Food and Beverages

Colostrum Market

Colostrum Market Size, Share, Growth & Industry Analysis, By Type (Whole, Skimmed, Others), By Nature (Organic, Conventional), By Form (Powder & Granules, Liquid), IgG Levels (Low IgG < 20%, Medium IgG 20% - 40%, High IgG > 40%), By End Use and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR1011

Colostrum Market Size

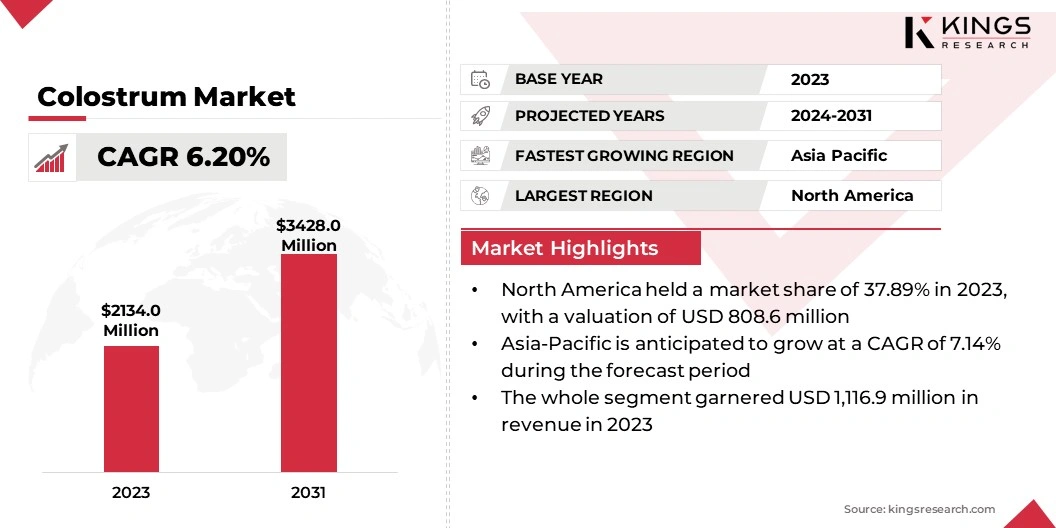

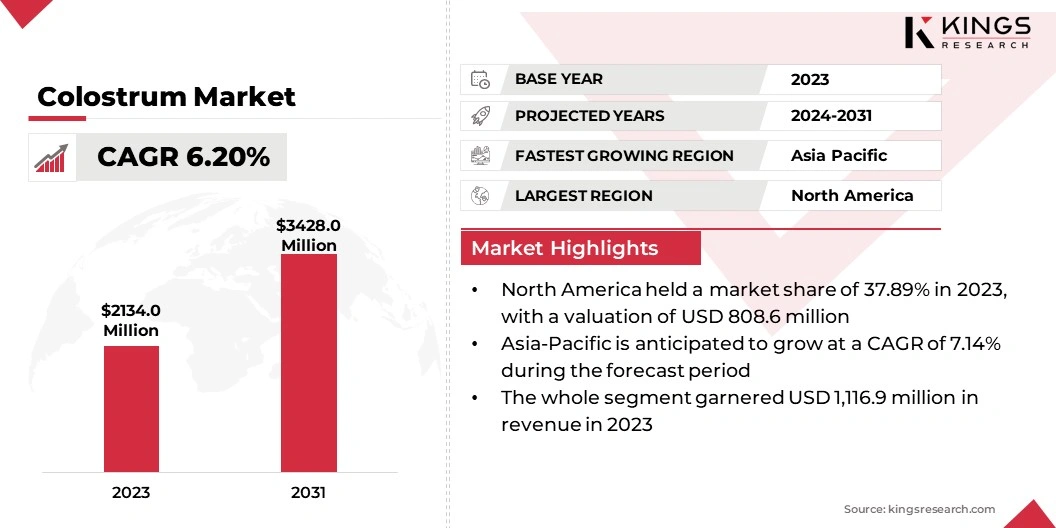

The global Colostrum Market size was valued at USD 2,134.0 million in 2023 and is projected to grow from USD 2,249.2 million in 2024 to USD 3,428.0 million by 2031, exhibiting a CAGR of 6.20% during the forecast period. The market expansion is driven by increasing consumer demand for natural health supplements, rising health consciousness, advancements in processing technologies, and growing awareness regarding the benefits of colostrum for immune support and gut health.

In the scope of work, the report includes solutions offered by companies, such as Biostrum, Biotaris B.V., Colostrum BioTec GmbH, Deep Blue Health NZ., Glanbia PLC, Ingredia, Pantheryx, Sterling Technology, Vivesa holding s.r.o., SCCL, and others.

The colostrum market growth is driven by increasing awareness of its health benefits and a growing demand for natural health supplements. Colostrum, rich in antibodies and growth factors, is highly valued for its immune-boosting properties and potential to enhance gut health. Additionally, rising consumer preference for dairy-based products and innovations in processing technologies are fueling market expansion. The increasing prevalence of chronic diseases and health issues, combined with a growing focus on preventive healthcare, also supports market growth.

The growth of the sports nutrition sector and increasing consumer interest in wellness products contribute significantly to the rising demand for colostrum-based supplements. Furthermore, manufacturers are trying to incorporate and innovate packaging materials and formats to increase the penetration of their products and offer convenience to their consumers.

- For instance, in April 2024, Nutifood, a leading Vietnamese dairy company, adopted SIG's DomeMini carton bottle for its Varna brand premium adult nutrition milk. This marked a shift from plastic to a more sustainable carton pack, enhancing consumer convenience and environmental benefits. The new packaging, made from FSC-certified paperboard, aims to improve product appeal and sustainability with a better plastic-to-product ratio and complete recyclability.

The market size has witnessed significant growth due to heightened health consciousness among consumers and the expanding supplement industry. North America dominates the market, driven by established healthcare systems and high consumer awareness. Emerging markets in Asia-Pacific are also experiencing growth, fueled by increasing disposable incomes and a shift toward preventive healthcare. The market landscape is competitive, with key players focusing on product innovation, quality enhancement, and strategic partnerships to capture a larger market share.

Colostrum is the initial milk produced by mammals immediately after giving birth. It is rich in essential nutrients, antibodies, and growth factors, which plays a crucial role in boosting a newborn’s immune system and promoting overall health. In the commercial market, colostrum is utilized in dietary supplements and functional foods due to its perceived health benefits.

It is often processed into various forms, such as powders and capsules, to enhance its usability and bioavailability. The market encompasses products derived from both bovine and human colostrum, each offering distinct benefits in health and wellness applications.

Analyst’s Review

The colostrum market is currently benefiting from increased consumer interest in health and wellness. Key efforts by manufacturers include developing innovative colostrum formulations and investing in advanced processing technologies to enhance product quality. New products, such as targeted supplements for immune support and gut health, are being introduced to meet diverse consumer needs.

- For instance, in December 2023, Blendhub collaborated with ColoPlus AB, a Swedish biotechnology company, to develop and commercialize nutraceutical food products using bovine colostrum. The partnership combined innovative research and practical expertise to create a porridge with colostrum as the key functional ingredient, aimed at improving immune health. Blendhub contributed to both the product formulation and packaging, resulting in a health-focused product with proven benefits, particularly for immune-compromised individuals.

Manufacturers are recommended to focus on expanding their online presence by leveraging digital marketing initiatives to reach a broader audience. Additionally, investing in research to explore new applications of colostrum and ensuring transparency in product sourcing and processing will further enhance market share for market players. Companies are advised to further consider penetrating emerging markets, where health awareness is rising.

Colostrum Market Growth Factors

The rising consumer awareness regarding health and wellness is a key driver in the colostrum market. As consumers are increasingly seeking natural supplements with proven health benefits, colostrum is gaining popularity due to its nutrient-rich profile. The focus on immune system and gut health is particularly influencing this trend.

Health-conscious individuals are opting colostrum supplements to boost their overall wellness and prevent illnesses. This growing consumer preference is encouraging companies to innovate and offer a variety of colostrum-based products, catering to different health needs and preferences. As more people prioritize their health, the demand for colostrum supplements continues to increase, propelling market growth.

A major challenge in the market is the high cost of production and processing. Colostrum is often more expensive than other supplements due to the specialized collection and processing required to maintain its nutritional integrity. To overcome this challenge, companies invest in advanced technologies and streamlining their production processes to reduce costs.

Innovations such as improved collection methods and more efficient processing techniques are helping manufacturers to lower production expenses. Additionally, economies of scale achieved through increased market demand are enabling companies to offer more competitive product pricing.

Colostrum Market Trends

The increasing popularity of personalized nutrition is shaping the market. Consumers are seeking products tailored to specific health needs, and colostrum supplements are being marketed to address individual wellness goals. Companies are responding to this trend by offering customized colostrum products that target various health aspects, such as immune support, digestive health, and overall vitality. This trend is driving innovation in product formulations and marketing strategies, as brands strive to provide personalized solutions.

The focus on personalization is helping brands boost consumer engagement and loyalty, as tailored products are perceived to deliver more effective health benefits. The proliferation of online retail channels is significantly impacting the colostrum market. E-commerce platforms are becoming increasingly popular for purchasing health supplements, including colostrum products. This trend is providing consumers with greater convenience and access to a wider range of products.

Companies are expanding their online presence to reach a broader audience and capitalize on the growing trend of online shopping. Digital marketing strategies, such as targeted ads and social media promotions, are also becoming more prevalent. As online retail continues to grow, it is expected to reshape the market landscape and drive increased sales of colostrum supplements.

Segmentation Analysis

The global market has been segmented based on type, nature, form, IgG levels, end use, and geography.

By Type

Based on type, the market has been categorized into whole, skimmed, and others segments. The whole segment led the colostrum market in 2023, reaching a valuation of USD 1,116.9 million. The whole colostrum segment is expanding due to its higher nutrient content compared to skimmed options.

Whole colostrum retains all the beneficial components, including fats, proteins, and antibodies, which are essential for comprehensive health benefits. Consumers are increasingly valuing the full spectrum of nutrients provided by whole colostrum, leading to its dominance in the market. Additionally, whole colostrum is often perceived as more natural and effective, aligning with the growing trend toward natural health products.

By Nature

Based on nature, the market has been classified into organic and conventional segments. The organic segment is poised for significant growth at a CAGR of 8.37% over the forecast period from 2024 to 2031. The organic colostrum segment is experiencing notable growth due to rising consumer demand for organic and natural products.

Organic colostrum, produced without synthetic additives or antibiotics, aligns with the increasing preference for clean and sustainable health solutions. Consumers are becoming more aware of the benefits of organic farming practices, which contribute to the demand for higher-quality products. The growing focus on environmental sustainability and health-conscious choices is further boosting the demand for organic colostrum.

By Form

Based on form, the market has been segmented into powder & granules and liquid segments. The powder & granules segment secured the largest market share of 65.83% in 2023. The powder & granules segment is expanding due to its convenience and versatility.

Powdered colostrum is easier to store, has a longer shelf life, and can be easily incorporated into various products, such as capsules, shakes, and functional foods. Consumers and manufacturers alike are favoring powder & granules for their practicality and effectiveness. The ability to offer colostrum in a form that suits diverse applications is driving the continued preference for powder & granules.

Colostrum Market Regional Analysis

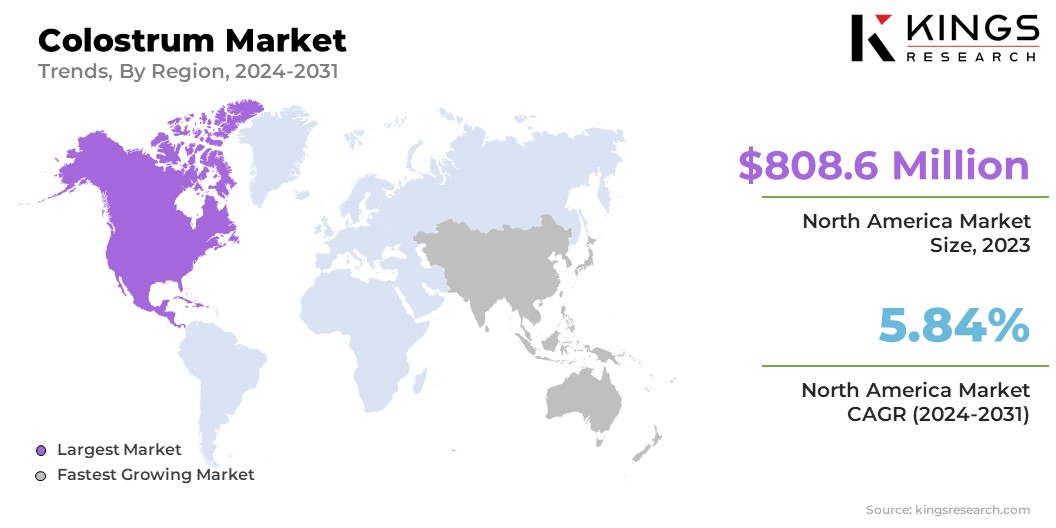

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North American colostrum market dominated the global market at 37.89% market share in 2023, with a valuation of USD 808.6 million. The region is dominating due to high consumer awareness and robust healthcare infrastructure. The region's significant market share reflects the strong demand for health and wellness products.

North American consumers are increasingly prioritizing preventive health measures, driving the demand for colostrum supplements. Additionally, established distribution networks and a high prevalence of chronic diseases are contributing to the market's dominance. The presence of key players and ongoing innovations in colostrum products are further supporting the market's leading position in the global arena.

Asia-Pacific is poised to experience the fastest growth over the forecast period at a CAGR of 7.14%. This rapid growth is driven by increasing disposable incomes and rising health awareness among consumers. With the growth of middle-income groups along with their health consciousness, there will be a growing demand for dietary supplements and natural health products.

Additionally, improving healthcare infrastructure and increased availability of colostrum products are contributing to the region's dynamic market expansion. The Asia-Pacific market is becoming a key area of focus for companies looking to capitalize on the region's evolving health trends and economic development.

Competitive Landscape

The global colostrum market report will provide valuable insights emphasizing the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategies adopted by companies in this sector. Industry players are investing extensively in R&D activities, developing new manufacturing facilities, and optimizing supply chain.

List of Key Companies in Colostrum Market

- Biostrum

- Biotaris B.V.

- Colostrum BioTec GmbH

- Deep Blue Health NZ.

- Glanbia PLC

- Ingredia

- Pantheryx

- Sterling Technology

- Vivesa holding s.r.o.

- SCCL

Key Industry Development

- April 2023 (Product Launch): PanTheryx launched a new product line named Life’s First Naturals PRO ColostrumOne Extra Strength, for healthcare practitioners, featuring high-quality bovine colostrum with nearly double the immune bioactive compared to the original formula. The adult version comprised 5,000 mg of colostrum, while the kids' formula included 2,000 mg along with added fiber. Both the products were developed to support immune and digestive health.

The global colostrum market has been segmented:

By Type

- Whole

- Skimmed

- Others

By Nature

- Organic

- Conventional

By Form

- Powder & Granules

- Liquid

By IgG Levels

- Low IgG < 20%

- Medium IgG 20% - 40%

- High IgG > 40%

By End Use

- Sport Nutrition & Functional Food

- Dietary Supplement Industry

- Infant Formula

- Cosmetics and Skincare

- Pharmaceutical Industry

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership