ICT-IOT

Cloud Billing Market

Cloud Billing Market Size, Share, Growth & Industry Analysis, By Type (Subscription Billing, One Time, Usage-Based & Others), By Deployment Type (Private, Public, and Hybrid), By Service Model, By Industry Vertical (BFSI, IT & Telecommunication, Education, Construction & Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1074

Cloud Billing Market Size

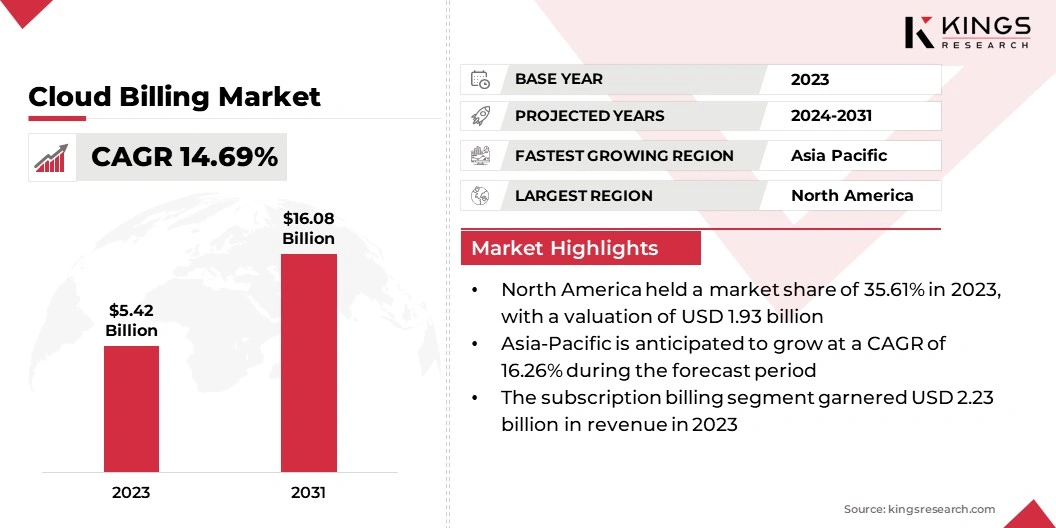

The global Cloud Billing Market size was valued at USD 5.42 billion in 2023 and is projected to grow from USD 6.16 billion in 2024 to USD 16.08 billion by 2031, exhibiting a CAGR of 14.69% during the forecast period. The widespread adoption of cloud services across industries necessitates robust billing systems, driving the growth of the market.

As organizations from various sectors migrate to cloud-based platforms, the complexity of managing usage, pricing, and billing has intensified. Therefore, thedemand for efficient billing solutions to handle diverse pricing models, scale with cloud usage, and provide real-time invoicing is gianing pace. Robust cloud billing systems are essential for businesses to track service consumption, optimize costs, and maintain customer satisfaction in an ever-expanding cloud environment.

In the scope of work, the report includes services offered by companies such as Aria Systems, Inc., Oracle, Amazon Web Services, Amdocs Inc., NEC Corporation, SAP SE, Cerillion Technologies Ltd., IBM Corporation, Salesforce, Zuora Inc., and others.

The demand for real-time billing solutions that enable organizations to handle dynamic pricing models, provide immediate invoicing, and manage usage-based billing with precision is significantly boosting the cloud billing market growth. This capability is particularly crucial in industries like telecommunications and IT, where service consumption fluctuates significantly.

By offering real-time insights and billing accuracy, these solutions help companies improve revenue management and enhance customer satisfaction. Additionally, as global and regional regulations around data privacy, financial reporting, and consumer protection become increasingly stringent, businesses need billing solutions that ensure compliance.

Cloud billing systems must adhere to various standards, such as GDPR in Europe or PCI DSS for payment security, to avoid legal penalties and maintain trust with customers. This demand for secure, transparent, and compliant billing processes is pushing organizations to adopt advanced cloud billing solutions, which can seamlessly integrate compliance features into their operations. This is expected to support the market growth over the forecast period.

Cloud billing is the process of managing and automating billing and invoicing for cloud-based services. It involves tracking cloud resource consumption, calculating costs based on various pricing models, and generating invoices in real time. Cloud billing systems are designed to handle complex cloud services, which often involve dynamic and usage-based pricing.

These systems provide businesses with detailed insights into their cloud expenditures, enabling cost optimization and accurate financial planning. Cloud billing solutions are essential for cloud service providers and users alike, ensuring transparency, compliance with regulatory requirements, and enhanced customer satisfaction by offering clear and flexible billing options.

Analyst’s Review

The integration of AI and automation is a significant factor driving the growth of the cloud billing market. AI-powered billing systems enhance accuracy and efficiency by automating complex billing processes, such as dynamic pricing adjustments, usage tracking, and invoice generation.

Machine learning algorithms can analyze vast amounts of data to identify patterns in service consumption, predict future usage, and optimize pricing strategies. Automation streamlines repetitive tasks, reducing manual errors and operational costs. Additionally, AI enables personalized billing experiences by offering customized payment plans and real-time recommendations to customers. As businesses more such advanced capabilities, the demand for AI-driven cloud billing solutions is expected to rise, fueling market growth and innovation.

- For instance, in August 2023, Aria Systems introduced Aria AI Datashare, a new feature designed to enhance Generative AI and large language models (LLMs) by incorporating crucial billing data, such as customer details, product offerings, and revenue performance metrics. Integrated within Aria Billing Cloud, this capability enriches GPT prompts and LLM training with contextually rich information. As a result, Generative AI can deliver more personalized and accurate responses to customer inquiries related to billing and service recommendations.

Moreover, as data privacy and financial regulations become more stringent, the need for cloud billing solutions to ensure compliance with various regional and international standards is becoming increasingly critical. This demand is driving the adoption of advanced billing systems that prioritize transparency and security.

Businesses are compelled to implement billing solutions that can seamlessly align with complex regulatory frameworks, reducing the risk of non-compliance penalties and enhancing customer trust. This focus on compliance not only safeguards businesses but also propels market growth by fostering the adoption of sophisticated, regulation-compliant billing technologies.

- For instance, in July 2022, Salesforce announced that it had achieved Second Level Compliance recognition from the EU Data Protection Code of Conduct. The EU Cloud Code of Conduct, a pioneering charter, allows cloud service providers to demonstrate their compliance with General Data Protection Regulation (GDPR) requirements with trust and transparency. This milestone reinforces Salesforce's commitment to adhering to global data protection laws and standards.

Cloud Billing Market Growth Factors

The expansion of the retail sales industry is a pivotal factor driving the growth of the cloud billing market. The retail sector is embracing digital transformation for managing transactions, subscriptions, and customer interactions across multiple channels.

Cloud billing solutions provide the flexibility and scalability needed to handle this complexity, enabling retailers to efficiently manage dynamic pricing models, promotions, and personalized customer experiences. Additionally, the expansion of retail cloud infrastructure supports seamless integration between billing systems and other digital tools, such as customer relationship management (CRM) and inventory management systems.

As the retail industry continues to evolve and expand globally, the demand for robust, cloud-based billing solutions that can adapt to changing market dynamics and consumer behaviors is expected to increase, further propelling market growth.

- For instance, in January 2023, Oracle enhanced its extensive retail cloud platform by introducing the Oracle Retail Payments Cloud Service. This new solution allows U.S. retailers to accept modern contactless payment methods, including debit and credit cards, as well as Apple, Google, and Samsung Pay, withouthidden fees or unpredictable costs that can impact profitability. The service offers transparent, fixed-fee pricing with no long-term contract commitments or monthly minimum requirements, providing retailers with greater financial clarity and flexibility.

Moreover, the growing need to reduce operational (OPEX) and capital expenditures (CAPEX) is a crucial factor for the cloud billing market growth. As businesses seek to optimize costs and improve financial efficiency, cloud billing solutions offer a compelling advantage by minimizing the need for expensive on-premise infrastructure and reducing ongoing operational costs.

Accenture suggests that migration to public cloud result could result in up to 30-40% total cost of ownership (TCO) savings. By leveraging cloud-based systems, organizations can scale their billing operations more efficiently, paying only for the resources they use while avoiding large upfront investments.

However, the surge in cyberattacks and data theft is a critical factor restraining the growth of the market. As cyber threats evolve and become more sophisticated, the security of sensitive billing and financial data is facing vulnerabilities. This can deter organizations from adopting cloud billing solutions due to fears of data breaches, financial loss, and regulatory non-compliance.

Forbes reported that between 2021 and 2023, instances of data breaches rose by 72%, surpassing the previous record. To address these concerns, companies are implementing enhanced encryption protocols to protect data both in transit and at rest, ensuring that sensitive information remains secure.

Additionally, adherence to industry standards and regulations, like GDPR and PCI DSS, ensures that cloud billing solutions meet stringent security requirements. Advanced threat detection technologies, including AI and machine learning, are also deployed to monitor and respond to potential security breaches in real time.

Furthermore, the integration of IoT technology into cloud billing systems is significantly driving market growth, particularly in process industries. IoT devices generate vast amounts of data in their operations, which can be used to create more accurate and dynamic billing models.

By incorporating real-time data from IoT sensors, cloud billing systems can facilitate usage-based pricing, monitor consumption patterns, and automate billing processes with greater precision. This enables process industries to enhance operational efficiency, optimize resource management, and provide more personalized billing solutions.

Cloud Billing Market Trends

The increasing demand for flexible monetization strategies is a significant factor driving the cloud billing market. Businesses offering value-added services require adaptable billing solutions that can accommodate diverse pricing models and revenue streams. Cloud billing systems enable organizations to implement innovative monetization approaches, such as subscription-based services, usage-based pricing, and tiered offerings, all tailored to enhance customer engagement and maximize revenue.

This flexibility allows businesses to respond to market changes and evolving consumer preferences, making cloud billing solutions essential for driving growth and maintaining a competitive edge in today's dynamic market environment.

- For instance, in January 2023, Zuora Inc. unveiled new, purpose-built solutions for consumption-based billing and revenue recognition. These offerings are designed to deliver end-to-end billing and revenue management for consumption-based pricing, providing companies with a comprehensive platform to streamline processes from quote to cash and revenue accounting.

In addition, the rapid expansion of e-commerce and the rise of virtualized workplaces are significantly driving market growth by amplifying the need for streamlined operations and transparent billing processes. As businesses increasingly operate online and across digital platforms, they require billing solutions that can manage complex transactions, integrate seamlessly with various systems, and provide clear, real-time insights into financial data.

This shift toward digital and remote environments result in efficient, transparent billing systems that can handle diverse payment models and ensure accuracy in financial reporting. The demand for such solutions continues to rise as companies seek to enhance operational efficiency and maintain clarity in their billing practices in the growing digital landscape.

- According to a study by the International Trade Administration, global B2C e-commerce revenue was valued at USD 3.6 trillion in 2023 and is projected to reach USD 5.5 trillion by 2027, reflecting a steady compound annual growth rate of 14.4%.

Segmentation Analysis

The global market has been segmented based on type, deployment type, service model, industry vertical, and geography.

By Type

Based on type, the market has been segmented into subscription billing, one time, usage-based, and others. The subscription billing segment led the market in 2023, reaching the valuation of USD 2.23 billion.

With the rise of subscription-based business models across various industries, including software, media, and telecommunications, there is an increasing demand for billing systems that can efficiently manage recurring payments, multiple pricing tiers, and usage-based charges. Subscription billing provides businesses with predictable revenue streams and the flexibility to offer customized pricing plans, which are appealing to consumers seeking tailored services.

Additionally, the shift toward digital and cloud-based services has further accelerated the adoption of subscription billing, as companies prioritize scalability, customer retention, and the ability to quickly adapt to changing market demands. This segment's ability to support diverse business models and enhance customer engagement makes it a dominant force in the market.

By Deployment Type

Based on deployment type, the cloud billing market has been classified into private, public, and hybrid. The public segment secured the largest revenue share of 48.87% in 2023 due to its cost-effectiveness, scalability, and widespread accessibility.

Businesses are increasingly adopting public cloud solutions to avoid the capital expenditures associated with on-premise infrastructure, benefiting from the pay-as-you-go pricing model that aligns with their operational needs. Public cloud platforms also offer unmatched scalability, allowing companies to easily adjust resources in response to fluctuating demands, which is crucial for growing businesses and startups.

Moreover, the extensive network of global data centers of public cloud providers ensures high availability and reliability, making it an attractive option for enterprises seeking robust, secure, and flexible billing solutions. This segment is further supported by the continuous innovation and advanced services offered by major public cloud providers, which enhance operational efficiency and drive overall market growth.

By Service Model

Based on service model, the market has been divided into IaaS, PaaS, and SaaS. The SaaS segment is poised for significant growth at a robust CAGR of 48.87% over the forecast period due to its flexibility, ease of integration, and cost-effectiveness.

SaaS-based billing solutions allow businesses to quickly deploy and scale their operations without the need for extensive infrastructure investments, making them particularly appealing to startups and small to medium-sized enterprises (SMEs). Additionally, SaaS models offer seamless integration with legacy systems, enabling companies to automate billing processes, reduce manual errors, and improve operational efficiency.

The subscription-based nature of SaaS also aligns with the growing demand for on-demand services, allowing businesses to pay for only what they use, thus optimizing costs. As more companies transition to digital and cloud-based operations, the demand for SaaS billing solutions continues to rise, driving its rapid growth in the cloud billing market.

By Industry Vertical

Based on industry vertical, the market has been classified into BFSI, IT & telecommunication, education, construction, healthcare, and others. The BFSI segment is projected to secure the largest revenue share of 33.91% in 2031, due to its complex billing requirements, high transaction volumes, and stringent regulatory demands.

Financial institutions need robust and scalable billing systems to manage a vast array of services, including loans, insurance policies, investment products, and payment processing. Cloud billing solutions offer the flexibility and efficiency in handling these diverse billing needs, providing real-time processing, automated reconciliation, and detailed reporting capabilities.

Additionally, the BFSI sector is heavily regulated, requiring billing systems that ensure compliance with various financial regulations and data security standards. Cloud billing platforms are equipped with advanced security features and compliance tools, making them ideal for the BFSI industry. As digital transformation accelerates within this sector, the demand for sophisticated, reliable, and compliant billing solutions continues to drive the segment's dominance in the market.

Cloud Billing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America cloud billing market share stood around 35.61% in 2023 in the global market, with a valuation of USD 1.93 billion. The rapid advancement of AI technology integrated into cloud platforms is a significant factor driving market growth. The region's telecom companies are using AI-optimized monetization platforms, which are made possible through strategic partnerships with SaaS providers.

AI-driven platforms offer telecom companies the ability to deliver personalized services, automate complex billing processes, and adapt quickly to market changes. These advanced platforms enable companies to enhance revenue management by utilizing AI to analyze data, predict customer behavior, and optimize pricing strategies.

- For instance, In September 2023, cloud billing company Aria Systems and cloud CRM specialist Salesforce announced the integration of their platforms to deliver a new AI-optimized "concept-to-care" monetization solution for telecom companies. This innovative platform is designed to equip enterprises and service providers with the tools needed to launch personalized services, broaden their offerings, and automate customer journeys, enhancing overall operational efficiency and customer experience.

Moreover, the shift toward virtualized workplaces and remote operations in North America is fueling the demand for cloud billing solutions that can seamlessly integrate remote and digital workflows. Cloud-based systems offer the flexibility to support remote teams, manage distributed transactions, and provide real-time access to billing information, contributing to market expansion.

Asia Pacific is poised for significant growth at a robust CAGR of 16.26% over the forecast period due to the rapid development of telecom infrastructure, particularly the rollout of 5G networks. As countries across the region invest heavily in next-generation networks, telecom companies generate the demand for advanced billing solutions that can manage the complexities of these new technologies.

Cloud billing systems are essential for handling dynamic pricing models, real-time usage tracking, and delivering enhanced customer experiences. The continuous expansion and modernization of telecom infrastructure in the Asia-Pacific region are thus propelling the adoption of sophisticated cloud billing solutions, contributing to the overall growth of the market.

- For instance, in November 2023, NEC Corporation announced the enhancement of its Converged Core with the launch of a containerized Charging Gateway Function (CGF). This new Network Function (NF) offers significant flexibility in processing increasingly complex billing data, allowing mobile network operators (MNOs) to efficiently introduce new charging models. As 5G networks continue to evolve, they are anticipated to deliver a wide range of services to end-users, including enhanced Ultra-Reliable Low Latency Communications (URLLC), Massive Machine Type Communications (mMTC), and Mobile Broadband (eMBB).

The robust growth of e-commerce and the widespread adoption of mobile payment systems in the Asia-Pacific region are critical drivers of market growth. As consumers across the region embrace online shopping and digital payment methods, businesses are adopting robust cloud billing systems that can efficiently manage high transaction volumes, support multiple currencies, and accommodate diverse payment methods. The demand for seamless and secure transactions in this rapidly expanding digital marketplace is pushing companies to invest in advanced cloud billing solutions.

- According to a recent study by the International Trade Administration, India is projected to lead 20 countries worldwide in retail e-commerce development between 2023 and 2027, at a CAGR of 14.1%.

Competitive Landscape

The global Cloud Billing market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Cloud Billing Market

- Aria Systems, Inc.

- Oracle

- Amazon Web Services

- Amdocs Inc.

- NEC Corporation

- SAP SE

- Cerillion Technologies Ltd.

- IBM Corporation

- Salesforce

- Zuora Inc.

Key Industry Developments

- June 2024 (Product Launch): Aria Systems unveiled Aria Billing Studio for ServiceNow, an integration suite developed on the ServiceNow platform. This solution allows ServiceNow customers to oversee the complete customer revenue lifecycle, from order through cash collection to customer care, across various industries such as communications, media, and technology, leveraging Aria Billing Cloud.

- February 2024 (Product Launch): Salesforce launched Billing Inquiry Manager, a groundbreaking innovation for Communications Cloud. This tool harnesses the power of generative AI to assist communications service providers (CSPs) in delivering personalized, proactive customer support, and resolving billing issues more efficiently.

The global Cloud Billing market has been segmented:

By Type

- Subscription Billing

- One Time

- Usage-Based

- Others

By Deployment Type

- Private

- Public

- Hybrid

By Service Model

- IaaS

- PaaS

- SaaS

By Industry Vertical

- BFSI

- IT & Telecommunication

- Education

- Construction

- Healthcare

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership