Healthcare Medical Devices Biotechnology

Clinical Trial Services Market

Clinical Trial Services Market Size, Share, Growth & Industry Analysis, By Service Type (Clinical Trial Management (CTM), Regulatory Services, Clinical Trial Supply and Logistics, Laboratory Services, Decentralized/Virtual Trials, Patient Recruitment and Retention), By Phase, By Therapeutic Area, By End-User, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR269

Clinical Trial Services Market Size

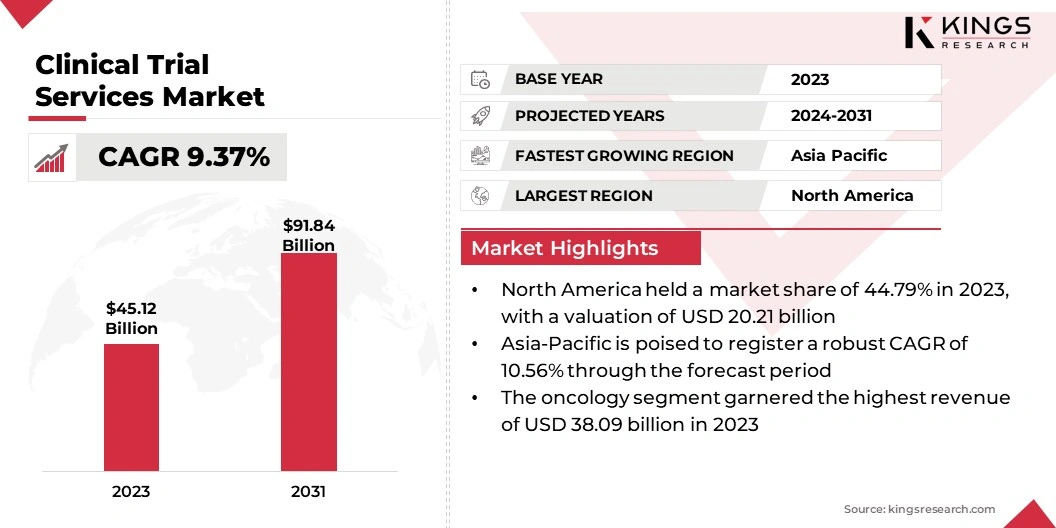

The global Clinical Trial Services Market size was valued at USD 45.12 billion in 2023 and is projected to grow from USD 49.07 billion in 2024 to USD 91.84 billion by 2031, exhibiting a CAGR of 9.37% during the forecast period. The market is advancing due to growing investments in personalized medicine and the rising need for global trial access.

Enhanced data analytics and patient recruitment strategies are improving trial outcomes and efficiency. The sector is further benefiting from regulatory changes that streamline approval processes. As these dynamics evolve, the market is poised to witness significant growth, supported by ongoing innovation and increased global collaboration.

In the scope of work, the report includes services offered by companies such as Charles River Laboratories, Laboratory Corporation of America Holdings, Eli Lilly and Company, Icon PLC, Novo Nordisk AS, Parexel International Corporation, Pfizer Inc., Thermo Fisher Scientific Inc., Iqvia Holdings Inc., F. Hoffmann-La Roche Ltd, and others.

The clinical trial services market is experiencing significant growth, mainly due to the increasing number of clinical trials worldwide. This rise is expected to boost market expansion as pharmaceutical and biotech companies seek efficient solutions for managing complex trials.

- For instance, in February 2023, an article published by the World Health Organization (WHO) highlighted that the United States led in trial registrations from 1999 to 2022, with 168,520 trials, followed by China with 94,193 and Japan with 63,499.

Advancements in digital technologies, including decentralized trial platforms and integrated management systems, are enhancing operational efficiency and patient participation. These innovations are streamlining trial processes, reducing geographical barriers, and accelerating research timelines. The market is further witnessing increased demand for specialized testing and regulatory compliance due to the complexity of biologic therapies, thereby fostering market expansion.

Clinical trial services encompass a range of specialized activities and support functions designed to facilitate the planning, execution, and management of clinical trials. These services include patient recruitment, site management, data collection, regulatory compliance, and monitoring to ensure the integrity and validity of trial results.

Providers of clinical trial services offer expertise in managing the complexities of clinical research, from designing protocols and conducting trials to analyzing data and reporting outcomes. Their role is crucial in advancing medical research by enabling the efficient development of new treatments and therapies, ensuring adherence to regulatory standards, and optimizing trial performance and outcomes.

Analyst’s Review

The introduction of integrated technology platforms is optimizing clinical trial management by centralizing access to critical tools and resources, which is expected to bolster market growth. These platforms are increasing operational efficiency, enhancing user experience, and enabling more effective oversight of trial activities, thereby supporting better decision-making and accelerating trial timelines.

- For instance, in June 2024, IQVIA unveiled a new technology platform called One Home for Sites. This platform offers a single sign-on feature and a centralized dashboard, allowing users to efficiently manage all critical systems and tasks related to the clinical trials they are conducting.

By adopting such advanced technologies, companies are improving user experience, simplifying processes, and positioning themselves as leaders in innovation, which is expected to propel market expansion and accelerate the development of new therapies in the coming years.

Clinical Trial Services Market Growth Factors

The increasing incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders is boosting the demand for clinical trials as pharmaceutical companies are continuously seeking to develop new treatments and therapies.

These conditions, major contributors to global morbidity and mortality, are compelling the healthcare industry to intensify research efforts. This is leading to increasing clinical trial activities, with companies competing to innovate and deliver effective solutions to market.

- In November 2022, Amgen reported end-of-treatment findings from its Phase 2 OCEAN(a)-DOSE study on the investigational drug olpasiran (formerly AMG 890) in adults. This study showed a reduction of over 95% in olpasiran lowered lipoprotein(a) levels in patients with established atherosclerotic cardiovascular disease (ASCVD).

This ongoing surge in research and development is contributing significantly to these initiatives, which is propelling the growth of the market.

A significant challenge impeding the expansion of the clinical trial services market is navigating the complex and varied regulatory requirements across different regions, which may lead to delays and increased costs. Key players are mitigating this challenge by investing in robust regulatory compliance solutions and expanding their network of global regulatory experts.

They are utilizing advanced technologies and data analytics to streamline the approval process and ensure adherence to diverse regulations. Additionally, strategic partnerships with local CROs and regulatory agencies are enhancing their capability to manage regional complexities effectively.

Clinical Trial Services Market Trends

The trend toward decentralized clinical trials, supported by advancements in digital health technologies and remote monitoring, is revolutionizing the clinical trial landscape.

- In September 2023, ProofPilot, a leading innovator in clinical trial automation, forged a strategic alliance with Eli Lilly and Company, a global pharmaceutical leader. This partnership incorporated Lilly’s patent-pending sensor cloud platform, Magnol.AI, into ProofPilot’s technology offering. Magnol.AI provided advanced capabilities for managing high-frequency sensor data with both security and efficiency.

This innovative approach is allowing for broader patient participation by eliminating the need for patients to be physically present at trial sites, thereby reducing geographical barriers and expanding access to diverse populations.

Additionally, decentralized trials are streamlining the research process by enabling real-time data collection and monitoring, thus significantly accelerating trial timelines. These efficiencies are enhancing patient engagement and convenience while also contributing to the growth of the clinical trial services market.

The rapid expansion of the biopharmaceutical industry, propelled by significant advancements in biologics and personalized medicine, is substantially increasing the demand for clinical trial services.

- In May 2023, the U.S. FDA announced its support for expanding the use of decentralized clinical trials (DCTs) for biologics, drugs, and devices.

As companies develop innovative biologic therapies, there is a growing need for specialized testing, rigorous regulatory compliance, and comprehensive data management. These requirements are becoming increasingly complex, particularly with the rise of personalized treatments tailored to individual patient profiles.

This complexity is boosting the growth of the market, as the industry seeks to navigate the challenges of efficiently and safely developing and introducing these cutting-edge therapies to market. The market is thus experiencing robust growth, supported by the continuous evolution of biopharmaceutical research and development activities.

Segmentation Analysis

The global market has been segmented based on service type, phase, therapeutic area, end-user, and geography.

By Service Type

Based on service type, the clinical trial services market has been categorized into clinical trial management, regulatory services, clinical trial supply and logistics, laboratory services, decentralized/virtual trials, patient recruitment and retention, data management and statistical analysis, and others. The clinical trial management segment garnered the highest revenue of USD 13.98 billion in 2023.

The clinical trial management segment is further divided into planning and design, project management, monitoring and data management, site management. The growth of the segment is propelled by advancements in technology, such as integrated trial management systems and digital tools that enhance efficiency and accuracy.

- For instance, in September 2023, Biofourmis introduced an AI-driven platform to accelerate drug development for trial sponsors and investigators.

Additionally, the rising number of clinical trials and the need for global trial access contribute to the expansion of the segment. Key players are investing heavily in innovative solutions to streamline trial processes, which support the growth of the segment.

By Phase

Based on phase, the market has been categorized into phase I, phase II, phase III, and phase IV. The phase III segment captured the largest clinical trial services market share of 49.87% in 2023. This phase is crucial for evaluating a new treatment's efficacy and safety against the established standard of care.

These trials aim to validate earlier findings by demonstrating the drug’s safety, effectiveness, and usefulness for its intended indication. Phase III studies assess the effectiveness of the new medication compared to existing treatments or confirm the safety and efficacy data from Phase I and II trials.

- As of November 2022, according to the National Clinical Trial (NCT) Registry data, approximately 12,136 Phase III trials are underway worldwide across various indications.

This substantial number of active trials is anticipated to boost the growth of the phase III segment through the forecast period.

By Therapeutic Area

Based on therapeutic area, the market has been categorized into oncology, cardiology, neurology, infectious diseases, immunology, respiratory, dermatology, and others. The oncology segment is expected to garner the highest revenue of USD 38.09 billion by 2031, mainly due to the increasing prevalence of cancer and the surging demand for innovative treatments.

- According to the American Cancer Society, in 2023, the United States recorded 1,958,310 new cancer cases.

The oncology therapeutic area focused on trials that evaluate new therapies, including targeted treatments, immunotherapies, and combination therapies. Advances in genomic research and personalized medicine are further fueling growth by enabling more precise and effective treatment approaches. The rising number of oncology trials is further supported by a surge in cancer cases globally, highlighting a pressing need for diverse and robust clinical studies.

- In June 2022, AION Labs, in collaboration with BioMed X, launched its Fourth Global Call for Application focused on predicting clinical trial outcomes in cancer patient populations. The new start-up aimed to develop an AI platform to enhance patient selection for Phase III trials by identifying biomarkers from existing single-arm early Phase I/II data.

The introduction of advanced platforms is anticipated to aid the growth of the segment by optimizing patient populations for Phase III trials.

Clinical Trial Services Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America clinical trial services market accounted for the largest share of 44.79% in 2023, with a valuation of USD 20.21 billion. The region's robust infrastructure supports a significant number of clinical studies, fueled by the increasing demand for drug development. The presence of key market players further propels this growth. Additionally, strategic collaborations, partnerships, and mergers are stimulating regional market expansion.

- For instance, in June 2022, Pfizer, MorphoSys, and Incyte collaborated on a clinical trial to explore the combination of Pfizer’s TTI-622, Monjuvi (tafasitamab-cxix), and lenalidomide in treating relapsed for refractory diffuse large B-cell lymphoma (DLBCL).

Such initiatives highlight the dynamic and collaborative environment of the North America market, stimulating its growth and fostering innovation.

Asia-Pacific is anticipated to witness substantial growth, recording a robust CAGR of 10.56% over the forecast period. This growth is largely attributed to the growing healthcare infrastructure and large, diverse patient populations.

Countries such as China and India are at the forefront of this growth due to their substantial patient bases and improving regulatory frameworks, which streamline trial approvals and enhance market attractiveness. The regional market benefits from cost-effective trial solutions and strategic partnerships between global pharmaceutical companies and local CROs.

- For instance, in October 2022, ObvioHealth and Oracle collaborated to integrate diverse data sets efficiently in decentralized clinical trials across Asia Pacific.

These collaborations leverage regional expertise and facilitate efficient trial management, thereby contributing to the regional market expansion.

Competitive Landscape

The global clinical trial services market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Clinical Trial Services Market

- Charles River Laboratories

- Laboratory Corporation of America Holdings

- Eli Lilly and Company

- Icon PLC

- Novo Nordisk AS

- Parexel International Corporation

- Pfizer Inc.

- Thermo Fisher Scientific Inc.

- Iqvia Holdings Inc.

- Hoffmann-La Roche Ltd

Key Industry Developments

- June 2024 (Product Launch): Labcorp, a global leader in innovative laboratory services, launched Labcorp Global Trial Connect. This suite of central laboratory solutions aimed to enhance the speed of clinical trials conducted at investigator sites.

- May 2023 (Partnership): Allucent joined forces with THREAD, a leader in decentralized clinical trials and eCOA technologies, to help biotechnology companies design and oversee customized trials. This partnership is designed to enable sponsors to create effective digital strategies for remote engagement and data collection.

The global clinical trial services market is segmented as:

By Service Type

- Clinical Trial Management (CTM)

- Planning and Design

- Project Management

- Monitoring and Data Management

- Site Management

- Regulatory Services

- Regulatory Submission

- Consulting

- Protocol and Safety Consulting

- Clinical Trial Supply and Logistics

- Supply Chain Management

- Packaging, Labeling, and Distribution

- Laboratory Services

- Bioanalytical Testing

- Biomarker Services

- Central Laboratory Services

- Decentralized/Virtual Trials

- Patient Recruitment and Retention

- Data Management and Statistical Analysis

- Others

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Therapeutic Area

- Oncology

- Cardiology

- Neurology

- Infectious Diseases

- Immunology

- Respiratory

- Dermatology

- Others

By End-User

- Pharmaceutical and Biotechnology Companies

- Medical Device Companies

- Contract Research Organizations

- Academic and Research Institutes

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)