Semiconductor and Electronics

Chipless RFID Market

Chipless RFID Market Size, Share, Growth & Industry Analysis, By Product Type (Smart Cards, Smart Tickets, and Others), By Component Type (Tag and Reader), By End-User (Retail, Healthcare, Logistics and Transportation, BFSI, and Other End-user Industries), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR909

Chipless RFID Market Size

The global Chipless RFID Market size was valued at USD 1,491.2 million in 2023 and is projected to grow from USD 1,720.8 million in 2024 to USD 5,286.6 million by 2031, exhibiting a CAGR of 17.39% during the forecast period. The expansion of the market is driven by increasing demand for efficient inventory management, enhanced supply chain visibility, regulatory mandates for item-level tagging, and ongoing advancements in printable electronics and sensor integration.

In the scope of work, the report includes solutions offered by companies such as Alien Technology, LLC., Checkpoint Systems, Inc., GAO Group, Honeywell International Inc, Molex, LLC, NXP Semiconductors, Tagsense Store., Vubiq Networks, Inc., Zebra Technologies Corp., AVERY DENNISON CORPORATION., and others.

The expansion of the chipless RFID market is primarily fueled by increasing demand across various sectors such as retail, healthcare, and logistics. The factors propelling market growth include the rising need for efficient inventory management, enhanced supply chain visibility, and the surging adoption of RFID technology for asset tracking.

Moreover, advancements in RFID technology, which offer cost-effective solutions compared to traditional RFID tags, boost market expansion. Additionally, regulatory mandates for item-level tagging and counterfeit prevention measures foster adoption. The market further benefits from ongoing technological advancements in printable electronics and sensor integration, which facilitate broader applications in industries that require real-time data capture and analytics.

- In October 2023, HID, a prominent player in identity and RFID solutions, introduced three new LinTRAK® RAIN® RFID ultra-high frequency (UHF) tags. The LinTRAK C10S, which is 20% smaller than its predecessor, provides an optimized balance of size and reading distance. The LinTRAK C15S features a unique 5 mm sewing zone, catering specifically to the needs of the linen manufacturers. Additionally, the LinTRAK C15SH, the smallest heat-sealable UHF RFID tag available, offers enhanced integration possibilities. Designed for durability, these tags are capable of withstanding harsh conditions, making them ideal for diverse linen types and medical settings, including MRI-safe environments.

The chipless RFID market is poised to witness significant growth, fueled by its ability to offer robust identification and tracking capabilities without the need for integrated silicon microchips. Unlike traditional RFID tags, chipless variants use printable electronics or conductive inks for data storage, rendering them a cost-effective solution for large-scale deployment.

This technology find extensive applications in retail inventory management, automotive manufacturing, and pharmaceutical supply chains. Prominent market players include technology providers specializing in printable electronics, conductive inks, and RFID solutions, thereby fostering innovation and stimulating market expansion.

The market encompasses radio frequency identification (RFID) systems that operate without an integrated silicon microchip. These systems utilize alternative technologies such as printable electronics, conductive inks, or magnetic materials to store and transmit data wirelessly.

Chipless RFID tags are highly preferred for their lower cost per unit compared to traditional RFID tags and their suitability for applications that require high-volume tagging, such as retail inventory management and supply chain optimization. These tags offer advantages in terms of flexibility, durability, and scalability, making them increasingly popular across diverse industries.

Analyst’s Review

Manufacturers are actively focusing on innovation and product development to meet evolving industry demands. This includes advancements in printable electronics and antenna design to enhance tag performance and cost efficiency. Manufacturers are introducing new product variants tailored for specific applications in retail inventory management, healthcare tracking, and logistics optimization.

This proactive approach is designed to capitalize on growing market opportunities resulting from digital transformation across various sectors. To sustain growth, manufacturers should prioritize investments in R&D for eco-friendly tag materials and interoperable RFID solutions. Additionally, fostering strategic partnerships to integrate RFID technology with IoT platforms could present new avenues for market expansion.

Industry participants are likely to benefit from leveraging data analytics for actionable insights and addressing cybersecurity challenges to enhance trust and promote the adoption of chipless RFID solutions.

- In January 2023, Checkpoint's RAIN Alliance member, Checkpoint, expanded its RFID technology offerings with the introduction of ItemOptix for Retail, a new RFID inventory management software. Available globally, this solution enhanced stock accuracy and sped up inventory handling, leading to boosted sales and improved customer satisfaction. Featuring a user-friendly mobile app and portal, ItemOptix for Retail operated on a SaaS platform, ensuring seamless integration and enabling retailers to efficiently manage inventory from source to store.

Chipless RFID Market Growth Factors

Growth of the market is propelled by the continuous advancements in printable electronics technology. This innovation enables RFID tags to be manufactured at lower costs and with greater flexibility compared to traditional silicon-based RFID tags. Printable electronics utilize conductive inks and other materials that can be applied using printing processes, allowing for both customization and scalability in tag production.

This technological evolution addresses the demand for cost-effective RFID solutions across various industries, including retail, healthcare, and manufacturing. As the efficiency and performance of printable electronics advance, they expand the potential applications of chipless RFID tags, thereby boosting adoption and contributing to market expansion.

A significant challenge hampering the development of the chipless RFID market is the limited read range and data storage capacity of existing chipless tags. This constraint restricts their their applicability in scenarios that demand long-distance tracking or extensive data storage capabilities.

To overcome this challenge, ongoing research is dedicated to enhancing the antenna design and material properties of chipless RFID tags. By optimizing antenna configurations and utilizing advanced materials with higher conductivity and durability, manufacturers are striving to improve the read range and data storage capacity of chipless tags.

Additionally, advancements in signal processing algorithms and RFID reader technology address these limitations, enabling chipless RFID tags to meet the performance requirements for diverse applications, including supply chain management and asset tracking.

Chipless RFID Market Trends

An emerging trend reshaping the landscape of the chipless RFID market is the integration of IoT (Internet of Things) technologies with RFID systems. This convergence enables real-time data capture and analysis, thereby enhancing operational efficiencies across various industries.

IoT-enabled chipless RFID tags facilitate seamless communication between tagged items and centralized systems, allowing businesses to monitor and manage inventory, assets, and processes more effectively. The synergy between RFID and IoT supports predictive maintenance, supply chain optimization, and inventory replenishment strategies.

As IoT infrastructure continues to expand, leveraging RFID for data acquisition and transmission is becoming increasingly prevalent. This trend is fueling the demand for integrated solutions that offer enhanced visibility and actionable insights in dynamic business environments.

The widespread adoption of sustainable and eco-friendly tag materials is influencing the chipless RFID market. Companies are increasingly prioritizing environmentally responsible practices, which has led to innovation in tag manufacturing by using biodegradable materials or recycled substrates. This shift addresses rising concerns regarding environmental impact and regulatory compliance, while also meeting consumer expectations for sustainable supply chains.

Sustainable chipless RFID tags offer durability and performance comparable to traditional tags, making them suitable for use in retail, logistics, and healthcare without compromising operational efficiency. Manufacturers are investing heavily in research and development to enhance the sustainability profile of RFID tags, fostering a market environment where eco-friendly solutions are integral to future growth and competitiveness.

Segmentation Analysis

The global market is segmented based on product type, component type, end-user, and geography.

By Product Type

Based on product type, the market is categorized into smart cards, smart tickets, and others. The smart cards segment led the chipless RFID market in 2023, reaching a valuation of USD 651.2 million. This expansion is primarily fueled by the widespread adoption of smart card technology across various applications, including access control, payment systems, and identity verification.

Smart cards offer enhanced security features, such as encryption and biometric authentication, which are particularly appealing to industries in need of robust data protection solutions. Moreover, the integration of chipless RFID technology into smart cards enhances their versatility and usability, thereby stimulating segmental expansion.

As industries continue to prioritize secure and efficient data management solutions, the smart cards segment is expected to sustain its growth trajectory, supported by ongoing advancements in RFID technology and increasing deployment across diverse sectors.

By Component Type

Based on component type, the market is classified into tag and reader. The reader segment is poised to witness significant growth at a robust CAGR of 19.12% through the forecast period (2024-2031). This growth is largely attributed to the increasing deployment of RFID reader systems across various industries for asset tracking, inventory management, and supply chain optimization. RFID readers play a critical role in enabling seamless communication with chipless RFID tags, thereby facilitating real-time data capture and analytics.

Advances in reader technology, including improved read range and data processing capabilities, contribute to enhanced operational efficiencies and more informed decision-making processes in businesses. Additionally, the integration of RFID readers with IoT platforms enhances connectivity and scalability, leading to widespread adoption across retail, manufacturing, and logistics sectors, thereby fueling the growth of the reader segment.

By End-User

Based on end-user, the market is segmented into retail, healthcare, logistics and transportation, BFSI, and other end-user industries. The retail segment secured the largest chipless RFID market share of 34.56% in 2023. This growth is propelled by the increasing adoption of chipless RFID technology to streamline inventory management, improve operational efficiency, and enhance customer shopping experiences.

Retailers leverage chipless RFID tags for automated inventory tracking to reduce out-of-stock incidents and minimize inventory shrinkage. The scalability and cost-effectiveness of chipless RFID solutions make them highly attractive to retailers looking to optimize supply chain visibility and logistics operations.

Furthermore, RFID technology supports omnichannel retail strategies by enabling accurate product traceability and inventory replenishment. As the retail sector increasingly prioritizes efficiency and customer satisfaction, the adoption of chipless RFID technology is expected to grow, thereby fostering the expansion of the retail segment.

Chipless RFID Market Regional Analysis

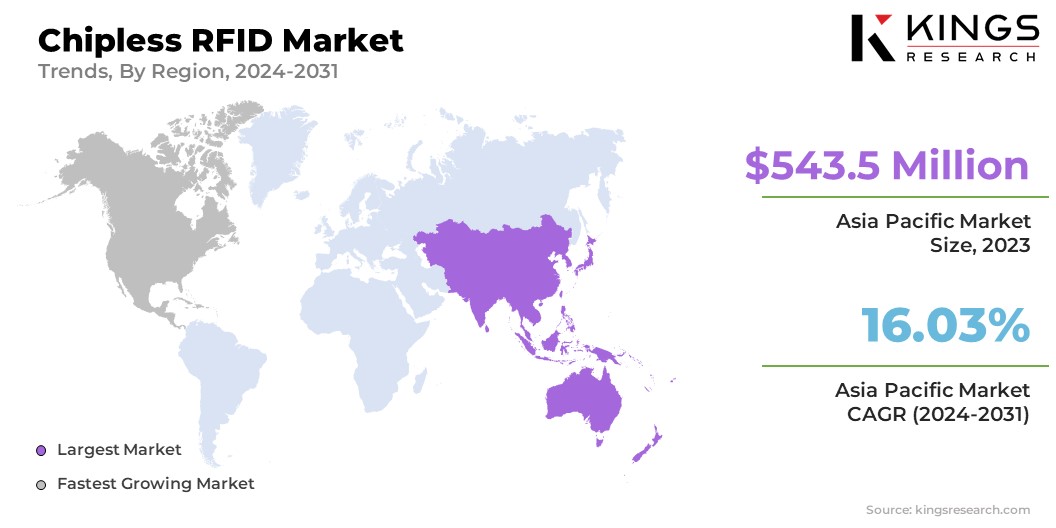

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific chipless RFID market captured a substantial share of around 36.45% in 2023, with a valuation of USD 543.5 million. This dominance is attributable to robust industrial growth, particularly in the manufacturing and logistics sectors. Countries such as China, Japan, and South Korea are at the forefront of adopting RFID technology for supply chain optimization and inventory management.

Additionally, favorable government initiatives that promote digital transformation and smart city projects contribute to regional market expansion. The presence of key RFID technology providers, coupled with a vast consumer electronics market, further bolsters adoption rates in the region. As economies in the region continue to invest in technological infrastructure, the Asia-Pacific market is projected to maintain its leading position through strategic partnerships and technological advancements.

North America is poised to experience robust growth at a staggering CAGR of 19.63% over the forecast period. This growth trajectory is bolstered by increasing adoption across diverse industries, including retail, healthcare, and automotive sectors. This growth is further reinforced by stringent regulations concerning product traceability and counterfeit prevention, which stimulate the demand for advanced RFID solutions.

Moreover, the region's robust technological infrastructure and early adoption of IoT and RFID technologies support regional market expansion. Investments in smart manufacturing and logistics technologies further propel domestic market growth, enabling businesses to achieve operational efficiencies and cost savings.

As enterprises increasingly prioritize innovation and operational excellence, the North America market is set to witness sustained growth, supported by ongoing technological advancements and strategic partnerships within the region.

Competitive Landscape

The global chipless RFID market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Chipless RFID Market

- Alien Technology, LLC.

- Checkpoint Systems, Inc.

- GAO Group

- Honeywell International Inc

- Molex, LLC

- NXP Semiconductors

- Tagsense Store.

- Vubiq Networks, Inc.

- Zebra Technologies Corp.

- AVERY DENNISON CORPORATION.

Key Industry Development

- October 2023 (Development): NTT Corporation collaborated with The University of Tokyo to develope a millimeter-wave RFID tag designed to transmit environmental information. These tags, readable by millimeter waves, provide accurate drone navigation in challenging weather conditions and low visibility scenarios. This technology aims to establish a robust sensor network for continuous environmental monitoring, with applications extending to remote and disaster-prone areas, including sea regions and disaster zones, thereby enhancing societal resilience and flexibility.

The global chipless RFID market is segmented as:

By Product Type

- Smart Cards

- Smart Tickets

- Others

By Component Type

- Tag

- Reader

By End-User

- Retail

- Healthcare

- Logistics and Transportation

- BFSI

- Other End-user Industries

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership