Healthcare Medical Devices Biotechnology

Chondroitin Sulfate Market

Chondroitin Sulfate Market Size, Share, Growth & Industry Analysis, By Source (Bovine, Poultry, Synthetic, Swine, Shark), By Application (Nutraceuticals, Personal Care & Cosmetics, Animal Feed, Pharmaceuticals, Others), and Regional Analysis, 2024-2031

Pages : 148

Base Year : 2023

Release : September 2024

Report ID: KR279

Chondroitin Sulfate Market Size

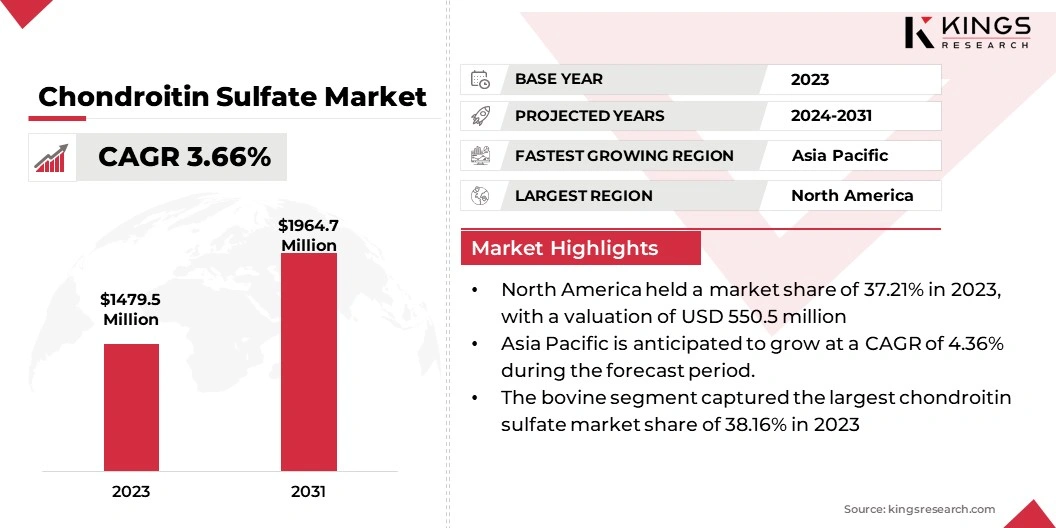

The global Chondroitin Sulfate Market size was valued at USD 1479.5 million in 2023 and is projected to grow from USD 1527.9 million in 2024 to USD 1964.7 million by 2031, exhibiting a CAGR of 3.66% during the forecast period. Increasing prevalence of osteoarthritis and rising awareness of joint health are augmenting the expansion of the market.

In the scope of work, the report includes services offered by companies such as Solabia Group, Oceania International LLC (Stanford Chemicals), Summit Nutritionals International, Yantai Ruikangda Biochemical Products Co., Ltd, Bioiberica S.A.U., Sino Siam Bio technique Co., Ltd., Knowde, ZPD A/S, SEIKAGAKU CORPORATION, Merck KGaA, and others.

Chondroitin sulfate offers significant opportunities in the cosmetic industry for its moisturizing, anti-aging, and skin-soothing properties. Traditionally used for joint health, this compound is increasingly gaining recognition in skincare formulations.

Chondroitin sulfate improves skin hydration by retaining moisture, enhancing elasticity, and smoothness. It further aids in repairing damaged skin and reducing signs of aging, including fine lines and wrinkles. With growing consumer demand for natural and functional ingredients in beauty products, chondroitin sulfate may find a niche in high-end cosmetics for mature skin.

- For instance, in March 2023, Symrise launched a new line of nutricosmetic bioactives for "Beauty from Within" products. The range includes solutions for skin, hair, and nails, featuring bioactives such as collagen Type I, chondroitin sulfate, and hyaluronic acid, further strengthening the company’s position in the beauty and wellness industry.

Additionally, its anti-inflammatory properties make it ideal for products that soothe sensitive or irritated skin. The demand for innovative cosmetic solutions incorporating bioactive ingredients is expected to boost the adoption of chondroitin sulfate in the beauty sector. This presents growth opportunities for manufacturers to expand into new markets and develop premium products that appeal to health-conscious consumers seeking multifunctional skincare solutions.

Chondroitin sulfate, a naturally occurring chemical found in human and animal cartilage, is essential for maintaining joint health and function. It is a type of glycosaminoglycan that retains water and provides structural support to cartilage tissue.

Chondroitin sulfate is commonly derived from animal sources, such as bovine, porcine, or marine cartilage, with bovine cartilage being the most prevalent. It is typically available in the market as a supplement or pharmaceutical ingredient. Chondroitin sulfate is widely used in the treatment of osteoarthritis and joint pain to reduce inflammation, improve joint function, and slow down cartilage breakdown.

It is often combined with glucosamine in supplements to enhance its effectiveness in promoting joint health. In addition to its medical uses, chondroitin sulfate is beneficial in personal care products, particularly skincare, due to its hydrating and anti-aging properties. Its versatility across various industries makes it a valuable ingredient in both health and cosmetic markets.

Analyst’s Review

The global chondroitin sulfate market is anticipated to exhibit significant growth, mainly fueled by increasing demand in the pharmaceuticals, dietary supplements, and cosmetics industries. Key market participants are diversifying their product offerings by expanding into new applications, including the cosmetic and veterinary sectors, to capitalize on emerging trends.

Companies can invest in research and development to improve extraction methods, enhance product quality, ensure regulatory compliance, and gain competitive advantages. Furthermore, strategic partnerships with pharmaceutical and supplement manufacturers can strengthen market position and foster innovation.

Expanding into the growing e-commerce market can be a key strategy for reaching a wider consumer base. Additionally, there is a growing emphasis on sustainability, with some players exploring plant-based chondroitin sulfate to appeal to environmentally conscious consumers.

Chondroitin Sulfate Market Growth Factors

The growing prevalence of osteoarthritis is a significant factor propelling the expansion of the chondroitin sulfate market. Osteoarthritis is a degenerative joint disease that primarily affects the elderly population, leading to pain, stiffness, and reduced mobility. The aging global population is leading to a rise in osteoarthritis cases, creating a substantial demand for treatments that alleviate symptoms and improve quality of life.

- For instance, in July 2023, the World Health Organization (WHO) reported that osteoarthritis predominantly affects older individuals, with 73% of sufferers over 55 old and 60% being women. The Institute for Health Metrics and Evaluation (IHME) projects that the global prevalence is likely to increase with aging populations, potentially reaching nearly 1 billion people by 2050.

Healthcare professionals and consumers alike are recognizing the long-term benefits of chondroitin sulfate in supporting joint health. Furthermore, the increasing demand for non-invasive, natural solutions for osteoarthritis management is anticipated to boost the adoption of chondroitin sulfate supplements. Pharmaceutical companies and supplement manufacturers are responding to this growing demand by developing products that specifically target osteoarthritis patients.

The high product cost associated with pharmaceutical-grade chondroitin sulfate presents a significant challenge to market development. The extraction, purification, and manufacturing processes involved in producing pharmaceutical-grade chondroitin sulfate are complex and require stringent quality control measures.

As a result, the final product is often expensive, limiting its accessibility, particularly in developing regions. This restricts the widespread use of chondroitin sulfate in pharmaceutical applications, despite its proven efficacy in treating joint-related conditions such as osteoarthritis. The high costs may deter healthcare providers and patients from choosing chondroitin sulfate as a primary treatment option.

To mitigate this challenge, companies are investing in advanced extraction technologies and exploring alternative sources to reduce production costs. Additionally, strategic partnerships with raw material suppliers and increasing production capacities are reducing costs. By enhancing supply chain efficiency and improving cost structures, manufacturers seek to make pharmaceutical-grade chondroitin sulfate more affordable and accessible to a broader range of consumers.

Chondroitin Sulfate Market Trends

The growing demand for dietary supplements is a key trend reshaping the landscape of the chondroitin sulfate market. As consumers become increasingly health-conscious, there is a rising preference for supplements that support overall wellness, particularly joint health. Chondroitin sulfate is widely recognized for its role in maintaining joint integrity, reducing inflammation, and alleviating pain associated with conditions such as osteoarthritis.

- As of 2023, according to Ministry of Food Processing Industries, India, the global nutraceutical market is dominated by the USA, Japan, and Europe, which together account for 90% of the market. Expected to reach USD 336 billion by 2023, India’s nutraceutical market is set to grow to approximately USD 18 billion by 2025, driven primarily by dietary supplements.

This has made it a popular ingredient in dietary supplements designed for joint health, particularly for the elderly and those with active lifestyles. The shift toward preventive healthcare, where consumers seek to address health issues before they become severe, is further contributing to the increased demand for chondroitin sulfate supplements.

Furthermore, the expanding awareness of the benefits of natural ingredients in health products is promoting the use of chondroitin sulfate in combination with other joint health supplements such as glucosamine. As consumer preferences evolve, demand for high-quality, effective dietary supplements are anticipated to support the growth of the market, spurring further product development and innovation.

Segmentation Analysis

The global market has been segmented based on source, application, and geography.

By Source

Based on source, the market has been segmented into bovine, poultry, synthetic, swine, and shark. The bovine segment captured the largest chondroitin sulfate market share of 38.16% in 2023. This expansion is largely attributed to the widespread availability and lower cost of sourcing chondroitin sulfate from bovine cartilage compared to other sources such as porcine or marine animals.

Bovine cartilage, a major source of chondroitin sulfate, is favored by manufacturers in the pharmaceutical, nutraceutical, and cosmetic industries. The established infrastructure for bovine cartilage processing and extraction in various regions further contributes to its dominance. Additionally, the high concentration of chondroitin sulfate in bovine cartilage ensures a consistent and reliable supply for large-scale production, thereby increasing its demand.

Regulatory approvals for bovine-sourced chondroitin sulfate in key markets such as North America and Europe have supported its widespread adoption. The robust demand for joint health supplements and osteoarthritis treatments that incorporate bovine-derived chondroitin sulfate further aids segmental growth.

By Application

Based on application, the market has been classified into nutraceuticals, personal care & cosmetics, animal feed, pharmaceuticals, and others. The nutraceuticals segment is poised to record a CAGR of 4.10% through the forecast period due to increasing consumer awareness regarding the benefits of dietary supplements in maintaining overall health and preventing chronic diseases.

Nutraceuticals incorporating chondroitin sulfate are widely recognized for supporting joint health and reducing osteoarthritis symptoms, making them highly sought after among aging populations and individuals with active lifestyles. As preventive healthcare gains prominence, consumers increasingly turn to nutraceuticals to address joint-related issues early, thereby boosting demand.

Additionally, increased disposable incomes and improved access to health supplements through e-commerce platforms are supporting the growth of the nutraceuticals segment.

Moreover, manufacturers are focusing on product innovation by introducing new formulations that combine chondroitin sulfate with other ingredients such as glucosamine, collagen, and vitamins to enhance effectiveness. The expanding global nutraceuticals market and increasing demand for natural and functional ingredients are projected to stimulate the growth of the chondroitin sulfate-based nutraceutical segment.

Chondroitin Sulfate Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

North America chondroitin sulfate market accounted for a substantial share of 37.21% and was valued at USD 550.5 million in 2023, positioning it as the largest regional market. This dominance is attributed to the high prevalence of osteoarthritis and other joint-related disorders in the region, particularly among the aging population.

The growing demand for dietary supplements that promote joint health and alleviate arthritis symptoms is stimulating regional market growth. The presence of well-established pharmaceutical and nutraceutical industries in the U.S. and Canada, along with favorable healthcare policies, is further bolstering the demand for chondroitin sulfate-based products.

Additionally, rising awareness of preventive healthcare and increasing consumer spending on wellness products are fostering the adoption of chondroitin sulfate in North America. Regulatory approvals from the U.S. FDA for the use of chondroitin sulfate in various pharmaceutical applications are further contributing to regional market growth. The robust distribution network and presence of major market players is supporting the expansion of the North America market.

Asia-Pacific is expected to grow at the highest CAGR of 4.36% in the forthcoming years due to the increasing awareness of joint health and the rising demand for dietary supplements in countries such as China, Japan, and India. The growing middle-class population and increasing disposable incomes are promoting higher consumer spending on health and wellness products, including chondroitin sulfate-based supplements.

In addition, the expanding geriatric population in countries such as Japan, where joint-related issues are prevalent, is highlighting the need for effective treatments and supplements to improve joint health. The region's robust pharmaceutical manufacturing industry and the increasing adoption of nutraceuticals are further contributing to the growth of the Asia-Pacific market.

Regulatory frameworks are increasingly favorable toward dietary supplements, creating opportunities for international companies to expand. Furthermore, the growth of e-commerce platforms is facilitating easier access to these products, thereby boosting regional sales.

Competitive Landscape

The global chondroitin sulfate market report will provide valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Chondroitin Sulfate Market

- Solabia Group

- Oceania International LLC (Stanford Chemicals)

- Summit Nutritionals International

- Yantai Ruikangda Biochemical Products Co., Ltd

- Bioiberica S.A.U.

- Sino Siam Bio technique Co., Ltd.

- Knowde

- ZPD A/S

- SEIKAGAKU CORPORATION

- Merck KGaA

Key Industry Development

- March 2024 (Launch): ZPD, a Japanese company based in Esbjerg, Denmark, partnered with EHP, a Vejle-based dietary supplement specialist, to launch Movagain Pro, a new nutritional supplement targeting joint pain relief. ZPD is known for its chondroitin sulfate production, which is approved for medical and dietary use in the EU and Denmark.

The global chondroitin sulfate market is segmented as:

By Source

- Bovine

- Poultry

- Synthetic

- Swine

- Shark

By Application

- Nutraceuticals

- Personal Care & Cosmetics

- Animal Feed

- Pharmaceuticals

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership