Advanced Materials and Chemicals

Carbon Black Market

Carbon Black Market Size, Share, Growth & Industry Analysis, By Process Type (Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others), By Function (Reinforcement, Pigments), By Grade (Specialty Grade, Conductive Grade) By End User and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : May 2024

Report ID: KR690

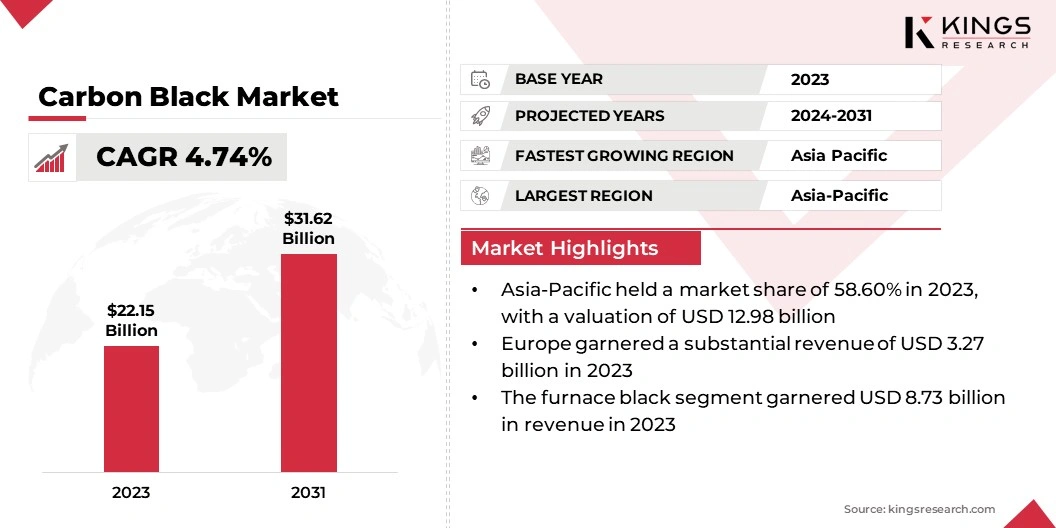

Carbon Black Market Size

The Global Carbon Black Market size was valued at USD 22.15 billion in 2023 and is projected to reach USD 31.62 billion by 2031, growing at a CAGR of 4.74% from 2024 to 2031. This growth is driven by robust demand from the automotive, plastics, and rubber industries. In the scope of work, the report includes products offered by companies such as Orion Engineered Carbons Holdings GmbH, OMSK Carbon Group, Tokai Carbon Co. Ltd., Asahi Carbon Co. Ltd., Continental Carbon Co., Birla Carbon, Cabot Corporation, OCI Ltd., Phillips Carbon Black Limited (PCBL) and others.

With increasing urbanization and infrastructure development, the market is witnessing steady growth. Industry trends such as technological advancements, sustainability initiatives, and industry consolidation are shaping the future of carbon black production and consumption. The growing automotive industry in emerging economies such as China and Japan is a significant factor fueling market expansion. As these markets experience rapid urbanization and rising disposable incomes, there is a surge in vehicle ownership and demand for tires.

Carbon black, a crucial component in tire manufacturing, experiences rising demand to meet the needs of tire production for original equipment manufacturers (OEMs) and aftermarket sales. Moreover, the development of high-performance and eco-friendly tires is contributing to the growing demand for specialized grades of carbon black. This trend is anticipated to persist as the automotive sector is evolving, driven by factors such as the increasing population, infrastructure development, and consumer preferences for safer and more fuel-efficient vehicles, which are fueling the growth of the carbon black market.

Carbon black is a fine powder produced through the incomplete combustion of hydrocarbon materials. Composed primarily of carbon, it exhibits unique properties such as high surface area, excellent UV resistance, and electrical conductivity. These properties make carbon black a versatile material with diverse applications across various industries. Its primary application lies in the manufacturing of tires, where it serves as a reinforcing filler to enhance tread wear, traction, and durability.

Additionally, carbon black is extensively used in rubber products such as conveyor belts, hoses, and seals due to its reinforcement and weathering resistance properties. Beyond rubber goods, carbon black is utilized in plastics, inks, coatings, and pigments, where it imparts color, conductivity, and UV protection.

Analyst’s Review

Key players in the carbon black market aim to implement strategic initiatives to maintain a competitive edge. These initiatives include investing in research and development to innovate new products with enhanced properties and applications, such as specialty carbon blacks tailored for specific industries or environmental regulations. Moreover, companies are increasingly adopting vertical integration strategies to streamline their operations, optimize supply chains, and control costs. This involves acquiring raw material suppliers, expanding manufacturing capacities, and establishing distribution networks to strengthen market presence and capture a larger share.

Furthermore, key players are investing heavily in environmentally friendly production processes, energy-efficient technologies, and recycling initiatives to reduce carbon footprint and meet the evolving demands of eco-conscious consumers. By focusing on innovation, integration, and sustainability, key players aim to maintain their leading positions in the global marketplace.

Carbon Black Market Growth Factors

The increasing use of carbon black in plastics and rubber industries is driven by its exceptional properties that enhance product performance and longevity. As a reinforcing filler, carbon black improves the mechanical strength, abrasion resistance, and tear strength of rubber products, making it indispensable in the manufacture of tires, conveyor belts, seals, and hoses. Additionally, its UV protection properties shield rubber and plastic materials from degradation caused by sunlight exposure, extending their lifespan in outdoor applications.

Furthermore, carbon black's inherent conductivity makes it suitable for applications in electronics, where it is utilized in conductive polymers and antistatic packaging materials. This rising demand for carbon black in diverse industrial sectors beyond tires indicates its versatility and indispensability as a multifunctional additive, thereby driving its widespread adoption and fostering market growth.

The volatility in raw material prices poses a significant challenge for carbon black manufacturers, as fluctuations in crude oil and other feedstock costs directly impact production expenses. Since carbon black is predominantly derived from hydrocarbon materials, any shifts in oil prices may lead to unpredictable changes in manufacturing costs, subsequently impacting profitability and cost competitiveness.

Moreover, these price fluctuations may disrupt supply chains and procurement strategies, making it challenging for manufacturers to maintain stable operations and meet customer demand effectively. To mitigate this challenge, companies aim to implement risk management strategies, such as hedging contracts or diversifying their raw material sources, to minimize the impact of price volatility.

Carbon Black Market Trends

The trend of industry consolidation and vertical integration is shaping the carbon black market outlook. As competition intensifies, companies are seeking strategic advantages through mergers, acquisitions, and partnerships to strengthen their market positions and enhance operational efficiency. By vertically integrating across the value chain, manufacturers aim to optimize supply chains, control key inputs, and mitigate risks associated with raw material price fluctuations and supply chain disruptions.

Additionally, consolidation enables companies to expand their geographic presence, diversify product portfolios, and capture new market opportunities. This trend toward consolidation and integration is driving the emergence of larger, more diversified companies with enhanced capabilities and market influence.

Segmentation Analysis

The global carbon black market is segmented based on process type, function, grade, end user, and geography.

By Process Type

Based on process type, the market is segmented into furnace black, channel black, thermal black, acetylene black, and others. The furnace black segment led the market in 2023, reaching a valuation of USD 8.73 billion. This dominance is primarily due to its widespread use and cost-effeciency.

Furnace black production involves the combustion of heavy petroleum products at high temperatures, resulting in high-quality carbon black with consistent properties. Its superior reinforcing properties, excellent abrasion resistance, and UV protection make it the preferred choice for tire production. Additionally, the versatility and compatibility of furnace black with a wide range of rubber and plastic formulations is contributing to its dominance in the market.

By Function

Based on function, the carbon black market is bifurcated into reinforcement and pigments. The reinforcement segment secured the largest revenue share of 78.06% in 2023. Carbon black plays a crucial role in enhancing the mechanical properties and durability of rubber products. It acts as a reinforcing filler that improves the tensile strength, abrasion resistance, and tear resistance of rubber compounds. Additionally, the reinforcing properties of carbon black extend its application to other products, such as conveyor belts, hoses, and seals, which stimulates the need for reinforcement-grade carbon black.

By Grade

Based on grade, the market is divided into specialty grade and conductive grade. The conductive grade segment is poised to grow substantially at a CAGR of 5.14% through the forecast period. Conductive grade carbon black is renowned for its unique electrical conductivity properties, making it indispensable in various applications such as electronic components, automotive parts, and industrial coatings.

With the rising adoption of electric vehicles, electronic devices, and smart technologies, the demand for materials with enhanced conductivity to facilitate efficient energy transmission and electromagnetic shielding is rising. This trend is positioning the segment for notable expansion in the upcoming years.

Carbon Black Market Regional Analysis

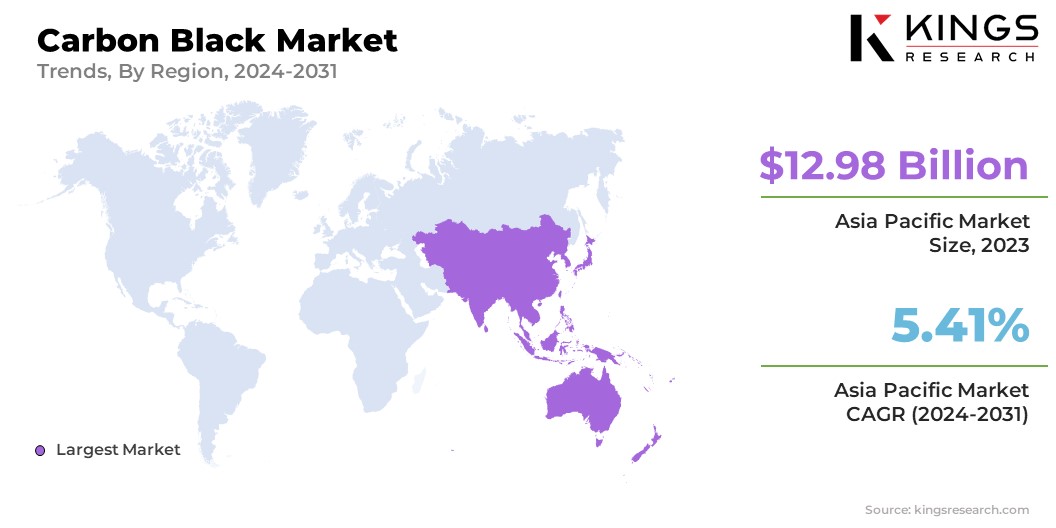

Based on region, the global carbon black market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Carbon Black Market share stood around 58.60% in 2023 in the global market, with a valuation of USD 12.98 billion. This dominance can be attributed to the region's robust manufacturing sector. Additionally, rapid urbanization, infrastructure development, and expanding transportation networks in the region are fueling the demand for tires and rubber products, thereby supporting regional market growth. Moreover, favorable government policies, supportive regulatory frameworks, and increasing investments in industrial development have contributed to the region's leading position in the market.

Europe garnered a substantial revenue of USD 3.27 billion in 2023 owing to the stringent environmental regulations imposed in the region that emphasize sustainability in manufacturing processes. Additionally, a well-established infrastructure, technological advancements, and a rising focus on research and development are fostering regional market expansion. Moreover, increasing investments in renewable energy and green technologies are driving the demand for specialty carbon blacks with eco-friendly properties.

Competitive Landscape

The global carbon black market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Carbon Black Market

- Orion Engineered Carbons Holdings GmbH

- OMSK Carbon Group

- Tokai Carbon Co. Ltd.

- Asahi Carbon Co. Ltd.

- Continental Carbon Co.

- Birla Carbon

- Cabot Corporation

- OCI Ltd.

- Phillips Carbon Black Limited (PCBL)

Key Industry Developments

- May 2023 (Product Launch): Goodyear introduced a tire featuring Monoliths carbon black, claiming it to be an industry first. The Monoliths technology promised enhanced performance, including better fuel efficiency and tread wear, while reducing carbon emissions. This innovation underscored the company’s commitment to sustainability and tire performance excellence.

- July 2023 (Partnership): Orion Engineered Carbons collaborated with ChemSpec to expand its reach in the U.S. and Canada. ChemSpec is dedicated to distributing Orion's specialty carbon blacks, strengthening its position in key markets, and providing customers with enhanced access to high-quality carbon black products and technical support.

The Global Carbon Black Market is segmented as:

By Process Type

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

By Function

- Reinforcement

- Pigments

By Grade

- Specialty Grade

- Conductive Grade

By End User

- Tire

- Paints & Coatings

- Inks

- Plastics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)