet the surging demand for healthier options. There is an increasing focus on creating new products such as organic and non-GMO variants to appeal to health-conscious consumers. Sustainability is a key focus area, with numerous companies adopting eco-friendly production practices.

To stay competitive, manufacturers should prioritize product quality and consumer education. Diversifying into emerging markets and expanding product ranges facilitates market growth. Manufacturers must remain informed about market trends and consumer preferences to thrive in the industry.

- In April 2023, Louis Dreyfus Company (LDC) expanded its processing complex for canola, located in Yorkton, Saskatchewan, Canada. This move bolstered its ability to serve food, energy, and feed markets. Since 2009, LDC has been operating the complex that is situated in a prime agricultural area. The facility primarily focused on producing food-grade feed meal and canola oil. The expansion, included a new crushing line and doubled the facility's annual crush capacity to over 2 million metric tons.

Canola Oil Market Growth Factors

The increasing consumer preference for healthier cooking oils boosts market expansion, as consumers are becoming more health-conscious and seeking products with low saturated fat and high omega-3 fatty acid content. Canola oil meets this demand due to its nutritional profile, which promotes heart health and reduces the risk of chronic diseases. Additionally, the food industry is increasingly using canola oil in processed foods, thereby boosting its demand. This trend persists as consumers increasingly prioritize their health and actively seek foods that contribute to a balanced diet.

The growing awareness and rising demand for health-promoting products are significantly propelling the expansion of the canola oil market. A significant challenge in the canola oil market is the volatility of raw material prices, which impacts production costs and profit margins. Weather conditions, crop diseases, and geopolitical factors often cause fluctuations in canola seed prices. To overcome this challenge, companies are adopting advanced agricultural techniques and investing heavily in genetically modified crops that offer higher yields and disease resistance.

Additionally, establishing long-term contracts with farmers and diversifying sourcing regions helps stabilize supply chains and reduces dependency on any single source. By implementing these strategies, the industry is mitigating the effects of price volatility and ensuring a steady supply of raw materials for canola oil production.

- In August 2023, BASF unveiled its canola variant, InVigor LR 4540P, which allows farmers to cultivate a 'triple trait' TruFlex variety. It is one of the sole varieties bred with three distinct trait technologies along with InVigor LT 4530P. Both varieties feature the LibertyLink and PodGuard traits exclusive to the InVigor hybrids. The production of these GMO varieties enables the company to produce novel products that improve crop yields and raw material supply.

Canola Oil Market Trends

Consumers are increasingly concerned about the environmental impact and health implications of genetically modified organisms (GMOs) and synthetic chemicals used in farming. This has resulted in the rising demand for organic and non-GMO products which are perceived as healthier and more environmentally friendly.

Producers are responding to this surging demand by expanding their organic and non-GMO product lines, investing in certification processes, and promoting these products to health-conscious consumers. This trend continues due to increasing awareness of sustainable and natural food products, which is significantly influencing the canola oil market. Another notable trend is the increasing use of canola oil in the food service industry.

Restaurants and food service providers are opting for canola oil for its health benefits, neutral flavor, and high smoke point, making it ideal for various cooking methods, including frying and baking. This trend is further fueled by growing consumer demand for healthier menu options and the food industry's focus on improving nutritional quality. Additionally, the cost-effectiveness and versatility of canola oil are contributing to its popularity in commercial kitchens. This trend is shaping the market landscape as the food service industry continues to adopt healthier cooking oils to meet evolving consumer preferences.

- According to the National Restaurant Association, the restaurant and foodservice industry is likely to exceed USD 1 Trillion in 2024, resulting in the growth of approximately 200,000 jobs in the industry. This growth in the foodservice industry is likely to lead to an increased demand for raw materials such as canola oil in order to cater to the evolving consumer base.

Segmentation Analysis

The global market is segmented based on nature, end-use industry, and geography.

By Nature

Based on nature, the market is categorized into organic and conventional. The conventional segment led the canola oil market in 2023, reaching a valuation of USD 30.14 billion. The expansion of the segment is primarily propelled by its widespread availability and lower production costs compared to organic canola oil.

Conventional farming methods are well-established and typically yield higher outputs, allowing for greater market penetration and competitive pricing advantages. Additionally, conventional canola oil often meets regulatory standards more easily, making it more accessible to a broader consumer base. Although organic canola oil is gaining immense popularity due to increasing health and environmental concerns, the conventional segment continues to dominate due to its affordability and widespread availability.

By End-Use Industry

Based on end-use industry, the canola oil market is classified into food processing industry, foodservice industry, retail/household, and others. The retail/household segment is poised to witness significant growth, registering a CAGR of 6.73% through the forecast period (2024-2031). This growth is mainly bolstered by shifting consumer preferences toward healthier cooking oils.

Health-conscious consumers are increasingly choosing canola oil due to its low saturated fat content and high omega-3 fatty acids. Additionally, the convenience and versatility of canola oil make it a preferred choice for household cooking purposes. As awareness regarding health benefits continues to rise, along with the availability of canola oil in retail outlets, the retail/household segment is likely to continue to expand.

Canola Oil Market Regional Analysis

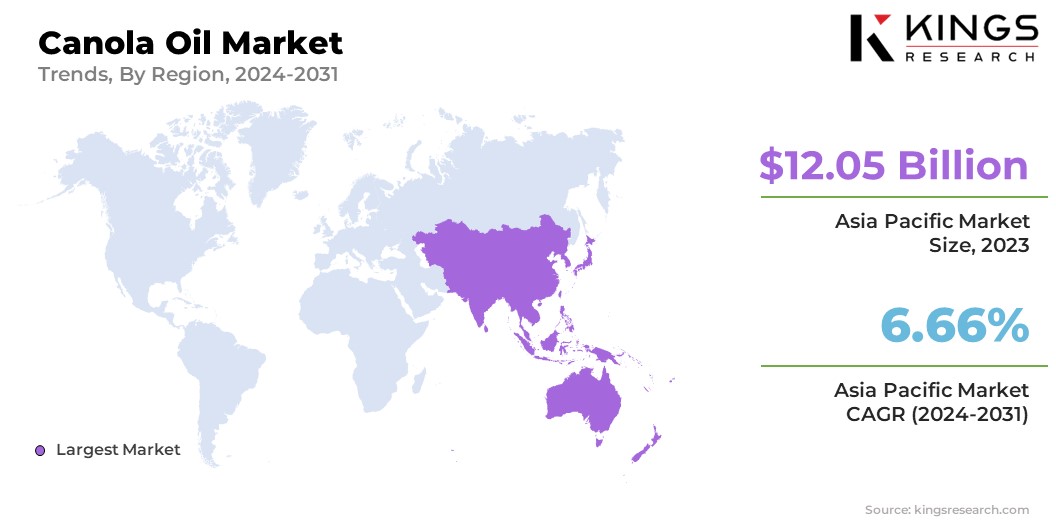

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia-Pacific Canola Oil Market share stood around 34.56% in 2023 in the global market, with a valuation of USD 12.05 billion. This dominance in the market is attributed to the region's large population, particularly in countries such as China and India, which creates a substantial demand for edible oils, including canola oil. Additionally, rapid urbanization and rising disposable incomes in the region have led to greater consumption of processed foods, leading to the increased demand for oil, including canola oil, which serves as a key ingredient.

Moreover, Asia-Pacific's favorable agricultural conditions and growing adoption of modern farming practices contribute to higher production levels, thereby ensuring a steady supply of canola oil to meet consumer demand. These factors collectively position Asia-Pacific as the leading region in the canola oil market.

Europe is set to experience significant growth, recording a CAGR of 6.10% over the forecast period. This significant growth in the canola oil market is fueled by the growing health consciousness among consumers in the region. This has led to increased demand for healthier cooking oils such as canola oil. Additionally, stringent regulations promoting sustainable agriculture and food production practices support the adoption of canola oil.

Moreover, the food processing industry in Europe is actively incorporating canola oil into various products due to its nutritional benefits and versatility. These favorable market conditions and a growing focus on healthy eating are estimated to solidify the region's position in the market over the forecast period.

Competitive Landscape

The global canola oil market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Canola Oil Market

- ADM

- American Vegetable Oils, Inc.

- Associated British Foods Plc.

- Bunge

- Cargill, Incorporated.

- Highwood Crossing Foods Ltd.

- Jivo Wellness Pvt. Ltd

- La Tourangelle

- Louis Dreyfus Company

- Wilmar International Ltd

Key Industry Developments

- December 2023 (Launch): Nuseed Nutritional U.S. Inc. chose Connoils to exclusively produce a powdered form of its Nutriterra DHA Canola oil, aiming to expand its use in beverages and functional foods. Connoils used low temperature electrostatic dehydration for encapsulation to preserve nutritional integrity. The Nutriterra canola offers higher DHA and ALA content, supporting omega-3 labeling claims. The neutral-tasting powder is versatile and suitable for various food and beverage applications.

- April 2023 (Expansion): Cargill announced a USD 50 million investment to upgrade its Narrabri, Newcastle, and Footscray oilseed crush facilities. This expansion aimed to meet the rising demand for canola and cottonseed products and improve Australian farmers' access to global markets. The Narrabri plant was converted into a dedicated cottonseed dehulling facility, while the Newcastle and Footscray plants received enhancements to increase canola crush capacity and improve processing efficiency.

The global canola oil market is segmented as:

By Nature

- Organic

- Conventional

By End-Use Industry

- Food Processing Industry

- Foodservice Industry

- Retail/Household

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership