Advanced Materials and Chemicals

Chemical Recycling Market

Chemical Recycling Market Size, Share, Growth & Industry Analysis, By End-Use Industry (Automotive, Construction, Industrial, Healthcare, Consumer goods, and Packaging), By Type (Recycled Polyethylene, Recycled Polyethylene Terephthalate and Others), By Process and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : July 2024

Report ID: KR857

Chemical Recycling Market Size

The global Chemical Recycling Market size was valued at USD 13.43 billion in 2023 and is projected to grow from USD 14.04 billion in 2024 to USD 19.97 billion by 2031, exhibiting a CAGR of 5.16% during the forecast period. The growth of the market is driven by increasing global plastic waste and rising environmental concerns.

It offers a sustainable solution by converting plastic waste into valuable raw materials, thereby reducing landfill waste and dependence on fossil fuels. Regulatory support and technological advancements further boost adoption, addressing the critical need for circular economy practices in waste management. In the scope of work, the report includes solutions offered by companies such as Agilyx, BASF SE, MaireTecnimont S.p.A., INEOS AG, Axens, Chevron Phillips Chemical Company LLC, JEPLAN, INC., Eastman Chemical Company, SABIC, LyondellBasell Industries Holdings B.V., and others.

The chemical recycling market is rapidly evolving as industries increasingly seek sustainable solutions to manage plastic waste. Chemical recycling technologies are gaining significant traction, fueled by stringent environmental regulations and the growing shift toward a circular economy. These technologies complement traditional mechanical recycling methods, enabling the processing of mixed and contaminated plastics.

Strategic collaborations among chemical recycling companies, plastic manufacturers, and waste management firms are contributing significantly to market growth by advancing technological development and integration. Despite facing challenges in handling diverse waste streams, ongoing technological advancements and regulatory support are positioning chemical recycling as a crucial component in global efforts to reduce plastic pollution and conserve resources.

Chemical recycling refers to a set of processes and technologies that convert plastic waste into its original monomers or other valuable chemicals through chemical reactions. Unlike mechanical recycling, which physically reprocesses plastics, chemical recycling breaks down polymers at the molecular level, allowing for the recovery of high-purity raw materials.

This method possess the ability to handle mixed, contaminated, and hard-to-recycle plastics that are unsuitable for mechanical recycling. Chemical recycling technologies include pyrolysis, gasification, depolymerization, and solvolysis, among others. These processes offer a sustainable solution for managing plastic waste, reducing landfill usage, and contributing to a circular economy by enabling the continual reuse of plastic materials.

Analyst’s Review

The market for chemical recycling is poised to witness substantial growth, mainly fueled by increasing environmental regulations and rising consumer demand for sustainable products. These factors are compelling manufacturers to invest in innovative technologies to address plastic waste management effectively.

- For instance, MAIRE’S NextChem's acquisition of CatC, an advanced plastic chemical recycling technology, exemplifies strategic market positioning. CatC's demonstration plant in central Italy showcases promising results with a high conversion rate of approximately 95%, offering a cost-effective and competitive solution for recycling Plexiglass.

Key players are focusing on developing such technologies and forming strategic partnerships to enhance operational efficiency and capitalize on growing market opportunities. Such initiatives underscore the industry's commitment to advancing sustainable practices and supporting a circular economy model.

Chemical Recycling Market Growth Factors

The implementation of stricter environmental regulations worldwide is driving the chemical recycling market growth by accelerating the shift towards more sustainable waste management practices and reducing the environmental impact of plastic waste. These regulations are designed to reduce the environmental impact of plastic by implementing more sustainable waste management practices. Due to this, there is a significant shift toward adopting chemical recycling technologies.

Unlike traditional mechanical recycling, which often degrades the quality of plastic, chemical recycling processes plastics into their original monomers or other valuable chemicals, allowing for the creation of high-quality raw materials that can be reused in the production of new plastics. This process reduces the volume of plastic waste sent to landfills and incinerators and also supports a circular economy by enabling the continuous reuse of plastic materials.

By converting plastic waste into reusable resources, chemical recycling helps meet regulatory requirements while also providing an environmentally friendly solution to managing plastic waste. This regulatory pressure is a major factor supporting the growth of the chemical recycling market.

The market faces challenges in effectively handling and processing diverse and contaminated plastic waste. The complexity of mixed plastic streams, which often include various additives and impurities, poses significant technical and operational difficulties. These challenges hinder the efficiency and cost-effectiveness of chemical recycling processes, highlighting the need for advanced sorting, cleaning, and pre-treatment technologies to ensure the quality of recycled materials.

- In Europe, about 30 million tonnes of plastic waste are collected annually. Alarmingly, 84% of this waste is either incinerated, exported, or sent to landfills, contributing significantly to CO2 emissions and the loss of valuable resources.

The chemical industry is committed to addressing this issue by advancing chemical recycling technologies. These technologies provide complementary solutions to existing mechanical recycling methods. By targeting hard-to-recycle plastics, chemical recycling aims to reduce reliance on incineration and landfills, thereby mitigating environmental impact and conserving resources.

- European Commission has established circularity goals for plastics. The revised waste directives mandate reducing landfilling of municipal waste to a maximum of 10% by 2035 and achieving recycling rates of 50% for plastic packaging by 2025 and 55% by 2030.

These ambitious targets signify a major stride toward minimizing waste disposal and fostering a circular economy for plastics. Moreover, the growth of this industry is likely to create numerous new employment opportunities, underscoring both the economic and environmental advantages of advancing chemical recycling technologies.

Chemical Recycling Market Trends

The chemical recycling market trend is accelerating as technological advancements improve efficiency and cost-effectiveness, driving the conversion of plastic waste into high-quality, reusable materials.

Continuous advancements in chemical recycling technologies are significantly optimizing both efficiency and economic viability. Improved catalyst designs enable higher conversion rates of plastic waste into reusable raw materials. Advanced depolymerization methods, such as hydrolysis and pyrolysis, allow for more precise breakdown of various plastics, enhancing quality and recyclability.

Pyrolysis, often referred to as "plastics to fuel," transforms non-recycled plastics from municipal waste into synthetic crude oil, which can be further refined into heating oil, gasoline, diesel fuel, or waxes.

- Pyrolysis reduces greenhouse gas emissions by 14%, lowers water consumption by 58%, and cuts traditional energy use by up to 96% compared to producing ultra-low sulfur diesel from conventional crude oil.

Moreover, many plastics contain additives to enhance specific properties, and advanced purification techniques ensure the removal of these contaminants, resulting in high-quality recycled outputs. These technological innovations collectively reduce operational costs and make chemical recycling a highly feasible and attractive solution for sustainable waste management, thus supporting the principles of a circular economy, and fostering market expansion.

Strategic collaborations and partnerships are becoming increasingly prevalent in the chemical recycling market. These alliances between chemical recycling companies, plastic manufacturers, and waste management firms aim to scale up chemical recycling operations and integrate these processes into existing supply chains. By pooling expertise and resources, these partnerships address the complex plastic waste challenge more effectively.

For instance, chemical recycling companies introduce advanced technologies, while plastic manufacturers contribute their knowledge of material properties, and waste management firms provide access to large quantities of plastic waste. This collaborative approach accelerates the development and implementation of innovative recycling solutions, promoting more efficient and sustainable practices.

Segmentation Analysis

The global market is segmented based on end-use industry, type, process, and geography.

By End-Use Industry

Based on end-use industry, the market is categorized into automotive, construction, industrial, healthcare, consumer goods, and packaging. The packaging segment garnered the highest revenue of USD 4.46 billion in 2023. This growth is attributed to the substantial volume of plastic waste it generates. Chemical recycling technologies offer a sustainable solution for processing diverse packaging materials, including single-use plastics and multilayered packaging.

Innovations in chemical recycling, coupled with stringent regulations and sustainability initiatives, are leading to the widespread adoption of these technologies in the packaging industry. Despite facing challenges such as high initial investments and infrastructure requirements, the packaging segment is set to witness substantial growth as stakeholders collaborate to address plastic waste and meet sustainability goals.

By Type

Based on type, the market is divided into recycled PE (polyethylene), recycled PET (polyethylene terephthalate), recycled PP (polypropylene), and others. The recycled PE (polyethylene) segment captured the largest chemical recycling market share of 43.56% in 2023, mainly due to growing emphasis on sustainability. With advancements in chemical recycling technologies, post-consumer and post-industrial PE waste can be efficiently converted into high-quality recycled PE suitable for various applications.

Despite facing challenges such as inconsistent quality and competition from virgin PE, favorable government support and growing demand are spurring the growth of the segment. Furthermore, continued technological innovations and collaborative efforts across the value chain are expected to propel the growth of the recycled PE segment.

By Process

Based on process, the chemical recycling market is categorized into depolymerization, dissolution, and conversion. The depolymerization segment garnered the highest revenue of USD 7.51 billion in 2023. This growth is primarily propelled by rising focus on sustainable waste management solutions. Depolymerization plays a crucial role in converting plastic waste into valuable raw materials, attributable to growing concerns regarding plastic pollution and the pressing need for alternatives to virgin plastics.

Technological advancements in depolymerization processes, including hydrolysis, enzymatic depolymerization, and solvent-based methods, have significantly improved efficiency and effectiveness. Despite encountering challenges such as high capital costs and energy-intensive processes, supportive regulatory frameworks and mandates for recycled content in products are boosting the adoption of depolymerization technologies.

Moreover, collaborative efforts between industry stakeholders and ongoing research and development initiatives are expected to further enhance the scalability and efficiency of depolymerization processes.

Chemical Recycling Market Regional Analysis

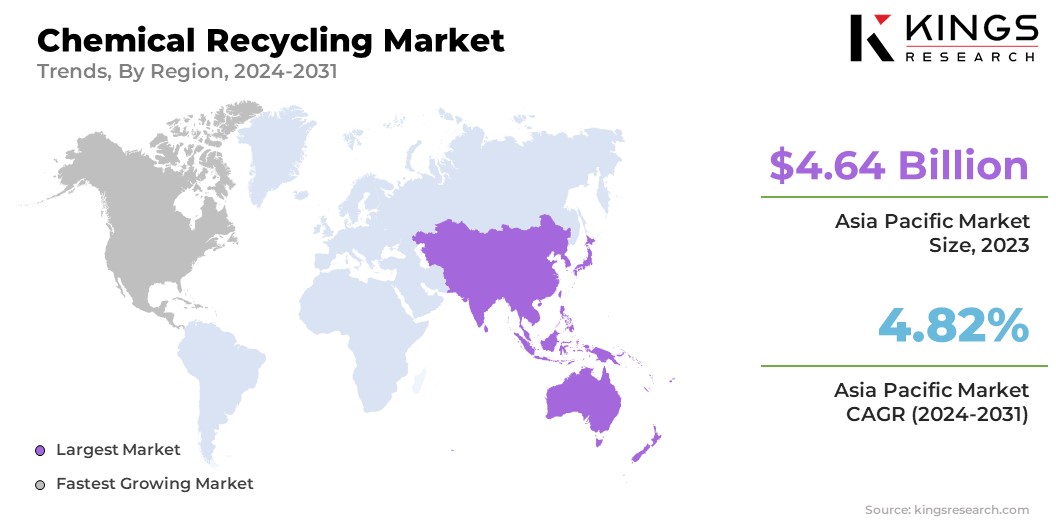

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific chemical recycling market share stood around 34.56% in 2023 in the global market, with a valuation of USD 4.64 billion. This notable expansion is fostered by increasing concerns regarding plastic pollution and the rising demand for sustainable waste management practices. Countries such as China, India, and Southeast Asian nations are at the forefront of this growth, largely attributable to supportive government policies and increased investments in recycling infrastructure.

Technological advancements in depolymerization and pyrolysis processes are making recycling economically viable and environmentally sustainable, the regional market outlook remains positive, with collaborative efforts expected to boost sustainable development and foster a circular economy.

North America is anticipated to witness a significant growth at a CAGR of 6.17% over the forecast period. Strong regulatory frameworks, including extended producer responsibility programs and mandates for recycled content, provide a supportive environment for the adoption of chemical recycling technologies.

Additionally, the region is home to vibrant innovation hubs and research institutions focused on developing advanced recycling solutions, contributing to ongoing technological advancements. Growing public awareness regarding plastic pollution and sustainability is fueling the implementation for sustainable waste management practices, thereby augmenting segmental market growth.

Competitive Landscape

The chemical recycling market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Chemical Recycling Market

- Agilyx

- BASF SE

- MaireTecnimont S.p.A.

- INEOS AG

- Axens

- Chevron Phillips Chemical Company LLC

- JEPLAN, INC.

- Eastman Chemical Company

- SABIC

- LyondellBasell Industries Holdings B.V.

Key Industry Development

- November 2023 (Geographical Expansion): LyondellBasell (LYB) announced its first industrial-scale catalytic advanced recycling demonstration plant at its Wesseling, Germany site. Using LyondellBasell's proprietary MoReTec technology, the plant was the first commercial-scale, single-train advanced recycling plant to convert post-consumer plastic waste into feedstock for the production of new plastic materials, marking a significant advancement in the market.

The global Chemical Recycling market is segmented as:

By End-Use Industry

- Automotive

- Construction

- Industrial

- Healthcare

- Consumer goods

- Packaging

By Type

- Recycled PE (Polyethylene)

- Recycled PET (Polyethylene Terephthalate)

- Recycled PP (Polypropylene)

- Others

By Process

- Depolymerization

- Dissolution

- Conversion

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership