Coffee Capsules Market

Coffee Capsules Market Size, Share, Growth & Industry Analysis, By Coffee Beans Type (Arabica, Robusta, and Blends), By Nature (Organic and Conventional), By Format Type (Plastic, Aluminum, and Compostable), By Distribution Channel (Business to Business, Business to Consumer) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : July 2024

Report ID: KR923

Coffee Capsules Market Size

The global Coffee Capsules Market size was valued at USD 18.68 billion in 2023 and is projected to grow from USD 19.71 billion in 2024 to USD 30.40 billion by 2031, exhibiting a CAGR of 16.22% during the forecast period. The expansion of the market is driven by increasing consumer demand for sustainable coffee products, innovative brewing technologies, and diverse beverage options.

In the scope of work, the report includes products offered by companies such as Fresh Brew Co., JDE Peet's, Keurig Dr Pepper, Lavazza, Nestlé S.A., Starbucks Corporation, The J. M. Smucker Company, The Kraft Heinz Company, COFFEE NIRVANA, MENSHEN, and others.

The growth of the global market is fueled by the growing consumer preference for convenience and quick preparation methods. Additionally, the increasing preference for premium and specialty coffee varieties among urban consumers has bolstered market expansion.

Moreover, rising environmental concerns have spurred innovations in recyclable and biodegradable capsule materials, appealing to eco-conscious consumers. Furthermore, strategic partnerships between coffee brands and capsule manufacturers contribute to market growth by leveraging brand loyalty and expanding distribution networks.

- For instance, in April 2024, NatureWorks and IMA Coffee collaborated to develop a compostable coffee pod solution designed for use with Keurig brewers in the North American market. The solution integrated NatureWorks' Ingeo PLA biopolymer and leveraged IMA Coffee's manufacturing expertise, achieving production speeds compatible to those of traditional materials, while also ensuring high brewing performance and environmental benefits.

With an expanding consumer base seeking convenience without compromising quality, the coffee capsules market is set to witness robust expansion. Major players are investing heavily in product innovation and marketing strategies to cater to diverse consumer preferences.

Market growth is further propelled by rapid urbanization, busy lifestyles, and a shift toward at-home coffee consumption. The market features a diverse range of products catering to various taste preferences and price points. Key players are focusing on product innovation, sustainability initiatives, and geographical expansion to gain a competitive edge in the global market landscape.

The market refers to the segment of the coffee industry that produces single-serve coffee pods or capsules for use in specialized coffee machines. These capsules contain pre-measured amounts of ground coffee, offering both convenience and consistency for brewing coffee in home or office environments.

The market includes a variety of capsule types, materials, and coffee blends to cater to diverse consumer preferences worldwide. Industry growth is further boosted by technological advancements in capsule design, increasing consumer awareness regarding coffee quality, and environmental sustainability concerns influencing capsule material choices.

Analyst’s Review

The market is witnessing significant innovation and strategic efforts by manufacturers to fulfill diverse consumer preferences. Major manufacturers are introducing new products, including eco-friendly and specialty coffee capsules, to address rising environmental concerns and cater to the growing demand for premium coffee experiences.

- For instance, in December 2023, TIPA and ATI launched a fully compostable high-barrier coffee capsule lid. This development addressed surging consumer demand for compostable coffee capsules and provided a solution for brands facing challenges with eco-friendly lids that met quality standards. The lid combined TIPA’s high barrier film with ATI’s patent-protected system, enhancing taste and flow. It ensured optimal coffee extraction and compatibility with compostable capsules and coffee-filling lines, all while meeting EN 13432 standards.

Investments in sustainable packaging and recycling programs are becoming industry standards. To capitalize on market growth, manufacturers are advised to focus on enhancing product quality, expanding a range of flavor varieties, and improving the compatibility of capsules with various coffee machines.

Coffee Capsules Market Growth Factors

The increasing consumer demand for personalized and specialty coffee options is boosting the growth of the coffee capsules market. Consumers are increasingly seeking a variety of flavors, strengths, and origins in their coffee choices, which is compelling manufacturers to innovate and expand their product lines. This trend toward customization is prompting companies to develop new capsule formulations that cater to specific tastes and preferences, thereby enhancing consumer satisfaction and fostering loyalty.

Manufacturers are leveraging advanced technologies to achieve consistency in flavor profiles while ensuring freshness and quality in each capsule. As consumer preferences evolve, this demand continues to shape the market landscape, promoting ongoing investment in research and development to meet diverse and discerning consumer demands.

- According to the United States Department of Agriculture, global coffee production in 2024/25, is anticipated to increase by 7.1 million bags, reaching a total of 176.2 million bags. This increase is attributed to a recovery in Brazil's coffee sector and the higher output from Indonesia. Export volumes are expected to rise by 3.6 million bags to 123.1 million, led by shipments from Brazil and Indonesia. Consumption was observed to rise from 3.1 million bags to 170.6 million.

The environmental impact associated with single-use plastic capsules presents a key challenge to market development. As concerns over plastic waste grow, consumers and regulatory bodies are increasingly favoring sustainable packaging solutions. To overcome this challenge, companies are actively seeking eco-friendly alternatives such as biodegradable or compostable materials for capsule production.

These materials aim to reduce the environmental footprint of coffee capsules without compromising quality or convenience. Moreover, companies are implementing recycling programs to promote responsible disposal practices among consumers. Innovations in packaging design and material sourcing are crucial in addressing these environmental concerns while maintaining product integrity and meeting regulatory standards, thereby facilitating sustainable growth and long-term viability in the market.

- In May 2023, Alpla, a global packaging company, announced the launch of biodegradable coffee capsules for the Blue Circle brand. These recyclable capsules, made from organic materials, are designed to effectively prevent the coffee aroma from escaping into the environment, thereby minimizing any impact on the contents. Produced in Alpla's own facilities, these capsules provide a sustainable option for coffee suppliers, wholesalers, and roasting plants. They could be conveniently disposed of in home compost or organic waste bins.

Coffee Capsules Market Trends

There is an observable shift toward sustainable and ethical sourcing practices in the industry. Consumers are increasingly concerned about the origin and production methods of their coffee capsules, prompting manufacturers to adopt transparent supply chains and seek certifications such as Fair Trade and Rainforest Alliance. This trend emphasizes the importance of environmental and social responsibility throughout the coffee capsule production process, from the sourcing of coffee beans to the manufacturing and distribution processes.

Companies that prioritize sustainability are gaining consumer trust and loyalty by offering products that align with their ethical values. As this trend continues, industry players are observing increased demand for responsibly sourced coffee capsules, thereby influencing market strategies and fostering a more sustainable coffee industry.

Another significant trend in the Coffee Capsules market is the growing popularity of premium and gourmet capsule options. Consumers are increasingly willing to pay a premium for high-quality coffee experiences at home, leading to increased demand for capsules that offer unique blends, single-origin coffees, and specialty flavors. This trend is further fueled by the demand for a café-like experience in terms of taste and aroma, coupled with the convenience of single-serve capsules.

Manufacturers are responding to this trend by introducing innovative product lines that cater to discerning tastes and preferences, showcasing the diversity and richness of coffee flavors from around the world. As consumer expectations for quality and variety continue to rise, this trend is reshaping product offerings and marketing strategies in the market.

Segmentation Analysis

The global market is segmented based on coffee beans type, nature, format type, distribution channel, and geography.

By Coffee Beans Type

Based on coffee beans type, the market is categorized into arabica, robusta, and blends. The arabica segment led the coffee capsules market in 2023, reaching a valuation of USD 9.78 billion. This growth is fostered by its superior flavor profile and higher consumer preference for premium quality coffee. Arabica beans are known for their smooth taste, aromatic properties, and lower caffeine content compared to robusta, making them more appealing to coffee enthusiasts.

Additionally, the rising trend of specialty coffee consumption and the increasing popularity of single-origin coffee boost the demand for arabica beans. Manufacturers are capitalizing on this trend by offering a wide range of arabica-based coffee capsules, thereby supporting the growth of the segment.

By Nature

Based on nature, the market is classified into organic and conventional. The organic segment is poised to witness significant growth at a CAGR of 7.35% through the forecast period (2024-2031). This notable expansion is largely attributed to increasing consumer awareness regarding health and environmental benefits. Organic coffee, free from synthetic pesticides and fertilizers, appeals to health-conscious consumers who seek natural and safe products.

The rising trend of sustainability and ethical sourcing further enhances the preference for organic coffee, as it supports eco-friendly farming practices and fair trade principles. Additionally, the premium positioning of organic coffee justifies higher price points, attracting affluent consumers.

By Format Type

Based on format type, the market is segmented into plastic, aluminum, and compostable. The plastic segment secured the largest coffee capsules market share of 76.55% in 2023. The segment dominates the market due to its cost-effectiveness, durability, and versatility in manufacturing coffee capsules.

Plastic capsules are lightweight and offer excellent barrier properties, effectively preserving the freshness and flavor of coffee. Their lower production costs enable manufacturers to offer competitively priced products, making them appealing to a broad consumer base. The widespread compatibility of plastic capsules with various coffee machines further enhances their market reach.

Despite environmental concerns, advancements in recycling technologies and increased efforts toward developing biodegradable plastics are mitigating negative impacts, thereby supporting the expansion of the segment.

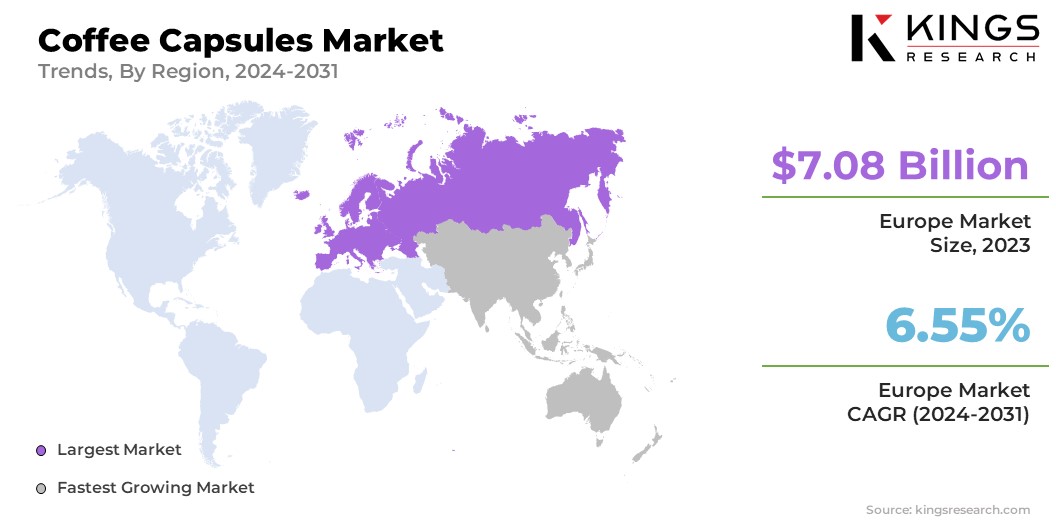

Coffee Capsules Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Europe coffee capsules market share stood around 37.89% in 2023 in the global market, with a valuation of USD 7.08 billion. This growth is propelled by the region's deeply rooted coffee culture and high consumption rates. The region's preference for premium and specialty coffee results in surging demand for convenient single-serve options such as capsules.

Additionally, Europe's strong purchasing power and sophisticated consumer base facilitate the adoption of innovative coffee solutions. The presence of major coffee capsule manufacturers and brands in Europe further boosts regional market growth. Environmental awareness and sustainability trends in Europe are influencing the market, with companies introducing eco-friendly capsules to cater to consumer preferences.

Asia Pacific is poised to experience considerable growth, registering a CAGR of 7.03% over the forecast period. This notable development is propelled by rapid urbanization, increasing disposable incomes, and the growing popularity of coffee culture. The region's expanding middle-class population is showing a growing preference for convenient and premium coffee options.

Additionally, the influence of Western lifestyles and the proliferation of coffee chains are bolstering demand for single-serve coffee capsules. Rapid technological advancements and the introduction of innovative coffee machines tailored to local tastes are further boosting regional market growth.

Competitive Landscape

The coffee capsules market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Coffee Capsules Market

- Fresh Brew Co.

- JDE Peet's

- Keurig Dr Pepper

- Lavazza

- Nestlé S.A.

- Starbucks Corporation

- The J. M. Smucker Company

- The Kraft Heinz Company

- COFFEE NIRVANA

- MENSHEN

Key Industry Developments

- March 2024 (Launch): Keurig Dr Pepper announced the launch of its multi-year innovation agenda, focusing on its Keurig single serve brewing system. This initiative included the introduction of plastic-free pods (K-Rounds) and a new brewer viz. Keurig Alta, which features a plant-based coating to preserve coffee flavor without the use of aluminum or plastic. The company further acquired technology from Delica Switzerland to enhance these innovations.

- February 2024 (Partnership): JDE Peet’s announced an agreement to manufacture, sell, and distribute Costa Coffee branded aluminum coffee capsules in Great Britain, starting in September 2024. This collaboration expanded their partnership and aimed to foster future growth. Additionally, JDE Peet is enhancing consumer choices with the launch of the L’OR Barista coffee brewer system in the UK.

The global coffee capsules market is segmented as:

By Coffee Beans Type

- Arabica

- Robusta

- Blends

By Nature

- Organic

- Conventional

By Format Type

- Plastic

- Aluminum

- Compostable

By Distribution Channel

- Business to Business

- Café and Restaurants

- QSR (Quick Service Restaurants)

- Others

- Business to Consumer

- Hypermarket/Supermarket

- Specialty Store

- Online Retails

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership